Credit cards at the best of times are a love-hate relationship for many Americans. We love the convenience, we love the painless way they enable the good life, and we like the perks of miles, points and more during normal times. Paying them back? Not so much.

In the coronavirus period, cards have trimmed the need for cash when ordering takeout from the corner pizzeria. They’ve smoothed the ways of ecommerce for people ordering necessities and boredom killers like puzzles and books. There are even cards out there like American Express Blue that multiply loyalty points spent on a wide range of streaming services — everyone’s coronavirus theater of necessity — by a factor of six.

In the months ahead, many Americans will be relying on credit cards as a backstop to unemployment insurance payments, especially after federal stimulus payments become a distant memory.

America is going into this stunning downturn already in a state of plastic hock. Six out of ten people surveyed by CreditCards.com held credit card debt before the COVID-19 pandemic hit. Of those 110 million consumers, 61 million have been carrying that debt for over a year and one out of four have held credit card debt for at least three years in a row. And that was in boom times with record-high employment.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Rough Times, But Credit Card Marketing Must Continue

Now, many Americans will be joining the ranks of the debt-laden as people live off their credit in the months to come. Already articles are appearing, advising on how to get new cards without having a job. Cards may wind up being the substitute for emergency savings that study after study has found many Americans lack. While initial offers of skip payments and other assistance on consumer credit have been proffered, lenders can’t carry the country on forgiveness.

All this may seem like an argument for shutting down credit card marketing for the duration, but the 100 or so issuers in the U.S. can’t and won’t do that.

For one thing, many people may want to switch programs or consolidate with one issuer. For another, consumer purchasing in time will need to transition from ecommerce to making purchases around town as we all emerge, gradually, from our cocoons.

In addition, people who still have jobs may have taken high pay cuts and still counted themselves fortunate as co-workers got laid off — but they may need to close the gap between their old budget and their new budget with credit, temporarily. CNBC Select suggests that obtaining a 0% promotional rate will avoid interest for a time, though charges must still be paid.

A competitive reality: “If the economy, as expected, enters a prolonged recession, many cards may be abandoned, especially from those whose wallets are over-filled” with cards, says Mark Miller, Associate Director of Insights, Payments, at Comperemedia, a Mintel company.

Read More: 3 Ways to Make Online Marketing Relevant for At-Home Consumers

6 Ways Card Marketers Can Improve Campaign Results in COVID period

It’s likely that credit card marketing will grow even more competitive, with issuers chasing fewer consumers with strong credit. It’s also highly likely that card marketers are going to be pilloried in Washington at some point when congressional gadflies begin asking why credit card rates remain in the double digits when the Fed has pushed rates to levels that would have been inconceivable only months ago.

Miller has been studying the challenge of communicating the value of credit card programs during the COVID-19 pandemic, writing both a report and a blog about the marketing challenges. Here are his key themes:

1. Show them that you know them. Oddly, only a few months ago many bank and credit union executives were worried about Google partnering with financial institutions to offer payment accounts. Soon it was realized that Google didn’t care so much about the transactions, but gaining the stream of purchasing data that goes with them. Perhaps issuers take their data riches for granted.

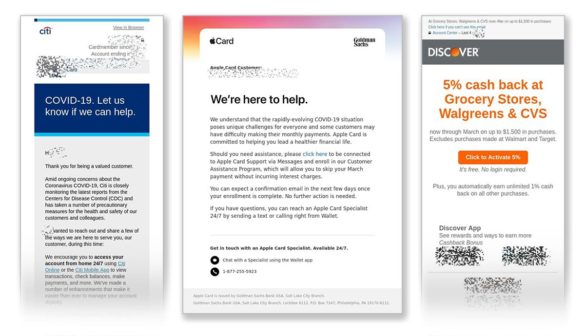

One of the key values in communicating about cards is to show even a basic level of personalization in the messaging, says Miller, especially in emails. Early on in the COVID-19 era major card brands were sending out messages that began with salutations like “Dear Valued Customer” — almost as inspiring as direct mail addressed to “Occupant.” It’s also surprising, considering how much data issuers have about consumers, from their financial data to what, where and how they shop.

“A little bit of personalization will go a long way,” say Miller.

Worse yet, many emails sent to consumers presented only the vaguest information about offers of help with card debt, according to Miller. Often the issuer referred card holders to the issuer’s website, which strikes Miller as odd given that they had already reached the consumer and had their attention.

