Since the onset of COVID-19, most financial institutions have been playing catch-up, developing and updating digital applications, responding to consumer and small business needs for financial relief and dealing with a work-from-home (WFH) reality. Not nearly enough banking organizations have been focused on innovation and the development of new opportunities presented by the expanded digital economy.

One area banks and credit unions need to examine more closely is API-enabled opportunities and the potential for Open Banking monetization. While APIs have the potential to encroach on banking products and services that traditional financial institutions have provided for centuries, there are also opportunities to expand offerings that could create new revenue streams. Traditional banks and credit unions could also use APIs to create seamless experiences that would take years to develop without third-party partnerships.

Despite the lack of clear guidance from regulators in several countries (including the U.S.), the threat of not investigating options provided by APIs is that fintech start-ups or large tech firms will continue to take market share and inhibit organic growth. Taking advantage of new opportunities during this time of digital transformation also can improve customer experiences as consumers become increasingly aware of how non-financial platforms have made everyday life easier.

Finally, not to be ignored, is the opportunity to serve previously unmet needs of segments of the population that are better (and more economically) served through new digital applications. With the potential for some of the costs to be assumed by third parties interested in reaching these unique segments, traditional banks can avoid relying only on penalty fees and services charges to make products viable.

“The API economy is an enabler for turning a business or organization into a platform. Platforms multiply value creation because they enable business ecosystems inside and outside of the enterprise to consummate matches among users and facilitate the creation and/or exchange of goods, services and social currency so that all participants are able to capture value.” Gartner

Read More:

- Open Banking Is Key to Relevance in Payments for Traditional Institutions

- Open Banking Fintech Partnerships Required For Better CX

- Platforms for Retail Banking Could Turn Rivals into Allies

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Need for an Open Banking Strategy

Organizations that do not rethink traditional operating models run the risk of falling further behind as non-traditional fintech and big tech providers continue to use APIs to power unique products and platforms. More importantly, with margins razor thin, and operating costs under pressure, all revenue opportunities must be investigated. According to Accenture, “Banks with a vision for Open Banking beyond regulatory compliance will be able to deliver the experience their customers expect and thrive in a new competitive and collaborative landscape that includes new players like fintechs, big techs and non-financial-services.”

In the Accenture study, they provide two primary ways to leverage Open Banking.

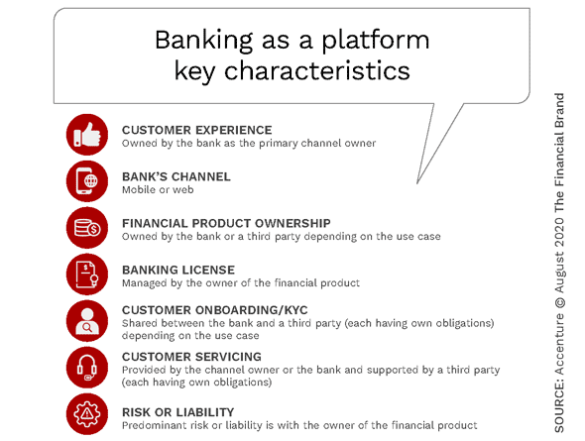

Banking as a Platform. Similar to the platforms we have observed in retail, the platformification of banking usually refers to the aggregation of services and/or capabilities beyond the limited portfolio offered currently. The building of a platform is intended to expand offerings from third-party partners in a seamless manner, providing the consumer more financial and non-financial options and increased convenience.

This option is often delivered by larger financial institutions that can benefit from expanding services to a broad consumer base of organizations wanting to serve a specific segment more completely. While developmental tools will be provided to potential partners, data from the financial institution is usually not shared with third parties.

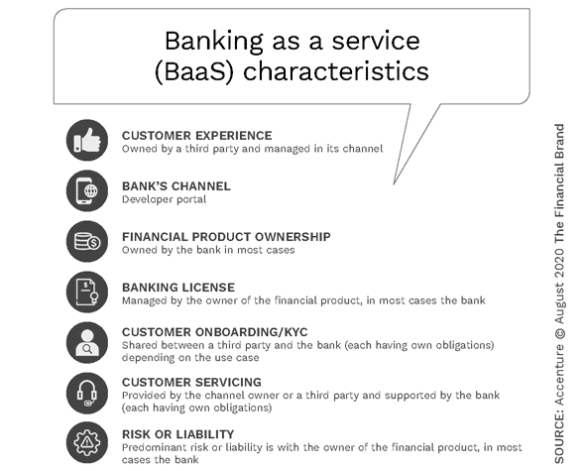

Banking as a Service (BaaS). The BaaS alternative allows fintech firms and other third parties to connect with the systems of traditional banking organizations through APIs so the third party can build offers and capabilities on top of the providers’ infrastructure. In many countries, the BaaS alternative has allowed traditional financial institutions to keep pace with fintech and big tech providers, while also providing a platform for innovative fintech firms.

This strategy is good for banks and fintech firms that want to rapidly expand distribution reach and access new markets. This strategy has been used extensively by firms in the payments, lending, investment and transaction banking ecosystems.

As progressive organizations begin to build solutions using open APIs and Open Banking and benefits materialize at scale, we will witness an accelerated shift towards Open Banking utilization. Both banks and external service providers can create benefits for their mutual customers, strengthen their competitive position in the API economy and potentially establish new avenues for revenue growth.

