Lenders seeking loan growth in the current economic environment may find opportunities in home equity lending if they tread carefully.

Growth will depend partly on loosening credit policy enough to open home equity lending to additional consumers who will make greater use of their credit lines — lenders make their money when people borrow, after all, not when they take out a line.

But the desire for growth needs to be balanced against an uncertain economic outlook and a credit picture that is still obscured due to the influence of pandemic-driven relief programs.

Tuning a bank or credit union home equity lending portfolio for the ideal sweet spot depends on what the risk manager can say yes to and what the marketing director can make happen.

That risk/reward balance is a continual challenge for financial institutions but is trickier than usual amid so much flux.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

‘Tailwinds’ for Home Equity Loans and Lines of Credit

Credit is definitely back in style, with credit card and personal loan volumes rising, according to Ken Flaherty, senior consumer market analyst at Curinos. Prices have been rising across the board at the same time that stimulus funds have finally been spent and people are beginning to eat into their savings or are already tapping available credit, he says.

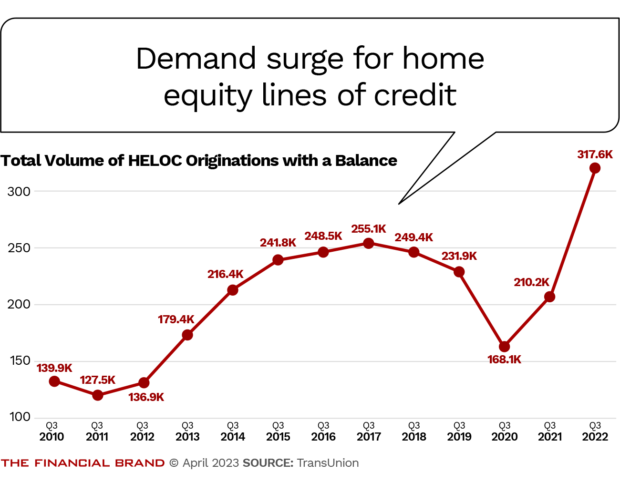

The banking industry saw “really robust origination growth” in home equity lending in 2022, but demand has subsided somewhat in 2023 so far, Flaherty says. Beyond that, actual usage levels of home equity credit lines have been “pretty lethargic” compared to the number of open accounts.

Sitting on a Pile of Equity:

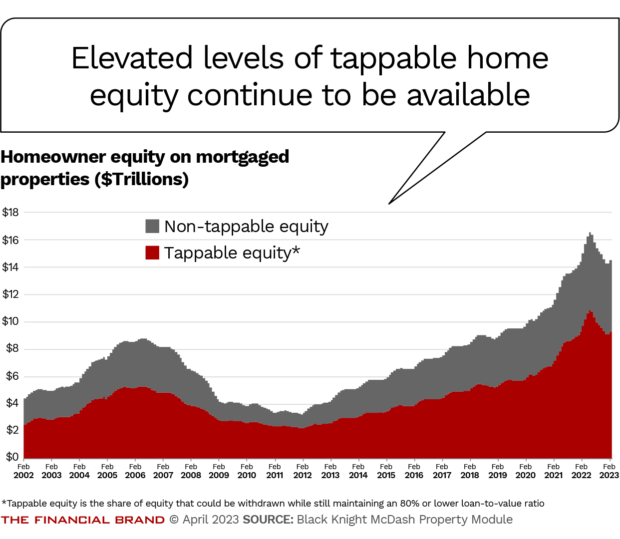

The average mortgage holder has $178K in tappable equity, down from more than $210K early last year, but still $61K (54%) above the market average three years ago, according to Black Knight.

Flaherty contends that financial institutions can do more, and he sees “strong tailwinds for home equity” going forward. He says that housing inventory will continue to fall short of demand for some time. That, combined with rising rates, will tend to keep people in their homes. He characterizes this as “I love my mortgage, but I hate my home” syndrome.

For many this situation won’t change anytime soon — they are trapped by a rate too low to give up. The rapid rise in interest rates make a new mortgage loan unattractive and, in some cases, out of reach, even if they could find a home to buy.

“This should push more homeowners to seek home equity credit to be able to make more of what they’ve got, and ride things out over the next couple of years until rates normalize and/or there’s better housing inventory available for them to go out and search for their dream home,” Flaherty says.

That possibility also assumes some economic upside — which Flaherty and fellow Curinos analyst Richard Martin, director of real estate lending solutions, say may not be in the cards for some people. The two spoke during a Consumer Bankers Association/Curinos webinar and in a subsequent interview with The Financial Brand.

Below we review the dynamics impacting home equity lending and examine the future potential, including strategies to boost borrowing and avoid credit missteps.

