The coronavirus pandemic has impacted the payments world in two major ways. First is the massive contraction in consumer purchasing after an initial spike as the U.S. began to shut down in March in hopes of flattening the curve of the virus’ spread.

Second is the accelerated adoption of digital payments driven by widespread fears of handling cash and touching hard surfaces such as PIN pads and touch screens, along with a big shift to e-commerce purchases out of preference or necessity.

The first is confirmed by both aggregate data and data released by individual institutions.

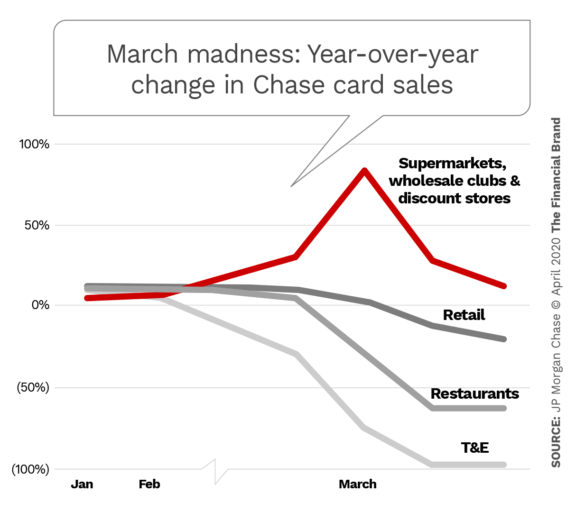

Transaction volume for credit and debit cards nosedived from early March 2020 to early April, dropping 30% and 25% year-over-year, according to Facteus. The real hits came in the restaurant, travel and entertainment sectors. Groceries, pharmacies and warehouse stores were up, at least for a time. This disparity can be seen in the first quarter card results for the nation’s largest bank, JPMorgan Chase.

A great deal of consumer purchases has shifted to e-commerce. Amazon’s web traffic was up 32% year-over-year in the second week of March, according to the Wall Street Journal. The shifting patterns of consumer purchases reflect health concerns, store and restaurant and movie theater closings, stocking up at various points on necessities, and the arrival beginning in April of government stimulus checks.

Payments analyst Sarah Grotta, with Mercator Advisory Group, points out another factor: Whatever means of payment is used, she states, there will be a pullback in usage because 26 million people in the U.S. are out of work and will run out of stimulus funds. Bain & Company noted in mid-April that 65% of credit card payment volume is at risk because of sectors hurt by the coronavirus. The firm also stated that 50% of cross-border payments have vanished.

“Even e-commerce categories ranging from clothes to furniture have gone quiet,” the firm stated.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

‘Dirty Cash’ and ‘Dirty Screens’ Are Changing Behavior

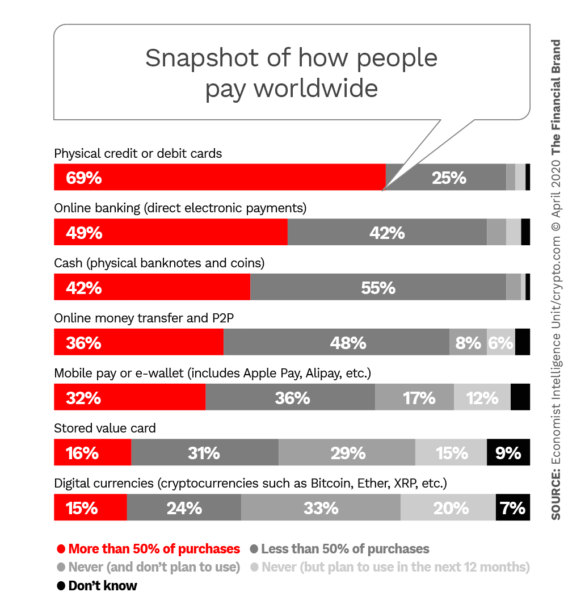

A survey by the Economist Intelligence Unit (EIU) in January/February 2020 gives a good snapshot of the global mix of consumer payment methods just as the pandemic was gathering momentum outside of China.

EIU found greater resistance to going cashless in developed countries and among people aged 39 and higher. Going forward, however, three out of five respondents (60%) were “extremely” or “very” likely to use digital payments for daily transactions instead of cash, the survey found.

Data from RTi Research’s coronavirus wave research shows that 30% of consumers are “very/extremely” worried about catching COVID-19 from cash and 36% are “not at all/not very” worried, the corresponding numbers for physical credit or debit cards are 21% and 54% respectively, and for cashless payments are 20% and 57%.

