Moving from a transactional mindset to an engagement mindset has become a crucial capability in banking. It doesn’t matter if the customer is a digital native, branch-based customer or a combination, the ability to provide contextual products, services, and recommendations is the foundation of developing a stronger relationship and greater revenues.

Building active engagement on a frequent basis beyond rudimentary transactions requires more than traditional personalization. In fact, research by the Digital Banking Report found that financial institutions that excel at building interactions beyond daily transactions generate more revenue from those activities than average players. This is accomplished by creating offerings, content, and communications to the right customer at the right time with the right interaction.

The urgency to create increased customer engagement has never been greater. According to McKinsey, “The surge in digital interactions since the onset of the pandemic escalated expectations – giving consumers more exposure to the personalization practices of e-commerce leaders and raising the bar for everyone else.” Organizations like Amazon, Netflix, Apple, and a multitude of other firms have made personalized engagement the default standard for relationship growth.

Customer Engagement Defined:

Customer engagement is the ongoing cultivation of a relationship between the company and consumer that goes far beyond the transaction. It’s an intentional, consistent approach by a company that provides value at every customer interaction, thus increasing loyalty.

— Cari Murray, Senior Manager at Content Marketing

The McKinsey research found that 71% of consumers expect companies to deliver personalized engagement. And 76% get frustrated when this level of engagement doesn’t happen. Making matters worse, if a customer doesn’t feel they are receiving a contextual experience, it’s easier than ever for them to move to another provider – usually without fully closing their existing relationship.

( Learn More: Consumers Demand Improved Digital Banking Customer Engagement )

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

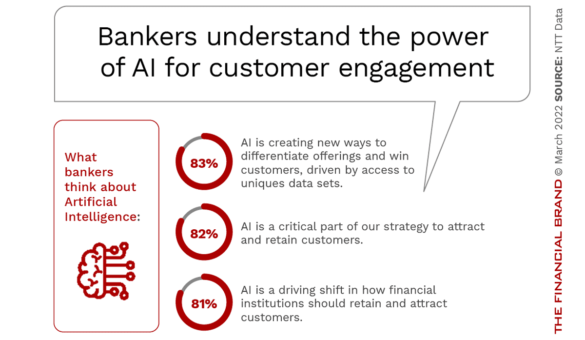

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Benefits of Banking Customer Engagement

Many financial institutions confuse customer experience with customer engagement. Customer experience is the perception that your customers have based on everything they see, hear, or learn about your company. Alternatively, customer engagement is the process of interacting with your customers across all channels in order to strengthen the overall relationship. Both the customer experience and the engagement process begins before an account is opened and continues through the entire customer journey.

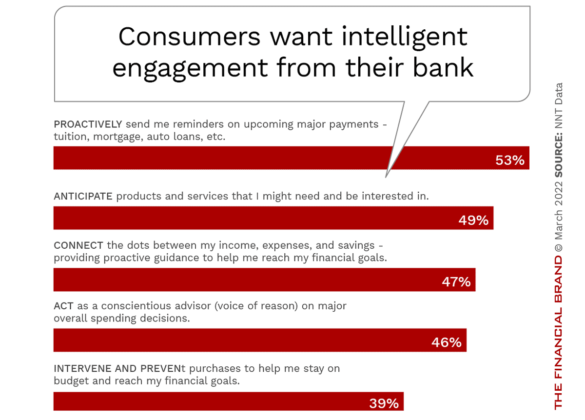

To build a more positive experience, banks and credit unions can engage with customers on a personalized basis via direct mail, email, social media, mobile banking platforms, websites, or any other channel where contextual interactions occur. The power of new technologies and digital tools assists in the most important component of customer engagement … listening. From monitoring transactions and customer inquiries, to asking for insights into financial goals, listening builds rapport and enables an organization to provide a personalized solution.

The ultimate goal of customer engagement is to offer customers something of value beyond your products and services. While products may attract customers initially, a differentiated contextual engagement is what keeps them around. A study by Gallup discovered that when companies successfully engaged customers, they reported 63% lower customer attrition, 55% higher wallet share, and overall performed 23% better than their competitors.

