How long is this going to last?

When coronavirus slammed the United States in March 2020, economic activity was shut down throughout the country. Businesses were ordered closed, and state and local officials issued stay-at-home orders to prevent the virus’s spread. The result? First-time weekly unemployment claims that dwarfed anything we’ve ever seen.

Both the government and financial institutions went into action to address the looming crisis. The government put in place economic measures, including stimulus checks, additional weekly unemployment benefits, and the Paycheck Protection Program. Meanwhile, banks and credit unions offered payment suspensions in the form of deferrals and forbearances.

Based on both publicly reported results and private conversations with different financial institutions, these measures have mitigated the worst of consumer delinquencies. The question is this: what happens when these protective measures run their course? They’ve done an admirable job mitigating delinquencies thus far. But the dam holding back the COVID-19 driven delinquencies is under ever-increasing pressure.

Knowing what’s coming, smart lenders have been preparing their collections groups to handle the anticipated volume of delinquencies. These moves will help during the pandemic, but are also beneficial once things return to normal. Let’s look at the ways financial institutions are preparing.

Collections Receives Much Needed Investments and Innovation

During normal times, collections groups provide an essential function — following up with customers who have failed to make their contractual payments. Without this function, the economics and integrity of lending would be severely undermined. This would bring brutal consequences for consumers overall, with many unable to access credit.

That being said, collections has generally been a lower priority for financial institutions. It’s understandable that when the topline is the first thing Wall Street looks at, an area not known for generating revenue would be lower priority. As McKinsey observed:

“At many institutions, senior management continues to view collections as a cost center rather than a value generator.”

But the prospect of a historic level of delinquencies has opened things up for many financial collections groups. Corporate resources — budget, IT capacity, project management personnel — are now available to prepare for the flood of delinquencies.

One major credit card issuer told us they’re implementing an improved predictive dialer system. This represents a big boost in efficiencies. An auto lender has improved its delinquency segmenting models, allowing it to more efficiently apply its efforts to the right customer at the right time.

Two different credit card issuers have told us about their plans for something interesting: self-service collections. Self-service collections? Isn’t that just the make-a-payment function on the bank’s website?

Not the way these banks are envisioning. Remember the reason that a customer moves into collections is they missed a payment. The dynamics of collections are more than just making that payment. It often requires an understanding of customers’ specific situations and a plan for the next best action to help both them and the creditor.

The challenge for self-service is this: How do you gain an understanding of a customer’s specific situation in order to determine the next best action? One way is to ask a series of insightful questions, similar to what the delinquency mitigation platform BackOnTrack™ does.

By using the three C’s of delinquency — cause, capacity, control — each collections customer’s situation can be assessed in detail. Using measures for those three traits collected via BackOnTrack, financial institutions can assign customers to one of nine collections personas. In the table below, the serious delinquency rates by persona are shown.

Grouping collections customers by persona

| Persona | Serious Delinquency Rate |

|---|---|

| “Financially secure” forgetter | 5.00% |

| “Will figure it out” forgetter | 8.30% |

| “Get through it” saver | 9.90% |

| “Scrappy” forgetter | 10.00% |

| “Resolute” payer | 12.50% |

| “Scrambling after a setback” payer | 19.80% |

| “Overwhelmed” payer | 25.10% |

| “On the edge” payer | 28.00% |

| “Under an avalanche” payer | 34.80% |

Source: RevolutionCredit

With this information, collected without human intervention, a collections group has an immediate head start on determining the next best action for a delinquent customer. This is a very useful tool to deal with the coming delinquency tsunami.

Reduce the Second Wave of Delinquencies

Something collection groups know: Being late once increases the chances that an account will be late again. A meaningful percentage of collections customers have been delinquent previously. Recidivism is a problem that costs creditors in several ways:

- Operational expense.

- Increased bad debt expense.

- Less cash on hand.

Recidivism is bad in normal times. With first-time delinquencies potentially soaring three times their typical level, all of those problems are exacerbated. Delinquent customers will be the hot spot inside banks.

The question then becomes: How can we reduce recidivism for collections customers? Payment modifications have been shown to reduce subsequent delinquencies for mortgage customers in collections. But there’s a way to reduce recidivism without payment modifications.

