Banks and credit unions marketing consumer loans — especially unsecured personal loans, which have rebounded in popularity in the last few years — face a challenge from fintech competitors that new technology and a fresh regulatory wrinkle may help them overcome.

Financial marketers want to reach out to as many consumers as possible to maximize results — yet many consumers have little or even no traditional credit data on file for evaluation, which makes the conversation short. The Consumer Financial Protection Bureau estimates that 26 million Americans — about one in ten — have no credit history and another 18 million aren’t scoreable. These people are called “credit invisibles,” in the realm of traditional credit bureau records and credit scores.

Risk and lending officers serve as gatekeepers and have to tune their institutions’ lending criteria based on credit records, risk appetites, regulatory tolerance, and the economic outlook. And compliance officers worry about unintended consequences of any behavior or policy that winds up causing illegal credit discrimination.

Into this conundrum comes a growing approach to credit called “alternative data,” increasingly being applied in tandem with machine learning or other forms of artificial intelligence. The AI tools are becoming more available and competitors are already using them, but financial institutions must proceed carefully.

What Alternative Data Means and What It Can Do

Alternative data is a very broad term, covering everything from financial institution deposit account usage patterns, to financial facts about individuals that haven’t traditionally been gathered or maintained by credit bureaus, to behavioral observations and even correlations between credit performance and actions that might seem far-fetched to some.

In fact, federal bank and credit union regulators recently defined “alternative data” in an interagency statement in a circular way: “Information not typically found in the consumer’s credit files of the nationwide consumer reporting agencies or customarily provided by consumers as part of applications for credit.”

For marketers, the attraction is the ability to move the volume needle. By and large adoption of alternative credit data can expand the number of consumers who can qualify for credit, according to Leslie Parrish, Senior Analyst in Aite Group’s Retail Banking Practice.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Parrish, who specializes in consumer lending issues, adds that not only can more people qualify for credit when alternative data gets stirred into the mix, but some can be offered better rates based on what the lender sees. That ability to more closely evaluate the consumer’s credit may give the lender using alternative data a competitive edge over one still using only classic measures.

In fact, Parrish says there is also a pricing argument for adopting alternative credit data.

“Traditional data in a lot of respects is a lagging indicator,” she explains. Pulling in alternative data may actually indicate that a consumer is a higher risk than traditional records would indicate — warranting a higher interest rate. Parrish adds that in talking to creditors, she’s found that most typically alternative data has a strong upside for consumers.

Something to ponder: CFPB’s Project Catalyst issued a no-action letter to online fintech lender Upstart Network in 2017 to allow it to pilot a new approach to unsecured consumer lending in consultation with the Bureau. Upstart’s model melds alternative data with artificial intelligence and machine learning to determine consumer creditworthiness. In the summer of 2019 Dave Girouard, CEO and Co-Founder, testified in Congress that efforts before and into the no-action period had generated almost “$4 billion in bank-quality consumer loans.”

Girouard testified that Upstart’s methods approved 27% more consumers and lowered interest rates by 3.57 percentage points, compared to traditional lending models, overall. Specifically among groups that are frequently under-served, he added, the alternative data approach produced higher approval levels and lower interest rates.

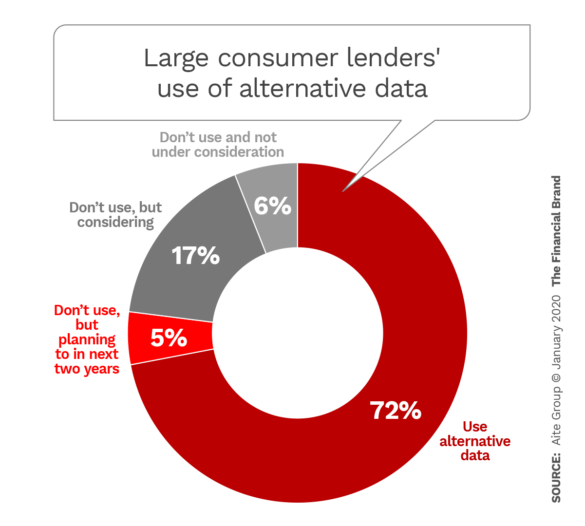

Upstart, which already works with several banks, is hardly alone. In mid-2019, Aite surveyed 18 of the largest unsecured personal lenders in the U.S. Over half were nonbank lending institutions, including online lenders, storefront installment lenders, marketplace lenders, and institutions that chiefly market point of sale credit, a growing field involving relative newcomers like Affirm and even traditional lenders like Citibank and American Express. The remainder were banks and credit unions with significant unsecured consumer loan portfolios.

As the chart above demonstrates, nearly three-quarters of the lenders use alternative data for at least part of their credit decisionmaking. All but 6% of the remainder are considering adopting this tool or already have it in the wings. Generally, says Parrish, alternative data serves as an augmentation of existing processes, rather than a complete replacement.

Read More: Traditional Lenders Losing More Ground As Fintech Loan Share Surges

Defining Alternative Credit Data as Regulators Greenlight It

Ever filled out an online loan form for yourself? It’s possible that the lender used software that evaluates how you interact with the web form, according to Parrish. Technologists and credit experts are always watching for patterns that can be compared to credit performance. One that Parrish cites: Consumers who adjust their income on the online form multiple times tend to have credit trouble later on.

