In no other area of banking is there greater evidence of the convergence of customer insight, digital technology and advanced analytics than in the global payments ecosystem. Still, most industry observers would agree that the acceptance and use of digital payments and mobile wallets has been less than expected.

In August, Goldman Sachs stated that digital wallet adoption had been “underwhelming to date by nearly every objective standard.” The analyst stated that while Apple Pay was the dominant digital wallet leader, accounting for 90% of all contactless payments originating from a smartphone in the U.S., it was still struggling to gain real traction.

Alternatively, research shows that digital wallets and P2P are poised for a significant upsurge. According to the U.S. Bank Cash Behavior Survey, 47% of consumers surveyed say they prefer the use of digital payment apps versus cash (45%). In addition, a study from Juniper Research found more than half (53%) of global transactions at POS will be contactless within 5 years, compared to just 15% this year.

To determine the potential of these payment alternatives and the strategies being used to expand acceptance and use of digital wallets and P2P payments, The Digital Banking Report conducted research of financial institutions globally. The report, Digital Payments and Mobile Wallets, sponsored by Fiserv, combines proprietary payments research with insights from key industry sources and global case studies to help organizations be better positioned for the future changes in the payment ecosystem.

Key takeaways from this payments research include:

- Organizations are increasing investment in payments solutions mostly to improve the customer experience and to support new solutions.

- FIs are focusing the most on P2P payments, mobile wallets and debit cards.

- Organizations believe P2P payments and mobile wallets are increasing in importance compared to other payment solutions.

- More than 50% of organizations in the U.S. have no plans to offer Zelle.

- Most organizations believe current payment security is inadequate and are working on biometric options.

- Fintech providers are considered to be the biggest threat in the payments ecosystem, followed by Apple and Amazon.

- Most organizations believe real-time payments and P2P provide significant revenue and strategic opportunities in the future.

- The Internet of Things (IoT) is believed to have potential, with voice payments being the technology getting the most attention.

- While Open APIs and wearables are thought to have potential, most financial organizations are not actively investing or developing in this space.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Investment in Payments Technology

The need to expand and improve product offerings, respond to competitive pressures and enhance security has resulted in banks investing heavily to deliver new and enhanced payments capabilities. Across all global regions and all sizes of organizations, banks are expected to grow their investment in back office systems and improved products in 2018.

The specific drivers of this increased investment varies by institution and the competitive and regulatory context each faces. But there are some strong themes that emerge when considering the expected return on additional payments IT investment.

As with most financial institution investments being made, delivering increased operational efficiency and reducing costs are important drivers for retail banks. In addition, the need to improve the consumer digital experience, improve all elements of security and provide multichannel capabilities is key.

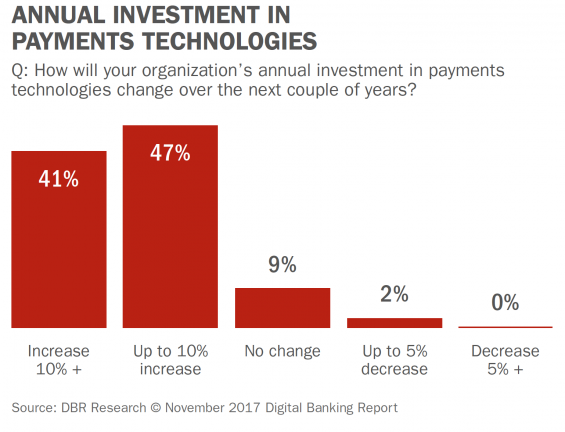

When asked how the investment in payments would change over the next couple of years, our research found that only 2% of respondents expected to reduce their investment, while 89% stated they would be increasing their investment. Of these firms, 41% believed their increase in investment would be in excess of 10%.

When asked to prioritize the areas where payment investments would be made, the number one priority was to improve the customer experience (4.56 on a 5-point scale). For most organizations, this investment equates to reducing payment friction and improving the speed of clearing and settlement (which are also listed separately).

Most organizations hope that by delivering an enhanced customer experience, new relationships and increased use of payment products will occur. The research found that increase customer use and increase sign-up were the second and third highest priorities with a 4.39 and 4.33 score on a 5 scale basis.

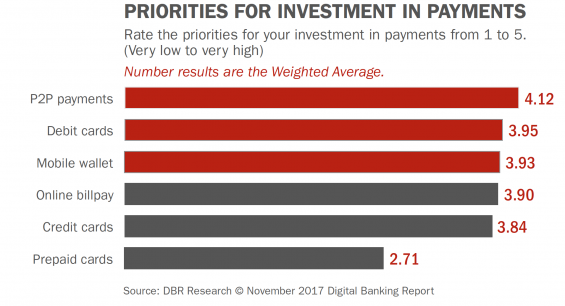

Aligned with the importance of payments within an organization, investment in the development of current and future payment products reflects the potential of P2P payments and mobile wallets. When our global survey participants were asked about what products they would invest in, P2P payments (4.12 on a 5-point scale), debit cards (3.95) and mobile wallets (3.93) were the highest ranked products. Only prepaid cards were a minor priority for those who responded.

Advanced Payment Technology Preparedness

When asked about the benefits of new payment technologies organizations cite the heightened administrative efficiency as the advantage that appeals to them most. In addition, they value other benefits such as reduced processing costs, end-to-end procurement transparency, the ability to automate processes, enhanced analytics and faster processing speed.