Open Banking is Not For Everyone

According to Innopay, the extent to which an Open Banking play will be successful depends on a bank’s Open Banking strategy, the organization’s existing product portfolio, the competitive positioning or the institution and the size of customer base. Another major component of success, as with all digital transformation strategies, is the innovation culture of the leadership within the organization.

Banks and credit unions that are willing to embark on an Open Banking strategy can learn from open business models in other industries as well as the few progressive banks that have launched their own developer portals with APIs and sandbox environments. This allows banks to offer access to third parties to interact and use the bank’s functionality and customer’s data to create next-generation financial services, states Innopay.

The Monetization of Open Banking

APIs threaten to fragment banking products and services that large institutions have owned for centuries, according to Capco. It also provides the potential for exciting new services with revenue opportunities. New banking solutions – with seamless customer experience at the front end and multiple interconnected providers in the background – will become the norm in the near future. Some organizations are already having success with these new models. Both imagin from CaixaBank and Liv from Emirates NBD are examples.

“The future of any Open Banking offering will depend on the value it provides, or the monetization options it creates. Participants can bundle or unbundle offerings and services and generate direct or indirect value. The quantum of value generated will depend on the overall market proposition, customer ownership model, partner value-adds, risk/liability share etc.” – Accenture

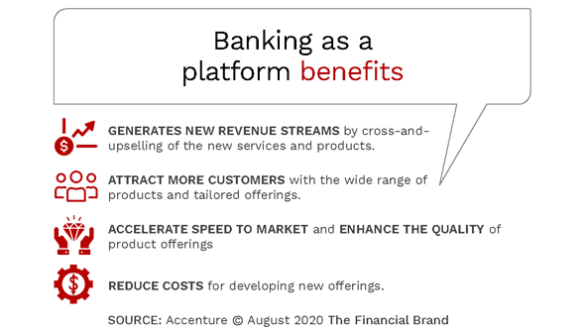

According to Accenture, banks pursuing a banking-as-a-platform model can generate value directly or indirectly. For instance, they can generate direct revenues by offering third-party access to the bank’s distribution network, in return for a fee or revenue sharing. Alternatively, they can generate indirect value by leveraging the partnership to expand their customer base, lower their product costs or increase efficiency.

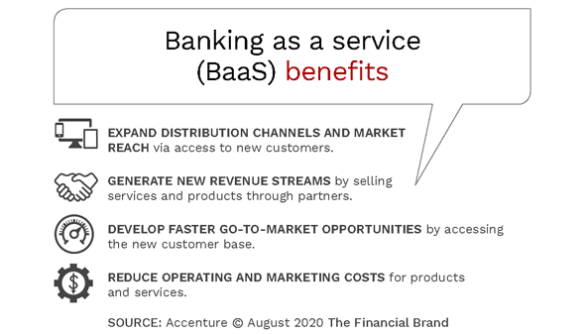

In a banking-as-a-service (BaaS) environment, value is generated by distributing financial services through third parties. As with the banking-as-a-platform model, value can be generated either directly with fees or indirectly through increased distribution or reduced costs of delivery.

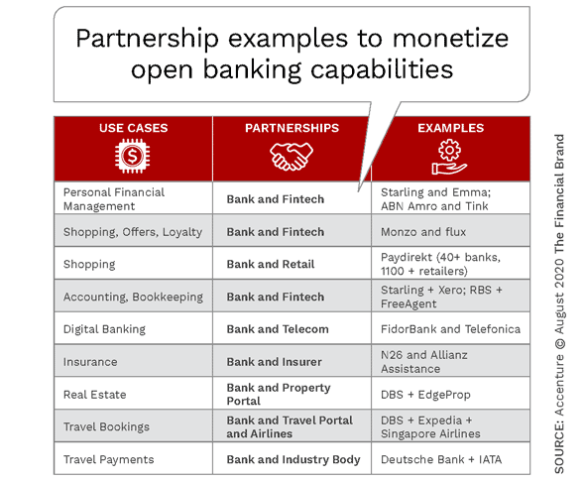

In both examples, the partnerships can be either with financial firms or organizations from other industries. Several cross-industry partnerships have been created in the payments and traditional banking industries with retailers, hospitality firms, media companies, telcos, insurance carriers and even gaming platforms. Any cross-industry partnership usually depends on the market segment being pursued.

The Future of Banking Requires ‘Out of the Box’ Thinking

The increase in competition, customer expectations and the technology to drive new banking models is forcing financial institutions of all sizes to consider new ways to reduce costs, increase revenue and rethink traditional products and services. The goal is to find new ways to monetize banking and make engagement both easier and more “sticky.”

Where consumers once saw websites and mobile apps as a way to learn about products or transact linear transactions, they now see as integrated platforms with embedded capabilities to make life easier. Efficient interfaces, immediate gratification, and interconnected solutions have become the norm.

According to Capco, “The lesson of the last few years is that competition in this market is based not on APIs’ technological capabilities but on their ability to deliver business value. They must meet an untapped consumer need and be invaluable to their distributors (i.e. developers, startups and fintechs).

The future of financial services will not be a menu of simple products and services, but on customized platforms that integrate solutions that work together to make consumer lives easier.