In research done by the Digital Banking Report in late 2020, 85% of financial institutions allowed consumers to apply for a loan online, with only 44% providing the ability to do the same on a mobile device. Of greater concern is that only 66% allowed the entire process to be completed online, with less than half (46%) allowing end-to-end completion on a mobile device.

The research found that the completion of an online or mobile loan application (when available) was anything but fast and simple. For organizations able to process website/online applications, 85% of applications took consumers more than five minutes to complete (with 38% stating a completion time of over ten minutes).

For mobile applications, 80% of institutions surveyed said their mobile applications took more than five minutes to complete (with 34% stating a completion time of over ten minutes). This highlights that most traditional financial institutions are not building digital loan processes, but simply turning old processes into a digital app.

Reality Check:

Most traditional banks and credit unions are not building digital loan experiences, but simply putting old processes on mobile apps.

Once the application process is complete, the ‘time to decision’ for most consumer loans is between three and five days, with the average ‘time to cash’ being a week … or longer. In a marketplace where mortgage loans can be applied for and approved in a matter of minutes, these delays are unacceptable. Digital lending leaders that have embraced the digital transformation of the borrowing process, have brought the ‘time to decision’ down to minutes, and ‘time to cash’ to less than 24 hours. In fact, some organizations provide an ongoing credit availability to consumers, where money can be disbursed directly to an account almost instantly.

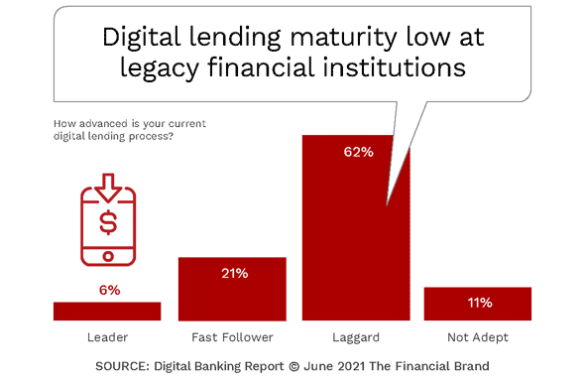

When we asked financial institutions globally for their self-assessment of their digital lending maturity, we found that most considered themselves either ‘fast followers’ or ‘laggards’. These categorizations represent lost business and/or dissatisfied consumers.

Digital lending transformation must become a top priority for banks and credit unions, improving the customer experience through improved credit processes, leveraging modern technology, available data and applied analytics, and innovation. Similar to the oft mentioned checking account, credit is at the heart of most customer relationships. Digitally transforming the entire journey from the inside-out offers significant advantages to both financial institutions and consumers.

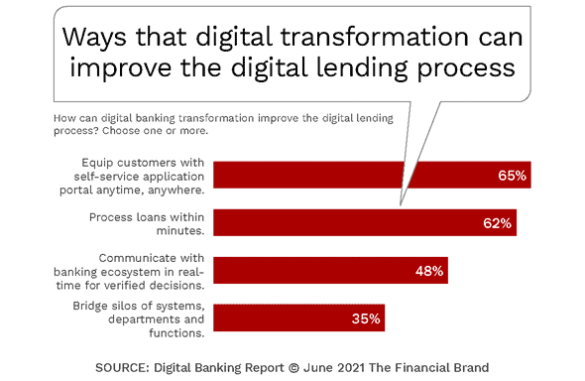

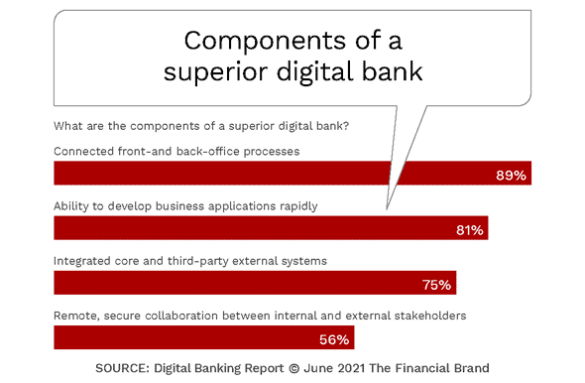

When asked about the benefits of digital lending transformation, financial institutions realize they are playing catch-up in equipping consumers with a self-service portal that is available 24/7 in a channel agnostic environment. Banks and credit unions also realize that speed and simplicity is a top priority with digital lending. Organizations realize that the benefits of digital lending transformation also impact the internal operations.

