Home equity lenders aren’t just competing with each other, but also with online providers of personal loans. All indications are that the speed, convenience, and generally superior digital experience offered by fintech lenders in the unsecured space is more appealing to consumers. Consumers don’t much care that unsecured personal loans typically carry higher interest rates than does secured home equity credit.

A pair of studies from J.D. Power — one focusing on HELOCs versus personal loans and the other on the rapidly growing personal loan business — show a HELOC industry pitting chiefly traditional lenders against digitally-savvy unsecured fintech lenders that offer money quickly.

Patience may be a virtue, but no one markets on that point. Among new HELOC borrowers surveyed, two-thirds considered alternative products when shopping for their equity line, according to the research. This is up substantially from previous years. Younger HELOC borrowers surveyed are even more likely to consider alternatives to HELOCs, including personal loans, credit cards, and cash advances.

What makes this especially noteworthy is that many HELOC lenders enjoy a leg-up versus other lenders because they already hold homeowners’ first mortgages. While that relationship would imply a cross-selling advantage, John Cabell, Global Business Intelligence Practice Leader at J.D. Power, says the firm’s research indicates that sophisticated fintech lenders offer the digital experiences that consumers increasingly want.

Read More:

- Traditional Lenders Losing More Ground As Fintech Loan Share Surges

- Four Ways to Beat Digital-Only Lenders at Their Own Game

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Online Credit Appeals to Appetite for Convenience

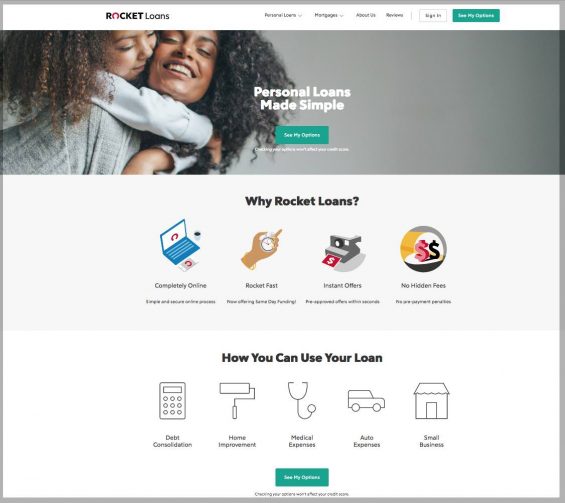

Convenience weighs heavily in the personal loan versus HELOC battle, according to J.D. Power. Overall consumer satisfaction with personal loan providers is significantly higher than for HELOC lenders, the researchers found. The personal loan process is most commonly a digital one, with two out of five applicants applying entirely online. Among the top institutions in the home equity satisfaction study, several allowed the process to at least start online, but others made it clear HELOCs should be applied for at a branch.

“Overall satisfaction is highest among personal loan customers in the digital-only segment, which also has the highest percentage of applicants who indicate that they completely understood the application (91%),” the research notes. J.D. Power finds that such understanding represents a big chunk of the satisfaction rankings. The firm warns that as satisfaction with the online personal loans grows that this will bring increased referrals for them versus HELOCS.

Cabell notes that dissatisfaction with HELOC lenders’ offerings begins long before the application stage — indeed, the first frustration would-be HELOC borrowers face is when they are shopping for credit.

“Consumers’ digital expectations are evolving and it doesn’t seem that HELOC lenders’ digital presence is evolving with them,” says Cabell in an interview with The Financial Brand. “That is becoming a major drag on future business as new, digital-native competitors enter the marketplace.” The firm’s research indicates that sometimes even finding such basics about a home equity credit program as interest rates and payment schedules can be difficult online.

Another factor at work here is queasiness about using homes as collateral. Cabell explains that “consumers are growing less comfortable with securing another loan on their houses. “There are more borrowers now who saw what happened to home values during the Great Recession.

Indeed, real estate research firm CoreLogic continues to track “underwater” residential properties a good decade after the recession. Equity among homeowners with mortgages went up by 8.1% in the fourth quarter of 2018, year over year, according to the firm. Even so, 4.2% of all mortgaged residential properties in the U.S. are underwater.

Read More:

- 5 Things Financial Marketers Should Know about Love and Money

- 6 Keys to Designing a Best-in-Class Financial Wellness App

Give Me the Money … Pronto!

Speed also plays a major part in the mix. The personal loan study indicates that receiving loan approval within two days increases consumer satisfaction, and getting funds within two days of approval increases satisfaction even more. Fintech lenders tend to play up such speed in their promotions, versus HELOCs. Consumers surveyed by J.D. Power reported an average application-to-funding time of 26 days with HELOCs. It’s beyond a tortoise and hare comparison.

“Start your home improvement project now, without waiting for a home equity loan or line of credit,” Lending Club states on its site. “Instead of getting a home equity loan and borrowing money against the value of your house, opt for a no-collateral personal loan. Getting a loan based on your creditworthiness instead of your home’s equity means you can use your loan as you see fit.”

Home improvement is a major reason for borrowing against home equity, according to studies by Bank of America. Two in five borrowers in the BofA research plan to use the proceeds of HELOCs for repairs, expansions, and other purposes. (This synchs with similar research by LendingTree.)