Because of health concerns, more local merchants no longer accept cash — and some larger establishments as well. Business Insider reports that certain Chick-fil-A locations are going cashless and others are encouraging customers to use contactless payments including the Chick-fil-A app, which can carry a preloaded balance and allows users to also pay by points.

Payment-related health worries go beyond cash. People don’t want to touch “dirty” ATM or POS signature screens or PIN pads or have to hand cards to clerks at a drive-up pharmacy or bank window.

“Businesses will have to rethink public touch screens as more customers see shared surfaces as an infection risk, no matter how often they’re cleaned,” Kiplinger states. While it’s risky to overgeneralize — because different parts of the country (and the world) have been impacted differently by the virus — some experts speculate that such fears could last well after the pandemic has ended. Others believe that once a COVID vaccine becomes widely available, this concern will diminish. Even if the latter is true, by then habits may have been formed that will not completely unwind.

Read More: How Algorithms Will Reshape the Entire Banking Landscape

Data Signals An Acceleration of Digital Pay Methods

Habits of card usage are notoriously difficult to break in the U.S. But it’s beginning to look like the coronavirus could be a habit breaker.

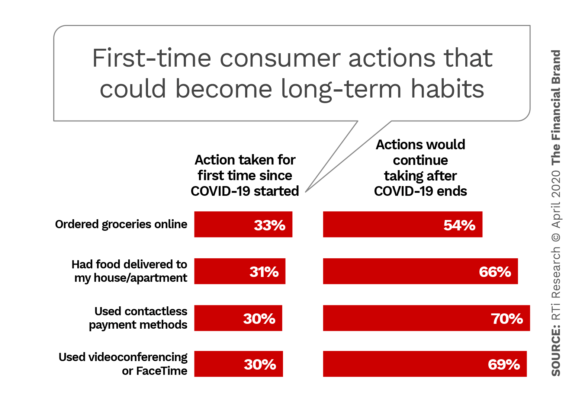

During Mastercard’s first quarter earnings call, company executives reported a 40% jump year-over-year in the use of card- and mobile-initiated contactless payments worldwide. Contactless card usage is far more common in countries outside the U.S. Nevertheless the payment company’s data is another indication of the trend. CEO Ajay Banga told analysts he thinks the contactless trend will continue after the pandemic, CNBC notes. Some self-reported consumer data from RTi Research supports that notion.

In the chart above, 70% of 30% works out to about one fifth of new users continuing to use contactless payment methods. “I do feel that the coronavirus crisis will be the moment where contactless payments will shine,” states Peter Reville, Director of Primary Research Services at Mercator Advisory Group. Still, he cautions against expecting “hockey-stick growth.” Contactless overall won’t suddenly jump to 50% of all transactions, he states.

“I do feel that the coronavirus crisis will be the moment where contactless payments will shine.”

— Peter Reville, Mercator Advisory Group

Payment industry consultant Richard Crone told Bloomberg that he expects contactless payments to account for an additional 10% to 20% of transactions at both stores and ATMs as a result of the pandemic. The CEO of Crone Consulting feels strongly about facilitating a shift to safer payments. In a LinkedIn post, he states “Payment processors and ATM deployers have a fiduciary responsibility to provide access safely.”

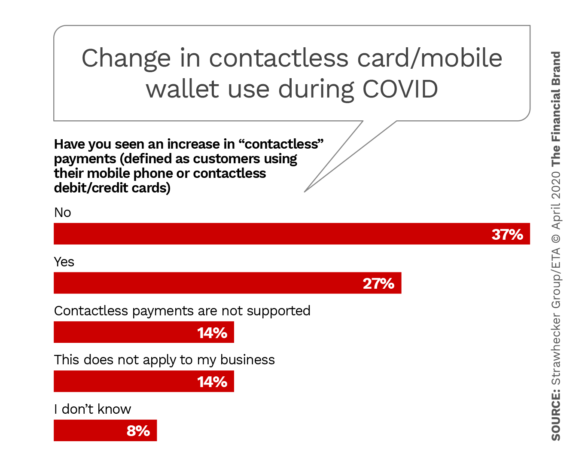

Additional data comes from a survey of 361 small businesses conducted in late March by The Strawhecker Group and the Electronic Transactions Association, which found that just over a quarter of the businesses had already seen an increase in customers using a contactless card or mobile wallet. (28% of the companies either don’t support NFC payments or are B2B companies.)

