PayPal began in 1998 with the unremarkable name Confinity, and a narrow focus on ecommerce payments — then just a blip. From this modest start PayPal has blossomed over almost 25 years into a payments powerhouse that keeps expanding way, way past its roots.

In 2021 PayPal passed the $1 trillion mark for annual total payment volume, hitting the $1.25 trillion level with expectations of continuing towards $1.5 trillion for 2022. Net revenues came to $25.4 billion for the year, up 17% year over year. (The revenue figures are “FXN” — foreign exchange neutral, that is, computed before currency effects are accounted for.)

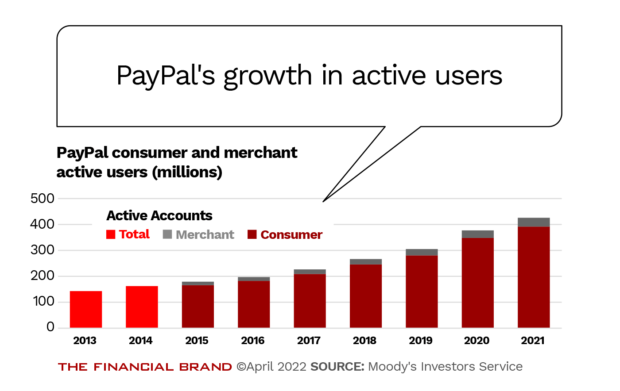

The company finished 2021 with 426 million active accounts, 34 million of whom are merchants. And transactions per account grew to an average of 45, an 11% increase over 2020. Having grown so much, management now plans to focus harder on engagement — increasing account holders’ usage of PayPal’s growing range of payment options and other financial services.

Deepening PayPal's Customer Penetration:

Most of PayPal's business comes from about a third of its customers and the company wants to boost participation to drive more volume on its channels.

Such growth always has its share of missteps, but an interesting perspective on PayPal’s developmental thinking came during a “fireside chat” between a Cowen Research analyst and the two top officials overseeing PayPal’s new effort to build cryptocurrency into its payments platforms.

Cowen’s George Mihalos, Managing Director and Senior Research Analyst, said: “You guys are not just moving fast and breaking things, as maybe some others in this space have in the past. Is that a very fair way to put it?”

“I think we would like to move fast and not break things, that’s our approach,” said Edwin Aoki, the Chief Technology Officer of Blockchain, Crypto and Digital Currencies for PayPal.

“We are a regulated payments company, so it’s important when you’re dealing with people’s money that you do it responsibly, so breaking things is not an option,” chimed in Jose Fernandez Da Ponte, SVP and General Manager of Blockchain, Crypto and Digital Currencies.

Banks and credit unions who don’t regard PayPal as a clear and present competitive threat just haven’t been paying attention. Not that PayPal is the only threat out there and not that it’s bulletproof. Analysts have pointed out that newcomers anxious to build a greater payments presence, such as Shopify, are nipping at the giant’s heels. And it already faces competition from banking payments leaders like BofA and JPMorgan Chase.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Understanding the Breadth of PayPal’s Operations

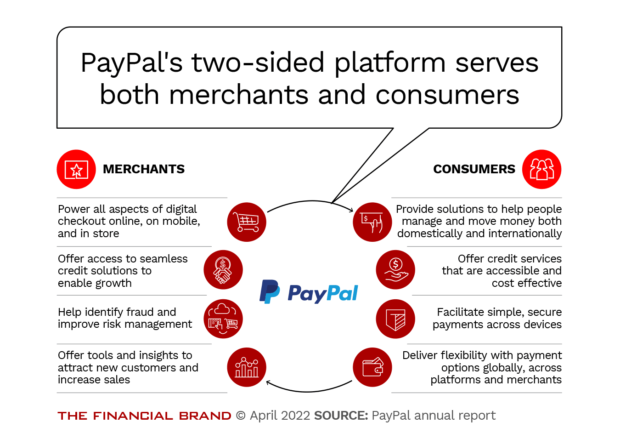

PayPal has grown into the behemoth it is by serving both merchants and consumers, in both ecommerce and live commerce. Merchants are seen as partners, rather than simply a conduit for transactions, and PayPal works to find ways to help increase merchant sales, which of course increases volume and compensation for PayPal.

