Few things have lit the fintech world on fire quite like the launch of Coin, a new technology product that allows consumers to consolidate eight different payment cards into one.

The setup for Coin is fairly simple. You plug an attachment (that looks remarkably like Square’s interface) into your iPhone headset jack. Using the Coin app, you upload up to eight of your credit/debit cards onto the phone, swiping each one through the interface and then taking a picture of it for your records. You swipe the Coin card your entire batch of credit/debit cards are uploaded onto a new single mag-striped card.

Except for its midnight black color scheme, the Coin card looks and works just like all the other card in your wallet. When you want to make a payment, you just flip the Coin card over, push a button and choose which debit/credit card you want to use. A small digital screen displays the four-letter names you assigned your cards — “BANK,” “WORK,” GOLD,” “HOME.”

This revolutionary innovation made Coin an overnight sensation. In three days, mainstream media properties like CNN, New York Times, Wall Street Journal, the San Francisco Chronicle and just about every tech pub on earth pumped out hundreds upon hundreds of articles.

Coin has an excellent demo video on YouTube — probably the best The Financial Brand has ever seen. It’s a very convincing sales pitch. The video was viewed a phenomenal 4.5 million times in 72 hours and an astonishing 21,000 “likes,” making it one of the most-viewed YouTube videos in the history of financial services.

You can pre-order a Coin card consolidator for $50 until December 13, 2013, then the price jumps up to $100, an amount that some observers worry will limit its uptake.

Read More: Will You Be Ready When Mobile Wallets Turn Banking Upside Down?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Fractional Marketing for Financial Brands

Services that scale with you.

The front of the Coin card (above) couldn’t be more simple. The back of the card (below) has a crude-but-functional digital display allowing users to choose from among eight different stored debit/credit cards.

Coin – One Coin For All Your Cards

The Real Revolution is Just Around the Corner

Consumers can now do just about every banking activity imaginable on a mobile phone. You can use a smartphone to check your balance, transfer funds, pay bills, deposit checks, manage credit cards, accept credit card payments, and even make person-to-person (P2P) payments from one phone to another — even via Facebook! You can do everything that is except buy stuff in stores (rare exceptions like Starbucks notwithstanding).

The advent of Coin illustrates how ridiculously close the banking industry is to a nearly all-digital payments ecosystem. It’s seems somewhat awkward that consumers have to load multiple cards onto their phone… to download them to another card… so that they can then swipe that one card on another phone… all to make simple payments — phone-to-card-to-phone. Why not get rid of that piece of plastic in the middle of the process? Instead of needing four cards, two dongles and two phones, how about just two phones? How long will it be before consumers demand to pay phone-to-phone? People will eventually realize the obvious: “I’ve got cards on my phone… I do banking on my phone… Why can’t I just pay with my phone?”

Read More: Consumers Can Switch Banks in Under a Minute w/Smartphone Cameras

Next Stop: Digital Money, Digital Payments, Digital Wallets

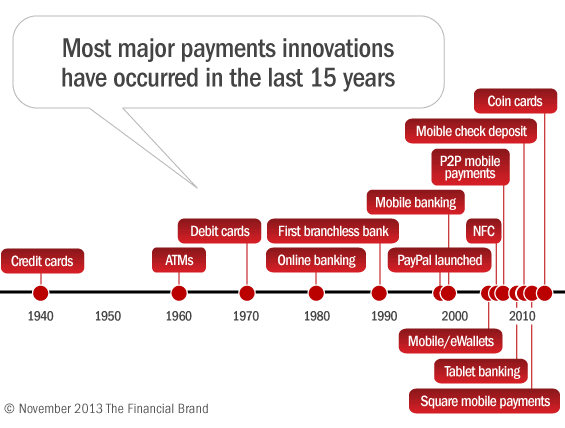

Consumers don’t have any clue how close they are to fully embracing digital payments and the eWallets that necessarily come with them. Coin’s card consolidator represents the zenith of the evolution of old world payment technologies. Look at the history of innovations in the banking sectors and you’ll see more activity in the last 15 years than we’ve seen in the previous 60 combined, and everything has been building up to the mobile future we face today. Digital/smartphone-driven payments are clearly the next major stop.

The mobile delivery channel would appear to be only one innovation away from shutting the door on the past for good. Some experts believe the only hurdle preventing ubiquitous adoption of a mobile payment platform is the merchant equipment — how can big retailers use smartphone technologies to handle all their transactions? But that shouldn’t be much of a problem, as the pioneers at Square have already proven. Phones are cheaper than cash registers and take up less space. You’d think retailers would be thrilled to eliminate cash handling from their operations.

Read More: Banks & Credit Unions Must Get Into the Mobile POS Game Now

Conclusion

Now granted, cash probably isn’t going away, at least not any time soon. There will always be those who want to hang on to the past — like vinyl records and video stores — whether out of nostalgia or [fear/dislike/distrust] of future tech. But eventually governments will realize they can quash a big chunk of illegal activity simply by killing cash, so there’s the possibility of a regulatory angle as well.

No matter what happens, in the end, the smart money… the young money… the money that really matters will all be moving it around digitally. In the future, finding a merchant who won’t take mobile payments will be as annoying as those places you run into today that say “Cash or Check Only” — oy vey!

All it’s going to take a merchant solution built on smartphone technology (whatever that may be) and an app. If you could lock the heads of R&D from Square, Coin, Mitek, Visa, Mastercard and a few big banks into a room, they could probably hammer out a viable mobile payments system in less time than it takes to pick a new pope.

Or Apple could just decide to will it on the world. If they finally think it’s time everyone needs an iWallet to go with their iPods, iPhones and iPads, they could probably make it happen.

One thing seems certain: mobile phones will be the epicenter of all things transactional. It’s already transformed banking; payments are all that’s left. It’s unstoppable, and it’s probably going to be here a lot quicker than we think (just like the future always is).

The only questions are who the primary players will be… and when.