Just as banks and credit unions feel like they are starting to wrap their heads around the Millennial market, new research comes along suggesting their financial attitudes involve more nuances, complexities and sometimes contradictions than previously believed. Many financial marketers are left wondering how they can keep up.

It’s clear that Millennials aren’t a stagnant, immutable group. As they grow older and life stages change, researchers are uncovering a broad range of new influences that define Millennials and their expectations for banking.

“As they’ve grown up, Millennials have continued to grow their wealth and their families and are now occupying the heart of the financial services market,” says a report from Edelman entitled Millennials With Money. “Whenever a generation ages, organizations that serve that market will need to adjust their assumptions, communications, and even their operations.”

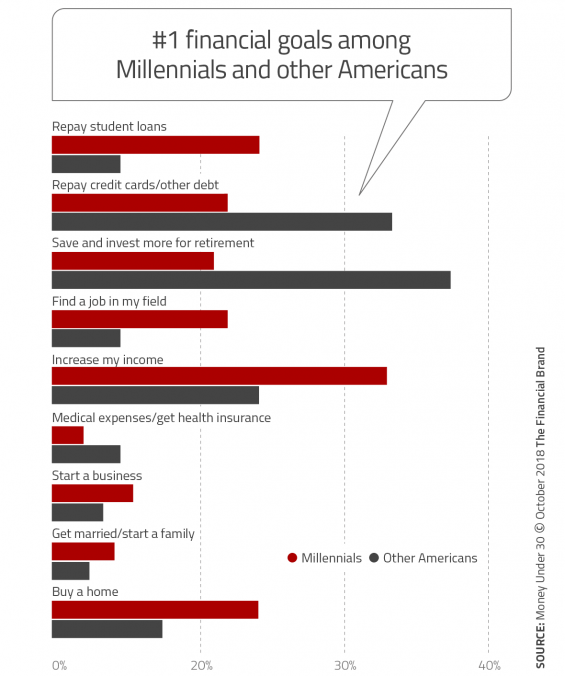

A separate survey by Money Under 30 found that 56% of Millennials are either very unsatisfied or somewhat unsatisfied with their current financial condition. This is substantially less happy than the 45% of the rest of Americans polled who feel the same way.

As dour as that may sound, the Money Under 30 study actually dismantles many of the common stereotypes surrounding Millennials — that they spend all their money on avocado toast, that they all believe they’re special, or that they spend most of their time mooching off their parents.

For instance, Millennials are far more optimistic about the future than the general U.S. population. Researchers found that 78% of Millennials believe that their financial affairs will improve, while many fewer other Americans — only 46% — think their financial circumstances will get better.

“Millennials’ optimism is striking,” says Yoni Dayan, Chief Editor at Money Under 30. “It doesn’t fit the stereotype.”

“For their entire adult lives, Millennials have known a healthy and improving economy,” Dayan explains. “They are more likely to see that upward trajectory as fixed rather than temporary. This contrasts with other Americans, who view the economy’s recent upward trend as one part of the natural ebbs and flows of the economy in general.”

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Millennial Haves or Have Nots?

While there’s that optimism, there are also some troubling realities in the research. Money Under 30’s found that — as a group — Millennials’ struggles with their finances are such that an unexpected $500 expense could be a problem. For example, they are three times as likely as other demographic groups to need to ask for financial assistance from friends or family when faced with such unexpected costs.

A $500 surprise should not pose such a challenge, says Dayan. He believes this illustrates how heavy student debt and other expenses have left many Millennials strapped.

“It’s not like Millennials have much of a choice,” says Dayan. “Most jobs today require a degree, if not two.”

The Edelman study, which looked specifically at affluent Millennials with $50,000 in investable assets or $100,000 in individual or joint income, found that even among affluent Millennials, preparedness is wanting. Only 52% of affluent Millennials maintain an emergency fund that can cover six months’ living costs, and only 30% of non-affluent Millennials have built up such reserves.

Among the affluent group, 81% believed they will be more financially successful than their parents, while 51% of other Millennials feel that way. Interestingly, when those groups were asked how their own children will do, fewer affluent Millennials — 71% — thought their kids would outdo them financially, while among non-affluent Millennials, 59% felt that way.

Millennials must contend with numerous expenses that other generations haven’t faced. For instance, everyone in the digital generation needs a smartphone, a laptop, and reliable high-speed internet access.

Such strains on Millennial budgets might help explain why more than half of those surveyed in the Money Under 30 research say they aren’t contributing to retirement savings in any form, and another 10% aren’t sure if they are contributing or not.

Similarly, the Edelman study found that comparatively few Millennials are making the most of 401(k) annual contribution limits. Only 45% of affluent Millennials have maxed out and only 20% of non-affluent Millennials have.

Can Banking Providers Improve Millennials’ Financial Literacy?