Read More:

- 2023 Consumer Loan Trends: High Demand, Rising Delinquencies

- Credit Unions Bulk Up in Commercial Lending and Home Equity

What the Home Equity Lending Data Shows

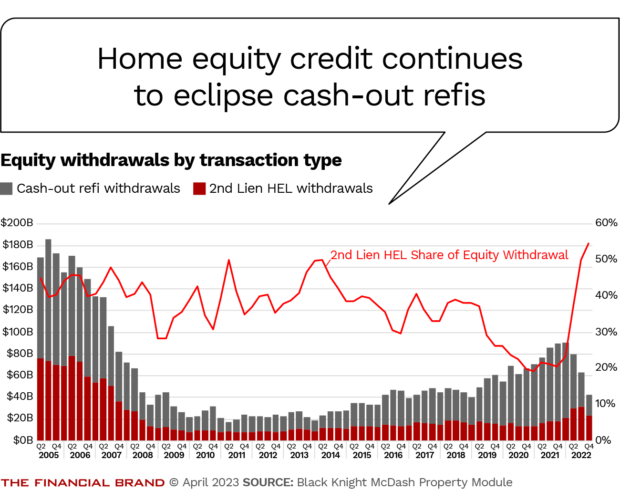

Boom times in mortgage lending ended as the U.S. shifted from a long period of very low interest rates to a period of ongoing rate increases.

But housing prices kept going up. This increased the value of homes already purchased and the amount of equity that homeowners/mortgage borrowers had in those homes.

Though housing prices did take a dip in the fourth quarter of 2022, they grew 4.7% in the first quarter of 2023 (annualized and not seasonally adjusted), versus the year earlier period, Fannie Mae reported in mid-April. Fannie Mae credited the uptick to continuing demand for housing amid the inventory shortage — which arises, in part, from people staying in their homes to keep their low mortgage payments. Black Knight, a mortgage data and analytics firm, reported that inventory levels for February fell to the lowest level since May 2022, but that home prices had ticked up in 39 of the country’s top 50 markets.

Even after a fall from 2022’s peak, as shown in the chart below, the level of “tappable” equity remains high compared with recent history. (The levels of tappable equity, as reported by Black Knight, refer to equity that can be accessed while maintaining a loan-to-value ratio on the home of 80% or less.) In April, Black Knight noted in its Mortgage Monitor report that tappable equity was $9.3 trillion, which it characterized as substantially high. The firm indicated that tappable equity had risen by 56% over the past three years.

As rates rose, many people who might have refinanced with “cash- out refis” — new mortgages that refinance a home for a higher amount, based on rising equity — preferred to hold onto the lower rates they had. Then, after a long hiatus among many consumer segments, home equity lending began a comeback. (The latest number in the chart below is from the third quarter of 2022, based on TransUnion’s yearend 2022 report on consumer lending, released in February. The credit bureau releases home equity line of credit origination numbers one quarter in arrears.)

Demand for home equity credit varies according to the region. Western markets have seen falling home prices and that has driven originations down, often much more than in other regions, including parts of the Southeast. However, western states, especially California, is where huge amounts of tappable equity exist.

Flaherty notes that even as consumers are borrowing more on cards and through unsecured personal loans, there is a growing perception that consumer lenders are or will be tightening up on such credit. This represents another potential tailwind, as consumers worried about being able to obtain new credit in the future may be more interested in lining up a home equity credit line.

Read More:

- Marketing Home Equity Lines Shows the Way to Intelligent Cross-Selling

- 3 Ways to Solve for Sneaky Credit & Deposit Concentration Risks

‘Sticker Shock’ in Consumer Credit Affects HELOC Use

Rates on home equity lines of credit, while less costly than options like credit cards, are elevated. In a presentation at CBA Live 2023, Andy Walden, economist and vice president of market research, data & analytics at Black Knight, reported that HELOC rates have risen to their highest levels in 20 years. In fact, Walden pointed out that historically 30-year mortgage rates tend to ease before HELOC rates do.

“We’ve seen such an upsurge in rates so quickly in this cycle, it is almost sending consumers into sticker shock. They are wondering, ‘What happened to those 3%-4% rates? Now rates are between 8% and 9%. Now what do I do?'”

— Ken Flaherty, Curinos

The difference between homeowners’ mortgage rates and HELOC rates is significant, given the increases seen out of the Federal Reserve. Black Knight research indicates that roughly 70% of tappable equity is held by homeowners whose mortgages bear rates of under 4%.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Finding the Home Equity Lending Sweet Spot

Lenders seeking growth have a two-fold challenge: stimulating more usage of HELOCs while avoiding a surge of bad credit. It’s important to remember that home equity is a function of the market price for the home. As already established, trillions of dollars in equity can go away.

