Financial institutions have to maintain perspective as the relationship between Americans and their wheels evolves — or they’ll react too soon to coming hot trends while missing practical challenges that are right in front of them.

Major macroeconomic disruptive forces are reshaping the auto lending market, from self-driving technology and shared vehicles, to ride-hailing and online-only dealerships. A new report by Raddon Research Insights says these factors will significantly change the relationship between Americans and their cars — both how they are used and financed — and urges financial marketers to adjust their auto lending strategy to these long-term trends.

The pool of potential vehicle loan borrowers has shrunk, due to multiple factors outlined in the report. Sales are falling as fewer Americans are buying cars than they have in previous decades, partly because better manufacturing standards means vehicles last longer, affecting both the new and used markets. There are also fewer new drivers entering the market, as younger consumers obtain their licenses later in their lives, pushing demand out past its traditional starting point. Some Americans are eschewing cars altogether.

The report also notes that interest in leasing has picked up among younger drivers, comporting with the trend among Millennials to pay for “slices of usage” and experiences, thereby further reducing the ranks of traditional owner-borrowers.

While such tectonic changes are significant and cannot be ignored, Raddon cautions that there are more immediate challenges that financial marketers must address.

For starters, they may need to shift the longstanding emphasis in auto lending business indirect lending (at-the-dealer) to a more direct approach. Raddon says this is important to yield more cross-selling opportunities and keep fintech disruptors at bay, and grow a business line that on its own offers shrinking margins and historically smaller markets. In short, banks and credit unions will need to squeeze every drop of profit they can from auto loans.

The study criticizes financial marketers’ cross-selling efforts with both direct and indirect auto borrowers, characterizing them as mediocre. In fact, fewer than one in five institutions even try to cross sell from auto loan relationships. If most banks and credit unions were honest, they’d probably concede that their cross-selling strategy with indirect borrowers is lazy and halfhearted.

Read More: Traditional Lenders Losing More Ground As Fintech Loan Share Surges

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Tech Hasn’t Changed Things Much (Yet)

Several new factors have surfaced that will significantly impact demand for vehicles in the future, though Raddon indicates that these trends aren’t affecting auto purchase volume much yet.

Self-driving cars are making progress, but remain a concept. The report holds that consumer ownership of self-driving cars remains many years away. One source quoted suggests that in time self-driving cars could reduce auto ownership by 43% by doing more work than today’s typical personal vehicle. (The report indicates that nine out of ten American households have some kind of vehicle.) By one estimate cited, the demand for new vehicles caused by that extra wear and tear on autonomous cars could, in time, balance reductions in travel caused by telecommuting and online shopping.

On the other hand, “while self-driving cars are still in the limited prototype phase and electric cars have not yet taken off in popularity, ride-hailing via apps like Uber and Lyft is changing how many Americans drive, although not in ways one would necessarily expect,” the report states.

Only 9% of consumers surveyed by Raddon use ride-hailing as often as once weekly. The report identifies five categories of consumer that use ride-hailing at least a few times a month. These include “credit-driven” consumers (59%); Millennials (41%); urban dwellers (41%); upscale consumers (40%); and primary customers of major banks (39%). (The first category is defined by Raddon as between 18-34 making between $50,000 and $125,000 or more, and is considered young affluent. The last consists of consumers banking with one of six megabanks.)

However, overall, only 14% use ride-hailing for daily travel and only 20% for local travel. Other alternatives to ownership, such as car-sharing and vehicles via subscription — there are even services like Getaround that are the mobile equivalent of Airbnb — represent a tiny share of the transportation market.

“Ride-hailing and car-sharing seem to be taking rides away from other alternative transportation options, rather than personal vehicles,” according to the report. “At the moment, even in urban areas, ride-hailing and car-sharing are not yet significantly impacting car ownership. However, as time, technology and regulations change, we may yet see that impact occur.”

Read More: Banking Providers Must Overhaul Lending for Digital Millennials

Changing the Economics of Car Finance Within Institutions

What about the current state of vehicle finance?

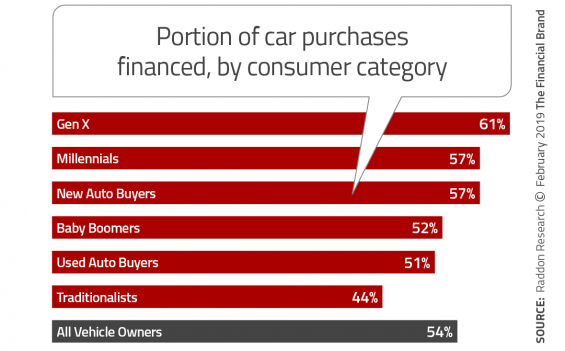

Just over half of America’s vehicle buyers finance their purchase, according to Raddon.

