A Cardtronics study found that 85% using at least two different types of payment methods each month, and 55% using at least three. The study revealed that 56% of consumers use cash as frequently as they did one year ago, and 23% are using it even more frequently.

Millennials may be the most tech-savvy demographic segment, but research shows that this digital generation is using all the major payment methods more frequently than they did a year ago — including cash — with one notable exception: paper checks. Two-thirds (67%) of Millennial respondents in the Cardtronics study said they were still using cash regularly.

In fact, cash is still the most commonly used form of payment in brick-and-mortar stores at 89% — compared with 74% for debit cards, 66% for credit cards, 18% for store mobile apps and 17% for mobile wallets.

of Millennials use cash the same or more frequently than they did last year.

of Millennials use cash the same or more frequently than they did last year.

— Cardtronics

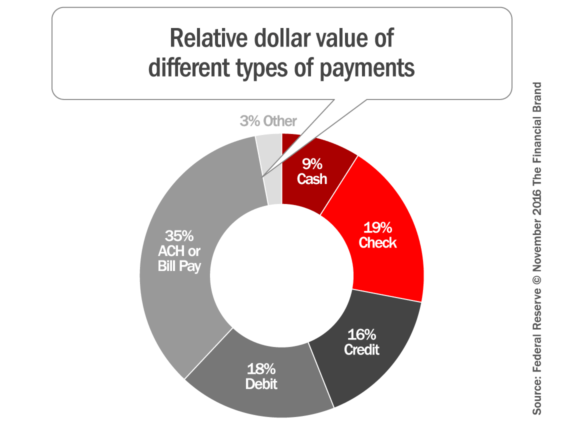

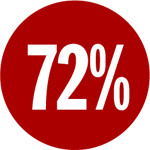

In general, 80% of people agree that they use cash for smaller items and other forms of payment for larger, more expensive items. Specifically, 72% of people use cash for purchases under $10 and 54% use cash for purchases under $20.

“Cash is still the preferred method for grass-roots retail transactions like street vendors, flea markets, neighborhood garage sales, mom and pop shops, and a kid’s lemonade stand,” says Melissa Newton at MoneyBasicsU.com.

At convenience stores, consumers are almost twice as likely to have used cash in comparison to credit in the past six months, and 33% are more likely to use cash than a debit card. When it comes to impulse buys, 75% of items such as candy and gum — frequent convenience store purchases — are made with cash.

Cash continues to dominate (79%) person-to-person payments. In specific scenarios, such as dining out, 55% of consumers (including 47% of Millennials) still prefer to split the bill with cash.

A separate study conducted by the Federal Reserve Bank of San Francisco reached three similar conclusions:

1. Cash continues to be the most frequently used consumer payment instrument.

2. Cash is widely used in a variety of circumstances.

3. Cash dominates small-value transactions.

The third point is particularly troublesome for those pushing digital payments. Consumers see cash as the most convenient and efficient method for making small purchases; they feel it isn’t worth the “hassle” to take all the steps necessary to make a digital payment when they can just reach into their pocket and slap a note on the counter. For consumers to embrace digital payments in all settings and situations, they not only need to be as fast and as simple as cash, consumers have to perceive them as such.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Security Concerns and Budgeting Control Drive Preference for Cash

With data breaches routinely in the headlines, 83% of consumers have concerns about data security and privacy, and nearly everyone (93%) believes cash can keep them safe from hackers.

of consumers prefer to use cash for purchases under $10.

of consumers prefer to use cash for purchases under $10.

— Cardtronics

But cash also gives consumers a different level of security — emotional security. Nearly two-thirds of people feel nervous when they don’t have cash on them, and 84% say they always try to keep cash on hand. Respondents in the Cardtronics study said they had an average of about $50 in their wallet at any given time. This probably reflects consumers’ general unease with technology — that systems can crash or the power could go out or their card could get rejected, but you can always count on good ole cash. Indeed, only 44% of consumers feel credit and debit cards are safe, while about half (49%) think a mobile wallet is safe.

