Millennials are a generation of digital natives who have never known a world without the internet. They are the largest generation since the baby boomers, carrying a mobile phone with them wherever they go … to work, to dinner and even to bed. Because of their digital-first expectations and behaviors, they are a closely followed segment for organizations looking to succeed in the future.

A Millennial research report from Vocalink, “The Millennial Influence,” had the following objectives:

- Understand how technology and social media influences the lives of Millennials

- Explore attitudes and trends in Millennial payment behavior and examine how this may evolve in the future

- Explore how Millennials see and want payments to operate in the future

Millennials and Technology

When it comes to technology and Millennials, it is safe to say that the mobile phone is the device of choice for the entire generation. According to the Vocalink study, 40%

of Millennials use an iPhone 6 or newer model. With 19% of Millennials using another iPhone model, Apple smartphones account for well over half of all smartphones used by this segment. Samsung devices were the next most preferred, with 22% of Millennials using a Galaxy S6 or newer, and 19% using another Samsung model.

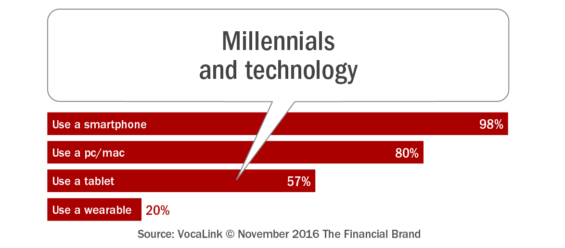

Looking at other digital devices, 57% of Millennials use tablet computers (mostly iPads), and 80% use PCs or laptops (with close to three in 10 being Apple devices). Finally, 20% of Millennials own wearables, with 12% having an Apple Watch, 9% owning a Samsung Gear device and 4% owning another brand.

While many observers believe the Millennial generation have become “slaves to their devices,” this segment depends on digital devices to simplify and integrate with their daily lives. The Vocalink research found that:

- 69% agree they couldn’t live without their smartphone

- 78% agree that technology gives them more control over their daily lives

- 83% say that they like technology that allows them to tailor things to fit their needs

- 79% agree that mobile banking is easy to use

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Millennials and Social Media

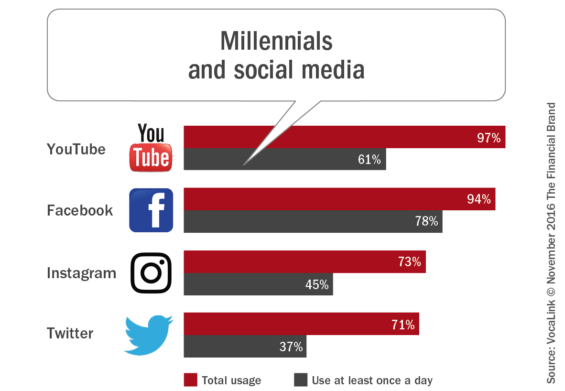

Similar to digital devices, social media has become an integral part of the daily lives of Millennials. The older sub-segment of Millennials tends to gravitate more to Facebook, Twitter, Google+ and LinkedIn, while the younger sub-segment of Millennials use Snapchat and Instagram more frequently according to the study. In fact, 67% agree that ‘Social networking is an essential method of communication to me,’ while 78% use Facebook at least once a day.

Of interest to banking organizations is that Millennials have increasing concerns about data security. The research found that 68% agree that ‘I am concerned about the amount of information available about me on social media.’

Millennials and Payments

Millennials overwhelmingly manage their money online, either through a PC/Mac or via mobile, with most consumers in this segment preferring to manage their personal finances using their mobile devices. In fact, Millennials are more likely to check account balance, transfer money, and/or receive account alerts using their mobile devices than with a computer.

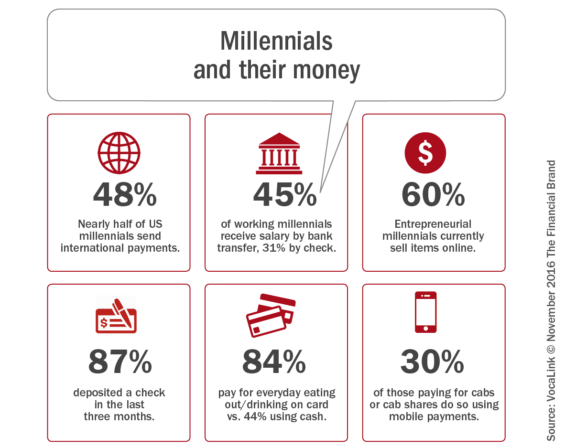

Very surprisingly, and maybe caused by parental influence and the continued dependence on checks in the US, 87% of Millennials surveyed have deposited a check in the last three months, with 69% having done so manually. Even more surprisingly, 14% of Millennials said that they write over 30 checks per month.