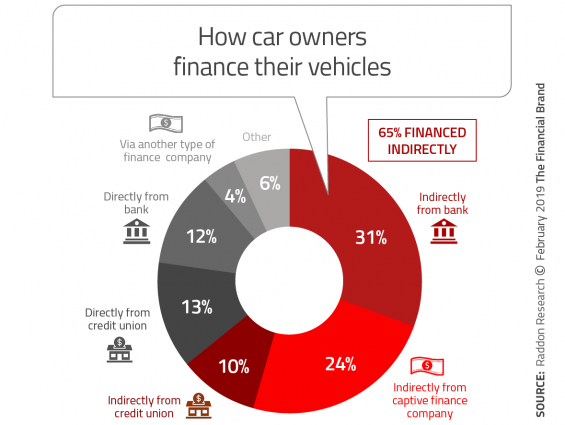

Raddon finds that 65% of borrowers opt for indirect loans. Banks account for 31% of that pie; captive finance companies, owned by manufacturers, account for 24%; and credit unions 13%. Buyers of new cars, as well as Millennials, the “credit driven” buyers described above and “middle market” buyers (aged 35-54 and making between $50,000 and $124,999), favor indirect borrowing.

Only 25% of borrowers obtain their loans directly, 12% from banks and 13% from credit unions. Buyers of used vehicles and Gen X borrowers are among those who favor direct loans.

“One of the justifications for engaging in indirect lending is the ability to gain customers who can then be cross-sold additional products and services,” the report states.

However, Raddon suggests this hasn’t been happening. Many indirect borrowers — 42% — say they are “not very” or “not at all” familiar with their lender. The study finds that comparatively few indirect borrowers — only 18% — recall being solicited for other financial services by their lenders. The study blames this not on lack of trying, but on the inability to cut through all the other marketing aimed at those consumers, both online and via traditional mail.

Indeed, while auto dealers maintain an ongoing direct relationship with the consumer through vehicle servicing, indirect lenders have little connection beyond billing.

Another couple of wrinkles here: The report finds that only 18% of prospective vehicle buyers intending to borrow anticipate that they’ll finance with their current primary financial institution. Among credit union members, however, 29% expect they’ll do so. Raddon feels that is overoptimistic.

Auto Lending Isn’t Always a Profitable Business

Cross-referencing data from Raddon’s Performance Analytics program, the report makes a strong case that the typical auto lender loses on indirect lending, while making a profit on direct lending.

| Profitability Metrics for Auto Loans | Direct Auto | Indirect Auto |

|---|---|---|

| Balance | $20,000 | $20,000 |

| Interest Rate | 4.42% | 4.66% |

| Replacement Rate | 2.30% | 2.25% |

| Net Interest Margin | 2.12% | 2.37% |

| Net Interest Income | $424 | $474 |

| Non-Interest Income | $72 | $69 |

| Fully Allocated Expense | $305 | $389 |

| Loan Loss Provision | 0.54% | 0.86% |

| Loan Loss Expense | $108 | $172 |

| Calculated Account Profit | $83 | ($18) |

The report cites two reasons for the extra expenses of indirect lending. The first is credit-related — indirect borrowers tend to have inferior credit compared to direct borrowers and this leads to higher credit losses. (Dealers typically work with multiple indirect lenders with programs designed for various segments, but a common point is that they strive to “move metal.”) The second is the “dealer reserve” — that is the commission paid for handling the indirect loan.

Raddon suggests that indirect lenders aren’t charging high enough rates to balance the credit risk of their programs. If they won’t do so, then, the report continues, they should be pricing direct credit to encourage borrowers to go that way.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

| Household Profiles of Borrowers | Direct Auto | Indirect Auto |

|---|---|---|

| % Single Product |

13% | 59% |

| Additional Deposit Balances |

$9,878 | $4,805 |

| Additional Loan Balances |

$14,449 | $6,187 |

| Additional Annual Profit |

$116 | $17 |

| Total Annual Household Profit (including auto loans) |

$150 | $35 |

The next couple of years may be an opportunity to cross-market to all borrowers, and to attempt to shift more borrowers to direct loans, before the influence of alternative transportation modes begins to bite. The report indicates that almost half of American households plan to buy both a new and a used car or truck in the next two years, and that almost three-quarters of them plan to finance their purchases.

Opportunity, perhaps. But institutions will have to work at it. One out of four borrowers say they will seek an alternative the next time they finance, and with competitors vying for a smaller pie, up-pricing will be hard.

One suggestion Raddon makes is for lenders to explore partnerships with mobile-based car buying services.

“It could behoove institutions to start playing in that mobile car-buying space to get better acquainted with existing providers, test marketing messages and understand their opportunities on the mobile screen,” according to the study. “Institutions that partner effectively and build competency in the digital realm today may be well placed for tomorrow.”

One example is Capital One’s Auto Navigator. The app permits consumers to pre-qualify for direct loans, shop virtually at participating dealers, customize their loan to the make and model they like, and then visit the dealership with financing lined up. One recent enhancement permits consumers to image-scan vehicles seen on the street, to explore potential deals and financing available through the app.