This analysis, based on seven consecutive quarters of data from checking account shoppers on FindABetterBank.com, reveals two high-level trends that financial marketers need to consider.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

1. A broader range of prospects do research online for checking accounts. How can it be possible that more shoppers are interested in features like unlimited check writing and free printed checks given that people write fewer checks? Well… it’s not a trend towards “old-school” banking, but rather, evidence that more segments of the population are shopping for banking products online. Mobile phones and tablets have given more people easy access to the Internet.

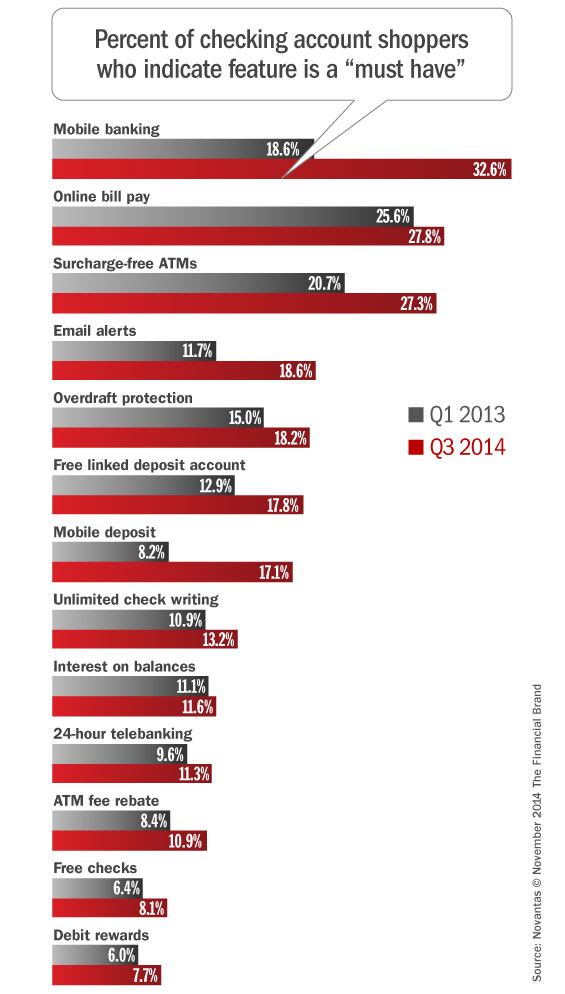

2. Consumers’ “mobility” changes how they bank. The features that have the highest increases in demand all indicate how mobility changes how people bank. In addition to increased demand for mobile banking and mobile check deposit, there were large increases demand for email alerts, free linked savings accounts and better ATM access. From a checking product perspective, demand for alerts is on the rise because mobile bankers want to respond to issues real-time (and avoid fees); free linked savings accounts are more important to mobile bankers because they want more flexibility managing the funds in their accounts; broader ATM access is important because mobile bankers don’t want to be tethered to fixed locations.

The first big implication is that checking products need to be designed based on how target segments want to bank. Today, most banks’ and credit unions’ checking line-ups follow the “higher balances = more features” strategy. But some features, like ATM fee rebates, are more appealing to younger consumers. They carry lower balances, so the high-balance account is unappealing. The other big implication is that today, many banks and credit unions invest most of their online resources targeting Millennials. As this data shows, a broad swath of consumers now shops online for banking products.