Next-generation payment methods such as account-to-account transfers and digital wallets are gaining traction in the U.S. as well as globally. Their growth comes at the expense of credit cards and other traditional payments, according to a study by Accenture.

The consulting firm estimates that such changes in consumer payments preferences will put up to $31.4 billion of revenue at risk for U.S. banks in coming years (2023 through 2026). To avoid these snowballing revenue losses, banks must begin to explore newer payment channels in earnest or come up with competitive moves to counter the growing consumer trend.

The Accenture report, titled “Payments Get Personal,” warns card-issuing banks against timidity, as that will mean surrendering more volume to fintechs and big tech.

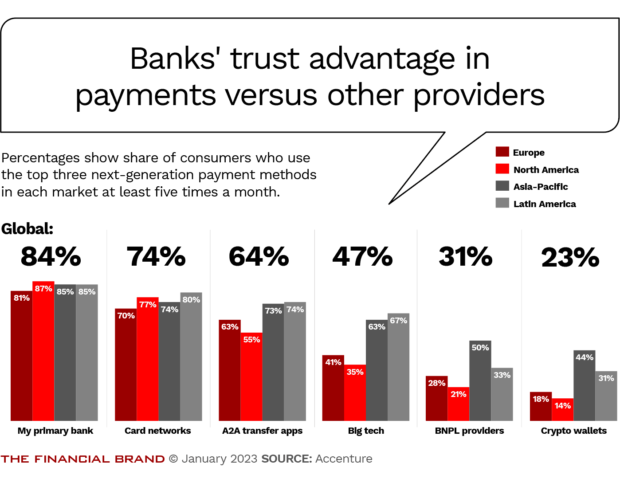

“Banks that rethink their strategies, and capitalize on consumers’ trust in their stability and security, could expand revenues and market share,” the report states.

One major insight from the research is that both the payments business and consumer behavior are moving beyond the much-dissected effects of the pandemic. Key drivers of the changes include people’s desire to pay lower interest, enjoy greater convenience and control, and satisfy simple curiosity about new ways of paying for things.

Among U.S. credit card users, about 22% are thinking about paying for their in-person shopping in other ways, based on the Accenture survey. They favor switching to payment forms that don’t run up interest, including debit cards, buy now, pay later financing, and even cash, the survey found.

New Payment Methods Growing Fast:

20% of global consumers use at least one next-generation payment method for ecommerce and 9% do so for in-person transactions. Accenture expects the latter to double by 2025.

“For banks, credit cards are clearly a high-value proposition and most organizations make a significant amount of money through their cards,” says Sulabh Agarwal, global payments lead at Accenture, in an interview with The Financial Brand. “When card volumes go away into other payment types, that’s when that value starts to get challenged.”

The interview with Agarwal explored the implications of increasing use of digital wallets in the U.S. and the potentially mitigating role partnerships could play in U.S. financial institutions’ response to nonbank payments competition.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Use of Digital Wallets Growing in U.S.

Credit and debit cards still dominate in payments, but next-generation methods are making meaningful progress.

Accenture asked survey participants which payment methods they used at least five times monthly. Debit cards were cited by 63% of Americans, followed by credit cards at 53%.

Nearly half (46%) of U.S. consumers use at least one digital wallet, such as Apple Pay, Google Pay and PayPal. Digital wallets may include both bank and nonbank payment streams.

Accenture’s research is based on a survey of more than 16,000 consumers in 13 countries, so the U.S. segment is just a subset.

In a telling statistic, the study found that globally about a third of credit card users are considering shifting some in-person spending to alternatives: 21% cited debit cards, 12%, buy now, pay later, and 4%, prepaid cards. The dominant reason is avoidance of interest charges, cited by 54% of participants.

In addition, 17% said they rely on cash purchases for that same reason: to avoid interest.

Accenture sees buy now, pay later as a strong opportunity for banks to expand their product set and to bring stability to a type of financing that has chiefly been unregulated in the U.S. Some banks have ventured into BNPL, among them Citizens Bank with its Citizens Pay product line that is tailored to individual retailers. (BNPL being substantially unregulated is going to change, as the Consumer Financial Protection Bureau continues to work towards oversight of BNPL firms.)