Cash also plays a role in helping consumers manage their finances, with 77% of respondents reporting that cash helps them maintain control over their spending — nearly half consider it the best option to do that. Among Millennials, the trend is even stronger with 71% leaving their credit card at home when they go out to avoid overspending, and 70% who don’t like using credit cards because they “don’t like being in debt.”

This is a significant challenge that digital banking zealots will have to address if they want to see payment instruments like cash fade into history.

When it comes to payments, “convenience will always come out on top,” as ACI Worldwide’s Mark Ranta astutely observes.

Cash Will Never Go Out of Style… or Circulation

There are signs suggesting the world will someday be cashless. India, for instance, has just banned notes with lower denominations (Rs 500 and Rs 1,000, roughly equivalent to USD $7.50 and USD $15.00 respectively). Citibank in Australia says it will stop taking cash or coins in its branches. And the homeless in Stockholm have started accepting card payments.

of Millennials say cash helps them budget.

of Millennials say cash helps them budget.

— Cardtronics

But a cashless society remains an elusive myth — both today and for the foreseeable future, with 79% of U.S. consumers in Cardtronics’ research claiming that they can’t imagine a world without cash. 83% of respondents said they would miss cash if it went away, and 85% believe cash will never go out of style. And while digital and mobile payment adoption is rising, a moderate pace of adoption indicates that consumers are complementing the use of cards and cash rather than replacing them large-scale.

There is a lot of hullabaloo and hyperbole surrounding the “death of cash.” But make no mistake: It isn’t going away. Not now, nor anytime soon. Central banks around the world seem to agree on this point.

“Cash is often in the media spotlight,” says the Bank of England in an official white paper it published late in 2015. “While some predict its impending demise, most people continue to use banknotes in their day-to-day lives. Over the next few years, consumers are likely to use cash for a smaller proportion of the payments they make, but cash is not likely to die out and aggregate demand for banknotes is increasing.”

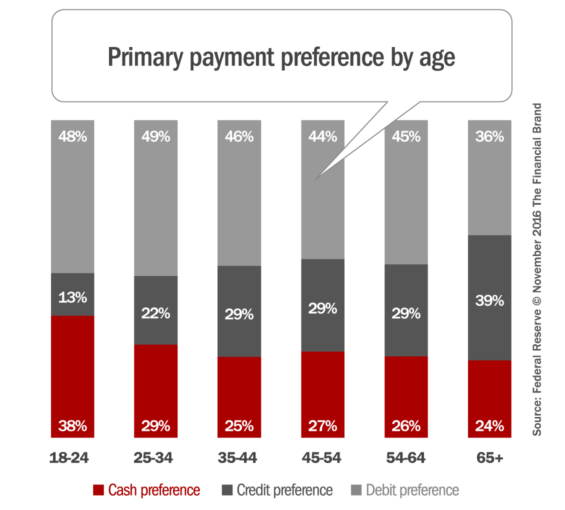

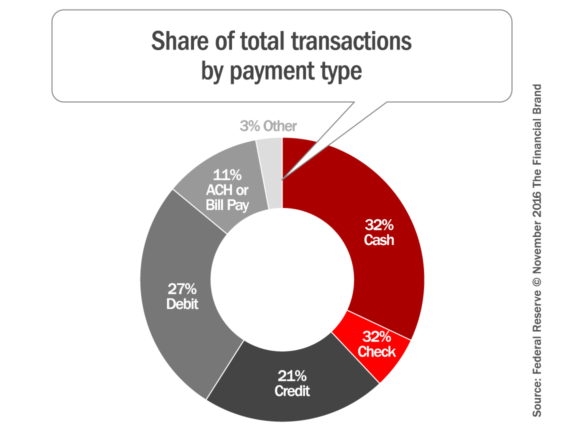

In research conducted by the Federal Reserve Board in 2015, 32% of all consumer transactions were made with cash, compared to 40% in 2012. Growing consumer comfort with payment cards and the growth of online commerce, among other factors, contribute to this trend. Nonetheless, a broad range of results suggests that cash remains resilient and continues to play a key and unique role for consumers.

“By the number of transactions, cash is the dominant payment type in every country in the world,” says Gareth Lodge, a Senior Analyst with Celent. “It is, in fact, typically more dominant than all other payment types put together.”