If you’re thinking, “Here we go again with the Apple hype,” nobody would blame you. But just remember, the Cupertino company is the world’s most valuable brand and even when it’s a product late-comer, it disrupts industries.

So it’s not surprising that just the rumor that Apple would soon launch — along with its Apple Card partner Goldman Sachs — a buy now, pay later product integrated into the Apple Pay wallet, sent stocks of the BNPL leaders like Klarna and Affirm tumbling. The impact of this mobile-focused product combination could reach far beyond the BNPL world, all the way to that banking mainstay, the checking account. Read on to see why.

Apple doesn’t always get it right, but one thing even its critics agree on is that the level of sophistication, ease of use and functionality of its Apple Pay platform, especially since the 2019 launch of the Apple Card, is unsurpassed.

Not Just a Slick Card App:

Apple is building a financial services ecosystem around the its leading-edge digital user experience – first a card, now buy now, pay later, with more to come.

“Apple Pay is the industry standard for digital account opening,” states Richard Crone, CEO of Crone Consulting. “It’s what’s allowed Apple/Goldman to do instant issuance of Apple Cards in three minutes or less.” Applying that capability to buy now, pay later, and likely other applications, is potentially game-changing, the consultant believes.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

Apple BNPL Product Stirs Great Interest

Bloomberg first reported on the new Apple/Goldman BNPL product, citing unnamed sources within the big tech company. Internally the product is referred to as Apple Pay Later, these sources said.

Much as other BNPL services do, Apple Pay Later would allow people making a purchase using Apple Pay to select an option to pay for it in four interest-free payments every two weeks, or across several months with interest, Bloomberg said. The still-to-be-announced service doesn’t require the use of the Apple Card and a consumer can elect to make the payments with any card in their Apple Pay wallet.

So what’s the big deal? you may wonder.

The answer can be stated in three words, according to Crone: “The credit wheel.”

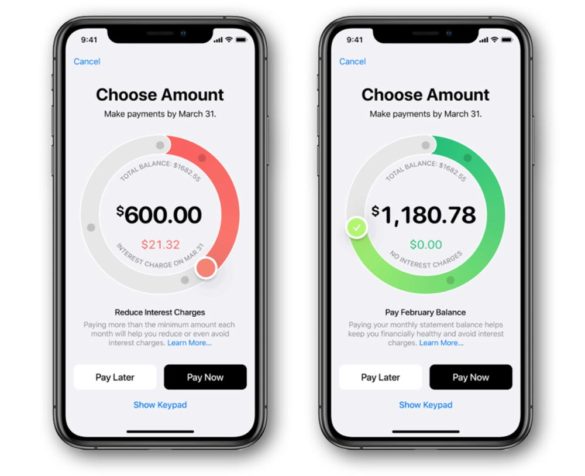

For those who are not Apple Card users, the credit wheel is the feature, pictured below, in the Apple Card app that lets consumers see what they owe, and decide how much to pay, including the interest that will accrue (if any) at whatever amount they decide to pay.

The whole payment process is almost ridiculously easy and fast, appealing to Gen Z and Millennial consumers, although growth in use of the Apple Card by Boomers doubled in 2020, according to research by Cornerstone Advisors.

Read More: What Banks & Credit Unions Can Learn from the Apple Card Experience

“The credit wheel is to credit what the iPod was to music,” says Crone. “It provides financial literacy at the same time as you make your decision to pay — both when and how much. It sets the stage for what Apple Pay can become.” The card was the first use case. Buy now, pay later will be the second, Crone believes.

Nobody has the user interface with the ability to instantly define or customize your credit at the point of sale that Apple Pay would provide, the consultant states.

Assuming it goes forward, Apple Pay Later will be a sweet deal for Apple because it gets 15 basis points for every credit transaction made inside the Apple Pay wallet, even for another institution’s card.

“They’re in the middle whether the consumer is using Apple Card or not,” Crone notes.

Read More: 8 Fintech Trends Changing Banking Forever

So How Are Apple Card and Apple Pay Doing?

Apple doesn’t break out the number of users of its Apple Pay mobile wallet, which launched in 2014. The most conservative source estimates that roughly 3% of U.S. adults use Apple Pay about once a week. But others show much higher use.