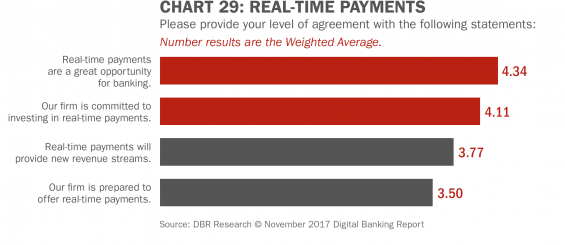

When we asked our survey participants about real-time payments, there was almost uniform agreement that real-time payments were a great opportunity for the banking industry (4.34 on a 5-point scale). There was also strong agreement that there will be an investment in real-time payments.

There was lower agreement, albeit still positive, that real-time payments will provide additional revenue streams (3.77 on a 5-point scale) and that organizations were prepared for this industry change (3.5 on a 5-point scale).

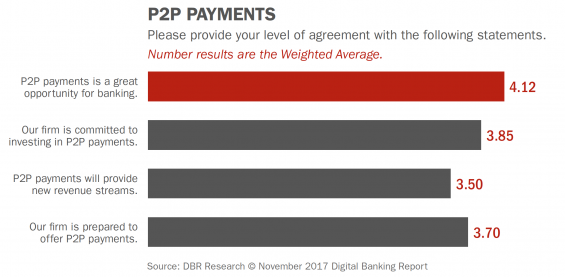

When we inquired as to the opportunity and preparedness for P2P payments, organizations were not as positive about the opportunity, investment in or revenue potential for P2P payments compared to real-time payments. On the other hand, organizations felt they were more prepared to offer P2P capabilities than real-time payments. This is not entirely surprising, given that solutions have been offered by 3rd party vendors for some time.

When we inquired as to the opportunity and preparedness for P2P payments, organizations were not as positive about the opportunity, investment in or revenue potential for P2P payments compared to real-time payments. On the other hand, organizations felt they were more prepared to offer P2P capabilities than real-time payments. This is not entirely surprising, given that solutions have been offered by 3rd party vendors for some time.

Read More: Traditional Banking Providers Struggling With Digital Payments Strategies

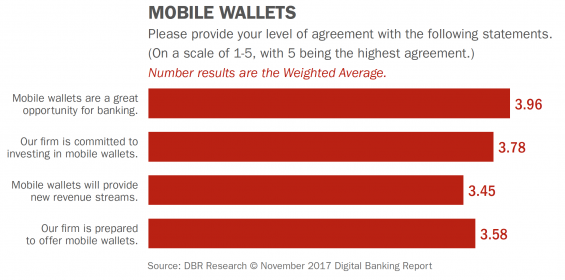

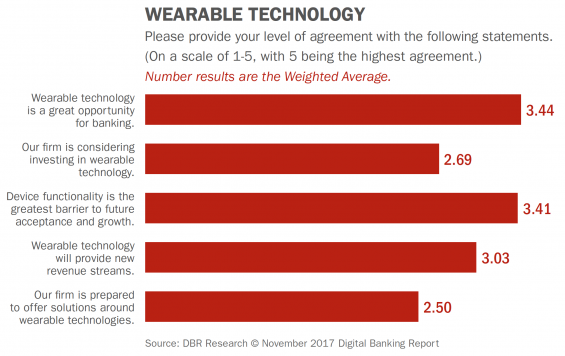

When we asked organizations about the opportunity and preparedness regarding mobile wallets and wearables, we saw some important differences. Across the board, financial institutions globally found the opportunity and readiness to offer to be higher for mobile wallets than for wearables. This makes sense, since most organizations see the use of wearables to be more than just checking balances.

The opportunity, commitment to development, preparedness and potential for revenue was strong for mobile wallets, reflecting the increase market pressures brought by financial and non-financial competition. It is important to remember that we did not ask questions regarding what respondents believed would be part of their mobile wallet. In other words, the functionality of mobile wallets will most likely be very different between organizations.

When we asked our survey participants about the opportunity and preparedness around Open APIs, we discovered that organizations found the potential of open APIs to be quite strong (4.14 on a 5-point scale). There was also equal agreement that APIs would improve innovation and provide compliance challenges (both at 4.18 on a 5-point scale).

There was less agreement that institutions were committed to investing in open banking or that there would be significant revenue streams from APIs. This is not surprising given that many of the responders came from smaller organizations that have much higher priorities in order to meet both payment and digitalization challenges.

The Future of Payments

Consumers, merchants, issuers and financial institutions are all completely rethinking the future of payments. As with most financial services transformation occurring today, the focus is on speed, ease, digitalization and security. At the same time, many organizations are considering the potential to bring all components of e-commerce into a universal ecosystem that makes life easier.

The challenge is — who will be prepared to be the provider(s) in the future? What organizations will make the investment and commitment necessary to provide seamless and secure contextual payments that use AI to make recommendations on purchases and the determine the best way to pay given a consumer’s personal financial situation?

The winners will be determined quicker than most realize as consumers’ expectations grow exponentially. Some organizations will be left on the sidelines, while others may play a prominent part in a consumer’s daily life. What is clear is that most traditional organizations are playing catch-up.

Download the Report

The report, Digital Payments and Mobile Wallets, sponsored by Fiserv, provides insight into the strategies, tactics, trends and level of deployment of advanced payment solutions at financial institutions globally. Beyond a benchmark study, there is analysis of payment technologies such as real-time payments, P2P, open APIs, mobile wallets and wearables as well as close to a dozen case studies from leading organizations worldwide.

The report, Digital Payments and Mobile Wallets, sponsored by Fiserv, provides insight into the strategies, tactics, trends and level of deployment of advanced payment solutions at financial institutions globally. Beyond a benchmark study, there is analysis of payment technologies such as real-time payments, P2P, open APIs, mobile wallets and wearables as well as close to a dozen case studies from leading organizations worldwide.

The report is based on a survey of close to 250 financial services executives worldwide and includes 80 pages of analysis and 42 charts.

You can download an executive summary of this Digital Banking Report or purchase the report by clicking here.