Finance and social media are often thought of as being incompatible, leading many financial marketers to overlook the usefulness and potential of social media platforms. However, they should be considering TikTok to grow overall brand awareness among younger consumers who are beginning their personal financial journeys.

TikTok draws over 680 million monthly users worldwide, according to Business of Apps. With the platform’s rise in popularity over several years, financial institutions need to evaluate how the platform can be leveraged.

Considering TikTok’s Core Users

Social media platforms offer an opportunity for speaking and interacting with consumers directly. This direct connection, if used correctly, can result in your bank or credit union establishing a much larger online presence and following.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

A Common Myth:

A misconception about finance is that it is unappealing to younger audiences, especially Gen Z. Finance, ultimately, is about money.

Information from banks and credit unions can be marketed through social media so long as a platform’s core users and their preferences are taken into account.

Some quick audience demographics for TikTok in the U.S. from Wallaroo Media:

- TikTok currently has around 80 million monthly active users, 60% of which are between 16–24.

- Gen Z is set to be the largest generation with approximately 23% of the total population.

- In 2020, TikTok was estimated to bring in around $500 million in revenue from the U.S. alone.

TikTok is Gen Z’s primary social media platform. Gen Z is becoming the largest generation, and, with more and more people in Gen Z coming of age, they will begin to engage in significant ways with the financial industry.

Digital marketing today greatly favors video. Unlike other social media platforms that may incorporate video features in with the ability to post photographs or text posts, TikTok focuses almost solely on short video content. While there are interactive text elements — such as captions, hashtags and comments — the main form of content on the platform is short-form video.

This makes the ability to create effective video content an absolute must when working to attain greater digital attraction on the platform. Moreover, TikTok users value interactions, making it highly important to create content that opens the door for further conversation. Creating content that is structured to succeed on TikTok will help reach new audiences.

Read More: The Financial Brand’s Power 100 Social Media Database

What TikTok Users Respond To

TikTok has become well-known for its dance challenges and lip-synching videos. However, there’s a lot more to what makes a successful video on the platform beyond entertainment. It’s all about understanding how to create niche content — such as content promoting financial services— that provides value or new information to viewers.

Financial topics that do particularly well on the platform include:

- Personal finance advice

- Financial literacy resources

- Micro-investing in the stock market

- Cryptocurrency

For instance, many financial institutions have hesitated to adopt new and advanced technologies for fear of scaring off older generations. By contrast, Gen Z, who make up the largest portion of the TikTok user base, embraces technology at a much higher rate.

Additionally, Gen Z has been shown to have a substantially larger interest in personal finance compared to older generations. Research by LinkedIn indicates that 59% of Gen Zers surveyed expressed the willingness to learn new skills in order to increase their income.

There’s a growing amount of content on TikTok dealing with personal finance, but, as reported by Vox, some of what is published is inaccurate, misleading or just not suited to the average person’s circumstances. The site detailed ten financial strategies publicized on TikTok. This includes the claim that the Federal Reserve is holding secret million-dollar accounts for every U.S. citizen to the idea of copying the investment strategies of the rich to suggestions on how to handle mortgage debt that don’t necessarily fit everyone’s situations.

A Key Opportunity:

Authoritative information from reputable financial institutions would be welcomed.

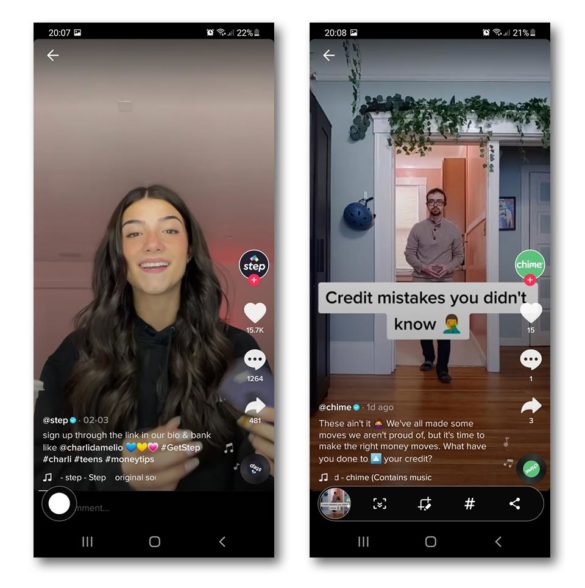

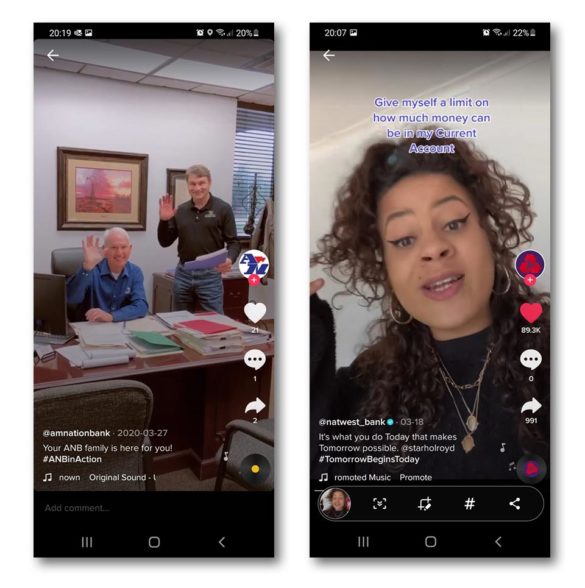

The screen captures accompanying this article show bank and fintech efforts to try out this platform by using young influencers as well as real live bankers.

Read More: 8 Essential Social Media Accessibility Tips for Financial Institutions

Providing Valuable Financial Resources to Your Target Audience

Performing well on TikTok as a financial institution comes down to the value your videos are providing to viewers. When it comes to services related to finance, it is important to keep in mind the clarity of marketing messaging on the platform.

When creating financially themed content, services your institution offers should be presented in direct relation to specific problems faced by Gen Z. Creating bite-sized information resources is just one example of gearing content towards the TikTok audience.

Ultimately, TikTok users want to see content that provides value in the form of entertainment or education. Establishing a financial institution’s TikTok account as a source for accurate and helpful information about money will help you to gain a larger digital audience.