A bank or credit union that grew assets by 200% in a year can count on one thing with certainty: The regulators will come calling. In “fintech-world,” however, that kind of growth is what keeps investor funds flowing.

Yet the very success of innovative and aggressive new financial competitors inevitably pushes them, willing or unwilling, under the bank regulatory tent.

Such is the case with the fast growing buy now, pay later marketplace. Several BNPL players, including Afterpay and Splitit grew 200% or more year-over-year in 2020, and other major players including Klarna, PayPal and Affirm have also grown rapidly. The BNPL players that operate in the U.K., one of the hottest buy now, pay later markets, now face the prospects of regulation by the Financial Conduct Authority.

Australia, another hot market, has also taken steps toward BNPL regulation.

Don’t Bet On It:

Bank-like regulations could derail the BNPL train, but it should be noted that Klarna has a banking license in its home country of Sweden, and PayPal is pretty familiar with regulatory challenges.

Regulations or not, consumers overall appear to love the buy now, pay later experience. It’s very convenient and simple to use, especially online. One of the most telling statistics is the amount of repeat business some of these BNPL companies get.

Afterpay reports that 91% of their users are repeat customers. The most frequent BNPL customers use it about 48 times a year, according to Sheridan Trent, research analyst at The Strawhecker Group (TSG). That’s more than some of them use credit cards.

Buy now, pay later can cover a range of services, but typically, as the name implies, it gives consumers the option to split a purchase into several equal payments over a few weeks or months with generally no interest due or fees — unless they miss a payment or are late.

These digital offerings are usually embedded in the online checkout process, or may be accessed through an app. The BNPL provider pays the merchant in full at time of purchase, minus a discount, and the consumer pays the BNPL provider.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Growth Picks Up in U.S. Market

Global buy now, pay later volume is expected to double by 2025, according to a new 81-page TSG report. The U.K., Australia, Asia and Middle East have had the most rapid growth, while U.S. adoption had been relatively slow until now.

Trent says a big reason for the slowness in the U.S. is because credit cards are so popular here. “People have had a lot of time to develop their preferences around payment methods,” she says. “So when buy now, pay later first came onto the scene, it was viewed a little bit like digital wallets — there was no huge need that it filled.”

All that changed with the pandemic, however, the analyst states. People started to look for more flexible payment methods. And then, over the 2020 holiday season, things really started to take off.

To put some figures on it, the TSG survey of more than 1,500 U.S. consumers in February 2021 found that nearly two in five (39%) had used a buy now, pay later service.

A separate survey conducted by Credit Karma and Qualtrics found a very similar BNPL usage level among Americans —42%, while a March 2021 survey by The Ascent found that more than half of U.S. consumers (56%) have used a buy now, pay later service, up from 38% in July 2020, a 50% increase in less than a year.

Repeat Business:

Just over a third (36%) of American users of buy now, pay later tap the service once a month or more, according to data from The Ascent.

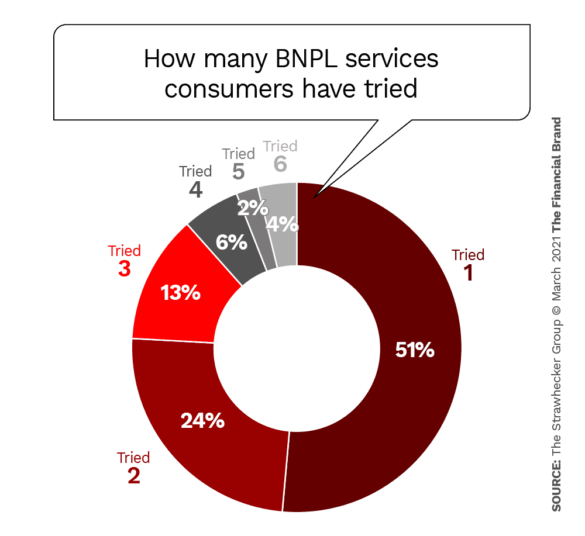

The TSG research found that nearly half of BNPL users had tried more than one service and a quarter had tried three or more services.