Digital Wallet Growth Largely Bypassing Banks

Digital wallets enable consumers to make payments without carrying cash or cards. The wallets are accessed via an app on the consumer’s phone or other mobile device.

The underlying payment method is often, though not always, a card. So operationally, they have one foot in the world of traditional payments and one in the world of mobile payments.

Because of this, some bankers have not viewed digital wallets as worrisome.

In fact, during JPMorgan Chase‘s 2022 investor day, Marianne Lake, its co-CEO of consumer and community banking, shrugged off the notion of competition from digital wallets and buy now, pay later being a threat. The reason: The new channels rely on the existing card system, so card issuers still book the volume. “As they grow, we grow,” said Lake.

But Accenture’s Agarwal contends that the gradual erosion of banks’ payments dominance will become increasingly costly. He advises banks to act quickly to protect their competitive advantage before it’s too late, as cards appear to be losing favor with many consumers as the main payment method within their digital wallets.

Digital wallets can be of the general use type, such as PayPal, Apple Pay and Google Pay, and those can be used at many places. Alternatively, there are digital wallets created for use at a particular major retailer or hospitality brand. (One example is the Starbucks app, which allows payments through the user’s method of choice, whether that is stored cash value, a credit card that’s been entered into the app, or the user’s Starbucks Card. The app also tracks rewards.)

Beyond payments, general purpose digital wallets can also hold travel and admission tickets, boarding passes and other secure documents. In this category of digital wallets, PayPal is the most popular by far.

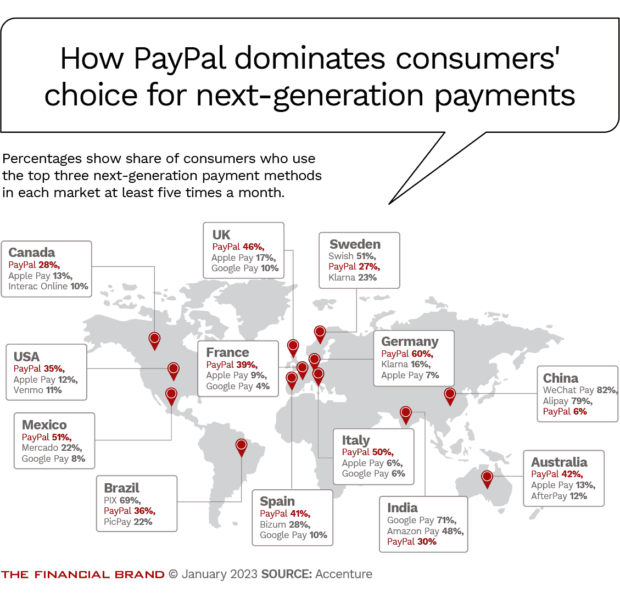

Accenture’s report notes that PayPal ranks as the top digital wallet in nine of the 13 countries studied. The leading markets are Germany, where a whopping 60% of consumers use PayPal at least five times a month, followed by 51% in Mexico, 50% in Italy and 46% in the U.K.

PayPal’s digital wallet also leads in the U.S., but has far less penetration. Only 35% of U.S. consumers use it. Apple Pay is next at 12% and Venmo at 11%.

Can Banks Gain Ground on Fintechs and Big Tech in Digital Wallet Race?

U.S. banks have worked with retailers to launch digital wallets and payment apps, but big tech dominates the digital wallet field. Can that change or have U.S. banks already lost the digital wallet race?

Agarwal argues that banks still have an opportunity to be competitive in this space. He points out that digital wallets have evolved differently in various parts of the world. In some ways their rise often has been intertwined with the development of super apps.

Take China, where WeChat Pay is used by 82% of consumers and Alipay by 79%. There, PayPal is used by only 6% of consumers, according to Accenture’s study. Both WeChat Pay and Alipay enable users to link bank and payment accounts to do many things, including paying their bills and purchasing goods and services. Similar dominance is seen elsewhere in Asia, according to Agarwal.

