As we look at the transformation of the banking industry, the ability to leverage and profit from new technologies is at the core of future growth and survival. The problem is, the digitization of banking is happening at a faster pace than most organizations can handle. In sync with these changes, consumer expectations are increasing as well, putting additional pressures on financial executives to deliver services in alignment with what is by the most progressive eCommerce giants like Google, Amazon, Facebook and Apple.

In 2007, PwC first measured an organization’s ability to harness and profit from technology. This measurement – Digital IQ – has actually declined over the past 10 years across all industries. In fact, while 67% of companies rated their Digital IQ as strong last year, only 52% gave themselves a high rating in the most recent period (an all-time low). Why does this matter? Because there is a direct correlation between Digital IQ and financial performance, according to PwC.

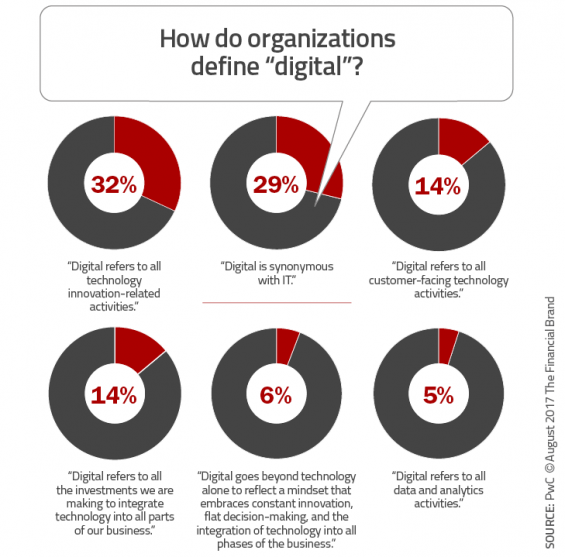

At the foundation of the challenge may be trying to define “digital”. The broad range of definitions is caused by the reality that tracking organizational preparedness is tough when new tools and innovations keep entering the equation.

“Powerful new tools continue to crowd into the marketplace, even as organizations struggle to digest the foundational technologies like cloud, mobile, and analytics on which next-generation innovations depend,” states PwC in the 2017 Global Digital IQ Survey. “At the same time, “digital” has evolved from a synonym for IT to a more expansive approach to technology and its impact on customers, culture, and business outcomes, raising the complexity and stakes of the game while it is in progress—and diminishing the confidence of the players along the way.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Digital Transformation Efforts Fall Short

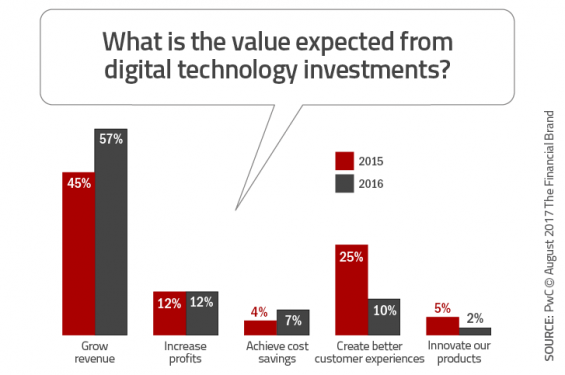

Part of the challenge with keeping up with the digital revolution is that many of the tasks related to digital transformation, including investment prioritization, innovation and product development reside only at the CEO and CIO levels of the organization instead of across all senior executives. This may explain why the top benefits cited from digital initiatives were around revenue growth, increasing profits and cost savings as opposed to creating a better customer experience. Interestingly, the goal of creating a better customer experience declined from 25% to only 10% over the past year.