Dayan says there’s a serious lack of financial literacy among Millennials. The Money Under 30 research found that 36% of those surveyed don’t know what their credit score is — more than double the number among all other generations. Many Millennials completely avoid credit cards — 35%, according to the website’s research — which would be a way to build up their scores.

Could financial institutions help Millennials improve their financial literacy? Dayan says they could, but a big gap needs to be crossed first.

“Banks are trying,” says Dayan, “but many Americans, especially Millennials, don’t trust banks. They still feel banks are just trying to sell them something.” He cites Millennials’ high rates of abstention from credit cards as evidence that they distrust financial institutions.

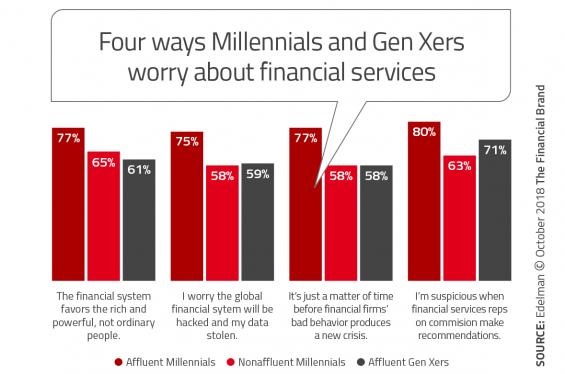

In the Edelman survey, substantial lack of trust is seen among all three demographic groups that the firm surveyed. For instance, three out of four affluent Millennials agreed with this statement: “The whole financial system is designed to favor the rich and powerful at the expense of ordinary people like me.” Eight in ten suspect recommendations by employees at financial institutions are doing so simply because they receive commissions.

“The solution to all that distrust is human relationships,” says Deirdre Campbell, Global Chair/Financial Services Sector at Edelman.

In many ways, she says, community financial institutions can outperform larger players because they often excel at building personal relationships with consumers. She believes community-based institutions’ local connections generate a trust that can be driven home among Millennials.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Insights on Affluent Millennials

Edelman’s research highlighted four key insights on affluent Millennials in their report.

Edelman’s research highlighted four key insights on affluent Millennials in their report.

1. Money means more to affluent Millennials than everyone thinks. Financial success means a great deal to these Millennials, according to Edelman. While all three demographic groups in this survey put family and health/wellness at the top of their preferred measure of success, the third factor for affluent Millennials was financial wealth. They placed this higher than either non-affluent Millennials and affluent Gen Xers.

2. Affluent Millennials relish disruption. While Millennials have acquired a reputation for being somewhat risk averse as a consequence of growing up during the Great Recession, affluent Millennials reveal a surprising comfort level with riskier financial activities. Overall, four out of ten say they are willing to take risks with their finances. More specifically, 25% of the affluent Millennials say they use or hold cryptocurrency and three out of ten say they are interested in using such forms of “money.” Three out of four of these respondents also favor innovations like blockchain.

3. Affluent Millennials are savvy but stressed. All three demographic groups admit to being stressed out over money and uncertain whether their financial decisions are correct. However, compared to the other groups, affluent Millennials’ biggest financial challenge if not knowing where to obtain information to make an educated financial decision. That is a stunning confession for people who grew up in the Internet Age. Non-affluent Millennials, by contrast, aren’t even as likely to feel that they can influence their financial fate. Many agreed with the statement, “I feel powerless and ineffective when it comes to finances; the system is rigged against people like me.”

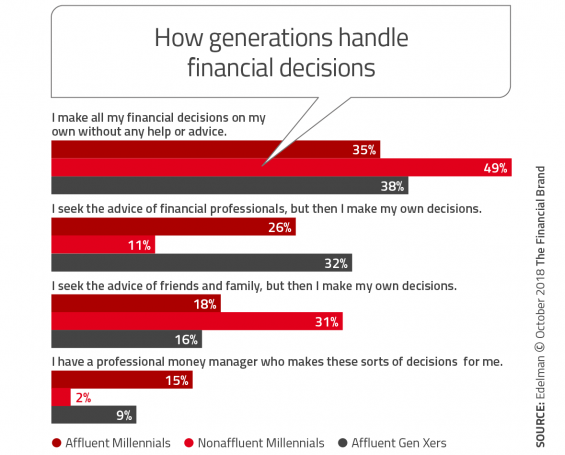

A key factor for all generations surveyed is that many are financial “DIY-ers,” making all financial decisions on their own, without any help or advice. Campbell believes the solution is financial institutions outreach that demonstrates how they can help improve affluent Millennials’ lot.

4. Affluent Millennials are more skeptical. This attitude is fed by disappointment with how financial institutions lag on customer experience. For example, 61% of affluent Millennials feel institutions fail to use data and technology to personalize their financial experience. And 65% feel that financial institutions lag far behind other providers in the quality of customer experience offered. And even more, 70%, think financial institutions make the process of doing business with them unnecessarily confusing and frustrating.