For financial institutions, successful digital lending transformation can positively impact revenue growth while achieving significant cost savings. By making the borrowing process faster, more simple, and transparent, more applications will be generated, approvals will increase, disbursements will rise and better pricing can be offered. This is against a backdrop of less human interaction and more efficient processes which will improve efficiency and decrease costs.

Bank and credit union lenders need to adjust to the increased pace of change in the industry. They also need to deal with the effects of dozens of fintech and big tech firms encroaching on traditional lending business with improved digital lending alternatives. In other words, leaders at legacy financial organizations need to embrace change, take risks and disrupt themselves.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

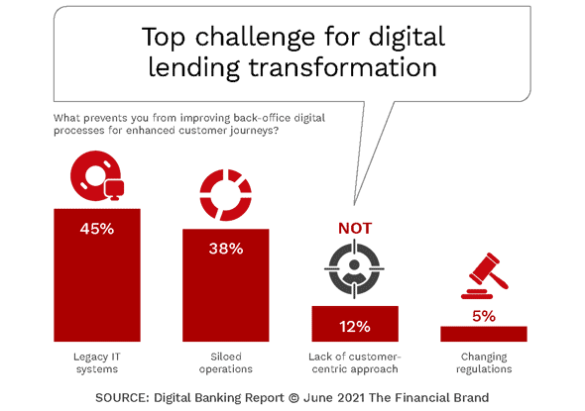

Digital Lending Transformation Requires Focus

While almost all banks and credit unions are progressing with different components of digital lending transformation, many are dissatisfied with their progress, especially in the offering of credit. Some of the challenges include having to cope with legacy IT systems, outdated back-office processes, a lack of a cohesive business plan to modernize credit offerings and customer experience across the organization, limited data and applied analytics deployment, and insufficient digital talent.

In many organizations, there is also a lack of leadership or single owner assigned to drive the needed improvements at a pace required. Digital lending transformation can not be considered a ‘project’, but must be an ongoing process of continuous improvement and innovation that reflects the changing desires of consumers wanting to borrow quickly and easily.

Without the needed leadership and focus, digital lending transformation efforts will be delayed or curtailed altogether. Research has proven that many financial institutions have leveraged the expertise of third-party solution providers who can help implement change. Having a partner to help guide the process helps secure the needed investment, keep the digital lending transformation on track and avoid incremental changes that can easily be substituted for needed end-to-end transformation.

Start With a Customer Journey Audit

As with any major transformation initiative that is intended to impact the customer experience, the best place to start a digital lending transformation is to take an end-to-end perspective of the entire customer journey, including the intended destination state and primary objectives that are desired. This customer journey audit includes both an external view of the customer journey as well as an analysis of back-office processes and operations.

The result of this end-to-end customer journey audit will be significantly greater efficiency with a vastly improved customer experience. Without an end-to-end orientation, changes to the lending process will most likely become piecemeal, missing opportunities to deliver the needed paradigm change in performance and approach.

Where to Start:

Start digital lending transformation by viewing the process from the perspective of the consumer, then focus on areas where greatest impact can be made the fastest.

Despite the need to analyze the entire lending and borrowing journey from the organization and customer perspective, it is also important to limit the scope of the initial waves of transformation, focusing on a minimum viable product (MVP). According to McKinsey, an MVP is “scoped to be substantial enough to drive real value, momentous enough to create excitement within the organization, and simple enough to be designed and implemented rapidly”. This kind of approach avoids too much early-stage complexity so that a transformative lending solution can be implemented more quickly, establishing momentum for future change.

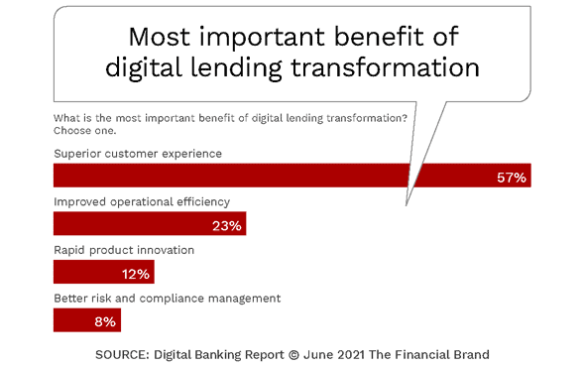

Organizations must also realize that simply delivering a digital lending product is not enough. It is important to transform the entire organization into a digital entity – that moves faster, has an innovation culture, encourages collaboration, streamlines operations and provides the tools for digital success across the organization. This requires digital leadership as well.

