Whatever a banker’s personal feelings may be about the rise of ESG issues — environmental, social and governance — data highlights their importance to a growing percentage of consumers. PwC found 83% of consumers worldwide think a company should be developing an ESG best-practice strategy.

The problem, however, is ESG puts many financial institutions in a tough spot. It’s yet another new term (in a growing glossary of banking acronyms), there are few regulatory standards and it’s unclear what it takes to meet society’s ESG expectations.

Soon, too, publicly-traded banks could have a different set of standards than privately held financial institutions as the SEC prepares to announce its climate-risk disclosure rules, following a comment period that ended in June 2022. Those rules are expected to arrive before pending regulations are issued by the OCC or FDIC.

There seems to be hot water on all sides — in acting or not acting. With that said, there are some steps financial institutions can take that can help them stay ahead of the ESG curve.

One of them is through sustainable lending, aka “green loans.”

Green loans not only appeal to consumers and investors interested in connecting to a sustainable brand, they also provide a bank or credit union with wholly new revenue streams.

“Banks that put sustainable lending front and center in a bold sustainability agenda will be best positioned to thrive in a world where the public, shareholders and regulators expect them to do the right things,” an Accenture report states.

Kicking Off ESG In Banking:

If your bank's team is wondering where and how to begin with ESG strategies, you're not the only one. Green loans can be a good place to start.

Here are key takeaways for banks and credit unions from several ESG banking leaders as well as from Accenture’s sustainable lending report.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Risks of Taking ESG Action & the Risks if You Don’t

It’s important to recognize there are risks littered everywhere in banking and ESG is not an exception. Case in point: there is contention building in banking over modifying existing lending strategies.

For instance, West Virginia’s treasury informed six large U.S. banks in June 2022 (Wells Fargo and JPMorgan Chase among them) they were on a “Restricted Financial Institution List” because they “publicly stated they will refuse, terminate or limit doing business with coal, oil or natural gas companies without a reasonable business purpose,” according to an official statement.

Some industry experts, such as Chris Skinner, financial industry influencer and best-selling author, have advised banks and credit unions to be wary of “greenwashing.” That happens when a company overinvests in marketing a sustainable image without following through with sustainable action. Skinner cites HSBC as an example of such contradiction, as the bank has aggressively marketed its green credentials even though it is Europe’s second largest funder of fossil fuels.

“It shows that these banks clearly understand the issues, but talk the talk and don’t walk the walk. It is purely PR and not action,” Skinner argues.

Yet, there is another side of the coin, especially if financial institutions fail to take any action. As Accenture points out, “large investors have, in some cases, dropped companies which do not disclose their emissions.” The report adds that any laggards in the ESG space could be facing increased credit risks and jeopardized profitability if exposure to fossil fuels becomes concentrated on their loan books.

Sounds like getting stuck between a rock and a hard place. But, it doesn’t have to be.

In fact, adopting sustainable lending practices and making green loans can be a good place to start. Green loans can come before overhauling old lending mindsets, before adopting comprehensive ESG strategies, hiring staff tasked with handling impending regulations and drafting full ESG reports to accompany annual 10-Ks.

“It shows that these banks clearly understand the issues, but talk the talk and don’t walk the walk. It is purely PR and not action.”

— Chris Skinner

Although some climate advocates call for complete divestment of all fossil fuel loans and other environmentally harmful investments, simply introducing green loans to a bank’s lending profile can be a low-risk way to be more ESG.

Dig Deeper: Banks Can No Longer Ignore Climate Change (And Here’s Why)

How Some Banks Are Executing Green Loans

Only a few banks have concentrated all their branding resources and core strategies around sustainable lending. Climate First Bank, which officially launched in 2021, is one. Its founder Ken LaRoe says sustainability is integral to how the company operates.

“I believe that we have an inherent responsibility to maximize our impact for good. We do not take lightly the mantra of changing finance to finance change,” LaRoe told The Financial Brand in an earlier article.

Climate First launched its digital lending program in May 2022 for consumers to get access to solar loans to compete with fintechs in the industry. LaRoe says fintechs offering similar loans will charge fees — some as high as 32% — and consumer protection laws don’t always apply.

In just a month, the bank approved in excess of $5 million in solar loans. He says a customer can apply in three minutes and get an answer half a minute later, using technology built by the bank. Climate First also offers electric or hybrid vehicle loans and home equity lines of credit, so customers can invest in energy efficiency projects around the house.

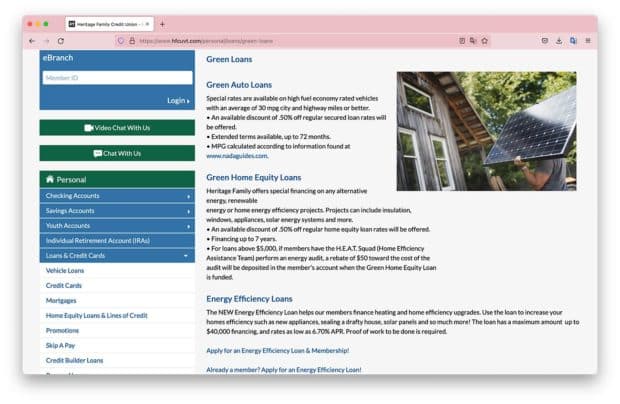

But, not every financial institution has to look like Climate First and make sustainability the main focus of their brand and gameplan. Other banks just offer sustainable lending products, without the full ESG branding. For instance, Heritage Family Credit Union — a Vermont-based credit union with $4 billion in assets — offers similar loans to customers.

