The nation’s largest generation of potential homebuyers, Millennials, faces a daunting barrage of obstacles that lenders need to understand. Among the challenges are their huge student debt, wage stagnation, and Covid-imposed restrictions and isolation.

Homeownership is anything but straightforward, let alone reasonably affordable for Millennials. This generation must make critical decisions about where and how they can or want to live that will ultimately redefine residential real estate lending.

A data-rich study by Legal & General, a U.K.-based insurance and asset management company, details Millennial financial circumstances, attitudes and needs regarding homeownership in the United States. It yields significant insight with which banks and credit unions may adjust their approaches to tap into a huge potential customer base.

The study’s title signals its cautionary nature: “2021 U.S. Millennials and Home Ownership – A Distant Dream for Most.”

“The governing thought for a lender or banker from this report is that the broad category of Millennials is finding it harder to put together down payments and to move into home ownership,” says John Godfrey, director of corporate affairs, Legal & General. “Almost all of them still do want ultimately to own a property. So you have a large potential customer base out there, but they’re having to take a little bit longer in a lot of cases to get to the point where they can do it.”

Why it Matters:

The Millennial market is far too big to shrug off. Creative efforts by lenders and builders – aided by a measure of good fortune and wealth transfers – can help put more young adults into homes.

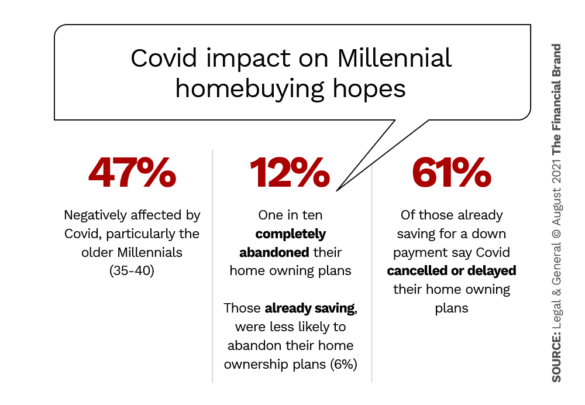

Even before the new Delta wave of the Covid pandemic, which threatens the return to normalcy consumers eagerly embraced, the initial waves had already crushed the homeownership prospects of many Millennials. The chart below highlights this graphically.

“Housing affordability, already an issue for [Millennials] in big cities and other desirable areas, became further unattainable to people in their mid to late 30s, many of whom opted to return to their hometowns, in some cases even their parents’ houses,” stated Nigel Wilson, Legal & General Group CEO. “This is a societal problem with significant repercussions: Millennials form the largest working cohort, yet many can’t get onto the ladder of home ownership.”

Read More: Helping Millennials & Gen Z Find Financial Security in Uncertain Times

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Tough Times If You’re Under 40

The study, which is being released in several parts, slices the broad category of Millennials into three distinct subgroups by age with highly individualized, often different housing needs. These are:

- Junior Millennials age 25-29, who are apt to seek high-wage jobs in big cities.

- Mid-age Millennials age 30 to 34, who are starting families and contemplating moves to more affordable places.

- Mature Millennials age 35 to 40, who are well along in career and family life and still trying to figure out how to buy a home in many cases.

In a more normal situation, once people reach a certain age and start forming families they become less interested in living in a small place in a city and interested instead in more space outside the cities. That’s the transition point where they become a really good mortgage loan proposition, Godfrey observes.

“This study confirms that for most young adults, buying a home is an increasingly unattainable goal.”

— Nigel Wilson, Legal & General

Millennials, however, have to contend with huge obstacles common to the generation as a whole. “This study confirms that for most young adults, buying a home is an increasingly unattainable goal,” says Nigel Wilson, Legal & General chief executive. “Millennials we studied cited crushing student and medical debt, and the failure of wages to keep up with the cost of living as accelerators of this generational problem of unaffordable housing. If you’re under the age of 40, you’re part of a generation that needs access to a bigger and more broadly available supply of affordable housing than currently exists.”

Battle of the Generations

As mentioned, Covid has had a distinct impact on Millennial homeownership. Seven out of ten Millennials surveyed agreed that it had some impact on their thinking about where they could live. “We suspect that with companies delaying their back-to-office dates and the rising fear and uncertainty around the Delta variant, these numbers could increase,” according to the report.

Ongoing Effect:

Covid delayed Millennial homeownership once, and now with rising uncertainty over the Delta variant, the delays look to continue.

Millennials are not without some resources. An earlier U.S. market study by Legal & General found that Millennials’ family and friends supported the purchase of $317 billion worth of property across America in 2018, accounting for 1.2 million homes, with an average sum of $39,000 lent or given. This so-called “Bank of Mom and Dad” would have ranked as the No. 7 housing lender in the U.S. at that time.

Paradoxically, older generations, at least in the short run, actually are starting to compete with Millennials as the Baby Boomers decide to downsize into the supply of what the younger generation would consider starter homes. Godfrey says this tension is unsustainable, though, and lenders should focus on bringing new buyers into the market. “There’s only so many older people who can be active in the market,” he says. “You need to keep the flow of new people coming through to keep the flow of new business strong and to keep that emphasis on first-time buyers.”

Read More:

- Banks & Credit Unions Facing Mortgage Headwinds With Millennials

- Financial Stress Now The #1 Reason Millennials Lose Sleep

- 5 Digital Strategies to Boost Mortgage Lending in a Red Hot Market

Freedom to Live Anywhere

Younger Millennials face a particular dilemma. More than a quarter of junior Millennials overall would move for job opportunities, even into large cities where home prices have soared. “It’s a real Catch-22,” the report says. “Millennials, and especially those in the younger age group, often feel they need to move to bigger cities to find higher paying jobs. Once they get there, the cost of even rental housing is so overwhelming that their plans for home ownership are put on a remote back burner.”

30% to 40% of mature Millennials, however, would prefer to move to a smaller town or area. Within that group, 66% of those who want to move to smaller areas currently live in cities of more than half a million inhabitants. With Covid having made working from home not only possible but desirable, such relocations have become more attractive and fundamentally change the relationships of city, suburb, town, and rural living.

“The current model of suburbs up to now has relied on people living there, sleeping there, and then traveling to work,” Godfrey says. “If half the population or a third of the population is mainly working from home, the character of a suburb might become very different. Therefore you need to have more housing there which is priced the right way.”

“The acceleration and use of technology is a kind of turbocharger. You’re almost looking at not having to hire people who are employed in a local market and that creates a huge number of more options for people around where they want to live and where they want to bring up their families. It’s much more flexible than it used to be.”

Don’t Give Up On Delayed Millennials

Changing the housing market to accommodate the potential Millennial market will have to be step by step. “The solution clearly needs to be multi-pronged,” Godfrey says. “It starts with increasing the supply of affordable housing and building more homes overall. But financial institutions must also develop different paths toward ownership, perhaps on a rent-to-buy model.”

The fact remains, says the report, that “even though they may feel they are plodding up a steep hill, nine out of ten Millennials still want to buy a home.”