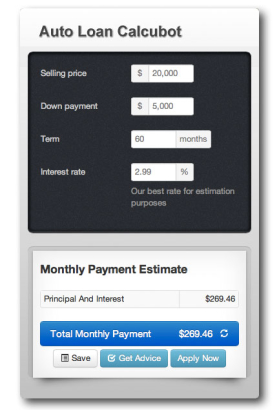

At first glance, Shastic’s Calcubot looks like little more than a basic financial calculator widget that can any bank or credit union might embed anywhere online. Just like other financial calculators, it allows consumers to preview various payment options for auto loans and mortgages.

Peek beneath the surface though and it becomes clear there’s more to Calcubot than initially meets the eye. For instance, the product collects contact information and other data from users, passing it along to the sales/marketing department. It also can usher folks to a financial institution’s online loan application, courtesy of the “Apply Now” button that pops up once they’ve completed their payment computations.

Then there are the product’s more consumer-focused elements. One allows them to save their calculations so they can return to them later. Another enables them to ask friends and family to weigh in and share their thoughts on a Calcubot estimate. Users also can ask to be alerted via text message or e-mail about rate changes.

In short, it’s a loan calculator on steroids.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Affordable + Easy to Install = Facebook Monetization

Calcubot, CEO Joseariel Gomez suggests the product’s real draw is that “it helps financial institutions monetize Facebook and other online platforms, it’s easy to install and it’s affordable.”

Calcubot’s flagship auto-loan and mortgage products — along with a third, Calcubot Cloud — makes it easy to deploy one or both of the company’s calculators across all an institution’s online channels — website, blog or social site.

According to a study of 700 Facebook pages conducted by Shastic, financial institutions have only connected with an average of 4.2% of their fan base on the social media site. Gomez says Calcubot gives consumers a reason to interact with their bank or credit union.

“They’ve invested a lot of money and energy and time into building these Facebook pages and this following, but they have no engagement,” Gomez says. “Calcubot not only helps them with that by generating engagement, but it also helps them establish deeper online relationships with their members and customers and monetize the platform.”

Gomez says getting the product up and running “takes just 15 minutes. It’s like installing an app on your phone. You don’t even need to bother the IT guy with it.”

A financial institution can simply go to Calcubot.com, create an account (or connect through their Facebook account), select the images they want to use to brand different areas of the widget, input their compliance disclaimers, enter their loan application links, then click “save” and “release.”

“With Calcubot Cloud, the only difference is that since there’s no API for your website or blog, you have to copy this widget code and paste it to your page. But that’s it,” Gomez explains.

“We have an automatic scraper that pulls interest rates from their websites every night, so they don’t have to maintain that part of the widget,” adds Gomez.

Generating Results

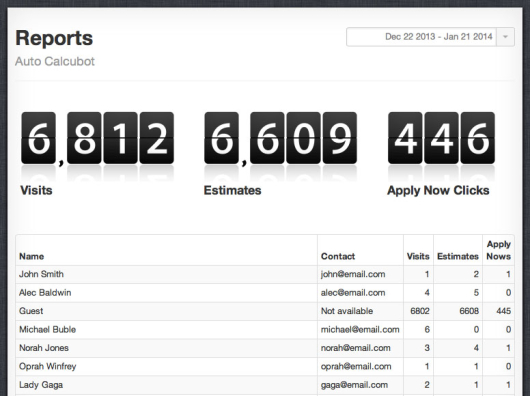

Those utilizing Calcubots have seen average engagement rates of 73%, and average conversion rates around 8.18% (the engagement rate represents the number of people who’ve interacted with a Calcubot unit by making one or more estimates during their visit, and the conversion rate being the number of qualified prospects Calcubot sent to the financial institution’s online loan application out of the total number of visitors).

“In order for Calcubot to take someone to an online loan application, he or she must have made a loan estimate beforehand,” Gomez points out, “so these are highly qualified prospects for the financial institution.”

One Calcubot client shared their results with The Financial Brand. In a two year period, the credit union’s Calcubot mortgage app was engaged 932 times and completed 1,600 payment estimates for users. The result? 78 people hit the “Apply Now” button. The credit union subsequently added the auto loan widget, which has generated an additional 44 clicks on the “Apply Now” link.

“Calcubot was one of the first Facebook apps that was useful for both members and the credit union,” a credit union representative said in an interview with The Financial Brand. “It was incredibly easy to configure and install. The reports give great information that show how useful it is.”

Calcubot’s reporting features.

Starting at $1,499

Like the tool itself, Calcubot’s pricing model is similarly easy to comprehend. Yearly subscriptions start at $1,499 per year per unit. (A “unit” equals each instance where the widget is deployed. The mortgage tool on your website and both auto and mortgage tools on Facebook would equal three “units.”)

“Depending on how many units you need, we’ll bundle them,” Gomez says.

Gomez points out that the product is portable, meaning you can move them around from one online channel to another.

“A lot of smaller financial institutions tend to go with just one unit and then use it for different purposes at different times,” explains Gomez. “Some larger ones, though, want to have everything everywhere, so they go with more units.”

Support as reporting features are part of the package, too. “They’re included with the subscription. No extra charge,” Gomez says.

“In most cases, a single funded loan will pay for both products — the auto loan and mortgage widgets — for more than a year.”

60 Clients and Counting

To date, nearly 60 financial institutions including Kinecta FCU in California, Numerica Credit Union in Washington and GSB Mortgage in Texas have implemented Calcubot in some form or fashion.

Just over 43% of those banks and credit unions are using the company’s Facebook-based mortgage calculator, while about 56% are using the auto calculator for Facebook.

Calcubot Cloud — which allows clients to add the widgets to websites, blogs and other online spaces — has seen a 9% uptake since it was launched at the end of 2013.