Younger consumers, less enthralled with using traditional credit cards and their ensuing debt, are adding drive to the point-of-sale financing trend. More and more variations on the “buy now, pay later” way of buying things keep rolling out.

Fintech lenders are the major drivers, but traditional consumer lenders have ramped up their efforts as the competitive risk of not doing so grows.

Trends that were already in motion have been given a big push by COVID-19, as the pandemic drove more consumers than ever to online and mobile purchasing channels. POS financing is available for both in-store and digital purchases, and is both a payments mechanism as well as a form of financing.

Ways for consumers to use this new form of payment and financing depend on the provider and include direct access at the point of sale, often via a fintech app or a button on a retailer’s app or on its checkout screen; the choice to switch a credit card purchase to an installment plan after purchase; and access to a platform that connects consumers, seller and financing providers.

Variations on this product are available for making purchases at some of the nation’s biggest retailers — including Amazon, Walmart and Target but have grown increasingly popular for niche retailers

This movement keeps gathering momentum: Afterpay, a plan provider that originated in Australia, saw the number of users enrolled in its offerings rise by over 219% in mid-2020 over the same point in 2019. That results in an increase to 5.6 million U.S. enrollees. Klarna, based in Sweden, one of the world’s largest buy now, pay later companies, added over 1 million new users during the summer of 2020. The company reports that daily downloads of its app hit an average of 20,000 daily in the U.S.

A related trend is social media platforms that increasingly make “social shopping” or “social commerce” part of the experience. This means being able to go straight from a post to a purchase, without having to leave the channel.

Influencers like actress Sarah Hyland help promote ‘buy now, pay later’ fintech firms like Afterpay.

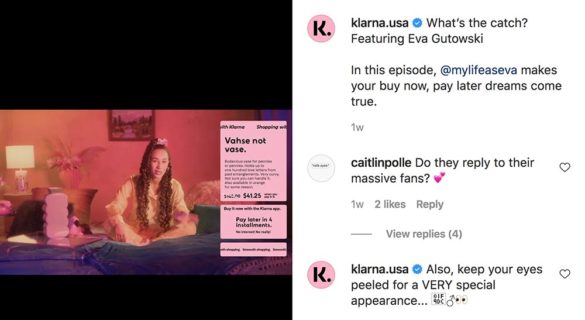

Instagram is the clear pioneer in this trend, according to Mintel’s Jeannette Ornelas, Senior Digital Analyst. A report by Ornelas indicated that Instagram leads the social platforms in on-platform purchasing, with Pinterest getting similar efforts underway. Leaders among buy now, pay later fintech firms like Klarna, Afterpay and Affirm use the Instagram platform to stimulate interest both in companies that permit consumers to pay this way and in the method itself. Social media influencers are a key tool to promote the service.

Read More: How the Coronavirus Changed Gen Z’s Views About Money

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why New-Age Installment Plans Appeal to Today’s Consumers

Finding ways to be where the consumer is when they want financing may rapidly become a survival skill. A McKinsey report indicates that “75% of consumers who seek financing decide to do so early in the purchasing journey.” Beyond share of wallet there is share of mind — the payments brand that puts itself in the vicinity of the purchase will most likely pick up the business.

McKinsey notes that banks have an advantage fintechs typically don’t. While the latter have their algorithms, traditional financial players “possess the consumer data necessary to design flexible personal credit lines allocated across credit card, point of sale, and multipurpose installment loans.” This is a far cry from the paper-based traditional personal loan offered by credit unions and some banks.

Research by The Ascent, a personal finance service by The Motley Fool, describes in detail how Americans have been using this type of credit thus far. (The study looked at use of fintech providers’ offerings.)

“Over a third of U.S. consumers between 18 and 54 have used a buy now, pay later service.”

Over a third (37%) of U.S. consumers between 18 and 54 have used a buy now, pay later service, according to the report. The Ascent’s research found in a consumer survey that the top two reasons for choosing this option are to avoid paying credit card interest (39%) and to make purchases that fall outside of their normal budget (38%).

The types of plans offered fintechs that put consumers straight into an installment program generally don’t charge interest, promoting the plan as the retailer’s price divided by the number of payments selected. Of course, even in this low-rate period they aren’t doing this for free. Somebody pays, explicitly, in this case, the retailer. Typically they receive the sale price, less a service fee. This isn’t that different in principle from the discount taken by card issuers on purchases, although when consumers revolve the interest they pay go to the lender alone. A common selling point made by the companies providing plans that retailers pay for is that consumers who use them tend to buy more than those who buy with traditional methods.

The plans generally fall into three categories, according to blogger Mike Eckler writing for PracticalECommerce. These are fixed plans, which set the number of installments and flexible plans, where the consumer can choose the number of payments within an offered range. In these the seller pays the fee. In the third choice, micro-loans, the consumer pays a flat fee to the plan provider.

The Ascent’s research found that use of buy now pay later programs rises until the age of 44. According to the survey, the following percentages have used such a service at least once:

- 18-24: 37.7%

- 25-34: 46.8%

- 35-44: 50.1%

- 45-54: 42.2%

- Over 54: 20.6%

Some consumers may be considering these repayment plans to somehow not be “debt” in the same sense as credit card balances because they have a finite term. This makes them seem more palatable. “The option to buy now and pay later can be the difference between ‘hopefully one day and ‘how about now’,” Visa observed in a company blog.

