One of the major advantages digital-native companies have compared to legacy financial institutions is the technology infrastructure that supports product and service development and delivery, contextual personalization across the customer journey, and improved experiences and engagement. To respond to these marketplace advantages, banks and credit unions must quickly upgrade their marketing technology capabilities to support a more customer-centric approach.

Unfortunately, many banks and credit unions have not adequately responded to fintech firms or big tech alternative providers. Some legacy banking organizations have played defense, with iterative modifications to existing business strategies, while others are confused as to what to actually do.

Interestingly, while the largest financial institutions have the financial capabilities to invest in new technologies, many fail to move from a product-centric approach to customer-centric marketing.

To succeed in the future, financial institutions will need to move beyond their traditional product and service mindset. By leveraging an existing client base and brand strength, banks and credit unions can use data to build a more robust view of customer needs and improve engagement across the entire customer journey.

Fractional Marketing for Financial Brands

Services that scale with you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Changing Marketplace Raises the Martech Bar

As branches became unavailable during the pandemic, the awareness of digital-native alternatives increased, with both consumers and small businesses ‘testing the waters’ with alternative providers that had created highly personalized digital solutions. For bank and credit union marketers, increased confidence in digital banking products and services provided a surge in usage, and an opportunity for institutions to create improved levels of real-time communication and engagement.

What became even more important during the pandemic was the need for financial institutions to seamlessly deliver messages across multiple channels, such as a phone, tablet, computer and even smart devices simultaneously. It has also become more important to create two-way interactions as opposed to simply using push communication.

Finally, the pandemic has required financial marketers to rethink their business model to provide hyperpersonalized engagement at scale. This requires new marketing technologies that support data collection, analytics, real-time triggered communication, insight democratization, and agile test-and-learn approaches.

Read More: 5 Martech Tools & Trends for Financial Institutions

Marketing Priorities Differ by Type of Provider

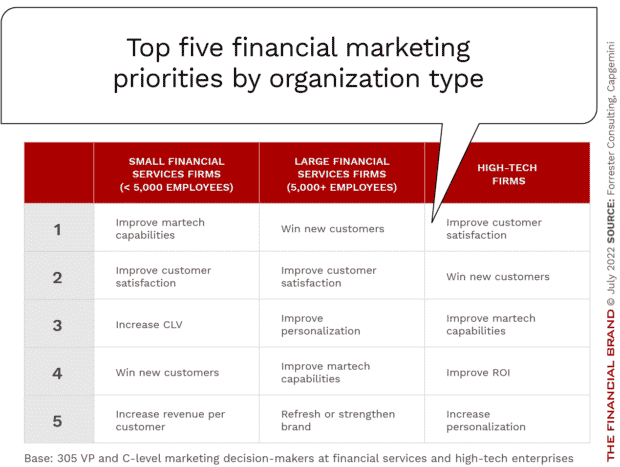

Responding to the opportunities (and challenges) that have evolved since the pandemic, financial services providers of all sizes and types are prioritizing marketing technology investments. According to research conducted by Forrester Consulting on behalf of Capgemini, the focus of these investments differed between smaller financial institutions, larger banks and credit unions and high tech firms.

The research found that high-tech firms make customer-centricity a greater focus of their marketing strategies than traditional financial institutions. Legacy firms continued to be very product-centric in their marketing mindsets, organization, and strategies. In fact, the research found that only 7% of traditional financial services companies were customer-obsessed in 2021.

“59% of large financial services companies say their martech roadmap only somewhat aligns to their customer strategy.”

— Forrester Consulting

Read More: How Inflation Is Reshaping Bank Marketing Strategies & Budgets

Martech Maturity Differs by Type of Provider

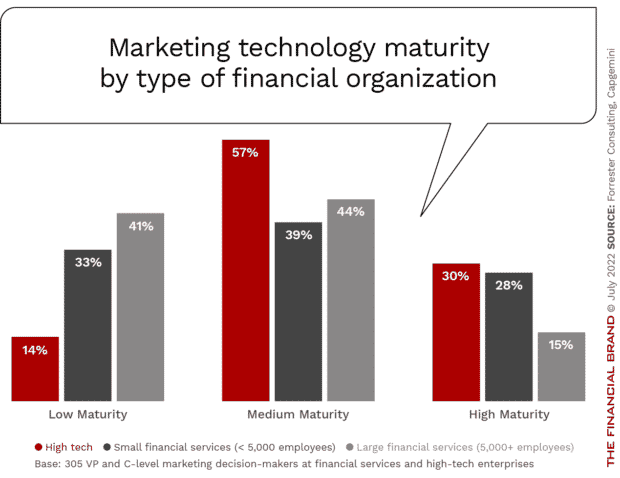

The research also did a deeper dive into the strengths and weaknesses of financial services and technology organizations on a martech maturity basis across 24 key capabilities within five categories, including strategy, process, technology, data, and organization. The organizations were grouped into three maturity brackets as low (bottom 25%), medium (middle 50%), and high (top 25%). This helped to determine a strategic roadmap for each level of maturity.

