Every year, global tech giant FIS fields a comprehensive survey encompassing thousands of consumers around the world. The results of their 2017 PACE Report paint a harrowing picture for the future of community banks and credit unions.

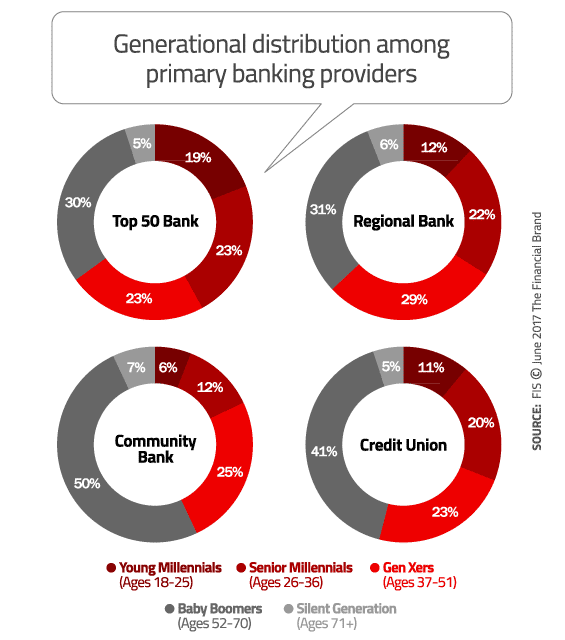

Smaller, local institutions face stark realities when it comes to the demographic breakdown of their base. Only 18% of community banks’ customers are Millennials, a segment FIS defines as those ages 18 to 36. That’s in sharp contrast to big banks, where 42% of their customers are Millennials.

Credit unions and regional banks have similar penetration rates among Millennials (32% and 34% respectively). But that doesn’t mean credit unions are safe.

You see, the problem isn’t with the distribution of percentages among the various demographic segments. It’s the net numbers these percentages represent. Megabanks and regionals have customer bases that number in the millions, while community banks and credit unions typically only do business with a few thousand people. That means the banking industry’s largest players are scooping up a massively disproportionate share of Millennials. Every consumer who chooses a big bank is a precious lost opportunity for community banks and credit unions.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

While community-based institutions have made progress targeting younger consumers (namely Millennials) and have shifted the average age of the consumers they serve downward, the FIS study suggests they are still in serious demographic trouble. 57% of community banks’ customers and 46% of credit union members are over the age of 52. Conversely, 65% of megabank customers and 63% of regional banks’ customers are under the age of 52.

Future prospects for smaller, local institutions seem dire if they can’t make significant headway in this area. Every day that goes by, the advantages to megabanks and regionals grow. As they solidify their relationships with a younger audience, inertia — that all-powerful force in banking — takes greater hold (think: auto bill pay, switching friction). Couple that with the level of digital sophistication that banking’s big boys can bring to bear, and the challenges facing community institutions mount.

