The LivingSocial Rewards Visa Card is being touted as the first partnership of its kind between a social site and a direct provider of financial services.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

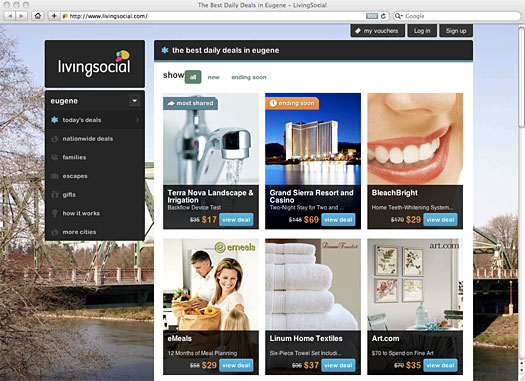

For those who aren’t familiar with LivingSocial, the site offers a new deal each day to its members, who subscribe via email. Offers include those from restaurants, spas, shops, travel, etc. — kind of like Groupon. In addition, purchasing members have the option to send a link to any or all of their contacts, and if three of them purchase the offer the original purchasing member obtains their offer free. Members must either print out their vouchers or download the LivingSocial app on their Android, iPhone, iPad, or iPod to redeem.

LivingSocial cardmembers can earn points at an accelerated rate:

- Five points per $1 spent on items and services offered through LivingSocial

- Three points per $1 spent on dining

- One point per $1 for all other purchases

There are no limits on the amount of points a cardmember can earn, with 100 points equaling one LivingSocial Deal Buck. Deal Bucks are LivingSocial credits that are automatically applied to a cardmember’s next eligible purchase on LivingSocial.com.

As part of a special promotion for 2012, cardmembers will receive ten Deal Bucks after making ten purchases within a billing cycle.