Read More: Buy Now, Pay Later Programs: Threats and Opportunities in Banking

Digital Lending Requires Back-Office Automation

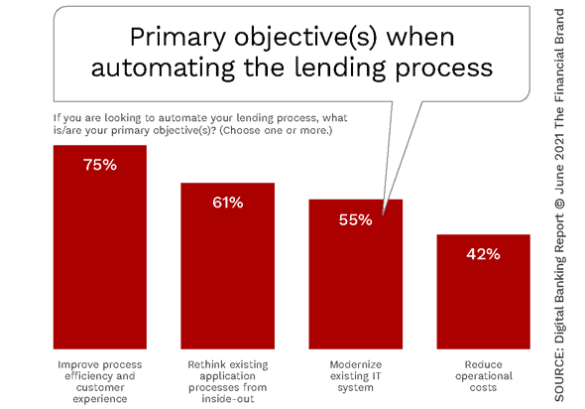

One of the major stumbling blocks in the transformation of digital lending is the comfort level with the automation of the lending process, including the potential of automating approval processes. Most financial institutions have long-tenured human-centered policies and proceedures that include manual reviews and cross-checks. The concern around risk and the nuances of many past lending decisions causes hesitation around automation.

Risk assessments at most banking organizations use experience-based subjective assessments to achieve low default rates. While these assessments are often very time consuming, they are also time tested. Alternatively, while the success of data-driven, model-based decision making continues to improve, automation needs to have universal buy-in to be effective.

To build an automated decision engine, most organizations test automation against past decisions made without automation. According to several global examples, a data-driven automated engine – with a structured credit ‘decisioning’ framework – was better at predicting default risk than the subjective human assessments. The decisions were also more consistent, which provides the foundation for future automation.

Organizations also often start with a minor sub-set of loans to build both experience and a history of credibility. As internal processes are automated and legacy steps are rethought and reconstructed, the automation process can prove itself with increasing percentages of loans being added over time. At the end of the day, automation and rethinking legacy processes is not optional for organizations looking for digital lending transformation success.

The Need for Agility and Flexibility

Change is never easy, especially for people and organizations that have had decades of success following time-tested processes. The challenge is that the marketplace has changed dramatically, requiring a complete rethinking of the lending process.

Transformation of the lending process is no different than the digital banking transformation being implemented across all product lines at banks and credit unions – it creates tension and disagreement between progressive and legacy bankers. Many transformation processes can get sidetracked due to legitimate but conflicting internal interests. People and departments can stifle change and innovation as they look out for their own interests rather than collaborating on creating efficiencies and improving the customer experience.

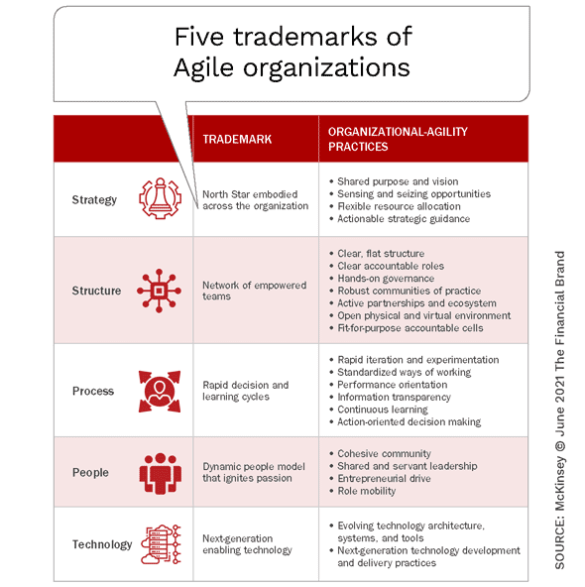

An Agile approach, with built-in flexibility, is paramount to successful credit transformation. This includes the use of cross-functional, dedicated teams that have decision-making authority with the mission of delivering results on deadline in intense bursts of effort called ‘sprints’. Unfortunately, as we have seen in the area of innovation, many organizations know what ‘agile’ is, and talk about being ‘agile’, but are not fully embracing the process – creating the impression, but not the impact of agile.

