The doom and gloom predictions about financial institutions’ role in the payments system are sounding less like Chicken Little and more like Paul Revere. Legacy banks’ long-time dominance in payments clearly is under siege and the bottom-line impact may soon be significant.

A pair of reports focusing on the payments business paint a picture of a rapidly changing competitive scenario in which banks and credit unions are well aware of the challenges, but remain on the defensive. That’s due to a reluctance to change profitable business models and concerns over data security, among other factors.

An unlikely ally: financial regulators concerned over the growing number and clout of nonbank payment players, as well as with the impact of conflicting payment standards. Another ally is the growing population of fintechs that more and more legacy institutions recognize as part of the solution.

The stakes keep growing. Capgemini reveals in its World Payments Report 2019 that noncash transactions grew globally by 12% from 2016-17, the most recent data. The consulting firm predicts the total volume of non-cash payments of all kinds will reach just over $1 trillion by 2022, representing a compound annual growth rate of 14%. The U.S. still dominates in overall value of non-cash transactions, at $147 billion compared to second-place Europe at $80 billion and China at $65 billion. But growth in the U.S. was 5% from 2016-17, compared with China, which grew at a 35% rate, powered by the Alipay and WeChat Pay mobile wallets.

The Chinese ecommerce and payment platforms have not made significant inroads into the U.S. market so far, but are making headway in Europe and elsewhere, often through partnerships with regional players.

Accenture released a report that predicts legacy banking providers could lose up to $280 billion of payments revenue to nonbank competitors by 2025.

“A world of instant, invisible and free payments spells trouble for banks that don’t want to be relegated to the plumbing of payments.”

— Gareth Wilson, Accenture

“We face an inevitable world of instant, invisible and free payments, which spells trouble for banks that don’t want to be relegated to the plumbing of payments,” said Gareth Wilson, Accenture’s global payments lead, in a statement. “But it also presents an opportunity to tap into a new business model based on this digital boom.”

In its report Capgemini outlines many challenges facing incumbent financial institutions — chief among them growing fears over Big Tech competition, and wariness of open banking, even in countries where it is the law.

Much More Complexity in Payments Now

Four primary factors have created a complex competitive and operational environment for traditional banks and credit unions, according to Capgemini:

- Emerging technologies — among them: APIs (application programming interfaces), distributed ledger technology (DLT, the foundation of the blockchain), artificial intelligence, and bank-as-a-service solutions.

- Big Tech inroads. Firms such as Amazon, Google, Microsoft, Alipay and Apple are looking for additional ways to leverage their technological prowess.

- Regulatory complexity leads to fragmented compliance and multiple systems and schemes. Coordinated regulatory action, however, could help slow the nonbanks’ inroads.

- Rising consumer expectations create a challenge for legacy banking providers. “Overall, new currencies, loyalty schemes, and penetration of wallets are driving integrated customer experience in the retail segment,” the report states.

As a result of these trends, new payment use cases have proliferated, and more are in development or in the early stages of adoption.

Chirag Thakral, Capgemini’s Deputy Head of Market Intelligence, Financial Services, comments on three emerging types of payments banks and credit unions must take note of:

Conversational commerce and in-car payments: With the growing adoption of IoT (internet of things) and digital assistants such as Amazon’s Alexa, Apple’s Siri, Google Assistant and Microsoft’s Cortana, consumers can map their payments instruments and habits in the background. It is not widespread yet but is expected to gain traction as adoption of voice assistants continues.

Invisible Payments: The most notable examples are that of Uber and Amazon, which have streamlined the check-out and payments experience, with payments occurring in the background.

Open-Banking In-Store Payments: As an example, if you receive the bill with a request to pay on your mobile, and you validate and initiate an instant payment from your bank account a TPP (third-party payment) intermediary is needed to route your instruction to your bank in a PSD2/open banking context.

Read More:

- Will ‘Open Banking’ Sizzle or Fizzle in the U.S.?

- 5 Pivotal Technology Trends in Retail Banking

- Building the ‘Intelligent Bank’ of the Future

Open Banking May be the Answer, But Acceptance is Slow

For something with such a benign sounding name, “open banking” doesn’t engender much support from many financial institutions nor from consumers. The latter worry about sharing their financial data with third parties. Banks and credit unions worry about that too, as well as about losing control of the customer relationship.