Where does PayPal make its money? For most of its history the bulk of revenue has come from fees charged for receiving and processing online, mobile and in-store payment transactions, generally paid by merchants. Consumer charges include fees for instant transfers from debit cards or bank accounts to PayPal or Venmo accounts.

Another source of revenue is interest on certain credit products. For example, PayPal has been holding buy now, pay later balances for the interest income, which comes from merchants who subsidize interest that consumers would otherwise be paying. Revenue also comes from various value-added services.

PayPal’s Super App Has Become a Major Company Focus

In many ways PayPal increasingly comes together in the super app it unveiled in later 2021. Dan Schulman, President and CEO since late 2014, said in an earnings presentation that:

“Our vision of becoming an essential consumer financial super app across payments, basic financial services, and shopping tools is more relevant than ever before, and our tens of millions of merchants continue to look to us to provide a comprehensive platform for them to navigate the digital economy where the lines between virtual and physical commerce are disappearing.”

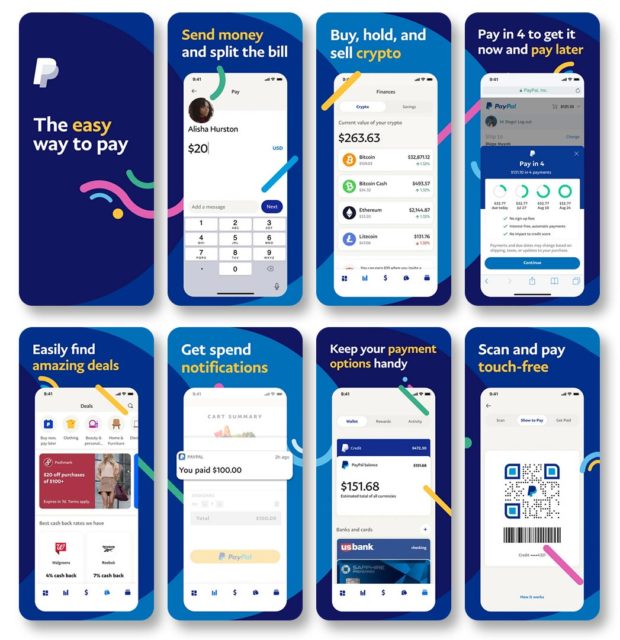

Bankers and credit union executives who want to have a constant update on where PayPal is going next have the convenient option of downloading the company’s super app. That will give them a PayPal précis in their pockets.

In one place consumers can do almost anything they need in payments, and more: pay with digital wallets, including payment by QR codes and PayPal credit cards; load other credit, debit and loyalty cards into the wallet; get updates on scheduled payments; send money and split bills; buy, hold and sell crypto (even at the point of sale, for purchasing) and receive PayPal “cashback” incentives in crypto form; tap PayPal’s pay in four buy now, pay later plans at checkout; store PayPal Cash Card balances, which can be drawn on like bank accounts; and more. (PayPal Cash balances can be added to via direct deposit, cash loads at 90,000 retailers.)

Many fintechs have made transaction accounts their beachhead into banking, with the idea of expanding into other services later. In contrast, PayPal made its landing via payments and has been building on that beachhead since. Earlier this year PayPal began offering high-yield savings through the super app in partnership with Synchrony Bank, which holds the deposits and pays the interest at present. (It can be argued that PayPal is already in the quasi-deposit business through balances kept in consumers’ PayPal and Venmo accounts.)

This prompted Moody’s Investors Service to speculate on the longer-term significance: “The high-yield savings product supports PayPal’s objective of becoming the center of its customers’ financial lives, notably for the underbanked consumers. The ability to offer savings accounts will help PayPal gain share of primary transaction accounts as well as direct deposits, which substantially increase engagement.”

Moody’s adds: “We expect the company to offer additional services over time to support consumer use of PayPal as primary transaction account.”

