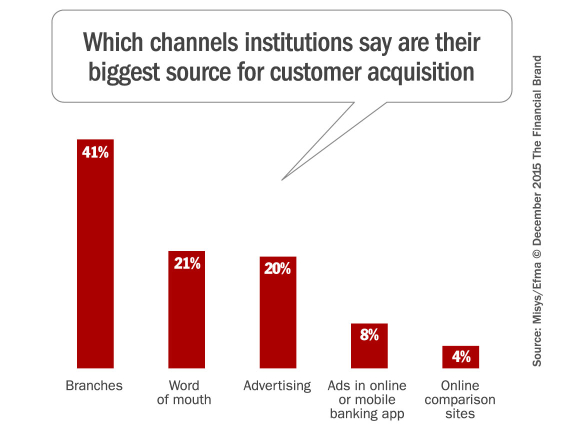

A survey conducted by Misys and EFMA asked bankers around the globe which channels are the biggest source of customer acquisition. Four in 10 said branches, followed by 21% who said word-of-mouth (WOM).

What this data doesn’t answer is: 1) What % of new customers does the “biggest source” actually account for? and 2) What are the next two or three biggest sources, and what’s the gap in percentage of new customers that each source accounts for?

In other words, it’s great to know that one in five banks thinks word-of-mouth is its biggest source of new customers, but does it account for 20% of new customers or 80%? And how far back are the other sources at those banks?

WOM Will Become Even More Important

Don’t get me wrong–I’m not arguing with the results. In fact, the findings fit my premise that word-of-mouth is an important source of customer acquisition, and that it is going to become an even more important source.

There may be more reasons, but here are two reasons why WOM is becoming more important: 1) Financial services are shifting from utilitarian products to self-relevant products among Gen Yers, and 2) Gen Yer’s desire for advice.

Banking is Becoming a Self-Relevant Product

Let me quote from an academic study:

“Imagine a consumer who has a shopping cart filled with a variety of different products. Some of the products in her cart are valued strictly for their utilitarian features (e.g., Tide is good at getting clothes clean), while other products are valued for more personal reasons (e.g., the bottle of wine she has tells others she is a person of sophistication and good taste).”

For most people over the age of 40 (maybe even younger), banking products have been a utilitarian product. For the most part, at least. Which checking account you selected carried little cache (much to the disappointment of banks offering the Crown Royal Plus account on top of the Crown Royal checking account).

To a certain extent, some high-end credit cards did (some card issuers tried to create a cache around their cards). But I can’t think of anyone who was particularly impressed by which bank issued my mortgage, or who I had a savings account with. Nor did I care much either.

As technology has become an important part of our lives, it has become a means of self-expression. And so high-tech-infused products (not just technology products, but analog products that now have a high-technology component to them) become means of self-expression as well.

It’s not enough to have a fancy car–it has to be wifi-enabled and able to access Pandora on the car radio.

Nobody is impressed that you use Tide to get your clothes clean. But have an Amazon Dash button on your Tide, and you’re the coolest dude in the dorm.

And that credit or debit card you’ve been carrying around for the past few years, which has impressed no one, takes on a different meaning when it can be used to make a payment from that geeky looking watch on your wrist (which only impressed someone a few years if it said Rolex on it).

Thanks to the digitalization of banking, banking products are becoming self-relevant products.

Self-Relevant Products Drive Word-Of-Mouth

The academic study I cited earlier is titled The Consumer as Advocate: Self-relevance, Culture, and Word-of-mouth (a title that’s even worse than the titles I come up with for Snarketing posts). The paper reports:

“The results of two studies suggest consumers are more likely to provide WOM for products that are relevant to self-concept than for utilitarian products. There was also some indication that WOM was biased, in the sense that consumers exaggerated the benefits of self-relevant products compared to utilitarian products. Finally, self-relevance had a greater impact on WOM in individualist cultures than collectivist cultures.”

The authors found that:

- WOM concerning self-relevant products serves as a means of self-presentation, whereas WOM about utilitarian products does not provide the same social benefits. Products that are self-relevant seem to offer consumers an opportunity to communicate something important about themselves to others by providing WOM, compared to products that are more utilitarian in nature.

- Self-relevant products offer consumers an opportunity to self-promote. Consumers are willing to claim a counterfeit watch they own is actually a genuine name brand product in order to create a positive impression and gain social status.

Gen Yers and Advice

There is a ton of evidence pointing to Gen Yers’ desire for advice–guidance or help might be better words–regarding the management of their financial lives. I’m not going to waste space here quoting every last source. This desire for advice/guidance/help regarding the management of their finances, combined with (self-perceived?) social nature and their (misguided?) lack of privacy boundaries adds up to this: Gen Yers will increasingly be turning to each other for banking-related references and referrals.

Bottom line: As banking products become more self-relevant (and less utilitarian), and Gen Yers increasingly turn to their peers for help referrals and references, word-of-mouth activity will increase, and WOM will become an even more important source of customer acquisition than it is today.

WOM Measurement is MIA

I have no way of knowing, but I bet that the 21% of respondents in the Misys/EFMA study who said WOM is their biggest source of customer acquisition don’t do a good job of tracking WOM and customer referrals–if they even track and manage it at all.

I’d also bet that a majority of all the respondents to that survey have metrics out the wazoo to track ad effectiveness and the impact of their digital channel marketing investments.

I’m not saying that banks shouldn’t be tracking these metrics. What I’m saying is their marketing measurement efforts are incomplete–woefully incomplete.

Considering the time and effort required to track and use marketing metrics, banks and credit unions that don’t do a better job of tracking WOM today will find themselves playing catch up a few years from now (if even that long down the line). And it’s going to cost more to play catch up than investing now. Getting more marketing budget for measurement is no problem at your FI, is it?

Measuring WOM

If you do want to get ahead of the game, however, read up on the Referral Performance Score, which I’ve written about a number of times here on The Financial Brand.