Increased Engagement Driven By Digital Connectivity

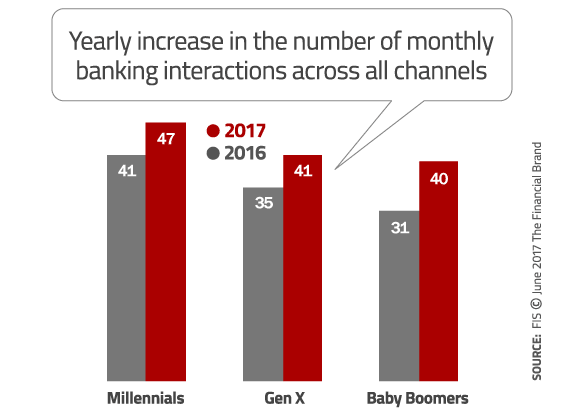

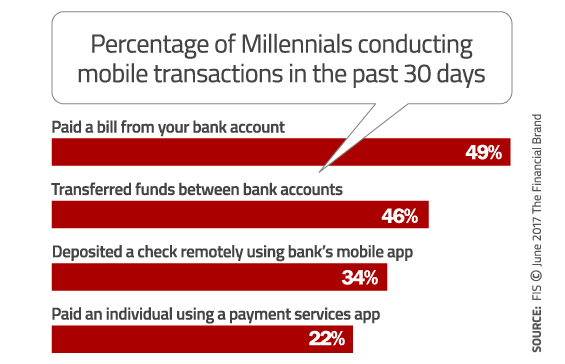

The FIS study uncovered other interesting insights for financial marketers. For instance, Millennials have the most number of monthly interactions with their banking providers, largely driven by a high volume of mobile and ATM usage. Indeed, FIS found that the mobile channel has surpassed online contact among young Millennials.

Neither of these findings are necessarily a big surprise, considering that younger consumers have always been the most active demographic when it comes to interacting with their cash via checking accounts. They have busy lifestyles, make more small(er) transactions, and have lower average balances — factors that will spur frequent visits to their institutions’ mobile app, website and ATMs.

What’s important here is that all demographic segments — not just Millennials — are interacting with their financial institution more frequently. It’s safe to assume that improved convenience and accessibility via digital channels is behind this trend. That further suggests community banks and credit unions have to up their game and get their digital experience right.

Digital & P2P Payments Are a Priority

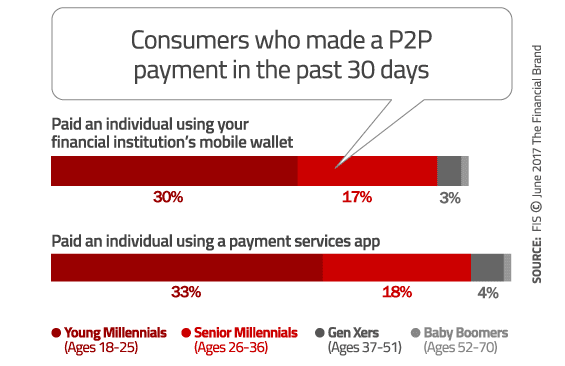

Digital payments became more important this year for all age segments, increasing significantly. On average, only 7% of payments were using mobile payment vs. cash, credit/debit cards and checks. But FIS sees mobile payments gaining traction quickly, particularly among Millennials. They conclude that mobile payment adoption may follow an adoption curve similar to what the banking industry has seen with mobile banking. If that prediction proves true, then community banks and credit unions must make digital payments — of all shades and flavors — a strategic priority.

Unfortunately, they are behind the curve and will have to make up some ground. FIS research found that 74% of large bank customers make mobile transactions/payments vs. only 68% at community banks.

“Payments help cement connections to the banking provider,” FIS said in their report. “Providing digital payments options — including mobile wallets and P2P options — may not yet be table stakes beyond Millennials, but it’s getting there, as the importance of digital payments increased significantly in this year’s study. Not offering these options is an Achilles’ heel for community banks.”

In terms of usage, young Millennials are nearly 2x more likely to make P2P mobile payments than senior Millennials, and nearly 10x more likely to make P2P mobile payments than Gen Xers. To gain “top of phone” status as payments shift from plastic and paper to digital, FIS says retail financial institutions will have to focus specifically on P2P.

Striking Similarities Between Older Millennials and Gen X

FIS research revealed the emergence of what they call “Gen MX,” a segment of higher-income Gen Xers and older Millennials who share strikingly similar banking behaviors and digital preferences.

The FIS study revealed that senior Millennials (age 26 to 36) and Gen Xers (age 37 to 51) have nearly identical expectations and usage patterns. Both segments are more likely than other age groups to use regional banks as their primary financial institutions. They share — in the same order — the ten most important attributes they want most from their banks, ranging from safety and security at the top to simplicity, transparency, omnichannel options, and the ability to anticipate and meet their financial needs. Both groups handle three-quarters of their banking interactions via online and mobile channels, and perform more than twice as many mobile banking interactions as Baby Boomers.