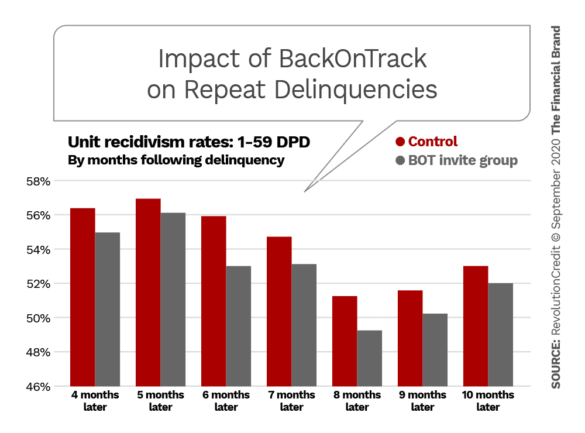

Delinquent customers who complete BackOnTrack exhibit meaningful improvements in recidivism. In the first implementation of BackOnTrack for a top ten credit card issuer, results for two groups representing nearly 400,000 customers were evaluated. The control group underwent the usual collections process of the creditor. The BOT Invite Group consisted of delinquent customers invited to complete BackOnTrack (BOT); the group includes those who completed it and those who did not.

A series of BackOnTrack invite campaigns were run over several months. These campaigns’ performances were all measured at a single point in time four to ten months later. As you can see in the chart below, the BackOnTrack (the BOT Invite Group) improvement in recidivism was significant and persistent.

This recidivism benefit, welcome in normal times, becomes critical when managing the deluge of COVID-19 delinquencies.

Enhance Your Brand with Accidental Delinquents

Alan McIntyre, head of the global banking practice at Accenture, made an astute observation about the COVID-19 pandemic:

“The current crisis provides an opportunity for banks to be active and positive participants, helping both consumers and businesses weather the economic storm we are experiencing. Doing it well with empathy, personalization, but also appropriate risk management, could create stronger, enduring relationships that will be a foundation for future success. This is how banks will be able to survive the short-term and thrive long-term.”

People whose employment was affected by the coronavirus pandemic are the ones who will be late on their payments when the various government and banking measures run their course. These customers are the “accidental delinquents.” They had jobs, were making their payments, and were good customers. Suddenly they find their lives turned upside down during this pandemic, and they now are struggling to make their payments.

These accidental delinquents happen during normal times as well. There are two factors that increase the urgency of taking a different approach with this cohort right now:

- The sheer volume of this cohort makes a differentiated approach worth the effort.

- The reputation risk for using a typical, transactional approach to collecting.

Consumers will remember how financial institutions handled things during this pandemic. While that could be a negative, it’s an opportunity for more forward-thinking lenders to leap ahead.

BackOnTrack differs from traditional outreach to customers in collections. It was specifically designed using empathetic principles from the get-go. The use of empathetic principles was designed to reduce the temperature of a stressful situation. And the coronavirus pandemic with its attendant economic impact is a prime example of a stressful situation.

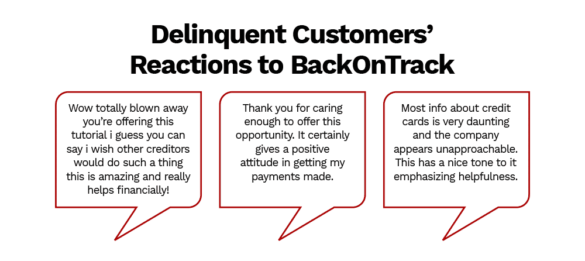

The “hard” benefit of this empathetic approach is lower delinquencies, as described earlier. But the “soft” benefit, one that relates to the financial institution’s brand, is the reaction of people to BackOnTrack. The actual consumer quotes below provide a sense of the experience:

Powerful statements that demonstrate a real difference in collections approach. Mark Sullivan, Global Business Leader of Banking at Genpact, made this observation:

“Those lenders who deliver on customer experience will be paid first and will come out much stronger than their counterparts when this crisis is over.”

Financial institutions that understand the opportunities for collections innovation and improvement will be better positioned once the pandemic has receded.

This sponsored post was brought to you by RevolutionCredit.

More Information: