U.S. consumers are signing up for credit cards at rates higher than ever before. For issuers, this means there is a fierce competition to remain “top of wallet,” whether physical or digital, when consumers have so many options at their disposal.

Since the pandemic, consumers’ perception of credit cards has swung from being a mere luxury to a valuable asset, according to the 2022 State of Credit Report issued by payments technology vendor Marqeta. Credit cards are seen as a viable option to make day-to-day purchases and to build up credit history.

Marqeta surveyed 4,000 consumers from the U.S., Australia and the United Kingdom. While credit card usage was up in general, Americans were twice as likely to have three or more credit cards.

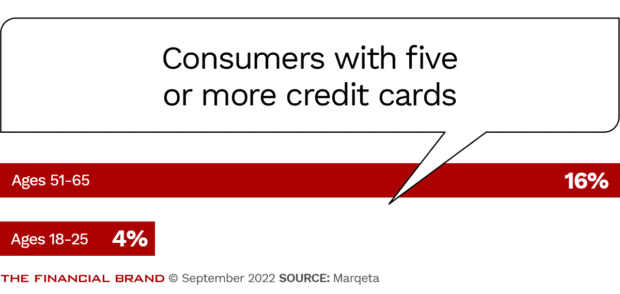

What’s more, credit card ownership in the U.S. increases exponentially with age, the research found. 51 to 65-year old’s are four times more likely to have five or more credit cards than the 18 to 25-year-old’s surveyed.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Personalization Is Key to Wallet Status

In the U.S. alone, more than one billion credit cards are in circulation. With so many credit cards being used, being (or becoming) a consumer’s primary card is much tougher now.

Achieving that status is critical, however. In fact, the report stated that consumers will spend four times more on the card they consider their primary card.

So, what can card issuers do to remain competitive? The top differentiators for credit cards are interest rates, personalized rewards, and the flexibility to have credit limits increase over time, says Rachel Huber, Marqeta’s market intelligence lead.

Know Thy Customer:

Card issuers must create personalized, customized rewards programs, rather than generic offers.

“Consumers expect their credit product to evolve along with them — are they being offered rewards based on their actual spending patterns?” Huber continues. “Is their credit limit being raised or interest rate being lowered after consistent, on-time payments? Consumers notice these things and expect their financial provider to as well.”

Read More: Surging Digital Wallet Use Threatens Traditional Credit Card Market

Untapped Market for Credit-Building Cards

Patrick Rahlfs, senior research analyst for Mintel Comperemedia, agrees that card benefits need to be more targeted. Specifically, card issuers should tailor different benefits based on income level and credit history.

According to Mintel research, the most common motivation for U.S. consumers to sign up for a new credit card was simply to build a credit score or credit history. Those related factors were what motivated 37% of cardholders who applied for a card in the past five years.

Given that, issuers should focus on marketing “credit building cards” to those with limited (or bad) credit history that use alternative metrics for approval and also focus on financial education, Rahlfs suggests.

“Issuers that focus on education and responsible card usage can attract a substantial customer base that is simply trying to build credit,” he adds.

Learn More: Stressed Consumers Seek Alternatives to Credit Cards

Tailored Rewards Programs Expected

Conversely, card competitors in the premium space must ensure that their benefits are top-of-the-line in order to fend off the competition. Owners of premium cards are willing to pay a higher annual fee if they feel the card offers them the right rewards, Mintel data shows.

“Issuers like American Express have responded to this mandate for benefits by consistently refreshing their premium cards’ benefits structures, and providing credits to various partners as key elements of the card’s value,” Rahlfs observes.

With the pandemic-driven shift away from traditional travel benefits toward lifestyle benefits, he notes, consumers are responding to card products that give them frequent opportunities to engage with their card benefits.

Targeted Incentive:

In an inflationary economy, card providers should reward users on highly price-sensitive categories like groceries and gas.

However, card issuers are largely lagging when it comes to personalization and customization. The Marqeta report found that only 26% of U.S. consumers say their credit card rewards are “very personalized.” Many card providers still have fairly generic offerings targeting a median age or income group. These programs need to be tailored.

“The goal should be to help consumers along on their financial journey,” Marqeta’s Huber states. doing so effectively can result in a stickier relationship with the consumer.

As always, interest rates are a key factor in whether — and how often — consumers use a credit card.

“With interest rates continuing to climb in recent months, “consumers may turn to alternative payment methods simply to avoid the accumulation of further debt,” observes Mintel’s Rahlfs.

To counteract this, the analyst advises card issuers to “reward users on inflation-impacted categories like groceries and gas; they can tout those rewards as a way to combat the current environment.”

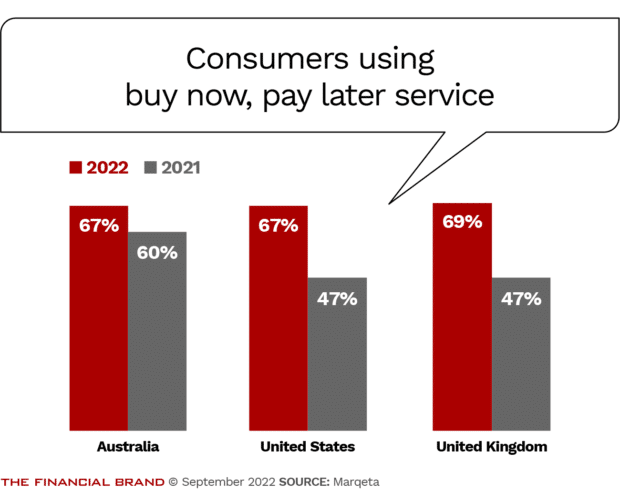

The Soaring Attraction of BNPL

Despite some headwinds faced this year by many of the more prominent buy now, pay later providers, the service is still proving highly popular with consumers. There remains a big opportunity for credit cards to integrate BNPL-like aspects into their offering to attract and retain more customers.

Consumers are also increasingly willing to use BNPL for many different types of purchases, including dental visits, home renovations and pet care, the Marqeta survey found.

Shifting Payments Tide:

Number of U.S. respondents who say they prefer using BNPL services over credit cards58%

“The main reason cited for BNPL’s popularity was convenience, with 46% of consumers surveyed crediting the ease of use,” the report states. “Flexibility in terms of managing finances was also a big draw for survey respondents with 44% stating the fact that it helped them budget as the main appeal, while 41% said zero interest was the main appeal and 40% said it was flexibility on repayments.”

Dig Deeper: The Real Risks and Hidden Costs in the Buy Now Pay Later Game

There remains a big opportunity here for credit card providers to integrate BNPL-like services into their over offering. So far only about a third of consumers polled by the payments firm said they had accessed BNPL-like functionality from their credit card.

“If credit card providers want to keep up with BNPL’s popularity, they’ll need to improve the user experience they provide,” Marqeta states. “Consumers know what benefits they want, and if credit card providers can tap into this, both sides will benefit enormously.”