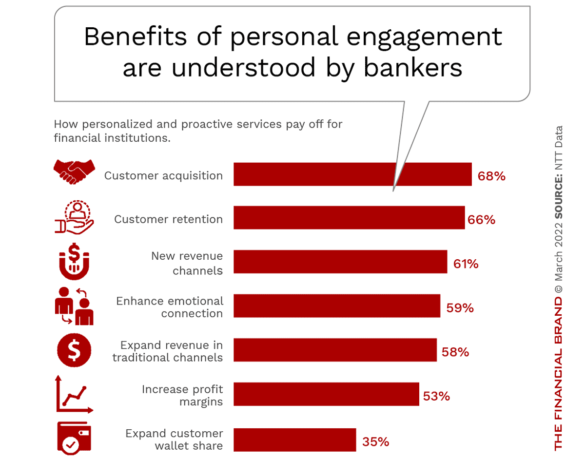

The relevancy of the engagement process is what makes customers engage with your brand. The level of engagement results in an improved customer experience. According to NTT Data, improved engagement and enhanced experiences provide acquisition and retention benefits as well as uncover cross-sell and up-sell opportunities at a rate that is at least 3x to 10x greater than pure prospecting. And, instead of building a product-based marketing cycle, the customer is being served at the time of need.

Read More: Increased Digital Banking Interactions Require Greater Personalization

Using Technology to Drive Banking Customer Engagement

Technology is the engine that makes customer engagement possible. Customer data is the fuel for that engine. Modern engagement platforms use AI-driven tools as well as internal and external data to automate interactions, creating a personalized experience that encourages a prospect to open an account and a customer to expand a relationship.

The beauty of combining data, advanced analytics and modern communication platforms is that you can anticipate needs, create custom responses to inquiries at scale, build new products and services for micro segments, and retarget potential customers in real-time. By building a seamless, streamlined communications cycle, teams can focus on innovation, custom outreach, and learning from previous communication efforts.

A data-driven approach to engagement goes beyond the power of simple incentives and special offers to provide relevant content that customers value. As customers become more familiar with your highly personalized communication process, they will often go to your brand before others for future needs. If your content provides value (from the customer’s perspective), there is a much higher tolerance for increased quantities of communication. This equates to more opportunities.

Strategies for Successful Banking Customer Engagement

Customer engagement strategies in banking will work if they involve all areas of the organization (as opposed to just marketing). Creating an exceptional customer experience using powerful engagement strategies expands across the entire customer journey, using all channels and every department of your organization.

The key strategies and tactics to include in your digital banking engagement playbook include:

- Know your destination. As with any initiative, you can’t reach your goal if you haven’t defined your destination. What will customer engagement look and feel like in your organization. What components can be implemented today and which may have to wait? Will your engagement strategy include proactive recommendations based on data and AI? Will your organization build content that is accessible on demand? How will your employees be involved?

- Engage your employees. Identify who in your organization will have a role in engaging customers and get their collaborative buy-in. This will help avoid any reservations around the process and help build a comprehensive strategy that engages the customer across channels and throughout the customer journey.

- Identify your target audiences. Identify who you will be targeting for communication. Will you focus on only a single segment of customers, or your entire base? Once your target audience is selected, you need to understand the preferred engagement styles of sub-segments. For instance, who has shown a preference towards digital communication as opposed to in-branch engagement? Also, identify the financial needs of your target customer and what motivates their decisions.

- Build content. Create content and a communication flow that is customer-driven. Make the content personal to the target audience and reflective of the insights you know about them. Provide solutions to the specific target audience’s pain points and measure the impact of your communication. Make recommendations based on past purchases or search history. Don’t be afraid to ask for customer insights at the beginning of the experience, using this insight to delight the customer as soon as possible.

- Utilize modern technology. As soon as possible, leverage the most appropriate automation and communication tools that can allow you to simplify an increasingly complex engagement process and track results.

- Measure results on a macro and micro basis. Monitor the success of all of your activities against the original goals and on a campaign basis. Gather feedback from internal teams as well as any third-party providers you have engaged in the process. Also gather feedback from the customers you targeted to determine what worked and what didn’t. Just monitoring sales results is not enough given the longer-term nature of engagement communication.

- Modify tactics and strategies in real-time. The technology and tools available for a customer engagement process can provide immediate feedback on results. Leverage this feedback as it becomes available as opposed to waiting a month, a quarter, or a year in the future.

The Future of Banking Customer Engagement

In order to acquire, convert and retain customers – and turn them into advocates – you need to engage them across channels and over time at every opportunity that creates value for your customers. The objective is to connect with your target audience in an appropriate, effective and meaningful way.

Successful banking customer engagement doesn’t eliminate the need for strong branding – it relies on it. While new technology and marketing communication tools can make the customer engagement process easier and scalable, it is also important to create a brand personality that customers will love getting to know and want to engage with. This brand personality must be evident in each communication.

Engaging with customers effectively sometimes means sending timely push notifications that require action and provide value. This very powerful communication tactic requires customers to subscribe for these notifications. By opting-in to receive these messages, they are already choosing to engage with your brand.

There are more ways than ever to engage with customers today. This means lots of opportunities for your financial institution to capture your customers’ attention and get them engaged. It also means that your competitors have the same opportunities. Whatever engagement strategies you employ, you must be consistent and ongoing through the brand journey.