Over the past decade, there have been several ‘Chicken Little’ moments. Branches will disappear … mobile payments will replace debit and credit cards … we will have a cashless society. And most recently, fintech firms will eliminate all but the largest traditional banks and credit unions. Despite these warnings and increasing digitization of the industry, banking’s business model remains broadly intact.

So, will the potential of open banking be different? Will the legacy banking players use the opportunity to share customer data (with approval) to expand the overall definition of banking and become more embedded in a consumer’s life? Or, will the smaller fintech firms and large tech companies take advantage of the banking industry’s lethargy to grab a larger piece of the banking ecosystem?

The answers to these questions could be ‘yes’, ‘no’ or something in between. The overall customer relationship – and resultant revenue – is what is at stake. And while it probably won’t result in a ‘winner take all’ outcome, a transformation of the industry will certainly take place. Finally, even though the changing regulations in the UK and across the EU make open banking imminent, there is no reason to think that similar market forces won’t soon impact the US and other major banking systems as well.

Underlying Market Forces

The banking industry has been treading water (or worse) since the global financial crisis. Revenues have lagged, and the ability to cut costs further has become much more difficult. At the same time, competition from financial and non-financial organizations has eaten away at the edges of banking’s value chain.

Most of this competition has leveraged consumer data, advanced analytics and new digital technology to deliver an improved customer experience, further reducing profits of legacy banks. All components of the banking ecosystem have been attacked by new players. Most recently, new challenger banks have come on the scene, offering a holistic mobile-only banking solution.

As if these combined forces weren’t enough, regulatory changes (mostly across the EU and in the UK) have enabled an ‘open banking’ model, where customer transaction data is made available to third parties. The regulations also increase the transparency of product and pricing information. This could result in disintermediation of customers, with the ease of this switching process made easier than before.

In a worst case scenario, legacy banking organizations could be relegated to the status of commoditized product providers.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

A Digital ‘Perfect Storm’

The combined forces of advanced technology, high speed internet, increasing penetration of smartphones and the increasing popularity and functionality of application program interfaces (APIs) has created a ‘perfect storm’ for innovation. The increasing affordability of each of these components has further strengthened the storm.

In an excellent report, ‘Open Banking: How to Flourish in an Uncertain Future,’ Deloitte states, “Technologies such as ‘Infrastructure-as-a-Service’ (IaaS), ‘Platform-as-a-Service’ (PaaS) and ‘Software-as-a-Service’ (SaaS) have allowed new tech-enabled entrants to enter the retail banking sector with lower IT overheads. They have also allowed them to respond more flexibly to changing market needs.”

Finally, as Deloitte points out, none of these capabilities would make a difference if the consumer didn’t want change. As numerous research reports have pointed out, however, there is a significant pent up demand for improved digital banking experiences from the increasingly tech savvy consumer base that has already embraced innovations in other industries. This latent demand also extends to small businesses and specific product lines like payments and wealth management.

Future Evolution of Banking

There is a growing consensus among industry observers that, while the initial transformation of the banking industry may be an expansion of providers offering new alternatives to existing banking services, the ultimate transformation may be far greater. In the future, the banking ecosystem may expand far beyond just financial services, or financial services may become relegated to being just a small component of a broader non-banking ecosystem.