There is also the possibility that Millennials use of checks is impacted by banks that have linked old and new payment channels. According to the research, a total of 44% of Millennials used a PC/Mac, smartphone or tablet to deposit a check in the last three months.

Except for P2P transactions, cards have become the dominant payment option of choice for Millennials. Even with P2P. cards are a close second choice, with cash being used by 48% of millennials and cards by 44%. Mobile payments (both contactless and in-app) are the next most used method, being used by 22% of Millennials.

It was found that there is a high degree of correlation between mobile payment use and social media activity in the study. With all Millennial groups, it was found that if a person was comfortable making mobile payments, they are also much more likely to be active on social media.

Within the variety of payments made by Millennials, the Vocalink research found:

- With the exception of international payments, P2P payments are made largely by card and cash

- For paying utility bills, rent or mortgage and other regular commitments, cards dominate, with checks and mobile payments being the next most likely method

- Payment for travel is dominated by cards and cash, but mobile is becoming increasingly popular when paying for public transport, specifically cabs/Uber (30%

of users having paid by mobile) - When it comes to food, retail and entertainment, cards and cash are the most popular methods, with mobile payments becoming more popular when the payee is also digital (Netflix, Amazon, etc.)

When it comes to the receipt of payments, most Millennials receive their salary from work via bank transfer (45%) or check (31%), with though 14% still receiving cash. While cash still dominates small value transactions, the growth of PayPal was noted in the study, especially when splitting bills or transacting with digital organizations.

Millennials and Security

According to Vocalink, while 82% of Millennials surveyed had either heard of, or think they have heard of, Apple Pay, only 8% of iPhone users said they currently used this method of payment. The same was true of Samsung Pay, with awareness/adoption rates of 71%/8%. Interestingly, PayPal was only used by 9% of Millennials as a mobile payment option.

So why is adoption so low? The research found that while over half of millennials (52%) are current users of mobile payments in one form or another, 86% of contactless mobile payment users have experienced either technical problems or acceptance issues. For Millennials who have tried mobile payments and stopped, 47% discontinued use because of concerns over losing financial data or because they feared the network itself wasn’t secure.

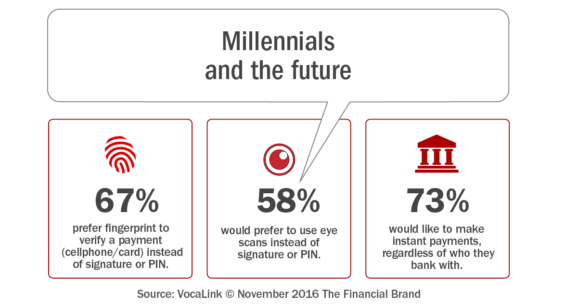

Digging deeper, it was found that users who tried mobile only once or twice were significantly more likely (51%) to abandon it due to security concerns than users who tried mobile a few times (43%). According to Vocalink, “These lower frequency users, combined with the 22% of Millennials who have yet to try mobile payments, indicates a huge incentive to payments providers to refine their offer and improve the user experience.” Close to 80% of those that currently use their mobile to pay say they are likely to increase their usage, whereas only 40% of non-users can see themselves using mobile payment, illustrating the importance of promoting usage. One way to improve usage may be to introduce biometric security enhancements. The biometric methods which were the most preferred were fingerprints (67%), followed by facial (47%) and voice recognition (46%).

Close to 80% of those that currently use their mobile to pay say they are likely to increase their usage, whereas only 40% of non-users can see themselves using mobile payment, illustrating the importance of promoting usage. One way to improve usage may be to introduce biometric security enhancements. The biometric methods which were the most preferred were fingerprints (67%), followed by facial (47%) and voice recognition (46%).

Millennials, Alternative Providers and the Future

While Millennials are the first segment to try new technologies, the research found that Millennials still prefer to do mobile payments offered by their bank (70%), by PayPal (64%), by a card provider (62%) or by a service provider endorsed by their bank (49%). They do not prefer large technology companies, ISPs, telcos or the Government as mobile payment providers. Finally, only 27% of Millennials would use mobile payments provided by a new fintech provider.

To increase mobile payment use, Millennials make it very clear that there will need to be security guarantees. They also want mobile banking is easy to use, contextual and integrated with their daily lives. Finally, 73% agree that they would like to be able to make instant payments… with the emphasis on instant.