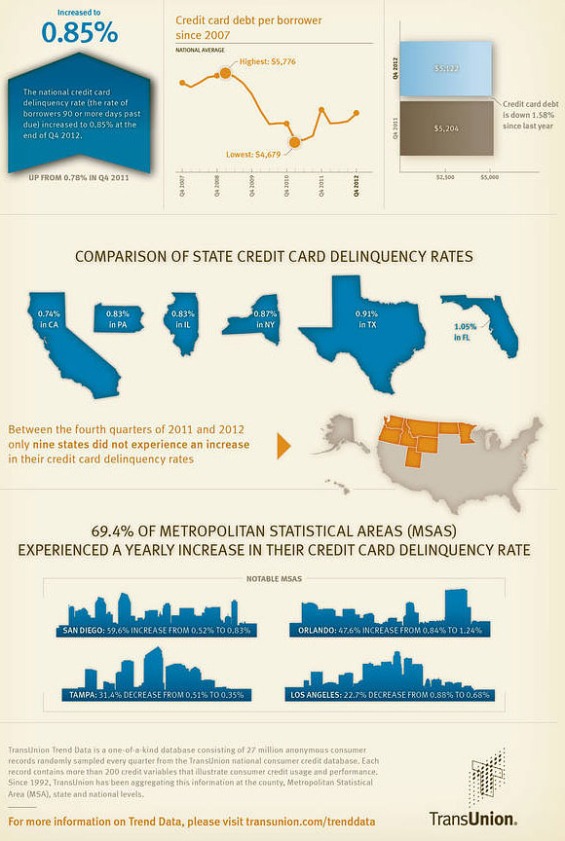

The national credit card delinquency rate (that is the ratio of borrowers 90 or more days past due) increased to 0.85% in Q4 2012, up from 0.78% in Q4 2011. According to a study by TransUnion, the delinquency rate is also up from the third quarter, when it stood at 0.75%.

Average credit card debt per borrower has dropped 1.6% to $5,122 in Q4 2012, down slightly from $5,204 in Q4 2011. However, on a quarterly basis, card debt rose 2.5% from $4,966 in Q3 2012.

“The fourth quarter traditionally results in higher credit card balances and delinquencies, much of it to do with the holiday shopping season,” said Ezra Becker, VP of research and consulting in TransUnion’s financial services business unit. “Though serious delinquencies have risen seven basis points in the last year, average credit card debt has actually dropped, which is a sign that consumers continue to manage their credit well. Both credit card delinquencies and balances are below historic norms.”

In the last 10 years, the average national 90-day delinquency rate for the US during the fourth quarter is 1.06%, while the average credit card debt per borrower is $5,389. In that same timeframe during the fourth quarter, delinquencies were at their highest in Q4 2003 (1.42%) and credit card debt peaked in Q4 2009 ($5,729).

“Consumers continue to value their credit card relationships and are diligent about paying off their balances in a timely fashion,” said Becker. “This is a positive sign as more and more subprime borrowers have either entered or re-entered the credit card market.”

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Number of New Credit Cards Drops

The TransUnion quarterly analysis of credit card performance also examines origination rates, which are analyzed one quarter in arrears to account for the reporting lag of new accounts. In Q3 2012, new credit card originations dropped 2.4% relative to Q3 2011.

The share of non-prime, higher-risk originations (with a VantageScore® credit score lower than 700 on a scale of 501-990) was 30.51% in the third quarter of the year, slightly below the same time one year ago (30.63% in Q3 2011), but much higher than the 27.03% observed in Q3 2010.

“It’s not surprising that originations dropped in 2012 relative to 2011, as solicitation volumes from the largest issuers decreased materially over that timeframe,” explained Becker.

Credit Card Delinquencies Rise Across the US

Thirty-nine states and the District of Columbia saw increases in their credit card delinquency rates year over year, while nine states saw decreases. Two states experienced no material changes.

On a more granular level, 67% of metropolitan statistical areas (MSAs) saw increases in their respective credit card delinquency rates in Q4 2012 relative to one year ago. This is only slightly higher than last quarter, when 64% of MSAs experienced year-over-year increases.

Some of the largest MSAs to experience year-over-year increases in Q4 2012 included San Diego (59.6% increase from 0.52% to 0.83%), and Orlando (47.6% increase 0.84% to 1.24%). MSAs experiencing significant declines included Tampa (31.4% decrease from 0.51% to 0.35%) and Los Angeles (22.7% decrease 0.88% to 0.68%).

Based on current economic assumptions, TransUnion forecasts credit card delinquencies to slightly decrease to approximately 0.81% in the first quarter of 2013. This forecast is based on seasonality effects and various other economic factors such as anticipated gross state product, consumer sentiment, disposable income, and employment conditions. The forecast changes as the economy deviates from a conservative economic forecast, if there are unanticipated shocks to the economy affecting recovery, or if lenders materially change their underwriting standards.

Q4 2012 Credit Card Statistics – Delinquency Rates

| Quarter over Quarter | Q3 2012 | Q4 2012 | % Change |

| USA | 0.75% | 0.85% | 13.33% |

| Year over year | Q4 2011 | Q4 2012 | % Change |

| USA | 0.78% | 0.85% | 8.97% |

| Highest Credit Card Delinquency States | Q4 2012 |

| Mississippi | 1.41% |

| Alabama | 1.16% |

| Georgia | 1.12% |

| Nevada | 1.12% |

| Lowest Credit Card Delinquency States | Q4 2012 |

| North Dakota | 0.41% |

| Montana | 0.53% |

| Minnesota | 0.54% |

| Utah | 0.57% |

| Top 3 Year-over-Year Increases | Q4 2011 | Q4 2012 | % Change |

| Alaska | 0.41% | 0.63% | 53.66% |

| Massachusetts | 0.67% | 0.87% | 29.85% |

| New Hampshire | 0.67% | 0.83% | 23.88% |

| Top 3 Year-over-Year Declines | Q4 2011 | Q4 2012 | % Change |

| Oregon | 0.69% | 0.60% | (13.04%) |

| Idaho | 0.78% | 0.70% | (10.26%) |

| Montana | 0.58% | 0.53% | (8.62%) |

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Q4 2012 Credit Card Statistics – Credit Card Debt Per Borrower

| Quarter-over-Quarter | Q3 2012 | Q4 2012 | % Change |

| USA | $4,996 | $5,122 | 2.53% |

| Year-over-Year | Q4 2011 | Q4 2012 | % Change |

| USA | $5,204 | $5,122 | (1.58%) |

| Highest Credit Card Debt States | Q4 2012 |

| Alaska | $7,012 |

| Connecticut | $5,820 |

| Colorado | $5,792 |

| North Carolina | $5,748 |

| Lowest Credit Card Debt States | Q4 2012 |

| Iowa | $4,048 |

| North Dakota | $4,179 |

| South Dakota | $4,303 |

| West Virginia | $4,412 |

| Top 3 Year-over-Year Increases | Q4 2011 | Q4 2012 | % Change |

| District of Columbia | $5,530 | $5,634 | 1.87% |

| Rhode Island | $5,173 | $5,226 | 1.01% |

| Delaware | $5,463 | $5,498 | 0.64% |

| Top 3 Year-over-Year Declines | Q4 2011 | Q4 2012 | % Change |

| Idaho | $4,910 | $4,626 | (5.78%) |

| Colorado | $6,110 | $5,792 | (5.21%) |

| Wyoming | $5,060 | $4,859 | (3.99%) |