Not long ago, Millennials saddled with massive student debt during the Great Recession had to move back with their parents. In recent years, Millennials have increasingly been buying their own homes, but new research indicates may be coming at a price.

Many Millennials are relying on their parents or grandparents to provide substantial help with the costs of home ownership, to the point where older generations are accepting lower living standards, draining their retirement savings, working longer, or even taking on fresh debt of their own to put a roof over their kids’ heads.

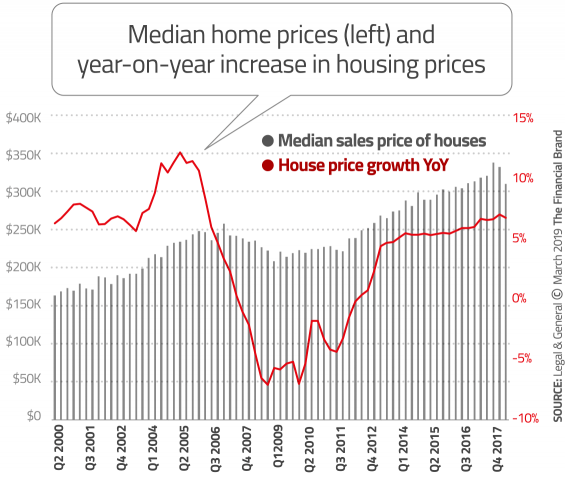

Parents helping children with down payments and other costs of achieving home ownership isn’t new, but with the rising rate of home ownership in the U.S., the relatively low supply of starter homes, and rebounding home prices, this is happening more and accounts for larger amounts of money.

If the “Bank of Mom & Dad” would have an enviable balance sheet if it was a chartered institution. According to a new study, this figurative bank now ranks as the seventh-largest housing loan originator.

| # | Bank | Loan Volume (in billions) |

|---|---|---|

| 1 | Wells Fargo | $249.0 |

| 2 | JP Morgan Chase | $104.0 |

| 3 | Quicken Loans | $96.0 |

| 4 | Bank of America | $79.4 |

| 5 | U.S. Bancorp | $57.3 |

| 6 | Freedom Mortgage | $53.6 |

| 7 | Bank of Mom & Dad | $47.3 |

| 8 | Caliber Home Loans | $40.6 |

| 9 | loanDepot | $38.1 |

| 10 | Flagstar Bank | $32.0 |

The data echos similar studies fielded in the U.K., where the “Bank of Mum & Dad” ranks as the 10th largest mortgage lender.

Fractional Marketing for Financial Brands

Services that scale with you.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This “bank” has “millions of satisfied customers, has never asked for a bailout, and really cares about its borrowers,” the report’s authors quip.

More seriously, Nigel Wilson, Chief Executive at Legal & General who fielded the report, says the trends in housing prices and availability are worrisome. In an interview with The Financial Brand, Wilson notes that he recently purchased an apartment for one of his daughters that cost twice what he spent when he bought a five-bedroom house for the family, his first home purchase.

Many parents are “giving until it hurts,” the study reports. The concern is that older Americans will be postponing — perhaps even endangering — their retirement years in order to help out their children. They’re taking on new loans at an advanced age or doling out savings that can be hard to replace. Neither option is attractive.

Separate research by PNC shows how some consumers are giving financial aid both to both their adult children as well as their own elderly parents — what researchers call the “sandwich generation” for the predicament they find themselves stuck in.

Read More: Home Loans Get Hot as More Millennials Make the Move

Price of Home Ownership

In early 2019, the U.S. Census Bureau reported that the share of Americans who own their homes — 64.8% in Q4 2018 — stands at the highest level since 2014. Demand from Millennials, who have been shifting from their initial preference for rental housing, accounts for much of that. (The recent figure remains below the high point seen in 2004, pre-crisis, when home ownership hit 69.2%.)

Homeownership levels were up among both the 35-44 year old group as well as the under 35 category, which between them take in Millennials as well as some Generation Xers.

Wilson notes that the growth reflects not only changing preferences but a general trend of starting “traditional life” later. Education lasts longer and costs more. More women have children in their 40s than in their 20s. And with high divorce and remarriage rates, there are more multiple family relationships, which complicates the traditional trends.

The “basement exodus” of grown children moving out of their parents’ homes began in earnest in 2013-2015, according to an analysis by Fannie Mae’s Patrick Simmons, Director of Strategic Planning.

Legal & General’s report indicates that family and friends supported the purchase of $317 billion of property in the U.S. in 2018 — 1.2 million homes. The assistance, generally given as a cash gift or an interest-free loan, averaged $39,000 per purchase.

Housing costs have risen dramatically, outstripping many Millennial’s earning and saving potential, with median home prices rising beyond $300,000 in the last few years. At the same time, the cost of servicing mortgage debt has risen to 17.5% of income in metro areas in 2018, versus 12% in late 2012.

“The real killer for most is the down payment,” the report states. The math isn’t favorable for those who would do it on their own. A 20% downpayment comes to $60,000 on the median home price above. The report contrasts this with the median savings balance in America: $7,000. Many American adults don’t have even $1,000 in savings. As a result, many Millennials have given up on homeownership, at least wholly on their own power. A full third of those surveyed don’t expect to ever be able to buy a home.

As a result, just over half of the younger generation — 51% — expect to have help of family or friends. Without it they told surveyors they would either not be able to afford to buy a home at all, or would have to wait at least three years.

This familial housing aid frequently comes on top of parental assistance with education costs. The study found that 52% of college graduates who recently bought a home had an average of $41,500 in family and friend educational aid.

Read More: Can Financial Marketers Hit The Millennial Moving Target?

Where Money Comes from to Help the Kids

More than half of the Bank of Mom and Dad generation helped out by digging into their savings. The report says 54% of Baby Boomers have tapped cash savings to help younger consumers to buy homes. However, 15% have obtained loans themselves, to be able to help, and 8% have withdrawn funds from 401K and Individual Retirement Accounts. Another 6% have downsized their own home in order to free up assets to help their kids, and 7% have refinanced.

Others have diverted income, with 15% saying that they are leading tighter lives in order to help out. Legal & General suggests that some members of this generation may resort to reverse mortgages to provide aid. Though only 2% have done so thus far, one in five who have not say that they would consider it.

7% of the older generation surveyed say that they’ve postponed retirement — on average by four years — in order to help someone buy a home.

One out of seven surveyed indicate that their generosity has left them less certain for their own financial futures. “This means that, at the very time when older workers and retirees are planning or enjoying their retirement years, they’re having to make real sacrifices to help secure the future of their children and grandchildren,” the report states. ”

The attitude of helping the kids at such costs is not universal. The survey found that 29% of the older consumers polled frown on such financial support, in the belief that self-reliance should be encouraged.

However, overall, the report found that “Bank of Mom and Dad would provide even more support, if it could. There is little reason to think that affordability will improve substantially in the near or medium term.”

Asked in the interview what banks and credit unions could do to improve affairs for the Bank of Mom and Dad, Wilson says that in the U.K. an Intergenerational Commission was founded to study “intergenerational fairness.” (Wilson serves on the commission, which has produced reports addressing the balance of needs among the generations.)

One certainty, he says, is that there is no quick fix. Supplies of affordable housing don’t materialize overnight, nor do savings.

“It demands a ten-year kind of solution,” says Wilson. That’s what the U.K. commission has been looking at, and likely the way the U.S. needs to go, he says.