Nearly anything market researchers and social scientists could ever want to know about consumers could be gleaned from Facebook’s ginormous database. It is quite possibly the biggest collection of consumer insight in the world — a virtual gold mine. Just like Google can tell health officials where the next flu outbreak will strike, there isn’t much Facebook couldn’t tell marketers about the psychology, preferences and motivations of today’s consumer. That’s doubly true for Millennials, who grew up living their lives on the world’s #1 social network.

So when Facebook decides to point its omnipotent analytical magnifying glass at the banking industry, financial marketers should sit up and pay close attention. You would be hard pressed to find a larger, more reliable sample for a research project.

To help financial institutions better connect with Millennials, Facebook examined their financial behaviors and attitudes about money. Facebook took a three-pronged approach, looking at consumer data, fielding surveys and (of course) analyzing conversations about financial matters on their own network, listening to Millennials in their own words.

Facebook sought unfiltered answers to the mission-critical questions banks and credit unions wrestle with today — how Millennials relate to the financial services, what Millennials really want from banking providers, and where the industry should focus to have the most impact.

In its study, Facebook focused on working-age Millennials (ages 21–34) in the United States, including a specific profile for affluent Millennials (HHI $75k+). They also looked across generations, comparing affluent Millennials to both Gen Xers and Boomers.

Here’s what they uncovered — four insights into the unique psychology behind Millennials and their relationship to money.

1. Millennials Are Redefining Financial Success

While #YOLO so often typifies Millennials’ social mindset, that is not the case with their financial mindset. According to Facebook, Millennials have two main financial priorities: paying down debt (43%) and saving for the future (38%). In fact, the burden of debt weighs so heavily on Millennials that they have redefined the meaning of “financial success” around it; 46% say that financial success means being debt free. By comparison, only 13% of Millennials say being able to retire is the number one indicator of financial success, and 21% who say owning a home is how they would define it..

“Millennials are the most educated generation in U.S. history,” says Facebook in its report, “and they continue to pay a heavy price for it. But whether it’s student loans or credit card debt, Millennials say paying down debt is their top priority.”

Millennials apparently have a complex relationship with credit. Millennials see credit cards as a strategic tool; 46% say the main reason they use them to build credit, and 36% say they use credit to increase their financial flexibility. Yet at the same time, they are wary of going deeper into debt, which is why more than half of all Millennials say they prefer to pay primarily with cash vs. credit, and one in four describe credit cards as something that worsens their financial standing. Even affluent Millennials in Facebook’s study were 2.2 times more likely than affluent Gen Xers/ Boomers to pay primarily with cash.

Looking at Millennials’ second most important financial priority — accumulating savings for the future — Facebook found that 86% are actually socking money away —whether for an emergency fund, a down payment on a home or just to be responsible. Facebook’s analysis of conversations on its network indicates that although many Millennials may just be starting to save, the “saver’s mindset” is already firmly entrenched.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

2. Millennials Are Looking For a New Kind of Financial Partner

Millennials are 1.5 times more likely than Gen Xers and Boomers to be engaged, and 1.4 times more likely to move. These moments have major financial implications that many Millennials do not know how to deal with. In fact, 83% of Millennials in Facebook’s study say they seek financial guidance during those times, with buying a home being the main trigger (at 48%). But half of all Millennials say they have no one to turn to for financial guidance. Only 36% talk to their parents about money and just 8% trust financial institutions.

Growing up in a world of financial instability, constant innovation and near-infinite information, Millennials have unique needs and are not looking for the fuddy duddy kind of banks their parents used. Three out of five Millennials say they’d like their bank (or credit union) to be a partner; they want to feel understood. But only a minority of Millennials (32%) feel their bank understands them (compared to 41% of Gen Xers and Boomers).

Unfortunately, Millennials don’t see a lot of viable options among today’s banking providers. A third of Millennials describe their primary financial institution in unflattering terms — e.g., “used car salesman” or “aggressor” — which likely explains why they are 1.4 time more likely than other generations to switch. The good news? They are open-minded and optimistic. Nearly half (45%) say they would switch (banks, credit cards, or brokerage accounts) if a better option came along.

Ultimately Millennials expect three things from their financial providers. They want to feel rewarded for their loyalty (30%), they want things to be made easier and more convenient (29%) and they want honesty (28%).

3. Millennials Crowdsource Financial Advice

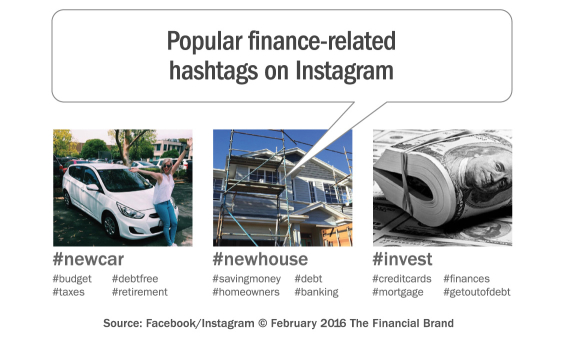

Where it was once taboo to talk about money in public, Millennials go online to talk about everything, and that includes financial issues. Facebook says Millennials are 1.5 times more likely than other generations to discuss their finances online. Furthermore, they focus 40% of the conversation about finance on Facebook. When faced with important financial questions, from how to best build credit to how to buy a home, Millennials put their faith in the wisdom of their friends and family online. And as the world shifts towards increasingly visual communication, from photos to videos, GIFs and emojis, the impact of imagery is felt within the financial conversation, too.

