In some ways banks and credit unions can’t seem to get a break with public opinion. In one recent study, the reputation of the industry overall came in lower than all but telecommunications among 16 industries tracked. In another, banking reputation ranked significantly below retailers and auto dealers.

Some may dismiss these overall ratings, saying they don’t matter. A common belief in the industry is that people don’t like banks in general, but they like their own financial institution.

While that may be true, the mistakes of large, visible bank brands can influence consumers’ opinions of other institutions. Crisis communication consultant Merrie Spaeth observes that highly publicized failures, like the Capital One data breach, have a cumulative impact on consumer confidence.

“Remember, these events take place in the context of diminishing trust in other large institutions, such as government and the media,” she points out.

The profitability of the industry overall is strong, certainly. And collectively huge amounts of capital are being invested in upgrading technology to match consumers’ expectations. Yet banking’s reputational needle hasn’t moved. In fact, it is moving the wrong way, not only for the industry as a whole but for many individual institutions.

Reality Check: You can’t hide behind the “our own customers love us” argument when the data show that the love is cooling.

In its latest survey of bank reputations, Reputation Institute (RI) found that of the 40 large and regional financial institutions it studied, the number of institutions ranked by their own customers as “excellent” shrank from six to two. Further the financial brands that were considered just “average” rose from two to five.

Overall, more than half (27) of the 40 institutions saw their reputation scores decline. The two institutions ranked excellent were USAA Bank and Huntington Bank.

“While other industries have enjoyed a reputation recovery in 2019, the banking industry is struggling to regain reputation equity across all measures,” says Brad Hecht, EVP, Americas, Reputation Institute. “The reputational challenges in U.S. banking are diminishing the level of support banks are able to engender among the general public. … In particular, a consumer’s willingness to do business with banks and to give them the benefit of the doubt is most impacted by a decline in reputation.”

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. 83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

Navigating the Role of AI in Financial Institutions

Further evidence of the reputational challenge banks face comes from the 2019 Axios Harris Poll of the 100 most visible companies — “visible” meaning in the news due to either good or bad reasons. No financial services companies rated “excellent” in this survey. Only three financial firms came in as “very good.”

Where Financial Services Firms Place in Axios Harris Top 100 Reputation Rankings

| Rank | Company | Change in rank |

|---|---|---|

| #13 | Fidelity | n/a |

| #17 | USAA | +17 |

| #45 | Berkshire Hathaway | -21 |

| #47 | American Express | +3 |

| #52 | JPMorgan Chase | +11 |

| #55 | Allstate | n/a |

| #62 | Capital One | n/a |

| #66 | State Farm | n/a |

| #67 | Progressive | n/a |

| #75 | Citigroup | -7 |

| #92 | Bank of America | n/a |

| #93 | Goldman Sachs | -1 |

| #96 | Wells Fargo | +1 |

Source: Axios/The Harris Poll

Companies ranked “excellent” by Axios Harris Poll include Amazon, L.L. Bean and Samsung. JPMorgan Chase, however, was among the fastest rising companies, up 11 spots.

Read More:

- Marketing Lessons From Chase Bank’s Twitter Blowup

- Biggest Threats to Banking: Fees, Lousy Tech and Digital Disruption

- Why Banking Executives Need A Social Media Presence

- Social Media & Social Issues Create Brand Challenges For Financial Marketers

More and More, Brands Must Stand for Something

A significant trend impacting bank and credit union reputation is the emergence of corporate governance and citizenship as significant reputation drivers, particularly among younger consumers. “‘Stand for something,’ [young people] say, and ‘we’ll reward your company with our attention’,” states AdWeek.

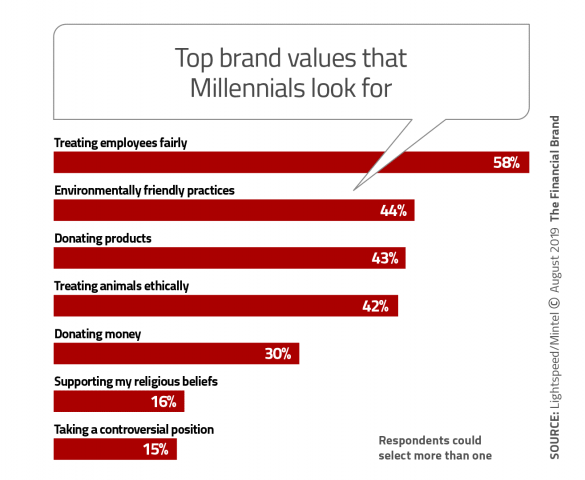

“Millennials are more likely to be concerned with the ethical and moral ramifications of their brand allegiances,” states a Mintel report on millennials and finance. The firm reports that 58% of Millennials say they care if brands represent their values, compared with 42% who don’t. Topping the list of factors indicating whether a brand passes muster is fair treatment of its employees.

As brands work to create campaigns that resonate with more socially conscious consumers, they must keep in mind that authenticity matters. The least important factor in the chart above, “Taking a controversial position,” prompts Mintel to caution that “mere words are not enough.” There must be actions not just clever marketing.

Some financial institutions are responding to this message. They are putting restrictions on clients involved with the sale of firearms, for example, or stopping the financing of private prisons. Others are ponying up megabucks for environmental improvement efforts.

