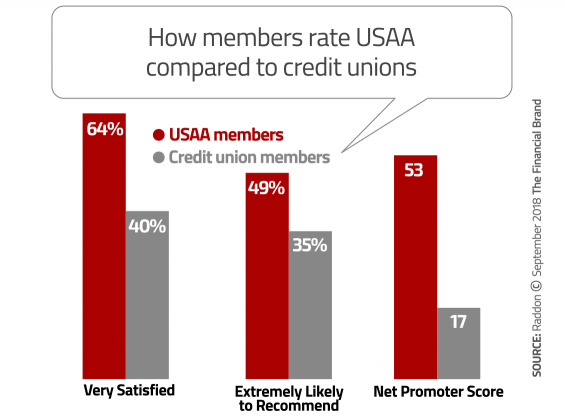

In banking circles, USAA is in a class by itself. It dominates nearly every satisfaction study and brand benchmark in the financial sector. For instance, in 2018, USAA’s Net Promoter Score was more than four times higher than the average score among banking providers, and they’ve had the best Net Promoter Score in the financial industry eight years straight.

According to research from Raddon, 40% of credit union members say they are “very satisfied.” In study after study, credit unions have historically ranked higher than banks, but USAA tops them all. A phenomenal 64% of USAA members are “very satisfied” — that’s 50% better than credit unions.

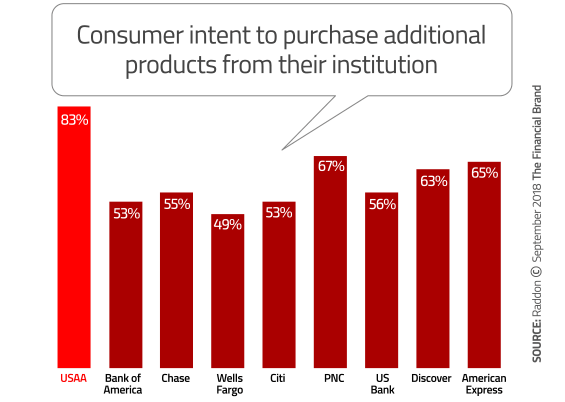

When it comes to brand awareness, USAA may trail its bigger rivals. But the $155 billion insurance and banking company handily beats all its competitors in a number of key loyalty categories. For instance, Raddon’s research revealed that USAA members are the most likely to obtain an additional financial product — something Raddon calls “repurchase intention.” Among USAA members, an astonishing 83% say they are likely to acquire more financial products from USAA. Compared to the next bank — PNC at 67% — USAA is ahead by a margin of 15 percentage points. Wells Fargo, whose brand has been beleaguered by a number of sales scandals, ranks last at just 49%.

United Services Automobile Association (USAA) was founded in 1922 by a group of Army officers in San Antonio looking to insure each other’s cars. Over the years the product base has expanded into home and life insurance, mutual funds, and, in 1983, banking services through its subsidiary, USAA Federal Savings Bank. While the association’s product line has expanded over the years, the overall corporate structure remains essentially the same.

Serving only military families gives USAA one big advantage: tremendous brand focus. Serving a narrowly-defined niche enables financial marketers and brand builders to target their products, services and solutions to that group’s specific circumstances, needs and preferences. This is the exact same principle that gave credit unions across the U.S. their unique strength — catering to the specific financial needs of niche constituencies like teachers, firefighters and labor unions. But in recent years, many credit unions have abandoned their original “common bond” charters that were once focused on a select group, opting instead for broad community charters that have diluted their value proposition.

Not USAA. USAA still only serves members of the U.S. military — current and former — along with their families. Currently, that numbers 12.4 million members.

But that’s not all that makes USAA unique. There is one major point of differentiation that sets USAA apart from all other large financial institutions in the North American market: the organization distributes its profits back to members.

Read More: Banking Must Measure Customer Experiences Across Entire Journey

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

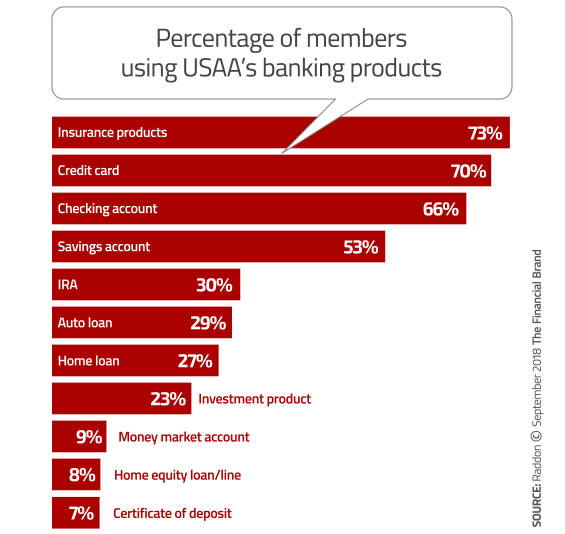

Members who bank with USAA use a wide array of financial products, including credit cards, checking accounts and savings accounts. Roughly a third of all members have an auto loan through USAA, and a similar number have a mortgage.