“Banks will ultimately need to accept open banking practices to ensure viability and success within the new payments ecosystem.”

— Anirban Bose, Capgemini

Despite that, Anirban Bose, Financial Services Strategic Business Unit CEO for Capgemini, states unequivocally that “banks will ultimately need to accept open banking practices to ensure viability and success within the new payments ecosystem.”

At present, however, open banking adoption rates remain low, Bose states in the report, despite regulations in Europe, the U.K., Singapore, Australia and elsewhere that require financial institutions to share customer data with third parties, with consumers’ consent. Institutions falling under such regulations are complying with minimum requirements, but little more, Capgemini reports.

“In an ideal scenario, the Capgemini report states, with frictionless adoption of open banking initiatives, banks can emerge as a one-stop-shop for all customer requirements — even beyond everyday banking and financial needs.”

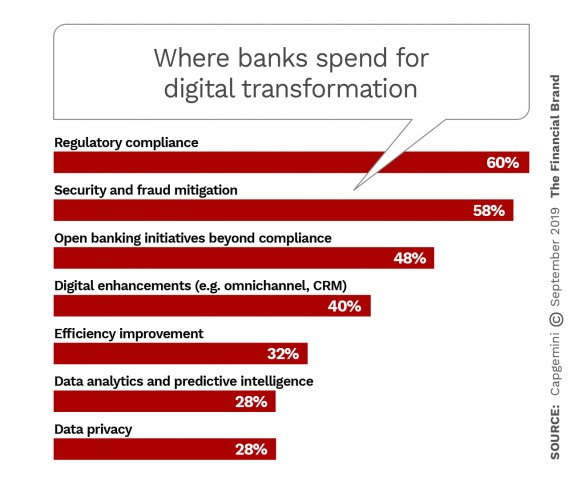

Financial institutions recognize the potential of — and even the need to move toward — open banking but the study found that related initiatives rank only third in terms of institutions’ digital transformation budget allocations.

Still, as Thakral states, PSD2 (the EU regulation implementing third-party data sharing) is about creating the right balance between customer convenience and security. “While it is a complex issue, with the advent of cybersecurity solutions and firms, customers are increasingly getting comfortable with APIs and are in fact, in many cases, demanding them.”

Banks and Credit Unions Have API Reservations

APIs are where the rubber meets the road in terms of moving beyond the traditional business models used by legacy institutions. They are also an integral component of open banking.

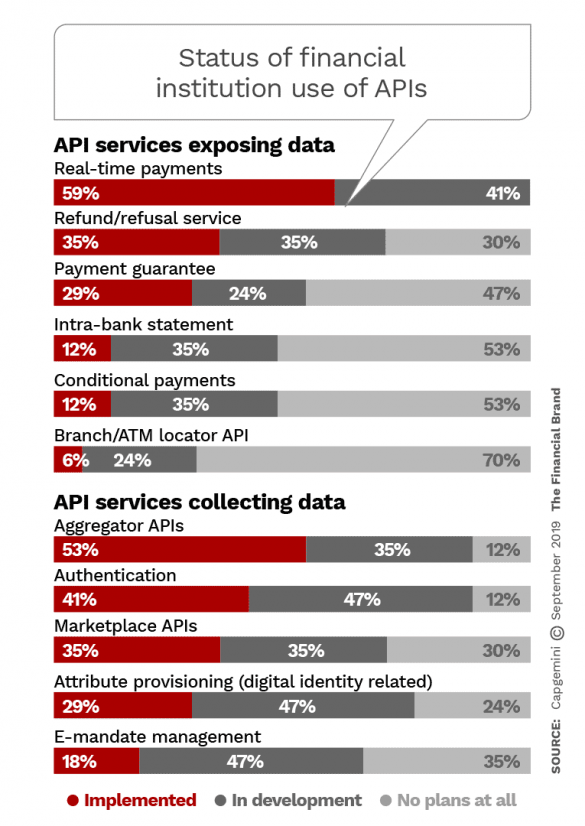

Capgemini probed into this area and found that API adoption by financial institutions has been lackluster because, similar to their views on open banking, banks and credit unions worry about losing consumers by sharing their data with third parties (including other banking providers).