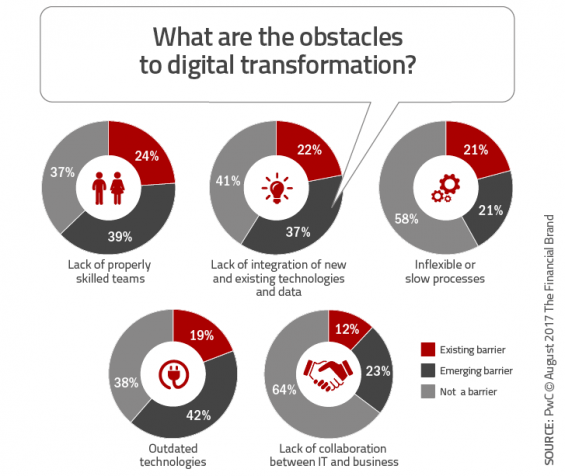

Companies are also falling short because they rely on ad hoc teams or outsourcing to determine prioritization of technology and innovation investments. Instead of proactively exploring new innovations, many firms wait until others test emerging technology … hoping for a fast follower benefit. Unfortunately, the definition of ‘fast’ has changed dramatically in recent years, with most firms reacting way too slowly to market opportunities.

Finally, most organizations recognize that there is a significant skills gap that puts transformation efforts at risk. According to PwC, “Respondents say skills in their organization lag across a range of highly important areas, including cybersecurity and privacy, business development of new technologies, and, yes, user experience and human-centered design. Worse, skill levels have declined since our last survey, even as the demands of digital keep advancing.”

A New Generation of Technologies

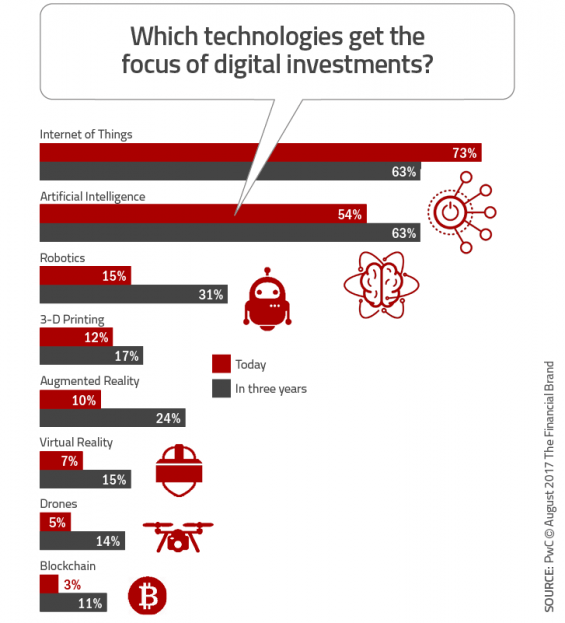

As quickly as past technologies have become the norm, a new wave of emerging technologies will combine digital technologies and the power of data to set new standards. These ‘essential eight’ technologies include:

- The Internet of Things (IoT

- Artificial Intelligence (AI)

- Robotics

- 3-D Printing

- Augmented Reality

- Virtual Reality

- Drones

- Blockchain

Obviously, the prioritization and investment in each of these technologies will vary based on the industry, business model and strategic goals of each organization. For instance, while the marketplace as a whole does not foresee investing much in blockchain technology, the financial services industry ranks this as a high priority.

That said, investment in emerging technologies as a percentage of overall technology investment has not increased since 2007 (across industries). In fact, the share of the overall technology budget that is allocated to emerging technology is only 17.8%, according to the PwC research.

Preparing for the Future

Especially for the financial services industry, it is imperative to think beyond individual emerging technologies. With the advent of open banking APIs as a way to bring external technologies and innovations directly to banking customers, and the emergence of non-traditional banking ecosystems that may include non-banking services, combinations of technologies will become the norm.

For instance, the use of customer data insights and advanced analytics may be combined with IoT technologies to allow payments directly from smart home devices. Likewise, the the expanded use of conversational AI and VR devices may come together, providing methods of banking interactions only imagined in sci-fi movies.

“Executives need to develop a rigorous approach to emerging technology, one that includes a formal framework of listening to those on the bleeding edge, learning the true impact of these technologies, sharing results from pilot projects, and quickly scaling by implementing them throughout the enterprise,” states the report.

In other words, being a leader in emerging technology is no longer a luxury only for the big players. It is important for all financial organizations to make emerging technology a ‘core competency,’ with engagement throughout the organization (not just the very top). In addition, the focus of every implementation much be both internal and external human experiences, as opposed to revenue, profit and cost savings.