Conditions differ in the U.S. and elsewhere in the western world, says Agarwal.

“There’s no domination here by one, two or three super apps,” he says. “In fact, we don’t really have a concept of ‘super apps’ that has emerged properly.” (While companies like Revolut are building out a super app approach, some question whether consumers in America really want a super app.)

Agarwal suggests that to the degree that multiple super apps become enabled in the West, this may provide an opening for bank-based general purpose digital wallets. Accenture’s report suggests that consumer trust in banks could help them pull ahead in super apps.

“You can see a scenario where the wallet will become the primary funder of the payments within those particular apps,” says Agarwal.

“So I don’t think the door is completely shut. There is still space,” he says. “However, it will have to be a thoughtful approach to the payment traffic part of things.”

Digital wallets could also represent an opportunity to build out payment services and yet tie them all together. PayPal promotes its app with this slogan: “The power of PayPal — all in one place.” That “power” includes multiple ways to pay, stretching to BNPL and crypto at checkout.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

Is Partnering the Way for Banks to Catch Up in Digital Wallets?

If that opportunity develops for banks, what could it look like? Agarwal expects to see banking organizations try to push their way into digital wallets both as single institutions as well as through consortia or partnerships. Zelle, the industry’s answer to Venmo and other P2P services, could be an entrée into a broader digital wallet push, though being owned by a group of large banks it has historically avoided competing with its owners and the many smaller players that participate in the service.

Agarwal says related developments in other Western markets are worth watching as things evolve.

One example he cites is in Ireland, where four major banks are developing Synch. The plan is to build a shared mobile payment app that can handle every type of consumer payment — in-person retail, ecommerce, friends and family, and more. The intent is for payments to be instant.

In Scandinavia, the merger of two mobile payments companies received final regulatory approval in late 2022. MobilePay, owned by Danske Bank, but open to all institutions in Denmark and Finland, is being combined with Vipps, owned by a group of Norwegian banks. (A third company left the proposed merger after anti-competitive concerns were raised by the European Commission.) The post-merger goal is to establish a regional mobile payments company, Vipps MobilePay — “one Nordic mobile wallet.”

Where Cooperation Didn't Work Out:

Strong interest in building a collaborative approach to mobile payments is not a guarantee of success, however. Consider the U.K.'s Paym, which is shutting down.

Paym is a collaborative effort launched in 2104 in the U.K. More than a dozen U.K. banks and building societies took part, but now the partners plan to close it down by early March 2023.

Paym was designed to be a common payments app among all of the participating financial institutions. It required little more than inputting a phone number to make a payment.

“It was supposed to become a ubiquitous payments app for the U.K.,” says Agarwal. But over time, transaction volume fell and the decision was made to close it. He explains that one issue was that the partners could also pursue their own digital payment efforts, creating a promotional tug of war.

“Over time the takeup of Paym was fairly limited and the banks could never justify the overall cost of running their own apps with their own marketing and operational efforts versus the costs of Paym,” says Agarwal.

Read about Apple’s payments moves:

- What the Apple Card High-Yield Savings Account is Really About

- Understanding the Retail Bank that Apple Has Quietly Built

- The Potential Impact of Apple’s New ‘Embedded’ BNPL Product on Banks

Understand What You and Your Partners Bring to the Deal

Looking at the idea of a digital wallet partnership more broadly, Agarwal says it is essential that would-be participants understand their own interests. He says a player that excels at foreign exchange, for example, might be loath to not own a potentially lucrative piece of the cooperative effort.

Other partnerships have involved fewer players and different structures. Agarwal points out that parts of the complement of services being built as part of the Apple Card involve Goldman Sachs as a banking partner, while other facets of the card are entirely Apple’s.

So there are interesting lessons in terms of how to do and how not to do partnerships, according to Agarwal.

“A lot of thinking needs to be done around what experience you want to enable and what role you want to play within that,” he says, “and how you can influence those partnerships.”