A significant challenge is the inability to embrace change when there are organizational silos. According to McKinsey, a cross-functional team with business, risk, IT, and operations is essential, for several reasons:

- Collaborating across all functions helps strike the balance of customer-journey and business efficiency objectives while focusing on improved credit decision making and adequate risk control.

- Allowing IT-development work to be controlled by the agile team allows rapid iteration and testing of journeys, data integrations, and results.

- Keeping a customer and ‘time to market’ focus helps to quickly assess trade-offs and work-arounds for IT and process bottlenecks as well as design solutions that allow rapid value delivery to customers.

The most effective digital transformation processes we have seen at U.S. Bank for new account opening and at organizations worldwide for other transformation projects have started with a blank sheet, rather than trying to work with incremental improvements to existing process. These organizations realize that ‘being digital’ does not begin with a legacy foundation. While the learnings from the past are helpful, they should not negatively impact the ultimate customer experience.

Leverage Third-Party Partnerships

Most organizations are ill-equipped to implement digital banking transformation alone. There is an increasing need for partnering with third-party organizations, including solution providers as well as fintech organizations.

Solution providers and fintech firms have the ability to evaluate current workflows and underlying credit processes without the bias of maintaining legacy journeys. There are several partnership opportunities in the marketplace that have already tested solutions and experienced the test and learn opportunities (and risks) to support real-time and online lending journeys. These types of partnerships allow banks and credit unions to develop new processes and create new solutions more quickly (and usually less costly) than developing everything internally.

Some of the advantages of third-party partnerships include:

- Understanding of the challenges and opportunities in the marketplace and within individual financial institutions.

- Ability to streamline decisions that are needed for all digital lending transformation, focusing on the unique components required at an partner organization.

- Experience in new lending approaches, including automated credit decisions, rethought internal processes and new product offerings.

- Skilled talent that specializes in digital transformation and digital lending.

- Data and applied analytics functionality that can enhance digital lending decision making and customer experiences.

The biggest benefit of third-party partnerships is the speed to market potential and scope of change. As opposed to incremental changes that could take years to implement, well formulated (and supported) partnerships can result in digital lending transformation being functional in months.

Don’t Delay, Start Today

Transforming digital credit processes needs to start immediately, leveraging steps that will improve customer experiences and reduce costs, while at the same time as reducing credit risk and expanding the potential number of consumers served. The steps used to improve digital credit offerings included the following:

- Complete a Self Assessment. How close is your organization to your desired state? What are the current times it takes for completing an application, assessing credit worthiness, approving a loan and disbursing funds? How does your organization find prospects and expand the credit portfolio? In other words, assess the entire customer journey, finding points of friction and removing steps that can be done more efficiently. Know your destination.

- Embrace Process Improvement and Automation. Assess where to start by ranking priorities based on the impact to the customer, impact to the organization and complexity of the solution. Engage a senior ‘point person’ to lead the process and get all impacted parties moving in the same direction. Be aware that change is both difficult and necessary. Don’t allow parts of the organization to hold onto legacy processes that negatively impact the transformation objective.

- Partner with Third-Parties. Review the marketplace and determine what organizations have the desired future state in place already. Review third party solution providers and fintech firms that can get you to the desired future state the fastest. Many of these potential partners can provide innovative processes and products that can be the foundation for future transformation initiatives.

- Use an Agile Approach. Move from talking about agility to actually implementing change through agile processes. Establish the parameters of the minimum viable product (MVP), determine the target IT architecture needed for the solution, and work across functions (business, risk, technology, and operations) on the components of change, following well-defined timetables.

- Focus on Constant and Never-ending Improvement. Understand your organization’s desired future state of digital lending transformation and use this goal as a motivating factor. Place the consumer at the center of the process and focus on the speed, simplicity and channel agnostic capabilities of leaders in the industry. When you have reached your initial future state of digital lending transformation, move the needle even further. The consumer expectations continue to set the bar higher as new offerings are made available.

The process of digital lending transformation is not easy. The path to success is not always evident. But, the potential to leverage third party providers that have already reached the desired state are available to assist.

Improving the digital lending process will make your organization more competitive in the marketplace challenges, more efficient and more profitable. According to McKinsey, “Success means much faster credit decisions, with customers getting cash up to 80 percent sooner; lower costs, with 30 to 50 percent less time spent on decision making; and better-quality risk decisions, which translate into greater profitability down the road.”