An important point to understand is that usage isn’t a frequent event for most respondents. This is in keeping with the trend to use buy now pay later plans for specific large purposes where the methodology permits the impact on the household budget to be contained to a given period and dollar amount. The study found this usage pattern:

- Once a year or less: 27.7%

- Every six months: 21.1%

- Every three months: 21.3%

- Monthly: 18.3%

- Weekly: 7.8%

- More than once a week: 3.8%

People using these plans tapped them to buy the following (they could select multiple categories):

- Electronics: 43.7%

- Clothing and fashion: 36.9%

- Furniture or appliances: 32.8%

- Household essentials: 31%

- Groceries: 22.5%

- Books, movies, music, games: 15%

- Other: 7.1%

The study also ranked fintech providers by usage:

- PayPal Credit: 48.1%

- Afterpay: 35.7%

- Affirm: 25.7%

- Klarna: 19.3%

- FuturePay: 10.7%

- QuadPay: 10.4%

- Sezzle: 6.1%

- Splitit: 4.7%

One bright flashing yellow light: The study found that only a bit over one in five users of these plans say they fully understand how they work. This suggests compliance issues will arise in the future, especially if a worsening economy puts some of these buyers in arrears.

While the plans generally promote the lack of interest charges, that’s only true so long as payments continue on a timely basis. The Ascent’s report delved into the terms and conditions pages of the providers. Some findings: Affirm disclosed that its interest rate could rise as high as 30% if payments faltered — the highest rate among the providers. In terms of late fees, Afterpay’s is stated as a percentage of the transaction — as high as 25% of the consumer’s charge, per purchase.

How Traditional Consumer Lenders Compete with Pay Later Plans

Traditional consumer credit companies have been active with their own variations on the buy now, pay later theme.

“American Express reports that since introduction of ‘Plan it,’ its card members have set up nearly five million installment plans, representing nearly $4 billion in purchases.”

Slightly ahead of the curve, American Express introduced its “Pay It, Plan It” option in mid-2017. The “Pay It” component is a way to direct the company to pay a card transaction immediately after making it, through linkage to the consumer’s checking account. “Plan It” permits consumers to turn a card transaction into a short-term installment plan, for a fee. The company reports that since introduction, its card members have set up nearly five million installment plans, representing nearly $4 billion in purchases. People using the Amex plan have created four of them, on average. The average plan size is $789.

Other large financial services companies have added plans along the lines of “Pay It, Plan It” to their menus, among them Citi and JPMorgan Chase. And fintech Klarna added the ability to pay immediately from a transaction account.

This wave of options comes at a time when the COVID economy has been pushing down traditional credit card volume, points out Brian Riley of Mercator Advisory Group in a blog, Mastercard and Visa, now have operations supporting pay-over-time options. The companies are working both with traditional card providers as well as with certain fintech players.

One example of what’s been going on is the partnership of Mastercard and TSYS, a global payments company. The partnership will enable consumers of participating issuers to choose to switch card purchases into installment plans. They will be able to make that choice before, during and after checkout.

In the firms’ announcement, Riley states: “Adding the installment lending function to a bank card is suitable for all parties in the transaction. The consumer has a discrete transaction, separate from their general purchasing. Merchants get to close the sale, and similar to credit card usage, have an opportunity to upsell the customer. The issuing bank benefits with increased spending.”

One aspect of the partnership that’s important to understand for the bigger picture is the option to choose the plan at the time of the purchase. TSYS will make it possible to do this without the need to integrate the merchant company into its processes. To the merchant, the pay later purchase looks like an ordinary card transaction.

Many of the fintech players have relied on their service being a visible option on the screen in-store, online and on the merchant’s mobile app. However, the fintechs are also moving towards the flexibility of apps that are transparent to the merchant. For example, Affirm introduced a service that creates a one-time virtual card that can be used to make a purchase at any retailer, both live and digitally. Other fintechs have been adding this to their lineups.

While an April 2020 report by Forrester indicates that 26% of retailers surveyed offer installment plan options at checkout, growth in efforts like Affirm’s will bring more consumers the ability to buy on plans at virtually any retailer or etailer, not just those explicitly promoting it.

Another angle for traditional institutions to consider is getting aboard platforms that offer consumers multiple options through the retailers’ choice of payment partners. One example is Vyze, which Mastercard acquired. The companies taking part in the platform aren’t necessarily all pursuing the same segments. QuadPay, a fintech, specializes in four-payment installment plans for purchases under $1,500. Ally Lending, a financing subsidiary of Ally Financial, on the other hand, is joining the Vyze platform to offer plans lasting six to 60 months for up to $40,000, more like a traditional third-party financing arrangement.

The buy now, pay later trend involves more than tangible purchases. JetBlue and Goldman Sachs’ Marcus introduced the ability to pay for travel over time through the lender’s new MarcusPay service. Trips from $750 to $10,000 can be financed through the effort. This program carries a fixed interest rate.

Social Shopping Begins to Take Hold for Millennials and Gen Z

According to Mintel research, Millennials and Generation Z represent a key intersection point for etailers and payments and financing companies. The research has found that of consumers 18-43 who shop online and use social media, 34% would like to purchase items directly through a social media site and that 50% say they would be inclined to use buy now, pay later plans to buy expensive items online. Meanwhile, separate Mintel research indicates that 59% of consumers are trying to limit the time they spend in stores.

Social is also the place where fintechs offering buy now, pay later programs actively promote the goods of companies they’ve signed up, plus, as mentioned, where they use influencers to stimulate additional interest in their programs or specific goods.

Ornelas reports that Klarna is the biggest spender among the fintech firms offering payment plan, outspending its rivals significantly.