The Reputation Institute examined consumer attitudes toward banking providers in seven categories: products and services, innovation, leadership, workplace, performance, citizenship and governance. The top two factors were products and services and governance. And among 19 specific reputational risks assessed, deceptive sales practices and unequal pay by gender had the greatest potential to pull down an institution’s reputation, according to RI.

Read More:

- Clever Ads Can Backfire on Financial Marketers Who Overlook Gaffes

- Wells Fargo Unveils New Logo to Rebuild Its Battered Brand

- Ally Bank Pokes Rivals’ Negative Online Reviews in Fun Campaign

- 5 Ways Banks and Credit Unions Misread Consumers Today

Firestorms at the Speed of Electrons

The increasingly volatile nature of reputation management faced by banks and credit unions can seem almost overwhelming. “Reputations are made and lost at the speed of electrons these days,” observes Davia Temin, reputation and crisis management consultant. “The public goes postal over a company infraction, the internet explodes, and the reputation of an entire industry gets compromised. But then the public forgets, and things revert as attention turns to the next crisis.” Where this is not true, Temin states, is where an organization makes the same mistake more than once, when that mistake is egregious, or when the company doesn’t own up. “When any of that happens, loss of trust in the institution and its industry can be profound,” she states.

In the case of the Capital One data breach, for example, the company was pummeled on social media, even though it issued a fairly lengthy and detailed statement, including an apology from CEO Richard Fairbank. One of the things that many people, including knowledgeable experts, jumped all over was this wording in the bank’s initial statement:

“No bank account numbers of Social Security numbers were compromised, other than:

• About 140,000 Social Security numbers of our credit card customers

• About 80,000 linked bank account numbers of our secured credit card customers.”

Anyone who’s ever had to write a clear, compliant, careful statement on a complex topic under intense deadline pressure can sympathize with the folks in Capital One’s communications group. But the internet shows little sympathy, and the apparent contradiction was lampooned.

Read More:

- Just Because Banking Customers Don’t ‘Switch’ Doesn’t Mean They Love You

- Are People Happy With Their Bank? Study Reveals Blind Spots and Problems

- Can Financial Marketers Hit The Millennial Moving Target?

- Fixing Banking’s Pain Points Takes More Than Digital Bells & Whistles

How to Insulate Your Reputation in a Social Media World

Even for smallest bank and credit union, hoping that nobody will notice when a mistake is made is a recipe for reputational disaster. Here are some cogent insights and recommendations from several business reputation experts:

Do the right thing. Merrie Spaeth doesn’t mince words when she says in regard to Capital One, “The real issue is what did they do pre-breach to educate employees about security measures?” Similarly, Davia Temin says the best way to mitigate reputation risk is to always behave in a trustworthy manner.

“You cannot build a solid reputation, much less a successful company, without a framework of transparency and corporate governance,” states Reputation Institute.

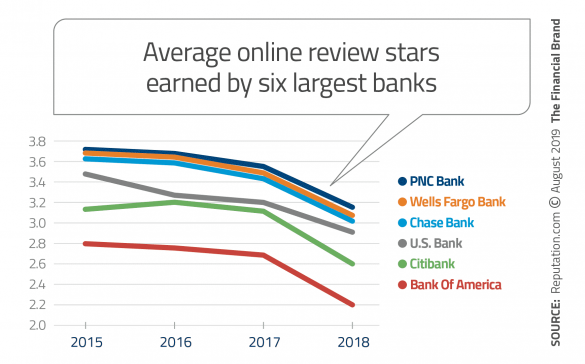

Be responsive routinely. While banks and credit unions have labored to improve customer experience, many don’t pay enough attention to comments of disgruntled consumers and bad reviews on social media. Even for the biggest banking brands, their star ratings have been trending down for some time in online review sites.

Poor reviews and low star ratings “have the power to annihilate reputations at the speed of a keystroke,” observes Reputation.com. The firm urges all size institutions to do three things:

- Encourage reviews — a low volume of reviews negatively affects the results.

- Respond to every online review — “If you do not respond, it magnifies the damage.”

- Learn from the online feedback — “It’s a gift.”

Unlock influencer potential. Influencers don’t have to be well-known people with huge followings. Reputation Institute recommends seeking out the voices of ordinary people. They have authentic credibility which enhances reputation. But don’t ignore market influencers either, the consulting firm states. “When managing reputation, consider subject experts and market influencers as a key source of information.” They may be ahead of the general public, RI states, but the public will follow.

Tap Your Own Experts. Any strategy to manage reputational risk should include enlisting and empowering employees, advises Merrie Spaeth. She says this resource largely untapped by financial institutions. The consultant recommends that banks and credit unions revisit the idea of an internal speakers bureau — experts, leaders and other employees who can speak to consumer groups. Not necessarily in a crisis situation but routinely, as a way to build positive reputation on issues like financial literacy and retirement planning. “This provides a foundation for authentic communication, which is what bank brands need today,” says Spaeth. In addition, she says, they are great opportunities for tweets and posting pictures on Instagram and Facebook Live.

Be Prepared for the Worst. Financial institutions are navigating quickly shifting sands in today’s world with so much misinformation out there, observes Temin. She recommends every bank and credit union set up and maintain robust monitoring practices — a “reputational war room where you monitor for every untruth about the institution and correct it, wisely, in almost real time.

“For those accusations that are true,” says Temin, “you need to address and repair them almost immediately, as well. Apologize, then talk about the solutions you have put in place.”