Many BNPL providers partner with individual merchants, to have a button placed on the checkout page. Others, such as Klarna and Afterpay, have apps that allow consumers to shop right within the app.

As a third option, Trent tells The Financial Brand, some merchants are offering buy now, pay later service under their own name in white label agreements with providers. Shopify is doing this with its Shop Pay Installments in conjunction with Affirm, according to Trent.

Read More: Buy Now, Pay Later Programs: Threats and Opportunities in Banking

Growth Going Forward Looks Even Stronger

Once people try buy now, pay later, they tend to like it. TSG’s research found that nine out of ten people who have used BNPL found it reliable and that 85% of consumers plan to continue using it.

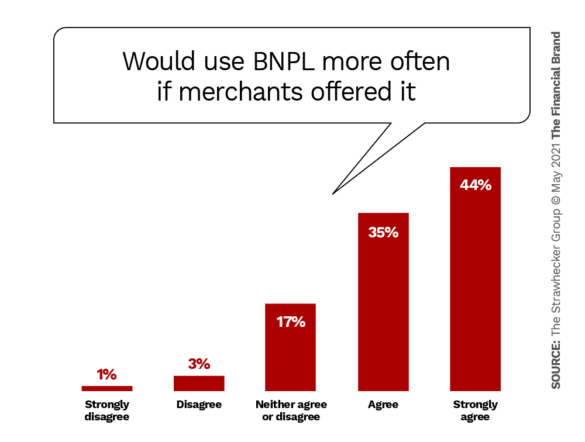

One of the roadblocks to even higher growth is that not all merchants offer the option. The TSG research clearly shows that greater access would drive even higher usage.

Now that much of the U.S. has reopened, the pace of in-store adoption of BNPL should rise, driving usage even higher.

Reasons Why Consumers Use BNPL

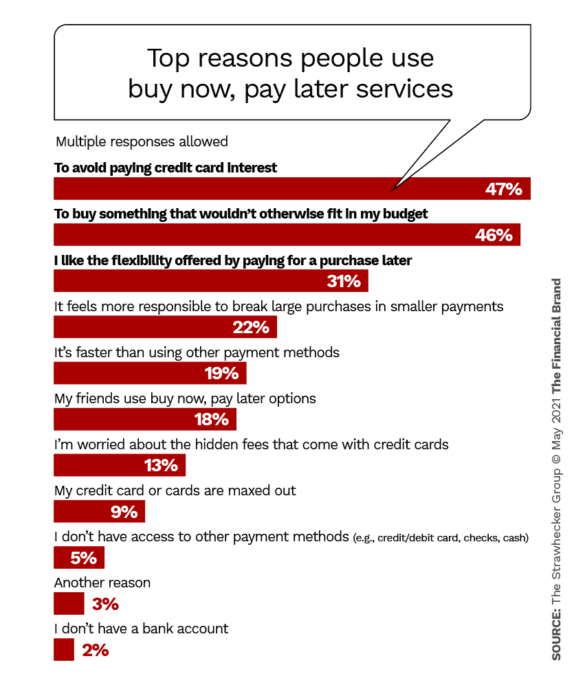

The prevailing narrative about BNPL use, according to TSG, is that its popularity is due to mainly to young people who don’t have a lot of money and who have “disavowed” credit card use. “This narrative isn’t wholly inaccurate,” TSG states. Its research found that the biggest reason given for using BNPL was to avoid credit card interest — nearly half say this. But as the chart below shows, this is far from the only reason.

Taken as a whole, the results suggest that using BPNL is not primarily about avoiding other types of payment methods. While some consumers are using BNPL as a workaround due to lack of credit, the report states, many are simply attracted to the payment method itself over other options.