About half of the PayPal base already has the super app right now, but the potential for millions more to adopt it stands a good chance. Schulman is allocating major marketing budget to build enrollment. The incentive is there, as adoption of multiple services within the super app runs strong.

PayPal Digital Wallet Dominates the Battleground

People who use digital wallets tend to have more than one, partially out of concern about acceptance at the point of sale. That said, PayPal officials indicate that when they have a choice consumers are using PayPal’s wallet, now a super app, over 50% of the time. Management says the company intends to build on this, and continue to add more functions to the super app, because “you’re beginning to see more and more preference for brand ecosystems,” says John Rainey, PayPal’s CFO and EVP, Global Customer Operations. (In May 2022 Rainey is slated to leave PayPal to become CFO at Walmart, which has been beefing up its own fintech muscle.)

“The company’s digital wallet service is one of the crucial technology enablers of global ecommerce,” states Moody’s.

The push on the super app front is an expansion, not a replacement, for the company’s strength in merchant checkout.

“We’re going to continue to focus on checkout because checkout is the bread and butter of PayPal and we have a best-in-class experience there,” says Schulman, “and we feel there are numerous ways we can continue to improve that.”

Banks that concentrate on business customers shouldn’t feel they don’t have a dog in this hunt, by the way. Many small companies use PayPal and Venmo for sales transactions. PayPal offers them PayPal Working Capital Loans in a program where WebBank provides the actual credit. The no-interest loans incur an upfront fee and repayments are taken a slice at a time from each sale made through PayPal. (Other credit services are also available.)

Clearly, PayPal’s strength comes from being willing to expand its battlefront while continuing to pay attention to the basics, which makes it a broader competitor to both banks and other fintechs as it adds more services to its roster.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

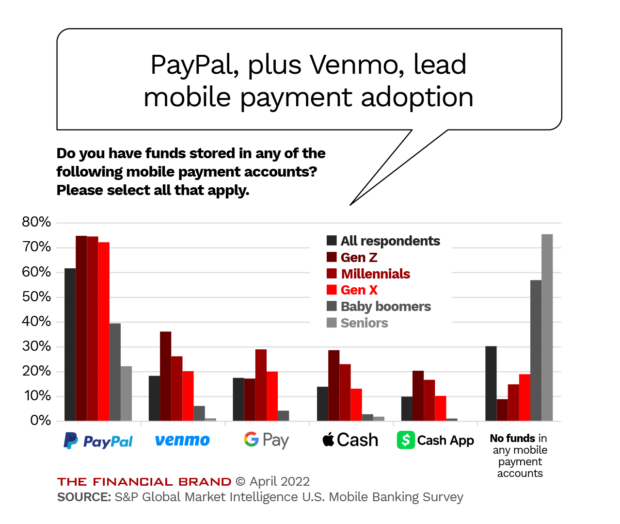

Venmo, PayPal’s Generational Play that Has a Life of Its Own

Venmo became part of the PayPal family in 2013, when PayPal purchased Venmo’s parent, Braintree Systems. Venmo leads an unusual existence. While in some ways what it does is parallel to aspects of PayPal, such as its P2P function, it still leads its own existence and serves its own slice of the payments market. (Venmo has its own app, credit card, and debit card, for example.) At the same time, it also benefits from being part of PayPal.

Darrell Esch, SVP and General Manager at Venmo, explained during a Bank of America digital payments symposium how this works.

“The day I took over, a couple of years ago, I pulled the Venmo team together,” said Esch. “I said that, ‘Going forward, one of the things that will change is that we are going to be Venmo — and we’re going to be PayPal. We will gather the enterprise value and the infrastructure capabilities around PayPal, and we will bring it to Venmo’.”

Esch, who is also head of digital wallets at PayPal, added that “we’ve got a bunch of PayPal capability that we still need to consume, but it will lead to more monetized commerce broadly.”

So, why not just merge Venmo into PayPal and call it done?

The reasons come down to demographic and social media. Millennials dominate the Venmo user mix and many use its social media tie-in, by which your followers learn what you’ve most recently spent money on.

“The Venmo base is overwhelmingly younger and mobile-centric, highly educated, and upwardly mobile. So it’s got the Millennial sweet spot merchants want.”