These numbers are simply staggering. Every other banking provider on the planet drools with envy at the prospect of getting home loans and auto loans from a third of their customer base.

Most interactions members have with USAA are digital. In Raddon’s research, 56% of members say they primarily use the online banking platform and 36% use mobile banking. Interestingly, 13% of USAA’s members claim to use a branch at least once a month, even though USAA only has four locations: San Antonio, Colorado Springs, Annapolis, and Highland Falls, N.Y. (near West Point).

The Keys to Loyalty

In its report, Raddon holds USAA up as the gold standard for financial institutions looking to improve loyalty and retain more relationships. According to Raddon, a combination of various metrics can be used to gauge loyalty, including someone’s willingness to recommend their financial institution to friends and family, and the intent to give an institution additional business.

After assessing which financial institutions have the strongest support, Raddon’s analysts have been able to identify seven of the strongest factors that contribute to customer loyalty:

- Offer products and services that customers want and need

- Ensure accounts are easy to open (hint: think digital)

- Be easy to do business with overall

- Provide fast and efficient service

- Develop innovative products and services

- Apply fair service charges

- Offer the latest technology for account access

Keeping customers in the fold and cross-selling them additional services is a very efficient and profitable way to achieve growth goals. Many studies suggest that it costs six to ten times as much to attract, acquire and onboard a new customer as it does to cross-sell an existing one.

Fractional Marketing for Financial Brands

Services that scale with you.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What Differentiates USAA From Competitors?

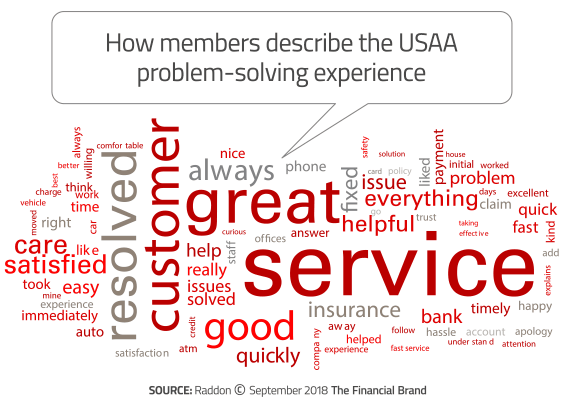

Raddon’s research team asked USAA members what words came to mind when they think about the USAA brand. The terms most frequently cited appear larger in the “word cloud” shown below.

It’s not often you hear people use words like “awesome” and “amazing” when describing their financial institution.

“By any metric,” writes Raddon, “USAA members are pleased with their experience.”

Digging deeper, Raddon also asked respondents to rate how important 26 different elements of service were, and then to rate how well USAA performed for these criteria compared to other financial institutions. The resulting data was fed into a model to identify differentiating factors. With USAA, 10 of the 13 differentiators are related to their quality of employee and/or service. The top two were “accuracy” and “problem resolution,” with “fair service charges” and “products/services that match needs” also ranking highly.

Factors that didn’t play a significant role in USAA’s brand loyalty included mobile banking functionality and “having the latest technology,” both of which are presumably taken for granted at an organization that essentially has no branches.

Read More:

- Branches Still Dominate, But Banks Won’t Need as Many to Compete

- Exclusive Insights Into BofA’s Massive Rewards Program

Raddon also found that credit unions scored better on convenience metrics (office hours, locations, etc.) as well as loan and deposit rates, but USAA wins on service, products and fees.

Interestingly, respondents in Raddon’s research didn’t feel it was important for USAA to offer a rewards program. Perhaps being a member is reward enough, particularly since members receive profit-sharing bonus dividends. After all, a little cash goes a long way. Who says you can’t buy love?

Key Insights: Strong, well-differentiated brands targeting a specific audience segment with great CX can (and do!) charge more. They generate more revenue and enjoy wider profit margins. Weak, poorly-differentiated financial brands become commodities where rates and fees are their only competitive levers.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Proof is in The Problems

One of the most interesting findings Raddon teased out of its USAA research — possibly the secret sauce behind its consistently high satisfaction numbers — is that problem resolution can trump everything.

At both both USAA and credit unions, Raddon found that roughly one out of every five members had experienced some sort of problem — transaction error, online/mobile banking issue, issue with a fee, etc. Noteworthy is that 64% of USAA customers who had experienced such a problem were very satisfied with the resolution compared with just 40% of credit union customers who felt that way. Again, that comparison is impressive because credit unions are typically well-known for their ability to deliver an exceptional service experience.

Even though credit unions perennially score very well in consumer satisfaction surveys, Raddon’s data shows that USAA is even better. This accomplishment is reflected in the words that USAA customers use to describe the banking company after it has resolved a problem for them, depicted in the word cloud below.

Promptness in handling problems appears to be an important component of USAA’s problem-solving capability, says Raddon, and if you look past the largest words pictured above, you’ll see key terms like “quick,” “fast” and “timely.”

To pull off that kind of performance off consistently suggests a full commitment to such employee-related disciplines as hiring, training, and coaching, as well as providing the necessary data and technology tools to enable those employees to quickly resolve problems in whatever channel a customer prefers.