The Consumer Financial Protection Bureau (CFPB) sent out a press release with the following headline:

CFPB Report Finds Nearly Half of Borrowers Do Not Shop for a Mortgage

My take: Really? Half don’t shop around for a mortgage? That depends on how you define “shop for.”

In looking for an alternative source of data on mortgage shopping behavior, I immediately thought of Forrester Research because I know they do a lot of consumer research in this area. The most recent data I could find–that was publicly available–was from 2004. Ironically, it was a report that I wrote.

Back in 2004, 83% of consumers who applied for a mortgage said that they researched their decision before applying (and, in case you’re interested, 88% of those who refinanced said they researched that decision).

Taking the CFPB’s numbers at face value, in the 10 years since 2004, consumer shopping/research for mortgages dropped 30+ percentage points!

What happened? Are new homeowners too stupid to know that rates and points differ?

Compared to 10 years ago, I’d bet there has been a significant shift in the demographics of new homeowners, from Gen Xers back in 2004, to Gen Yers today. So maybe the explanation is that Gen Yers–who we all know are just lazy do-nothings, sponging off their parents–are too lazy to shop around for mortgages (of course, this begs the question how they can afford a mortgage in the first place).

Or maybe there’s another explanation. Maybe is has to do with how the CFPB defines “shop for.”

Look at how the question is worded: “How many lenders/brokers did you seriously consider?” Based on the ~50% who said one, the CFPB concluded that half of mortgage applicants don’t shop for a mortgage.

But “seriously considering” is not the same as “shopping around.”

It’s quite possible (and maybe even probable) that mortgage applicants checked the rates and fees at five different providers, but only “seriously considered” one or two of them.

So maybe the CFPB’s claim that half of mortgage applicants don’t shop around is overstated. But the tools it’s providing look quite interesting:

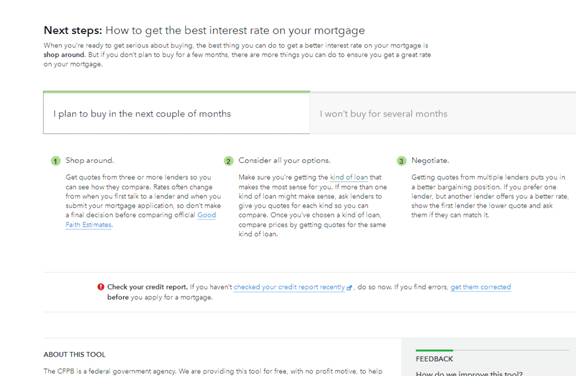

Using interest rate data from Informa Research Services, the site shows the rates offered by various providers–and the number of providers offering that rate–by credit score. The tool goes on to offer advice on what to do regarding research and negotiating, and splits that advice on whether or not a consumer will buy a home in the next few months or not.

Bottom line: The CFPB may have misstated the percentage of consumers who shop around for a mortgage. But its efforts to educate consumers on how to shop around, and what to look for is commendable. Frankly, it’s what FIs–and in particular, credit unions–should have already been doing.

“Whoa, hold on there, Snarketing Boy–we have been doing this and providing this educational material,” you say.

Well, now we have to get into a qualitative assessment of how well you’ve been doing it, and to what extent. And I would contend — granted from my very cursory review of just a handful of large credit union sites–that you have not been doing it to the extent that the CFPB is.

And that’s too bad. Because by not doing so, you’re missing out on brand development and marketing opportunities (I don’t mean that you’ve been missing out on sales opportunities).

What the CFPB is trying to imply with its (sadly, misguided) research is that consumers need help making mortgage decisions. The CFPB shouldn’t have the question it did–it should have asked (something to the effect) “when you researched your mortgage decision, did you know what to look for and what to ask?” Or maybe “to what extent did you know what to look for and what to ask?”

I bet they would’ve have found that consumers did not know… and needed help.

Providing help to consumers on how to make smarter decisions is marketing, in and of itself. It positions you as an advocate for the consumer. Even if that consumer doesn’t apply for a mortgage, she will remember who helped her make the decision. And — I’m betting, because I don’t have any data to prove this — she will consider your organization the next time she has a product need.