Publix Super Markets sped up its transition to contactless terminals, according to Bloomberg. Starting in April, all Publix stores allowed use of contactless cards and mobile wallets as payment. Others may do the same, although as Mercator Advisory Group’s Sarah Grotta observes, setting up for contactless capability is not the number one priority right now for many small merchants. “Survival is.”

Grotta, who is Director, Debit and Alternative Products Payment Advisory Service at Mercator, also points out that in many cases “contactless” isn’t completely without contact. In many instances consumers must either enter a PIN or push a button or touch a screen to “accept” or to indicate “yes” or “no” for a receipt. For some consumers, that is a turnoff. But it’s fixable.

In March, for example, Walmart made changes to its mobile wallet — which uses a QR code, not NFC — to eliminate the step of hitting a “pay now” button.

Read More: What Bankers Can Learn from an American Living Cashless & Masked in Shanghai

Some countries have raised the limit for contactless payments to reduce the need for entering a PIN. Banks and card companies in Australia, for example, doubled the amount to $200 that can be paid using a contactless card, according to Brisbane Times. In the U.S. transactions over $50 often require a PIN depending on the issuer or network.

To get a big long-term jump in contactless card use will require education, Peter Reville believes. “The biggest problem is that consumers don’t know the capability exists,” he states. “They may have a contactless card but haven’t noticed the little symbol on the card or know what it means.”

In fact the whole payments space is confusing. Within the space of a few decades, the American public has seen card transactions go from being manually run through “knuckle duster” imprinters to card swiping, card dipping, and now card tapping, not to mention mobile wallets. That’s a lot to expect the average person to stay up with, Reville states.

Little Evidence of Increased Mobile Wallet Use

Reville has made the point more than once that mobile wallets are “a solution in search of a problem.” He is a big-time Apple Pay user, but he’s a payment geek, as he says. As a result, public use of mobile wallets in this country, though growing, has been underwhelming. COVID would seem to be the problem for which mobile wallets were made. That might depend where you look:

- Australia’s CBA Bank reports digital wallet users spending a record $1 billion in transactions for the month of March in 2020, according to The Verdict. This represents a 17% year-over-year increase.

- TD Bank, which saw contactless card usage surge in March has not seen a similar uptick in mobile wallet payments during the crisis period, PaymentsSource reports. While the bank’s mobile payments volume has increased steadily, its share of overall transactions remains small.

A mid-March 2020 survey of U.S. consumers who had shopped at a physical retail location, conducted by Pymnts.com, found that at that point, the pandemic had not stimulated mobile wallet use. Apple Pay was being used in just 5.1% of eligible POS transactions, down from 6% the year before. Similarly, Walmart Pay usage fell from 4.5% in March 2019 to 3.3% in 2020.

A comment on LinkedIn may hit on at least part of the reason: If you’re wearing gloves for protection, the fingerprint reader still used on many mobile phones won’t work. And if you have a newer phone using facial recognition, that won’t work if you’re wearing a protective mask.

One stopgap seen here and there at the point of sale: cups of cotton swabs. Shoppers grab a swab, which enables them to use touch screens or terminal buttons while wearing thicker gloves.

Some P2P Use Cases Altered By COVID

Like mobile wallets, it would seem logical that person-to-person payment apps such as Zelle, Venmo and Square Cash would get a lift from people’s reluctance to handle cash during the pandemic. There have been reports of people buying groceries in bulk for a group of neighbors and then using a P2P app to collect payments.

Again, cumulative data is hard to come by. Bank of America reported a 70% year-over-year jump in Zelle transactions in its first-quarter report. While impressive, Sarah Grotta says that figure is actually lower than the gain reported the previous year. The analyst notes that some P2P use cases may have shifted during the pandemic. Utility and rent payments may have seen an increase, she believes, along with gifting as it switched away from cash. On the other hand sharing a restaurant tab probably fell off sharply.

Looking past the pandemic, Grotta sees much upside potential for P2P. One reason is that the whole area now has many variations. For example, she notes that PayPal’s Venmo unit has Pay with Venmo, in which consumers can load money into the app to pay others or use to purchase something at a market. It’s really a virtual prepaid card with P2P capabilities, she states.

Zelle works with businesses to make B2C disbursements like gig economy payouts, Grotta notes. Or to pay out rebates.

Square Cash, which the analyst thinks could be a bigger player than many realize, also has a physical prepaid debit card in addition to its P2P function.

(Article updated April 29, 2020)