The model showed that larger financial services firms were less mature than smaller financial firms and that all legacy banking organizations lagged big tech firms in martech maturity. In fact, almost 40% of legacy financial services organizations self-assessed their firms as being at the lowest maturity level, compared to only 14% of technology firms. Alternatively, 30% of tech firms considered themselves to have a high martech maturity level versus only 20% of legacy banks and credit unions.

“The greatest maturity gaps for traditional financial services firms are in the areas of strategy and data.”

— Forrester Consulting

The study found that financial services firms need improvement around data (collection, analysis, measurement, and insight activation and democratization). In addition, traditional financial services firms need more insights integrated into their strategies and program execution – moving from being product-centric to being customer-centric.

Investing in Becoming Customer-Centric

The most advanced financial services organizations invest in data analytics and automation to create personalized experiences across the entire customer journey. They also align their martech investments to supplement and compliment their organization’s broader customer initiatives. As the research dug deeper, it found that traditional financial firms are less likely to plan resource allocation around future opportunities, and are less likely to collaborate with outside providers to deliver customer-centric innovations.

“Only 36% of large financial services firms say they personalize programs based on real-time data, compared to 51% of technology companies.”

— Forrester Consulting

Modern technology is the greatest barrier to success and the area of great opportunity for both traditional financial firms and high tech providers. Outdated technology constrains larger financial services organizations, making it difficult to keep pace with the capabilities of high tech firms and fintech organizations that are digital-natives.

Areas for improvement and investment include:

- Cross-channel customer identification

- Real-time personalization

- Cross-channel measurement of customer engagement

- Modernize martech stack, removing redundancies

- Automate back-office processes for speed and efficiency

- Advanced analytics to enhance marketing effectiveness

Read More: 62 Digital Marketing Statistics Every Financial Marketer Should Know

Modern Marketing Technology – Now More Than Ever

Digital transformation of the marketing process in banking equates to using modern technology to continuously evolve all aspects of the digital banking business model. This includes what products and services are offered, how an organizations interacts with customers, how an organization supports customer centricity, and how engagement is supported across the entire customer journey. To support ongoing investment, all marketing activities must support business results.

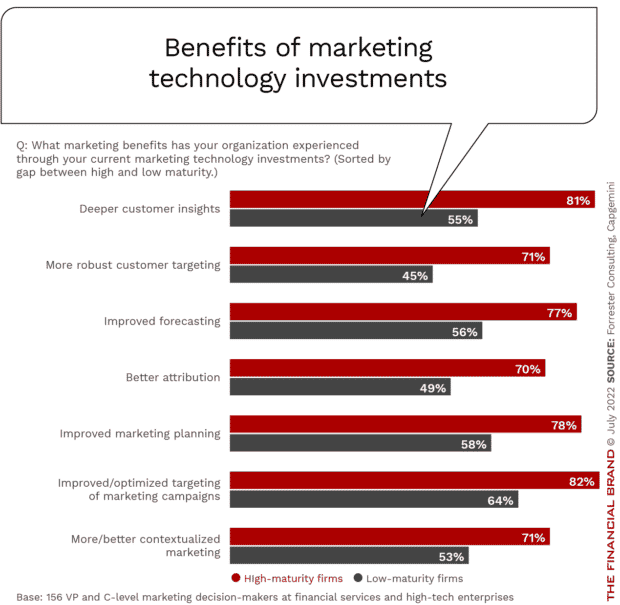

According to the Capgemini research done by Forrester Consulting, organizations that invest in modern marketing technology benefit in the following ways.

- Deeper customer insights and engagement

- Increased leads and conversions

- Better measurement of results

- Enhanced revenue

Put simply, modern marketing technology is transforming how marketing is done and the results it achieves. Those organizations that invest in a modern martech stack will win the battle for the acquisition and retention of customers, while laggards will lose. The most progressive organizations will not just use marketing technologies to drive communications but to democratize insights for everyone in the organization.

This will break data and communication silos, improving customer engagement and experiences. Similar to digital banking transformation, the evolution of marketing technology is a never-ending process. Those who delay in investing in the future will fall further behind.