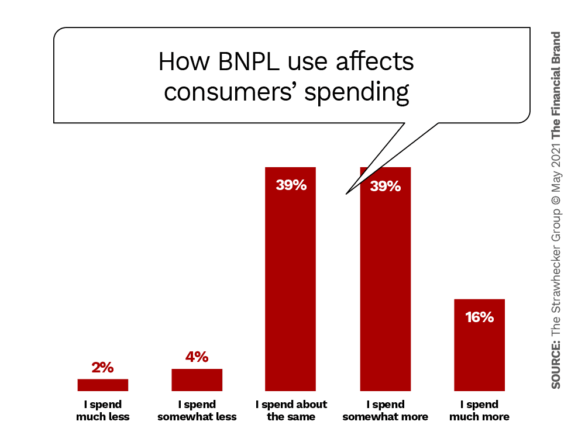

TSG’s research did confirm that buy now, pay later use tends to make people spend more.

Naturally merchants love this and it’s one reason so many of them are willing to accept a discount from the full amount paid to them by a BNPL provider. That point of course is much the same argument credit card issuers have used for decades.

Want It, Buy It:

The propensity for consumers to spend above their means — with one click ‘in the moment’ — has become a lightening rod for regulatory oversight of BNPL.

FCA Weighs in, Will CFPB Be Next?

BNPL’s rapid growth in the U.K. prompted significant pushback in 2020 culminating in new rules being proposed. As TSG notes in its report, Klarna’s strategy of using social media influencers to promote use of buy now, pay later drew criticism for “glamorizing debt.”

The pushback escalated when U.K. personal finance blogger Alice Tapper launched the #regulatebuynowpaylater campaign, as noted in a Wired article.

“The ambition of the campaign was not to put a stop to those providers or to say they can’t be useful,” Tapper told Wired. “It was about providing information for consumers and protection for consumers. I was seeing lots of young people whose first encounter with credit is buy now, pay later, but they aren’t familiar with the risk of the products or how to use them well.”

Ultimately the U.K.’s top financial regulator, the Financial Conduct Authority asked its former CEO, Christopher Woolard, to review the BNPL industry.

The Woolard Review was issued in February 2021, and identified “an urgent need to regulate all buy now, pay later (BNPL) products.” This will include affordability checks and the right of consumers to complain to the U.K.’s Financial Ombudsman Service, notes a Grant Thornton summary of the review.

In addition, new advertising rules were imposed for BNPL products in the U.K.

Is this a forerunner of what will happen in the U.S.? Already the California Department of Financial Protection and Innovation has pushed to regulate buy now, pay later services in the same ways as loans, TSG notes.

“Positioning buy now, pay later as credit is a good way to explain it to consumers, with all the advantages that can come along with that, but also with some of the caveats.”

— Sheridan Trent, The Strawhecker Group

The TSG report does not address whether the Consumer Financial Protection Bureau will focus on buy now, pay later, but it’s certainly within it remit. In his testimony before Congress, Rohit Chopra, President Biden’s pick to head CFPB, said he would seek to protect Americans struggling with debt from potential abuses by lenders.

The Credit Karma survey cited earlier reported that of consumers who’ve used BNPL, 38% say they’ve missed at least one payment. Of those, nearly three quarters (72%) also reported seeing a decrease in their credit scores.

The Threat to Credit Cards

Is BNPL a credit card killer? TSG’s report downplays that possibility, saying that “as of now, card networks and traditional players are too integrated into the payments infrastructure for many of these new services to represent an immediate threat.” Also, most BNPL services operate through a link to a credit or debit card, so there is still interchange revenue for incumbents.

However, Affirm, a key BNPL player, is launching the Affirm Card — part debit card part BNPL service. Also, Klarna has a full banking license in Sweden and in Germany. And as Sheridan Trent observes, things can happen pretty quickly in the BNPL market. PayPal just launched its Pay in 4 BNPL service in September 2020, and it’s already incredibly popular, she says.

Given all that, several large banks are hedging their bets by offering their own version of BNPL, including Chase, Citi, American Express and Barclays. Doing that creates some risk of cannibalization to their card businesses, which Chase CFO Marianne Lake acknowledged in an analyst presentation.

But, as reported earlier, she also said: “We saw the buy-now-pay-later trend as something that our customers want. …We’re also seeing decent incrementality from customers who want this capability who otherwise were either not revolving or revolving less.”