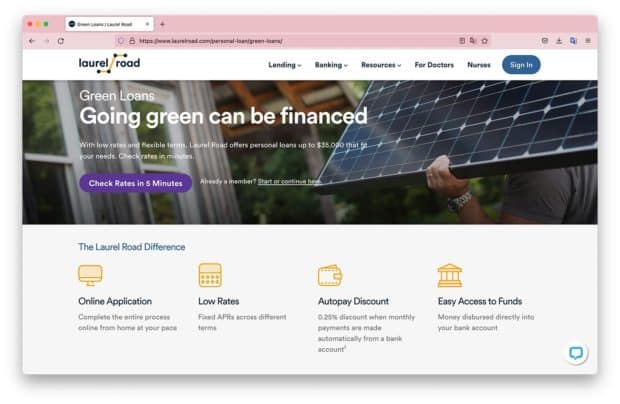

Digital bank Laurel Road — a unit of KeyBank — offers more generalized personal green loans with low-interest rates, which can be used for solar panels or upgrading a house to be more energy efficient.

There are other ESG options a bank or credit union can try out as well. Accenture points out a few:

- Green mortgages: Homeowners receive discounted mortgage rate if the house meets predetermined energy standards.

- Green loans: Loans facilitated for consumers and businesses looking for renewable energy, green building or sustainable farming financing.

- Sustainably-linked supply chain finance: Suppliers of local retailers can get preferential financing rates if they meet sustainable targets, such as carbon footprint data or emission mitigation.

- Green loans securitization: Asset-backed securities “with proceeds raised to finance loans for green infrastructure.”

Read More: How One Florida Bank Is Embracing the Green Banking Agenda

How Does My Bank Add Green Loans To Its Repertoire?

It’s not too late to enter the green loan game. The new market grew 300% year over year, reaching a record $717 billion globally in 2021, reports financial data insights company Refintiv. It’s only expected to continue.

Accenture points out many banks in the space are concerned about the “bankability of some of the organizations and projects in the sustainable lending category” — and understandably so.

However, the opportunities can outweigh the risks, the report points out, especially if financial institution leaders take the time to approach green lending correctly. After studying what pioneer ESG leaders are doing, Accenture suggests a three-pronged approach to start:

- Transform the lending value chain.

- Set up ESG data platforms.

- Reskill the bank’s lending practice accordingly.

The first component — transforming the lending value chain — not only helps to establish a green lending program, but also sows the seeds for the ESG conversation in the boardroom, which could have its own value with regulators down the road.

To accomplish this, Accenture advises banks adjust their credit products, policies and processes to include ESG as an underwriting standard. This doesn’t have to apply to every type of loan, but it can be good practice executed with green loans. These standards can change, depending on the loan and the industry.

For example, Climate First embedded a caveat into a local gas station loan when the bank first opened: the owners had to add solar panels, LED lighting and electric vehicle stations to their infrastructure. LaRoe says after the loan went through successfully, that caveat became a standard for any gas station or convenience store financing.

Thinking Outside The Box:

ESG isn't always about offering brand new products. Banks can also embed incentives in current loan products, like mortgages, to encourage customers to lower their own carbon footprint.

Figuring out what conditions to add will vary, and it won’t always be as clearcut as adding EV chargers in the same lot as gas pumps. The Accenture report says more complex approvals will require more research, but that working on sustainable lending can be the first step to establishing short- and medium-term ESG goals.

The second component is setting up an ESG data platform, even if it is in a basic state until federal regulations are finalized. Such technology is critical, especially for more complex loans — like green mortgages.

“To offer a green mortgage, a bank would need to be able to measure carbon dioxide equivalents for the property it is financing,” Accenture explains. “This would require the bank to have data on the characteristics of the building as well as energy consumption and performance information. In many cases, this would have to be sourced from third parties.”

Learn More: Banks Failing to Use Data and Analytics to Build Loyalty With Customers

When there are gaps in the data, it can be difficult to fill out the platform. Accenture suggests a few things to supplement the absence of ESG data clarity.

Create or select an ESG score methodology. There are plenty of third-party companies with predetermined ESG ratings to evaluate carbon footprints and proprietary ESG methodologies.

Set up a formal process to acquire information from non-public companies. In the case of business loans, it may be more difficult to acquire ESG data from private companies to compare to ESG rating scorecards. Accenture suggests offering incentives to borrowers through lower rates or accelerated loan processing in exchange for ESG information which would guide the decision. This can include “energy consumption, emissions, adoption of green policies, workforce composition, training and wellbeing programs, and board diversity.”

Design an ESG central data utility. Accenture says a singular, cohesive location for ESG data has been critical for financial institutions in the ESG space. It allows banks to manage the data and automate operations to fast-track loan underwriting.

The third element of developing a green loan portfolio is to create a team that can roll it out successfully. In fact, the barrier many banks and credit unions encounter is a lack of information and skills to support the new products, the report says.

Financial institution leaders can overcome this by incorporating modular training or offering certification programs for employees to learn more about delivering green loans and what to look for. Accenture’s report adds that any program should also include an open forum, where employees can congregate and decide what ESG should look like at your institution.