4. Millennials Live, Breath and Eat Mobile

Millennials are multichannel bankers. They expect to be able to engage across whatever channel is most convenient and best suited to their immediate needs. But mobile is their constant companion.

That’s why Facebook urges financial institutions to put mobile at the center of their multichannel ecosystem. They say that to woo and win Millennials, banks and credit unions must deliver a frictionless, omnichannel experience. Facebook says you must focus on your mobile app and look to seamlessly blend it with in-branch experiences. Make it easier for people to manage, move and research money, and give them new reasons to stay close on mobile. And make it as personal and customizable as possible.

Ten Tips to Connect With Millennials

Based on its findings, Facebook offers the following ten ideas to help financial marketers attract and acquire more relationships with Millennial consumers.

1. Think mobile first. Mobile is here, and it’s bigger than most people ever anticipated. Consumers now spend more time on mobile devices than any other option — even dethroning TV as the long-dominate media channel. But this new mobile reality raises huge questions for financial marketers. How do you build the right mobile experience and tell your brand’s story? (Hint: You can find the answers to these questions at The Financial Brand Forum, where Facebook’s very own Deepanjan De will be delivering a presentation that will help financial marketers leverage the mobile canvas.)

2. Help them walk before they run. Millennials are focused on near-term goals like paying off debt. Offer them solutions that address those pressing needs, have low barriers to entry (e.g., no minimum deposits) and help them manage multiple financial priorities (e.g., paying down debt, avoiding additional debt, and accumulating savings).

3. Give credit a makeover. Reposition credit to align with Millennials’ needs and values. Make it a strategic tool that gives financially responsible and goal-oriented Millennials the flexibility to achieve their short-term goals faster and build the credit they’ll need in the future. Appeal to the entrepreneurial mindset and make credit a lifehack.

4. Make financial planning a gateway. Helping Millennials develop a financial plan will not only provide them with a much-needed service, but it will make you a more valuable partner as you open their eyes to new financial opportunities.

5. Consider everyone a competitor. Today’s Millennials see innovation coming from outside the financial services industry. To become and remain relevant, be sure to look both within and beyond the category for inspiration.

6. Make it rewarding. Feeling understood and rewarded for their loyalty is uniquely important to Millennials and will require innovative forms of acknowledgement. Financial institutions could demonstrate their empathy and loyalty by waiving some fees in certain circumstances, offering a credit card with an interest rate that decreases over time or a savings account with an interest rate that increases over time.

7. Make it personal and actionable. Demonstrate understanding through personalized communication and by listening then prescribing. Once Millennials believe you get them, they will be eager for a concrete and customized action plan. Tell them what to do or tell them how you’ll take care of the situation for them.

8. Educate empathetically. Be present where people are talking about money matters. Champion the cause of financial literacy — a critical area of development for Millennials and massive area of opportunity for financial services to open minds and wallets.

9. Solve holistically. The questions people post often overlap because their financial needs are interconnected. Similarly, the solutions you offer should take into account and help resolve their multiple priorities.

10. Connect visually. While money matters are often discussed through text, the conversation is also increasingly visual. Just look to the financial hashtags people are using on Instagram as they share their photos and videos. Whether you use photos, videos or data visualization, inspire and persuade Millennials in the language they love most — images.

Conclusions & Key Takeaways

Millennials are misunderstood — famous for their impulse for instant gratification. But when we stop to observe their financial behaviors and listen to them describe their relationship with money in their own words, a new image of Millennial emerges. Cautious (some would say excessively so) and remarkably responsible, Millennials are diligent in paying down debt, careful with credit cards and dedicated to accumulating savings. But they stand at a crossroads. While most Millennials feel there is more they should be doing with their money, many just don’t know what to do. And half of Millennials say they have no one they trust for financial guidance.

Perhaps that’s one of the reasons Millennials feel disconnected from the financial industry. Many financial institutions have yet to realize that winning over the Millennial generation will require a transformative overhaul—from how each institution views its competition to how it connects with clients. Millennials have already begun shaping the future of financial services—reinventing the concept of financial advice as they increasingly put their investments in the hands of robo-advisors’ algorithms.

Millennials are on the cusp of many of life’s major milestone moments — from getting married to buying a home to becoming a parent. These moments increase their openness to new sources of guidance, and increasingly those sources come from outside the traditional financial sector.

To connect with Millennials and help them navigate life’s financial decisions, Facebook says banks and credit unions will have to take a fundamentally new approach. Millennials want to entrust their money to a true partner that shares their values and sees them succeeding together as they amass savings and unlock their greatest earning potential.

Millennials represent the future of the financial industry, and as their momentum continues to grow, those institutions that evolve and innovate alongside them will be best positioned to see the strongest long-term returns.