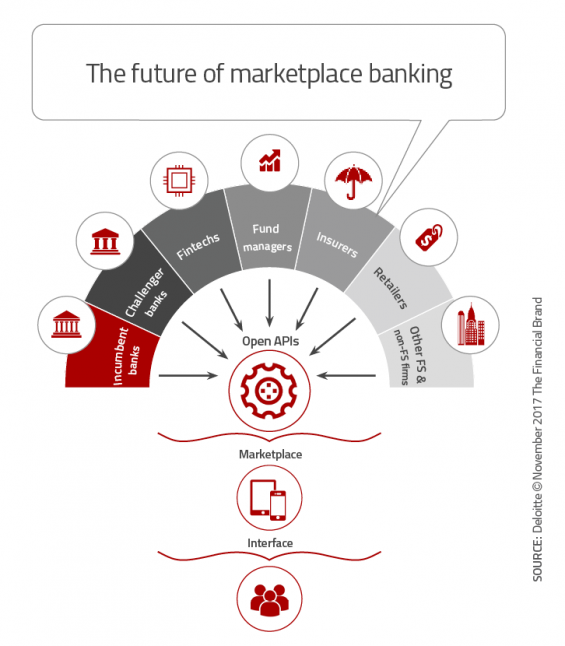

Deloitte believes the banking model of the future will be some form of marketplace banking. “In marketplace banking, the traditional banking business model is transformed into a data-intensive, platform-based marketplace, where several financial services providers continually compete to offer customers tailored, good-value products,” states the report. “As a result, traditional bank services are augmented by a variety of offerings through an ecosystem of providers.”

A marketplace banking ecosystem would give consumers access to highly personalized services that leverage customer data made available through open banking and APIs. Beyond today’s closed access budgeting tools, the new ecosystem would allow consumers to optimize all of their banking relationships – lowering costs and increasing returns.

Beyond traditional banking services, the new ecosystem would allow banks to become the ‘hub’ for other, non-financial ancillary services provided by other banks or organizations in other industries. In this scenario, bank APIs would centralize an array of lifestage services, reducing friction and improving the customer experience.

Instead of disjointed components of a lifestage process like a home or car purchase, starting a small business, or having a child, all involved players (banks, insurance, retail, governmental units, agents, etc.) could be brought together in a holistic marketplace.

Read More:

- The Future of Banking Depends On Open Banking APIs

- The Programmable Bank: Opportunities for Open Banking

Future Strategic Options for Incumbent Institutions

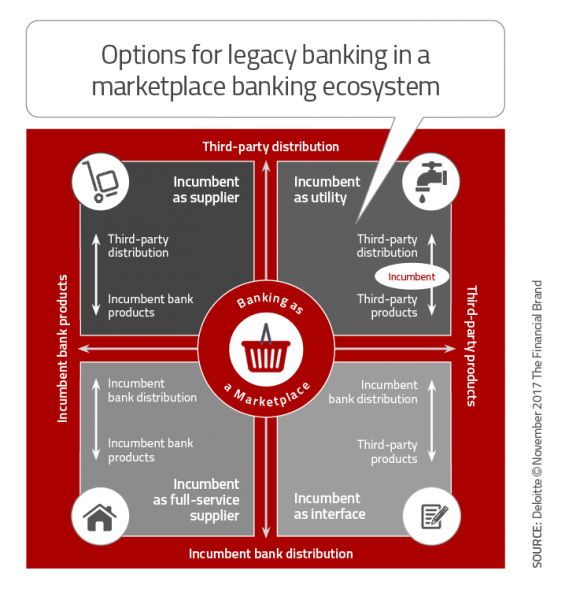

Deloitte believes there are four distinct strategic options for banks and credit unions in the future. In two scenarios, an institution remains in control of the customer/member relationship. In the other two, products and distribution become unbundled.

- Incumbent as a full-service provider

- Incumbent as a utility

- Incumbent as a supplier

- Incumbent as an interface

It must be mentioned that the options are not mutually exclusive. Organizations may want to play in multiple quadrants. For instance, they may want to be a supplier of services as well offering products in a third-party interface.

Data is the Fuel for the Future

The future is not just about selecting the most desired strategic option, it is about preparing for various market alternatives. “The ability to exploit and use customer data in innovative and more individually tailored propositions will be paramount,” according to Deloitte. “Banks will also need to engender a shift in culture towards a ‘fail fast and learn quickly’ mentality and an agile way of working that encourages experimentation.”

Banks must invest in advanced data collection and analytics, going far beyond creating internal reports, to creating great customer experiences. The objective will be to use cognitive analytics to drive cognitive engagement – providing a view of potential future outcomes as opposed to simply past occurrences. Beyond using just data within the organization’s firewalls, the future will require using vast amounts of external data (social, locational, risk, etc.) to improve decision making and engagement.

All future technological advances around improved customer experiences will require improved data and analytics. Whether an organization wants to embark on an AI strategy, integrating financial services and the Internet of Things (IoT), or simplify delivery with digital conversational interfaces, strong data will be at the foundation.