Reloadable debit card accounts look very similar to standard checking accounts: They include features like online bill pay, mobile banking, direct deposit, and access to cash through ATM networks. They’re easier to open for some because customers’ information are not put through ChexSystems for approval. From a consumer’s perspectives, the biggest differences are that you can’t write checks unless they’re pre-authorized, and you can’t overdraw the account.

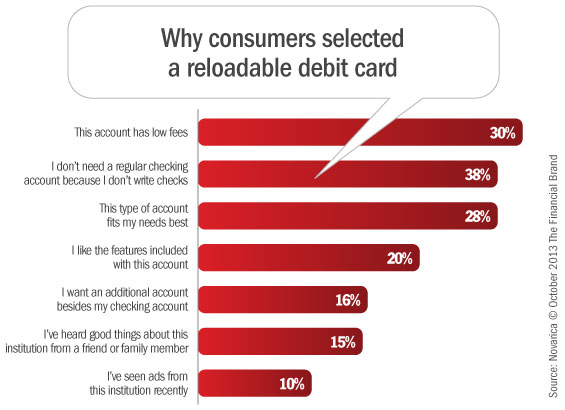

Over the last several months, shoppers visiting FindABetterBank have been able to compare checking accounts and reloadable debit cards. While most shoppers on the site are specifically looking for checking accounts, approximately 3% of shoppers choose reloadable debit cards. While that seems like a small percentage, only one of the reloadable debit cards listed is a national brand, and most consumers are not familiar with how reloadable debit cards work. Why did shoppers choose a reloadable debit card?

Base: FindABetterBank shoppers that selected a reloadable debit card and responded to the survey between August and September 2013.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Is this type of cash management account a viable alternative to checking accounts for many consumers, or is it a product for the unbanked, or for those who won’t be approved through ChexSystems? Analysis of the banking behavior of customers selecting these cards can shed some light:

- Reloadable debit cards appeal to unbanked shoppers. Twenty-five percent of shoppers selecting reloadable debit cards indicated that they don’t have a direct deposit compared to 20% of shoppers overall. These shoppers maintain much lower balances than those with direct deposits and are more likely to select one of these cards due to low fees — 40% versus 27%, respectively.

- People who don’t write checks see reloadable debit cards as a low-cost alternative. The simplicity of reloadable debits can be appealing to consumers who aren’t check writers – think young consumers. Thirty-five percent of shoppers who said they chose the account because they don’t write checks also indicated that they chose the account due to its low fees. These shoppers need cash management accounts – 70% indicate they withdraw cash from ATMs at least once per week.

- Some traditional checking account customers want a low-cost cash management option. Shoppers who chose a reloadable debit card because they wanted an additional account carry higher balances and are more likely to have a direct deposit. For these shoppers, reloadable debits cards are a low-cost alternative to an additional checking account.