Crone Consulting independently estimates the number of active Apple Pay users in North America (with at least two transactions per month) to be over 50 million. eMarketer in March 2021 showed Apple Pay with 43.9 million users, well ahead of Google Pay’s 25 million.

Loup Ventures estimated in November 2020 that Apple Pay transaction growth was “growing north of 30% over the past six months.”

As for Apple Card, Crone Consulting’s independent estimate of active users (same definition as above) is more than 6.9 million as of July 202. It expects that to “easily surpass 7 million or more within a few months,” boosted by the launch of Apple Pay Later.

“If you extrapolate Apple Card growth to 2025, Apple and Goldman will have more active card accounts than Chase.”

— Richard Crone, Crone Consulting

Why Apple Pay + BNPL Will Impact Bank and Credit Union Revenues

Not always appreciated is that the Apple Card already consists of four accounts in one, according to Crone:

- A credit card, of course, but it also acts like…

- a debit card because the user can pay for any purchase the same day. The cash rewards Apple pays for using the card accumulate daily in what amounts to…

- a prepaid card called Apple Cash. These funds can be used immediately for any purchase or can be sent to other iPhone users as…

- a P2P transaction through Apple’s iMessage. It all takes place in the mobile app although there is also a physical Apple Card.

It’s really an ecosystem and “a runway for new product launches” like Apple Pay Later, as Crone explains.

Two other new features are significant: a web portal so Apple Pay users can access the account online and not just on their phone, and Apple Card Family, which allows cardholders to share the card with other family members 13 or older.

As Heidi Liebenguth, Managing Partner at Crone Consulting observes, the cardholder can see on the web, not just on their phone, what their kids are spending on. It also assists Boomers or Gen X consumers to manage the finances of aging parents.

The combination of the payment parameters and financial literacy elements of the Apple Pay app (the credit wheel in particular), plus controls for parental or other family accounts “are things that just don’t exist inside demand deposit accounts today,” Crone observes.

Turning Point:

Checking account revenue and relevance is at risk from feature-rich digital banking accounts, of which Apple’s entry is a leading, but far from the only, example.

Further, the revenue generated by checking accounts, roughly $250 per account annually, is under pressure as about half comes from debit card interchange and half from overdrafts. Crone’s point is that consumers now expect more than what traditional checking accounts provide, and most mobile banking apps are not on par with the user experience of many fintech apps, and the Apple Card app in particular.

“Giving the typical checking account the kind of transparency, account management and cash management features provided by the Apple Card app and its credit wheel could really breathe new life into it,” Crone maintains.

Unfortunately literally thousands of credit unions and community banks still don’t have digital account opening, the consultant states.

Read More: Google Claims It Has ‘No Interest In Ever Becoming a Bank’

Google Plex, the ‘White Knight’ of Digital Banking?

Enter Google with its Plex account offered in partnership with financial institutions. Expected to officially launch in 2021, it has been for more than a year the subject of intense debate by banks and credit unions over whether the pros outweigh the cons of participating.

So far just 11 institutions, ranging from Citibank down to fairly small credit unions, have signed up for Plex. Very few details are known and none of the participants are saying much.

Crone is blunt in stating that Google Plex may be many financial institutions’ best hope of staying relevant up against the likes of the Apple/Goldman Sachs partnership.

“There is an open opportunity for those that manage checking accounts to come out with the same set of features, starting with digital account opening at Apple Card speed and adding all the functionality that the Apple platform offers,” says Crone. “And the white knight for doing that is Google Plex.”

Significantly, Crone and Liebenguth both believe Google will give Plex away for free. What Google gets is data — account-level transaction data.

“The average checking account generates about $250 dollars per year, but an active user of the Google Pay mobile wallet [of which Plex is a part] can generate more than $500 dollars per year from advertising and promotions and offers,” Crone states. “Google could share half of that with the bank and still come out way ahead.”

If Crone’s assessment is correct about Plex and Apple Pay, financial institutions are in an interesting position. Two tech giants, already up to their waist in financial services, are looking for more, but taking very different approaches. On the one hand, Apple (so far) has a closed system and a single big-bank partner. On the other hand, Google is piloting its digital platform with multiple financial institutions with the possibility (when further details are known) that it will be opened to more participants.

Crone’s conclusion: “Any financial institution whose contract for their mobile banking platform is coming up for renewal has to consider Google Plex as one of their options, because that could actually open up a new revenue stream.”