During the 2014 winter holidays, consumers spent over $600 billion, accounting for nearly 20% of most merchants’ retail sales for the year. According to the National Retail Federation, each person spent an average of $730 on food, gifts, decorations, and more. For most of those purchases, they used either a debit or credit card.

Every holiday season, community banks and credit unions ask, “What’s it going to take to get consumers to use our credit or debit card for all of those purchases?” Here are eight ideas to make your card rise to the top of people’s wallets this year.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

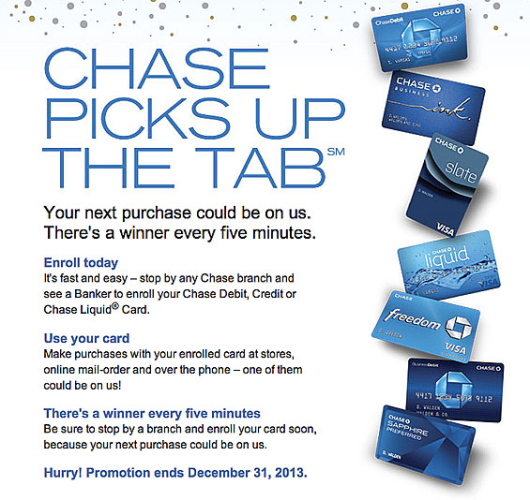

1. Enter users into a drawing. This can be done by purchase amount, or by number of transactions. Each purchase made on a debit or credit card enters the cardholder into a drawing where they could be reimbursed the amount of that purchase. Alternatively, they could win a $500 gift card (from your financial institution, of course). Another option is to automatically enter customers into a drawing when their total card purchases exceed $500 or 20 transactions in a one-month time period. These are relatively easy thresholds to monitor and administer, and shouldn’t require much extra work for your institution.

Chase holds drawings where the selected winner(s) have a random holiday purchase paid for.

2. Create “Swipes for Charity” days. On designated days, make a small donation for every credit/debit card transaction to a local charity. The more your clients swipe, the more you give to a local cause. A triple win – for you, the charity and for cardholders.

3. Offer cardholders local discounts. Use a mobile-alert platform to reach users at the right time and place as they are shopping and searching on their mobile device for holiday gifts, pumpkin cheesecake, or fancy New Year’s dresses. Offer them merchant-funded discounts at local businesses when they pay with your institution’s card.

Read More:14 Christmas Promotion Ideas for Banks and Credit Unions

4. Reward shoppers with gift cards. Reward everyone who spends beyond a set dollar amount or number of transactions with their choice of gift card from a choice of local merchants.

5. Active cardholders get free/discounted tickets or passes to local events. By presenting your financial institution’s credit/debit card at local events, performances and concerts, your cardholders can get free or discounted entry.

6. Set up “secret sales” for shoppers. Help local merchants promote their offerings to your users with “secret sales” and client-only buying incentives. Of course, shoppers must use your credit/debit card to get the deal. You can promote these special sales on your website and through email marketing messages.

7. “Shop to win on Black Friday!” Those who use your credit/debit card on a special designated day — Black Friday or Cyber Monday, for instance — can be automatically entered into a drawing. You can run this promotion multiple times on multiple days, or run it for a extended period (like one week, or a weekend).

8. Offer up your CEO for a fun stunt. Challenge cardholders to use your credit/debit card for a designated number or dollar volume of purchases to see your CEO (or other celebrity/local figurehead) make snow angels in red long johns, take a “polar bear plunge” in the lake, or perform other outrageous stunts.

Researchers at GoogleThink found that 48% of shoppers do most of their shopping on or before Cyber Monday, and 25% of people do some holiday shopping even before Halloween. If your financial institution wants to make sure your credit/debit card is the first choice this holiday season, you need to put incentives in place.

Gregg Hammerman is Co-Founder of Larky, a mobile discount and loyalty platform that drives interchange revenue, wallet share, acquisition and retention. To learn more about Larky, visit www.larky.com or email us at [email protected]. You can also follow Larky on Twitter, and LinkedIn.