HELOCs usually carry floating interest rates,. Some HELOC lenders offer variations on the theme, such as the ability to turn a draw on a floating-rate home equity line into a fixed-rate home equity loan. Some promote three types of equity plays: HELOCs, home equity lines, and cash-out refinancings, where a new first mortgage is generated and there is no junior lien.

But unsecured personal lenders frequently use fixed rates. On the home improvement loan page on the Marcus by Goldman Sachs website, the fintech lender promotes the ability to borrow up to $40,000 at fixed rates with no collateral or home appraisal required, and the ability to obtain an initial loan offering “in as few as five minutes.” (Marcus ranked highest in consumer satisfaction in the J.D. Power personal loan study, followed by LightStream, which is a SunTrust online lending brand, and Upstart, another fintech. Regions Bank topped the list of HELOC lenders, followed by Huntington National Bank and BB&T.)

Read More: Eight Challenger Banks Traditional Institutions Should Worry About

In the Wings, A Partnership Approach

Another wrinkle is fintech lenders’ offering HELOC products on their own platforms. In November 2018 Prosper Marketplace announced that it would begin offering a digital HELOC in 2019. A spokeswoman indicates that a pilot effort is likely to launch in the second quarter. Prosper’s thrust is expected to be structured as a partnership with banks, enabling the institutions to build their portfolios but with more convenience and speed for borrowers.

The marketplace lender says that consumers “will be able to complete an online application within minutes, receive an instant HELOC prequalification offer, and save weeks versus the traditional process.”

Rocket Loans is a sister company to Quicken Loans’ Rocket Mortgage. The unsecured loans made by Rocket Loans reside on the books of Cross River Bank, a N.J. institution that specializes in working with fintechs.

In a side-by-side comparison of traditional HELOC offerings versus Prosper’s concept, the company promises to provide instant initial credit offers online, and promises to halve the three-to-six week time it usually takes to actually receive the funds from traditional lenders.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How HELOC Lenders Can Compete

Advice from Cabell and the J.D. Power research, as well as other sources, on how to vie with unsecured fintech personal lenders:

1. Don’t give up. Even though personal loans are giving HELOCs stiff competition, it’s not a done deal that consumers will go that way. The J.D. Power personal loan study notes that almost half of consumers who went with the personal loans did consider competing products: 28% mulled credit cards; 17% considered personal credit lines; and 13% considered HELOCs. So, it’s time to marshal the best arguments.

2. If you can’t beat them … Cabell says it’s worthwhile investing in system revamps that will enable your institution to provide a faster, digital experience — the stress going forward will be on faster and easier and online.

3. Highlight advantages of HELOCs. Something HELOCs and home equity loans bring to the table that unsecured personal loans don’t, is potential tax deductibility of interest. Cabell says this is something traditional lenders can sell. (Bankers and credit union representatives doing this must take care to air the opportunities without rendering formal tax advice.)

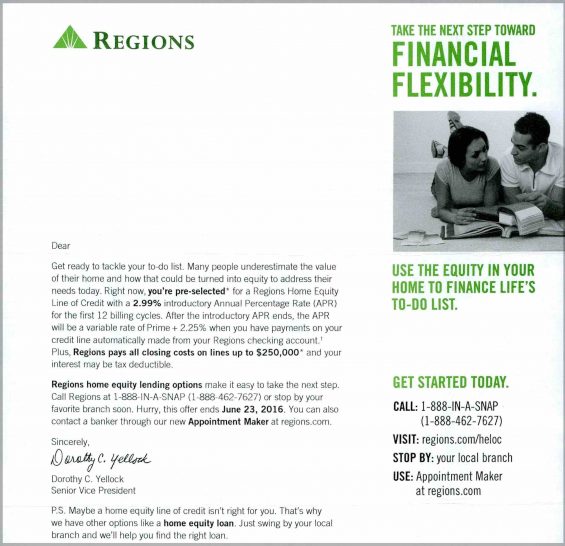

Likewise, there’s a rate advantage. At this writing the rate on a Regions Bank HELOC could be as low as 4.125%, while Marcus and SoFi indicate that their rate on personal loans could range from 5.99% to triple or more that rate. Rates at some other fintech lenders start even higher.

“Playing on the advantages of these credit lines is important, because clearly the competitors are playing on the disadvantages,” says Cabell.

4. Keep engaging with HELOC borrowers. The J.D. Power research found that consumer satisfaction with their HELOC tends to fall after they have had it for a few years. And if they haven’t used it much, details about how it works may fade. Cabell recommends engaging regularly with these consumers. Aside from encouraging usage, over other alternatives, there is the earlier point about satisfied consumers recommending the product.

Read More: Home Equity Borrowers Admit They Don’t Know Squat

5. Don’t be shy about competing. Consumers have grown to be extreme skeptics, so feed that when possible. The personal loan study notes that consumers see all lenders as profit-driven, but have greater concerns about the profit motives of alternative lenders. They also have greater concerns about the rates and fees charged by the alternative lenders.