Among the exceptions that he approved of were a message from Citi that explicitly invited consumers to call to discuss problems and which referred to “always on” assistance. And Apple Card sent a message that simply went ahead and told card holders they could skip that month’s payment without incurring interest charges. All they had to do was click on a link in the email to enroll in its Customer Assistance Program. Another was an early effort to help with the kinds of shopping American life now consists of, with Discover offering discounts at Walgreens and CVS pharmacies and at grocery stores.

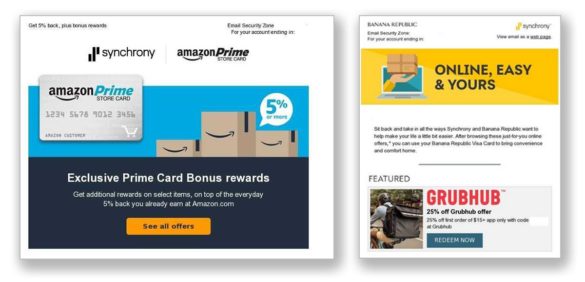

2. Brand partnerships matter more than ever. Building in advantages to using the institution’s card versus others in the wallet for frequently used services, take-out restaurants, and other essentials of the COVID-19 period shows an appreciation for what’s currently important to cardholders.

Synchrony, which partners with many organizations on its card programs, including Amazon for its cash back store card, is one example seen in our own exploring among card offers. The offer on the right, in full form, ties in seven brands besides Grubhub that are all front and center right now. This includes a Groupon discount for takeout offers; free shipping from Omaha Steaks, Kind bars, and GNC health stores; a special Disney streaming offer, and a 25% discount from Papa John’s Pizza.

Read More: Why Financial Institutions Should Keep Advertising, But Differently

3. Rethink incentives. For the most part, holding out travel incentives these days, when flying is basically nil, doesn’t get the blood stirring. Miller says some card brands had already added alternative redemption possibilities to their travel-oriented deals.

“Cash back seems the safest bet, though,” he says. Most people will be wanting more of it — at least in digital form.

He suggests that what some brands may do is partner with themselves. This could take the form of allowing card holders to redeem points for gift cards issued by the same institution.

4. Consider atypical channels for promotion. With more people living on digital devices than ever, opportunities beyond traditional email and digital ads have greater appeal. Miller points out that affiliate marketing sites, such as CNBC Select, have been carrying sponsored articles by the likes of Chase, American Express and Discover since the pandemic began.

5. Start thinking about secured cards. Many people are going to need help to get cards, or will need to rebuild credit. Secured card programs had already been growing pre-COVID, says Miller, and the likely recession will spur more firms to offer them.

Read More: Amazon Credit Card Targets Financially Vulnerable Consumers

6. Watch your messaging for unintended consequences. When we trolled through the Mintel email marketing database, we spotted a potentially helpful product marketed in April 2020 with an unfortunate name. It was the Surge Card, offered by Celtic Bank and Continental Finance, and designed for consumers with damaged credit who want to rebuild their scores.

However, the headline “Give your Credit a Surge!” might have looked better in January than April, when officials were talking about flattening the coronavirus curve.

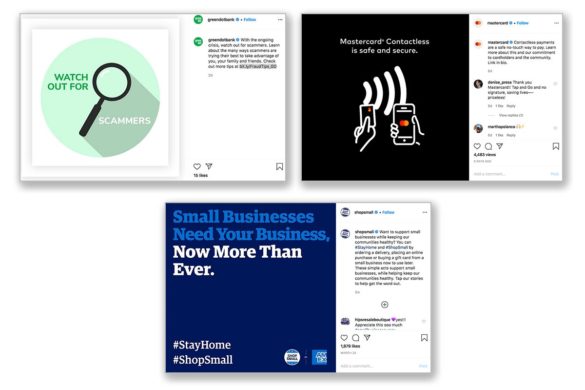

When we reviewed some major banking brands’ Instagram accounts some were current while others seemed to be paused. The latter often included crowd scenes at parties and other public gatherings that looked fine when posted, no doubt, but would make anyone’s skin crawl who has been wearing a mask, a hoodie and gloves every time they buy groceries.

“It’s very important to audit the creative and messaging for any products going to market to ensure they strike the appropriate tone amidst current travel restrictions and social distancing guidelines,” states Andrew Davidson, SVP, Chief Insights Officer for Comperemedia, in another blog. “Cash back cards and cards with accelerated earn on everyday spend, as well as non-rewards cards, are more suitable for promotion in the current environment, and lifestyle marketing should be avoided.”