Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

7 in 10 people considered, then selected a large national bank.

— J.D. Power & Associates

6 in 10 people considered, then selected a regional bank.

— J.D. Power & Associates

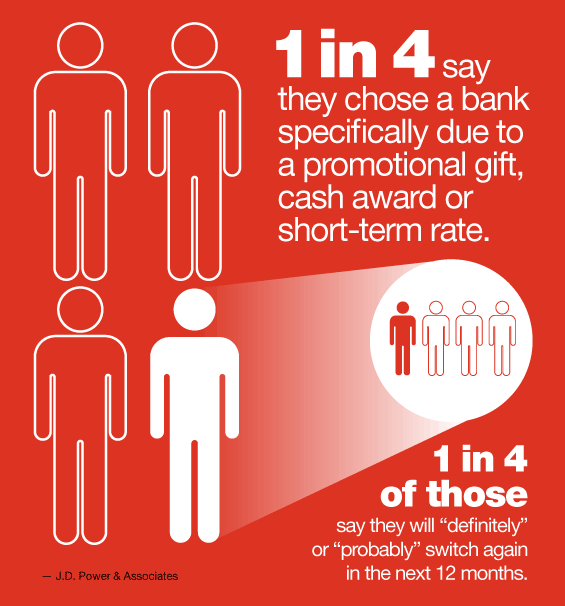

1 in 4 people say that they chose a specific bank because of a promotional gift/cash award or an attractive short-term interest rate. 1 in 4 of those attracted by incentive say they will definitely will” or “probably will” switch banks again in the next 12 months.

— J.D. Power & Associates

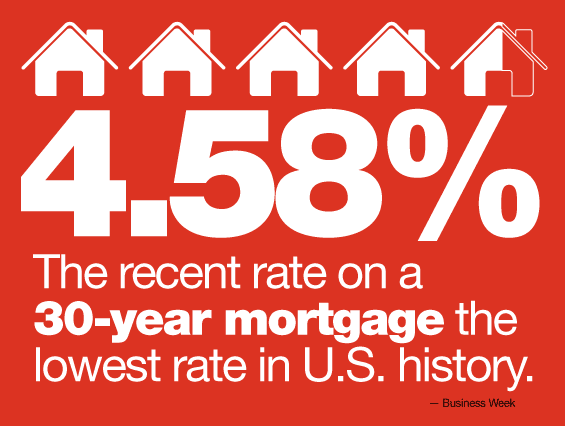

The recent rate on a 30-year mortgage, the lowest rate in history: 4.58%

— Business Week

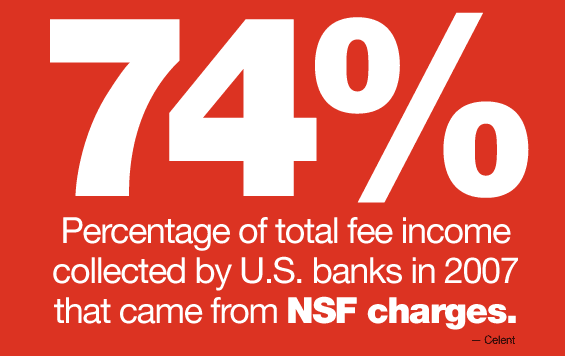

74% of total fee income collected by U.S. banks in 2007 that came from NSF charges.

— Celent

$30 billion in NSF charges collected by U.S. banks in 2007.

— Celent

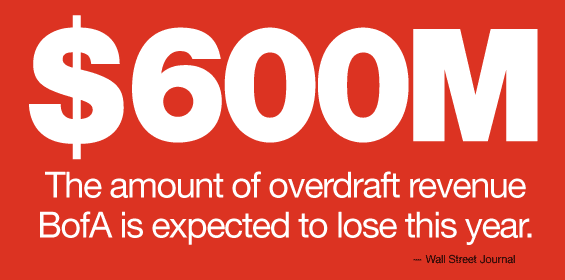

BofA is expected to lose $600 million in overdraft revenue this year.

— Wall Street Journal

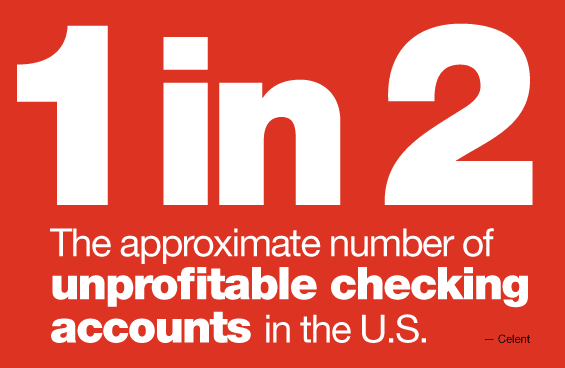

The approximate number of unprofitable checking accounts in the U.S.

— Celent

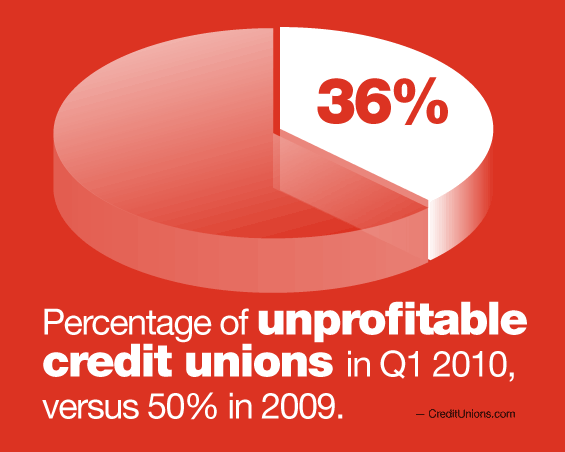

36.4% unprofitable credit unions in Q1 2010, versus 50.4% in 2009.

— CreditUnions.com

74% of financial institutions do not have a satisfactory social media policy.

— Evalsrus

$400B

Total of all nonperforming loans at U.S. banks (5.46% nationwide).

– Gonzo Banker

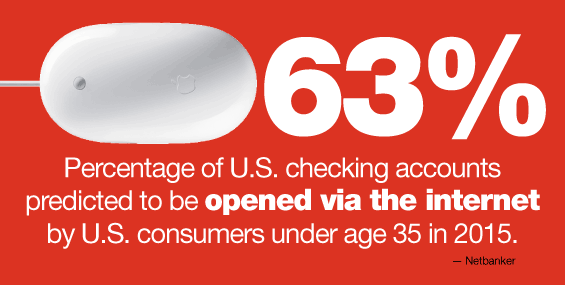

63%

Percentage of U.S. checking accounts predicted to be opened via the internet by U.S. consumers under age 35 in 2015.