Social media has always been a hot bed for negativity, and if you’re in the banking industry this comes as no surprise. Frequently social is the place where individuals and businesses go to complain about service and technical issues, as well as “optics” issues that they object to.

But with the mandatory shutdowns and social isolation, and the novel small business loans of the Paycheck Protection Program, new conversations are happening across every major social media platform.

Have people been happy or mad? The answer may surprise you. Here are three major insights we’ve uncovered.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

2020 Began on an Upnote, Then COVID-19 Arrived

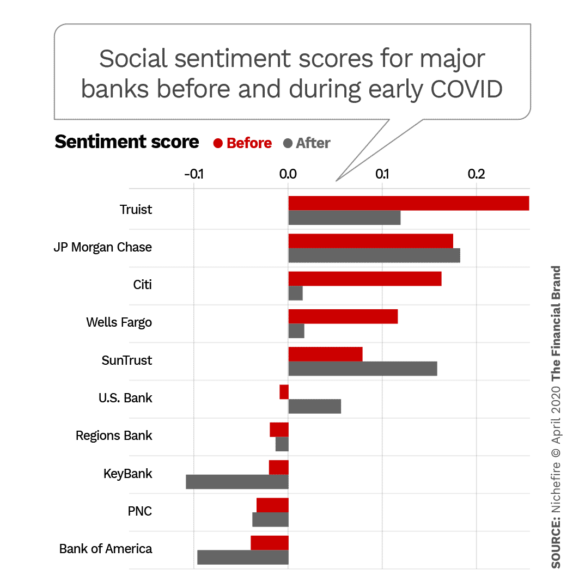

For the first three months of the new year, the majority of big banks had something to celebrate — their sentiment scores were starting to reach all-time highs. But when COVID-19 reached American shores and businesses were affected by mandatory shutdowns, big bank clients took their concerns to social media.

Here are the sentiment scores before and after COVID-19 was first identified in America:

While some banks drove higher sentiment with strategic social media strategies (specifically U.S. Bank and SunTrust), the majority of brands took a hard hit.

But clearly there’s more to the story. So, let’s dive more deeply and see what types of social posts are driving positive responses during COVID-19.

When banking brands post about corporate responsibility and social good, followers react positively. That’s been a leading strategy for years now.

However, followers don’t just react positively to corporate responsibility. Prior to COVID-19, most positive conversations with audiences in the banking and finance industry were around:

- Social good commentary

- Promotions/advertisements

- Customer service

One Pro Tip: Social posts on LinkedIn may not work on Twitter. Therefore, don’t just copy and paste across multiple platforms. Marketers need to be more conscious of each platform’s audience and how they might react to different announcements and content.

What should you be posting about now?

Here’s how businesses and individuals have been interacting with social media topics:

Social Media Conversation Topics: COVID-19 Sentiment (Scale: -10 to 10)

| Conversation Topics | Average Sentiment Before | Average Sentiment During |

|---|---|---|

| Social good commentary | 4.81 | 4.22 (-0.39) |

| Promotions/ads | 2.37 | 0.15 (-2.22) |

| Customer service | -1.36 | 0.19 (+1.17) |

| Locations | 0.08 | 0.75 (+0.67) |

| Products/services | -1.35 | -0.17 (+1.18) |

| Technical issues | -1.99 | -0.41 (+1.58) |

| Account issues | -2.21 | -0.71 (+1.50) |

| Recommendations/advice | 0.44 | 2.33 (+1.89) |

| Company commentary | -0.21 | -0.21 (0) |

| Miscellaneous | 0.73 | 0.17 (-0.56) |

Source: Nichefire, Inc.

We’ve studied numerous aspects of this. Let’s look at one: Locations. How did this category go from second to last, to fourth best?

Let’s look at some posts from U.S. Bank.

It doesn’t take a social media guru to understand why such posts are a major success. They scream, “We’re not just a bank. We’re members of your community!”

The key takeaway here is that your financial institution should be making connections with other businesses and with people in your local community. It doesn’t matter if they’re prospects or already doing business with you. Whether it’s ordering food from local restaurants, providing your employees with gift cards from local businesses, etc., this is strategy you can and should try immediately.

Read More:

- Why Organic + Paid Social Is a Powerful Strategy for Financial Marketers

- 6 Ways Financial Marketers Can Improve Their Online Reputation

- Ally Bank Pushes Phony Products in Funny Social Media Campaign

People Are Talking on Social More Than Ever. Are You Listening?

Many marketers make the same critical mistake: Ignoring negativity and not responding to frustrated customers. Don’t be that marketer!

Social media is so much more than a tool for pushing content. It’s a direct line of communication between customers, prospects and competitors. And they’re all talking more than ever. You can’t afford not to be listening.

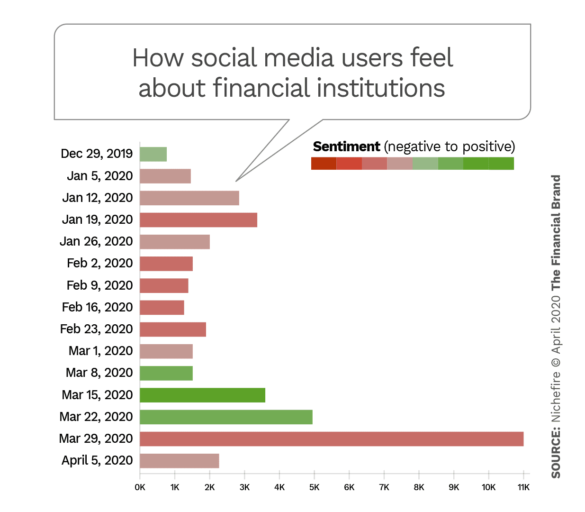

Here’s a breakdown of the tone of positive and negative comments financial institutions have received across social media since the beginning of the year.

The chart can seem a bit overwhelming but there’s one clear insight. Starting in March — when mandatory shutdowns began across the nation — individuals and business started interacting with their financial institutions more than ever.

This is the perfect opportunity to address the concerns (or praise) of your customers.

Your competitors are all in the same boat. When this is all over, one of the biggest differentiators will be which brand provided the best customer service during the COVID-19 pandemic. You can use social media as a strategic tool to retain clients, stand out from your competition, and win new business.