“Bank executives say they are not comfortable with one-sided data sharing — mandated from banks to third parties, but not vice-versa.”

— Capgemini

“Banks’ API adoption rate is steady only when it comes to sharing non-critical and basic data,” the report states. “Our survey data suggest that the percentage of banks offering APIs that both expose [share] and consume [collect] data is anemic.” Capgemini says that the fact that just 35% of respondents say they use marketplace APIs is telling. “Bank executives said they are not comfortable with one-sided data sharing — mandated from banks to third parties, but not vice-versa.”

That view is not universal, however. The consulting firm found that among 60 large European banks, two-thirds already are involved in initiatives requiring the consumption of third-party data, i.e. multi-banking solutions. Many have integrated such solutions into their proprietary online and mobile banking products.

Others have invested in budgeting/PFM fintech ventures or entered into strategic partnerships with third-party providers. HSBC, for example, is using a third-party API to enable the bank’s new mobile app to connect directly to a consumer’s other bank accounts, enabling transactions to be categorized in real-time, according to Global Banking & Finance Review.

Fintechs Are Your Friends (vs. Big Tech)

Many financial institutions are still wary of fintechs as competitors, Capgemini found, particularly those with “segment-focused value propositions.” Half the respondents perceived such firms as a threat. (Adyen was one example cited.)

Yet a clear majority (63%) identified Big Tech competitor as the leading threat because of their reach, brand equity, superior customer experience, and existing payments infrastructure.

“When compared with fintechs, the potential of domination by Big Techs within [the] financial services industry is higher,” the report states. In many cases these companies have already struck deals with large financial institutions (such as Amazon with JPMorgan Chase), alarming the rest of the industry.

Fintechs need banking providers for core services, infrastructure, and access to clients and some will continue to be acquired by banks, notes Capgemini. “They are part of the extended industry, which ensures fair competition.”

“In the absence of regulation, Big Tech giants will adversely impact banks’ profitability.”

— Capgemini

On the other hand, the Amazons, Googles and other Big Techs “have customer bases that are tens of millions strong and the ability to cross-subsidize ,” says Capgemini. “In the absence of regulation to maintain open competition these giants will adversely impact banks’ profitability and margins.”

What’s Needed to Stay in the Payments Game

Accenture suggests two approaches to maintaining payments as a profitable banking business.

First, scale technology to reimagine how their core payment operations are done to ensure that they continue to benefit from the volume/value tradeoff.

Second, differentiate themselves by adding value in a low-margin, high-volume business. In the instant, invisible and free payments world, differentiation will go to whomever owns the customer relationship, Accenture states.

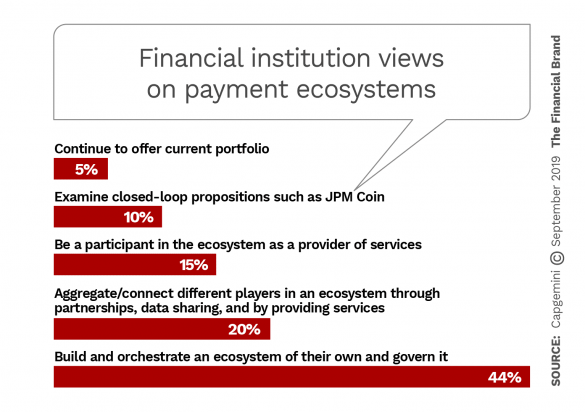

More and more financial institutions recognize the need for collaboration. Nine out of ten financial institutions surveyed by Capgemini say participation in ecosystem-based business models is the key to long-term success in the new payments’ market.

“While financial institutions are still working on putting together plans for open banking,” Chirag Thakral tells The Financial Brand, “our viewpoint is that the industry is already transforming into a future state. Players will collaborate to share resources with a primary focus on customer experience versus product delivery. Instead of assets on the balance sheet,” he continues, “customer data will take center stage. Players will seek to monetize (rent) their ideal infrastructure and will partner to overcome portfolio weaknesses versus attempting to develop products unilaterally.”