In a digital banking environment, there is no reason why financial services organizations should be limited to offering only traditional core banking services. In fact, the future of banking will most definitely include the integration of products and services from a variety of providers, all focused on helping the consumer simplify their daily life – without leaving a primary financial institution’s portal … all on a mobile device.

The combination of advanced data analytics, open banking APIs and conversational AI can create a differentiated experience that can improve customer satisfaction, increase loyalty and generate revenue for the provider. The challenge is that the provider of this advanced banking ecosystem doesn’t necessarily have to be a traditional bank or credit union.

According to a McKinsey white paper, customers in countries like Poland, China and Sweden already receive these types of advanced banking ecosystem experiences. The U.S., and to a lesser degree, the U.K., lack these types of banking ecosystems because of regulatory environments that are wary of non-traditional providers of financial services.

Non-financial examples of consumer ecosystems already exist in industries such as hospitality, healthcare, travel, etc. For instance, travel ecosystems can help a traveler secure a flight, lodging accommodations, a rental car, tour guides and even restaurant and entertainment options.

According to McKinsey, an ecosystem usually provides three key value components:

- Reduction of friction between related services: “Facebook Messenger enables users to shop, check into a hotel, message a friend, read the news or chat with a doctor— all from a single interface. Users do not have to toggle between portals, manage separate logins or spend mental energy maintaining multiple services.”

- Leverage of network effects: Smart home device producer, Nest, provides users a comparison report to measure the energy use of the device owner against other comparable users.

- Integration of customer data across a series of services: The system of combining consumer information with highly targeted business offers by a firm like Cardlytics provides value to both the retail and small business customer.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Existing Global Financial Ecosystems

As mentioned, digital ecosystems have advanced much more quickly in other countries. “Tencent’s WeChat enables users to send messages, make payments, invest, order taxis, buy bus tickets and more, from a single integrated system, according to McKinsey. WeChat has more than 700 million users, with nearly one-third using its payments functionality. (It is important to note that Tencent has already entered Europe with WeChat Pay, targeted to Chinese tourists in the region)

Another expansive ecosystem has been built by Alibaba, with 500 million customers who enjoy an eCommerce platform similar to Amazon, payments services, other financial products, travel, etc. Similar to ‘Amazon on steroids,’ it is clear to see the power of Alibaba’s integration of financial services with ecommerce.

While the progress of U.K. financial services ecosystems has been similar to the U.S. in the past, the emergence of ecosystems will be accelerated by the implementation of PSD2, which allows a more positive open banking environment. Many fintech firms in the U.K. have already taken advantage of regulatory trends and are building their solutions accordingly.

Financial Ecosystem Tipping Point

While few if any financial institutions have embraced the development of a banking ecosystem in the U.S. due to regulatory hurdles and historical banking behavior (existing diversity of financial providers), there are indications this latency will soon change. Some of the reasons mentioned in the McKinsey white paper include:

- Banking need for increased fees and revenue opportunities

- A move from a ‘product-push’ sales mentality to proactive ‘needs-driven’ solution offerings

- Digital customer experience expectations set by non-financial organizations (Google, Amazon, Facebook, Apple, among others)

- Advanced analytic and digital technology advancements, including APIs, artificial intelligence (AI), voice-based digital assistants and even the Internet of Things (IoT).

McKinsey believes the evolution of banking ecosystems to evolve in three ‘waves. Wave 1 will be the seamless integration of existing and related services into existing customer journeys. Easier to implement, this wave will also have only modest revenue potential.

Wave 2 will be similar to today’s private banking relationship, but available digitally to the mass market retail banking customer. With a focus on simplifying the financial life of a retail banking or small business consumer, “this wave will leverage ecosystems to integrate disparate aspects of a customer’s financial life to better understand behaviors and deliver highly personalized solutions.” Advanced data analytics is at the core of this wave.

Finally, Wave 3 extends beyond financial services, with partnerships in areas such as travel, hospitality, ecommerce, etc. (similar to what is occurring in China). Many traditional financial organizations may decide to forgo this level of integration. Alternatively, this is where many of the large technology companies may be looking to expand.

Financial Ecosystem Example

As a small business owner, I am amazed how many disparate challenges I faced when I started the Digital Banking Report. I am also amazed how many challenges have popped up since I started my small business banking relationship. From legal and accounting to regulatory and insurance, the scope is overwhelming.

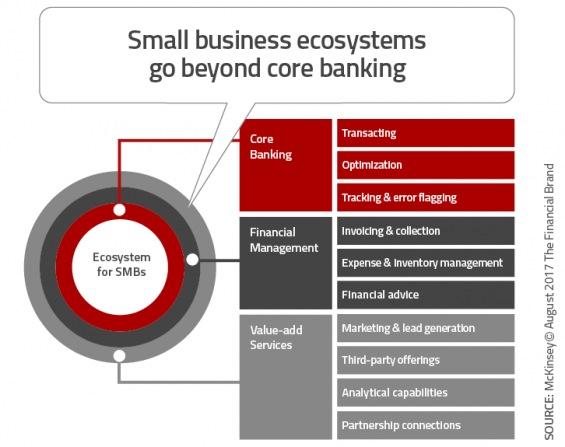

In a ‘perfect world,’ my financial services relationship would extend far beyond core small business banking services such as checking, savings, wire transfers, basic investment services and credit card processing. In addition, all of the relationships would be integrated digitally, so I could keep track of my business from my smartphone.

My small business banking relationship would seamlessly integrate core banking services, financial management and value-added services, such as sales management, marketing, analytics, website development and even help connect me with other businesses like mine or who serve my unique segment. The bredth of the small business ecosystem is only limited by the imagination of the lead organization.

Developing a Financial Ecosystem

As with the development of any large structure, the starting point is a strong foundation. This includes, but is not limited to building a master data management platform with cross-functional data collection, migration of the data to the cloud, building APIs and leveraging advanced data analytics and digital technology.

According to the McKinsey report, there are even more fundamental areas most legacy banks and credit unions must focus on:

- Building a customer-centric vision that looks at needs from the customer perspective as opposed to the perspective of the financial institution.

- Development of cross-functional teams that are not constrained by traditional product silos.

- Improving the ability to innovate at the ‘speed of digital’. This requires more than a nice mobile experience. It requires a complete rebuild from the inside-out to enable real-time changes in direction.