“Lenders have found this kind of thing to be quite predictive of the risk level they are taking on,” says Parrish. A white paper published by the American Bankers Association cited research indicating that a consumer’s “digital footprint” — including what times of the day they buy online, their operating system, even their grammar — can be a proxy for future credit behavior.

These concepts for alternative data are leading edge, for now. But they have lots of company.

CFPB has been studying alternative data for several years, and the House Financial Services Committee Task Force on Financial Technology held hearings on its use in mid-2019. The three major credit bureaus have not been idle. Each has purchased an alternative data vendor, Experian buying Clarity, TransUnion buying FactorTrust and Equifax buying DataX, to expand their offerings.

“The alternative data landscape is only going to grow over time,” says Eric Haller, EVP & Global Head of Experian DataLabs. While five or six years ago alternative data was of most interest to niche lenders, he says, many mainstream lenders have been looking at this strategy in order to make more loans to a broader spectrum of borrowers.

In December 2019 the federal regulators issued an interagency statement on the use of alternative data in credit underwriting that gave the methodology a cautious green light. While acknowledging that the data, coupled with AI, could bring credit to more people and improve terms, the statement also cautioned lenders to avoid fair-lending violations and other compliance risks.

“Firms may choose to consult with appropriate regulators when planning for the use of alternative data,” the statement says.

This matter, and potential opportunity, comes at a time when issues concerning data sharing by financial institutions with other firms and privacy concerns have been increasing. Banking lobbyists have expressed concern that in the absence of firm federal policy on Unfair, Deceptive and Abusive Acts and Practices, use of alternative data may be risky. This all adds to the need for lenders to tread carefully in considering adoption of alternative data methods.

Read More: 3 Steps Banks & Credit Unions Should Take as Data Privacy Gets Hotter

Caution and Criticism for Alternative Data Usage

While there is promise for more and better credit in alternative data, this strategy, interestingly, does not have the unconditional endorsement of organizations representing the interests of disadvantaged consumers. For example, during the House hearings, Chi Chi Wu, staff attorney for the National Consumer Law Center, said that while alternative data could help credit invisibles, “the devil is in the details.”

“The devil is in the details.”

— Chi Chi Wu, National Consumer Law Center

Wu testified that the broad range of alternative data sources entails pros and cons. One source of financial alternative information that’s much discussed is rental data, demonstrating that someone has covered their rent regularly. This doesn’t appear in traditional credit files, though mortgage payment trends do. Wu pointed out that many landlords don’t report such data and numerous small landlords would find doing so burdensome. Other forms of alternative data, such as gas and electric utility records, could harm a credit candidate’s chances if they have missed payments or been late.

Beyond this, there are other nonfinancial data forms that Wu’s group have still greater concerns about. One measure is educational or occupational attainment. “There are obvious racial disparities in educational and occupational attainment,” Wu stated. Certain attempts to use web browsing behavior as a form of credit data also concerns her group, because they say there are “indications of racial bias, despite relying on seemingly racially neutral algorithms.”

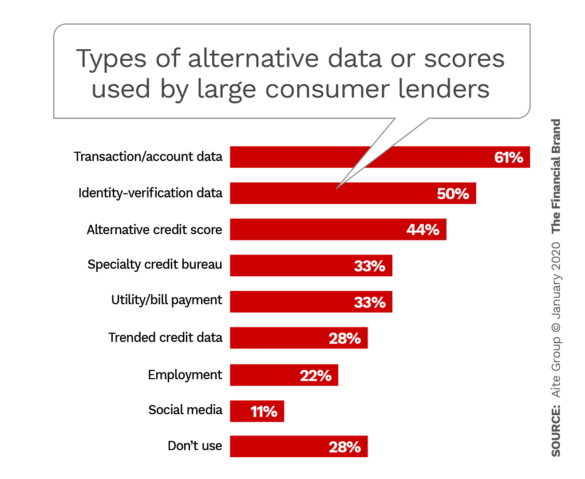

A growing methodology entails consumers allowing lenders to see how they manage their banking accounts, which was the leading form of alternative data used among the large lenders surveyed by Parrish for Aite.

Wu addressed concerns here as well: “Bank account data can reveal whether a consumer has sufficient available funds to take on a loan, since it includes both income and expense information, i.e., it can help show whether the consumer has ability to repay. Unfortunately, bank account information may not be able to help the 14 million consumers who lack a bank account.”

Overall, Wu’s group favors usage of alternative data only with consent of the consumer. Their stance is that using alternative data to create special credit scores for consumers otherwise without scores would be better than pouring alternative data into traditional files, “where it might damage consumers who already have credit scores.” Multiple alternative scores are available for lenders’ use and the group favors their use for voluntary “second chance” efforts by lenders.

Does Use of Alternative Data Increase Lenders’ Exposure?

While this seems fair, Parrish’s research found that all but one of the lenders using alternative data found it “critical or useful to use alternative data to underwrite applicants regardless of where they fall on the credit spectrum.”

Aite’s report quotes one lender: “Even consumers with credit scores of 780 or higher aren’t created equal; everyone is either moving north or south and at different speeds. We need [alternative] data to truly understand what’s happening.”

Many lenders already used “trended” data for this reason. Briefly, it’s the difference between a snapshot and a video, showing trend and direction over time.

Making the transition to some use of alternative data will have its challenges. Parrish points out that increasing use of AI to weigh alternative data will complicate the compliance process. When things happen in an AI black box, it’s harder for lenders to explain adverse actions taken on applications. She says no lenders surveyed have turned the entire decision process over to AI yet.