— Darrell Esch, Venmo/PayPal

There are approximately 80 million active Venmo accounts in the U.S.

Part of the appeal is that when Venmo users make a purchase it gets flashed to their social connections within the Venmo community. (Privacy controls are available.) Venmo can be used at point of sale now so it has moved beyond traditional P2P. This gives merchants publicity that could drive additional sales among users’ followers. Venmo has also been improving the user experience for purchases from merchants.

Esch said that more benefits will come to merchants as Venmo adds more PayPal services, such as buy now, pay later. As capabilities are added, Venmo markets them inside its app, to stimulate usage. Esch notes that while some of PayPal’s direct volume occurs outside of its digital wallet, most of Venmo’s volume comes from its app. Even with the introduction last year of a Venmo credit card, Esch stresses that it is “an app with a card. The app is where the magic is.”

More magic may be coming, as an agreement by Amazon to accept Venmo kicks in sometime in 2022.

PayPal Stays on the Leading Edge with BNPL and Crypto

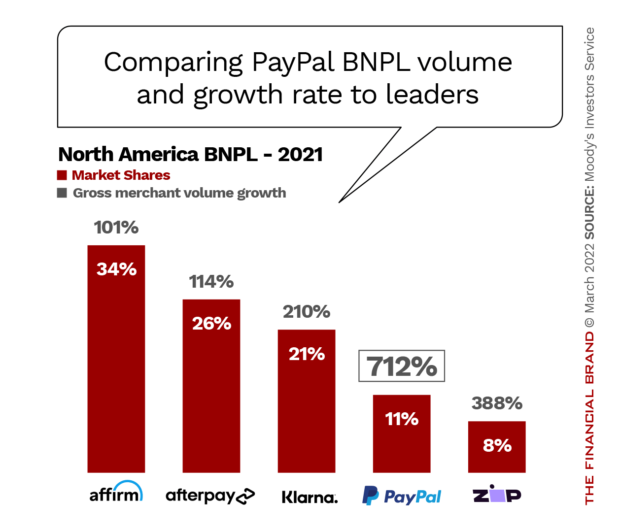

Buy now, pay later service makes a good reminder of how international PayPal’s operations have become. The company is offering the service in major markets, such as India, Japan and Germany, in addition to the U.S.

“The idea is to bring a buy now, pay later solution to everywhere PayPal is,” says Greg Lisiewski, VP and General Manager of Global Pay Later products at PayPal. During an interview with analysts at Wolfe Research, Lisiewski spoke of BNPL as something in between a payments method and a credit option.

“Ultimately, these no-interest merchant programs give customers a way to manage cash flow. And frankly, that matters for most people all the time,” said Lisiewski, who is a veteran of installment payment borrowing.

Lisiewski said that the programs “turn browsers into buyers and lift order values” — 30% to 40% higher, he said — which appeals to merchants. And on the consumer side, BNPL as practiced by PayPal, chiefly as a pay-in-four option at present, synchs well with younger consumers.

“The younger generations have grown used to a subscription lifestyle,” said Lisiewski.

Tailoring from country to country helps. While pay in four, done over six weeks, resonates in the U.S., Lisiewski noted that in France, a pay in four months approach works better due to the nature of the French economy.

Long term, Lisiewski sees BNPL moving beyond merchandise, for PayPal. He points to rent payments. Why must people stretch to make a monthly payment of, say, $2,000, when they could make four installment payments spread throughout the month of $500. Building management companies can’t handle that, he said, but it would be a natural for a company like PayPal.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Cryptocurrency + PayPal Illustrates Why Banks Should Worry

Cryptocurrency is the latest foray for PayPal. A special advisory council of outside experts in crypto was formed to help PayPal’s digital assets staff figure out how to proceed. Right now, not much actual “currency” applications are seen for crypto, though PayPal enables use at point of sale via an instant sale and conversion to local currency.

That said, Edwin Aoki expects that “one of the things that we continue to hear is that as our users become more sophisticated, they also still need and demand the security, the safety, the customer assurances that we provide.”

A lot of people think that’s why banks should be involving themselves in crypto too.