Millennials just can’t seem to get a break economically. As the world and the United States head further into the sudden downturn caused by the worldwide coronavirus pandemic, research by TransUnion finds that so far Millennials are taking the economic impact most of all generations, and in what would have been their peak earnings years.

The oldest Millennials were in their early 20s in 2001, the year of the 9/11 terrorist attacks and the economic impact that followed. When the Great Recession came in 2007-2009, many older Millennials got hit as they were starting their careers in earnest. Younger ones got walloped in their late high school and college years. Now that many Millennials have households with children, the economy is hitting them again.

TransUnion has been surveying thousands of consumers since mid-March on the impacts on their lives of the coronavirus itself and the economic slowdowns and lockdowns resulting from it. The credit analysis and reporting firm’s research has been conducted in the U.S., Canada, Colombia, Hong Kong, India, South Africa and the U.K.

Everyone is going through economic stress to some degree, says Charlie Wise, Head of Global Research and Consulting, but in all countries studied Millennials are hurting the most. (TransUnion’s research considers people 26-40 to be Millennials.)

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Trouble Hits Consumers in Multiple Ways

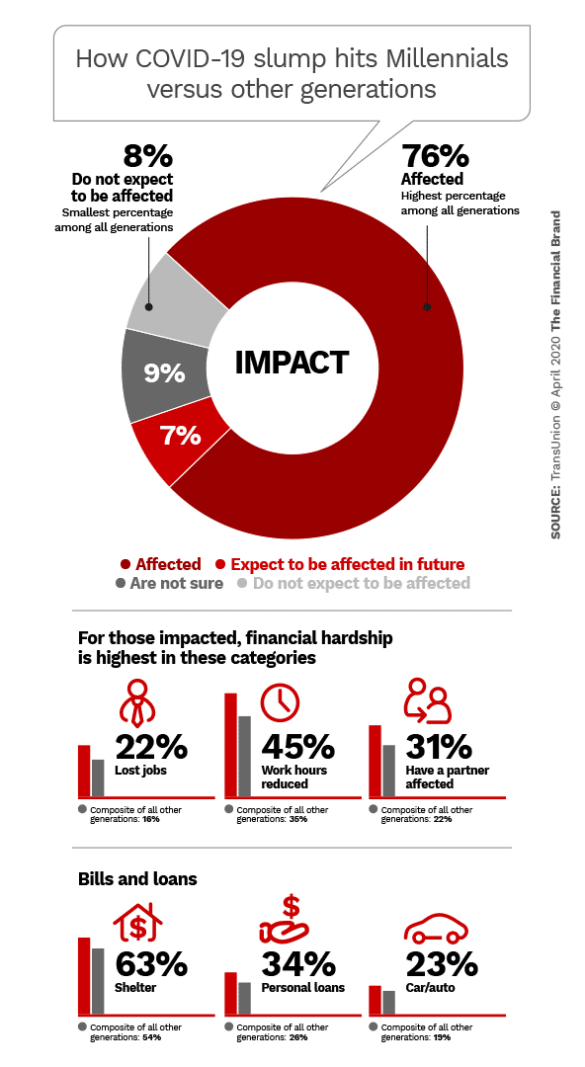

In the overall sample, 76% of Millennials have had their income negatively impacted, versus 64% of all other generations. In the U.S., 69% of Millennials have had their income hit, versus 58% of all other generations. More specifically, income has been affected for 64% of Gen Z, 65% of Gen X, and only 50% of Baby Boomers.

Job loss and curtailed hours were also reviewed in the study. The following percentages concern those factors among those with loss of income.

In the overall group, 22% of Millennials had lost their jobs versus 16% among other generations. In the U.S., the numbers were the same: 22% of Millennials lost jobs, versus 16% of other generations. In the U.S. Gen Zers actually experienced a higher rate of job loss — 29% — while it was much lower for Gen X (14%) and Boomers (9%).

Loss of hours hit much broader swaths of people, due to a variety of factors. Overall, 45% of Millennials lost hours, versus 35% of other generations. In the U.S., 48% of Millennials have lost hours, versus 32% of other generations. Among the other generations, 37% of Gen Z has seen reduced hours, while 39% of Gen X and 21% of Boomers have seen hours fall.

Wise points out that older consumers are more likely to hold salaried jobs versus jobs that pay by the hour. He adds that Millennials, many of who are raising children, are worse off when they are hit by the slump because they can’t just move back in with their parents. Whereas Gen Zers are young enough that they may still be at home or could still transition back to that.

The potential for a multiplier effect can be seen in the “covidnomics” data. States the study: “Millennials make up one-third of the world’s labor force and their consumption habits greatly contribute to economic demand. They began working during the last global recession and, compared to other generations, they entered this crisis with less income, assets and wealth — but more debt.” Indeed, the study found that 56% of Millennials have reached out to creditors to discuss potential options — the highest level among all the generations.

The shelter, personal loans and auto loan sections of the graphic above refer to the portion of those with negatively impacted incomes who will not be able to make payments on those debts or, in the case of shelter, mortgage or rental obligations.