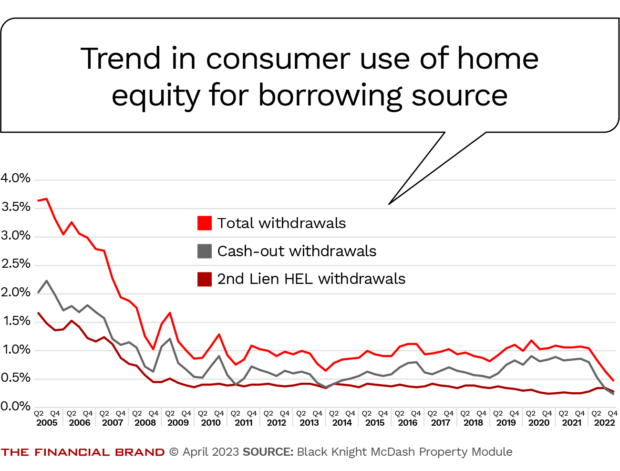

Yet, as the chart below illustrates, for all the equity out there, usage of HELOCs is comparatively low, at 0.23% of tappable equity. Additionally, TransUnion credit trend reports indicate that delinquency rates are relatively low for home equity lending.

Flaherty says that the home equity sticker shock among consumers appears to be having the most impact with recent vintages of mortgage borrowers. Among those consumers, he thinks the sticker shock may be temporary. “Customers have to get used to this new environment,” he says.

Flaherty says that the home equity sticker shock among consumers appears to be having the most impact with recent vintages of mortgage borrowers. Among those consumers, he thinks the sticker shock may be temporary. “Customers have to get used to this new environment,” he says.

He sees two scenarios for this group. They will either acclimate and see a strong opportunity to borrow against equity levels that remain historically high while housing inventory is constricted, or they will come along when the Fed eases up a bit on rates and HELOC rates “become a little bit more palatable.”

He adds that use of HELOCs is stronger among consumers who have had their accounts for four or more years. “They’re still not using them at robust levels,” says Flaherty, “but they are still drawing on their lines.”

Strategies for Lenders to Increase Use of HELOCs

The Curinos consultants point out that since the financial crisis, when lenders have gone in for home equity credit, they have tended to be very conservative. The days of promoting equity-rich homes as giant ATMs for everybody are long gone.

Flaherty says the conservative stance “gets you the reward of better performance from a repayment standpoint, but you get the risk of underperformance from a usage standpoint.”

Getting more out of HELOC programs, both in terms of successful originations and use of the product afterward, may hinge on judiciously marketing them to consumers further down the credit score hierarchy. Though lenders often focus on borrowers with scores in the high 700s, Flaherty says indications are that dipping into the lower 700s doesn’t affect credit performance significantly and brings the product to people more inclined to borrow.

“Speaking as an old credit guy, the difference between a 740 and a 780 is pretty immaterial in terms of their probability of default,” says Flaherty.

Read More:

- Credit Cards Evolve Toward All-Purpose Financial Services Accounts

- Behavior-Based App Helps Consumers Manage Rising Credit Card Debt

Avoiding Missteps in Home Equity Lending

At the same time, lenders willing to stretch need to do so with surgical precision, say the Curinos analysts. That requires going beyond credit scores when targeting prospects.

Things are not always as they seem with credit scores in the wake of pandemic relief programs, Flaherty cautions. There is credit risk lurking that the scores do not reflect.

“Customers that historically would have had lower credit scores, sub-700, are almost disguised today as 720-740 borrowers.”

— Ken Flaherty, Curinos

“A lot of that is due to student loans in deferment, plus stimulus money that was dumped into their checking and savings accounts and the opportunity to defer payments under forbearance programs,” Flaherty explains. “A lot of consumers had extra cash flow and performed really, really well. As a result, they have had higher performing credit scores.”

Now, he adds, “they’re kind of drawn back to their roots.”

Martin, his fellow Curinos analyst, also points out that lenders have to take inflation into greater account than they did in recent years when they evaluate prospects by income level. “Wages are up,” he says, “but they aren’t keeping pace with inflation. So real wages are declining.” Savings levels are way down now, and that means many consumers, especially younger homeowners, lack a cushion should the worst happen.

Historically, home-oriented credit gets paid even when credit cards and auto loans slip. People want to keep the roof over their heads.

Flaherty says employment continues to be strong and that’s been a major positive for lenders. But should that shift, lenders will have to be prepared, monitoring borrowers with higher default risks and reaching out to them proactively when glimmers of trouble begin showing up if and when unemployment begins to spike.

A wild card out there is the status of federal student loans. “If those payments come back in the middle of this year,” says Martin, “that makes me a bit nervous about what cash flow will look like.”