TransUnion’s Wise noted that Hong Kong has been dealing with COVID-19 longer than the other areas in the study and has seen harsher economic effects. Generally the longer a region has had coronavirus present and the countermeasures in place, the deeper the economic impact.=

Delinquencies Haven’t Emerged Yet, But Leading Signs Have

Under normal conditions TransUnion’s published studies typically report on the status of consumer credit in various categories. Testimony to the sudden effect of the COVID-19 threat to the U.S. and world economies, Wise notes that “we are early enough in the cycle that we haven’t actually seen [related] delinquencies surface yet.”

“We are early enough in the cycle that we haven’t actually seen [related] delinquencies surface yet.”

Wise also says that when Americans encounter financial trouble they tend to prioritize payments on auto loans over mortgage and credit card debt. That’s because in most areas they need a car to get to work or to look for work. Of course, in the post-COVID-19 economy, it’s hard to tell how many job interviews will be conducted face-to-face versus via FaceTime or Zoom. And while offices may be reopening, how soon many return remains to be seen. Wise notes that there have been downturns in which mortgages were the first payments made.

On the other hand, many people have not been able to work remotely. “It’s very hard to be a waiter in a restaurant working from home,” says Wise.

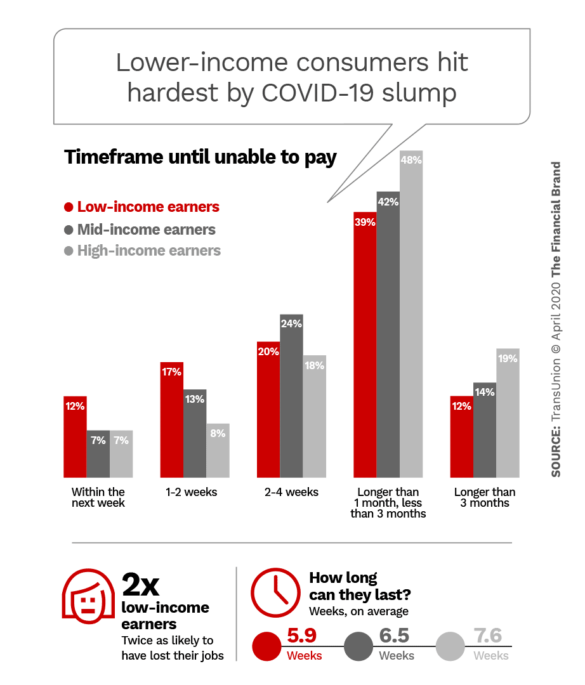

Around the world, the study found, employees of small businesses have been hit hardest, but even more significantly, lower-income employees have been twice as likely to have lost their jobs.

“The crisis is magnifying existing inequalities in wealth, income and social stability across the globe,” the report states. “Government response and healthcare options vary by region, creating visible discrepancies in how consumers experience hardship.”

TransUnion’s research found that 46% of Americans impacted economically by COVID-19 expect to use their federal stimulus payments as their main means of closing the gap between what they were making and what they are making now. The Pew Research Center found in early April 2020 that most lower-income adults who expect to receive a stimulus payment intend to use it to pay bills.

Many are reaching out to creditors, borrowing from relatives or friends to tide them over, or otherwise working some plan. Yet one out of six consumers throughout the study sample have no plan for recovery yet.

How Creditors May React as the Economic Crisis Continues

Wise notes that the CARES Act includes provisions to encourage lenders to work with borrowers. For example, a major section of the law provides forbearance options for federally backed mortgages and there are waivers for classifying debt remediation efforts as troubled-debt restructuring during the extent of the coronavirus period.

The CARES Act also amends the Fair Credit Reporting Act to require financial institutions reporting to credit bureaus to report an account as being current if the borrower has elected to defer, modify, seek forbearance, or make partial payment. However, if the borrower was delinquent before the crisis, they would retain that status unless they brought the account current prior to seeking aid.

Wise also noted that regulators thus far are jawboning lenders to not cut back on card and other credit lines.

Measures may be necessary, in time, however, to reduce lenders’ exposure to new indebtedness. In a separate interview, Paul Siegfried, SVP-Financial Services and Card and Banking Leader at TransUnion, noted that during the Great Recession and its aftermath card lenders trimmed credit lines. Under the Credit CARD Act of 2009, he says, lenders can take actions such as reducing lines on an individual account when a consumer misses a payment due date. They can also do so if a card account has been inactive. They are also permitted to make changes if they are applied broadly, rather than individually. Siegfried believes that lenders will eventually use these abilities as they seek to contain card portfolio troubles.

New accounts will see smaller lines, he also suggests. During the Great Recession new credit line levels were held down for the strongest consumers, the “superprimes” as well as for subprime accounts. As the economy improved, they were ratcheted up substantially.

While stronger credit categories may leave substantial parts of their lines untouched, Siegfried says that subprime borrowers’ pattern is to draw on their lines almost completely over a month, pay them down, and draw on them all over again.

He adds that efforts to accommodate borrowers overall are underway with many lenders right now. Among card issuers, relief going out as far as six months has been seen.