The gamer community is a very specialized group of consumers, but a very large one that is only getting larger in numbers and influence. There are now well over three billion gamers worldwide and almost 285 million of those come from North America alone, according to Statista.

There’s little evidence that the banking industry so far is seriously looking at this segment. In fact, Elliot Goykhman, CEO of Gen Z-tailored neobank Zelf, argues it is blatantly ignored.

“The creator economy by itself is really neglected by the banking industry,” he tells The Financial Brand, adding that gaming is in many ways an outlet for members of Gen Z to earn money. “Full-time employment was already on the decline before the coronavirus. Now that a lot of people are working remotely, it further promotes self-employment.”

“Creator economy” is a broad term for influencers and content creators who make money online. Gamers who make money from video games are a part of this creator ecosystem.

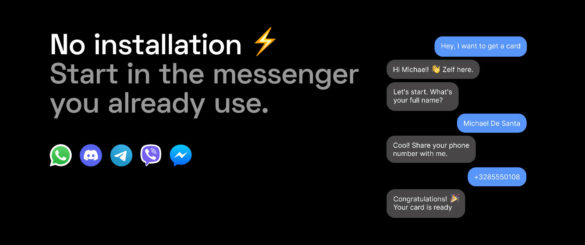

Goykhman didn’t launch Zelf to address the gaming population. The neobank is integrated directly into social messaging apps such as WhatsApp, Facebook Messenger and others. It has no digital bank app. And while it has a website, users can’t access their accounts there. Zelf began operations in June 2020, and by the end of 2021 it already had one million registered users.

( Learn More: The Most Popular Digital-Only Banks in the World )

The next goal is to reach five million customers by the end of 2022. To pull that off, Goykhman decided Zelf needed to take a much broader step. So, in early December 2021, it inked a partnership integration with Discord, a chat server, which has 350 million of its own users, 150 million of whom are active monthly. Discord has become a key tool for creators of all kinds, but gamers often use it to communicate while they play video games.

Games that use cryptocurrencies to pay gamers (called “NFT games” for non-fungible tokens) have gained traction in the industry, Goykhman says, which is why Zelf’s team is excited to bring a banking option to play-to-earn games that don’t use crypto as a primary payment source. “In providing these kinds of controlled financial services to the gaming industry, we help to ensure the sustainability of the gaming economies,” he says.

( Dig Deeper: Banks and Credit Unions Wade Into Crypto Banking (And Why) )

Although Zelf is based in the United States — Crunchbase reports that it is headquartered in Wilmington, Delaware — it is currently only operating in the E.U. and the United Kingdom. Goykhman says that in the E.U., Zelf uses French-approved digital bank Treezor SAS, a fully owned subsidiary of Société Générale. In the U.K., Zelf is backed by a firm that has both an E.U. subsidiary with an e-money license and U.K. FCA licensed institution. Zelf expects to launch its services officially in the U.S. in the second half of 2022.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

A New Kind of Banking Customer

Goykhman doesn’t look like your average bank executive — one side of his head is dyed bright pink, the other blonde (in his LinkedIn portfolio photo, it’s all neon green). In his Zoom interview with The Financial Brand, he sported a shirt covered with graffiti in what looked to be a small, cramped office in New York City.

Reading that, one might be surprised to learn Goykhman worked in legacy banking and technology corporations for years. He was CIO at Russian banks B&N Bank and MDM Bank, a Vice President at BNP Paribas and Barclays Capital (each for a year), a Principal Consultant at Deutsche Bank and a Systems Analyst at HP and Ernst & Young, in addition to eight other various roles.

The gamer market consists primarily of Gen Z and younger Millennials who make money by freelancing online, trading digital commodities and cryptocurrencies on Discord. Or they can be hired by retail companies to start a TikTok advertising campaign.

Goykhman saw a need for a financial institution to get involved. The sector is fraught with fraud, he insists, and there is often illegal trade of in-game assets. “It’s really crazy, because it’s a gray market. It’s not something that the games allow or build special interfaces for because of that. People are really on their own and they don’t have any legal recourse.”

Goykhman uses the example of an item purchased through a video game, such as a video game skin. (“Skins” change the appearance of an item in a video game and can be purely aesthetic, or can be used as tokens to bet with.) If one gamer decides to sell a skin to another gamer for $250, and the trade is facilitated, but the money isn’t transferred, the seller is out of luck.

Traditional banks will say that “nobody stole your card, it was not a fraudulent transaction, you can go to the police,” Goykhman maintains. “Then, how will police react when I tell them ‘Oh, I was in Counter Strike, and I was talking to this guy in a green jumpsuit and he promised he would pay me $250.'” No one takes it seriously.

Read More: Mobile Ordering Fad Poses Payments Fraud Threat

In the end, fraudulent activity can only be prevented by terms and conditions contracts and lawsuits or shutting down accounts of players altogether. By building banking into existing messaging software that gamers — or creators — are already using, it is much easier to facilitate legal and legitimate purchases.

“Zelf in Discord will bring much needed security and transparency for the P2P transactions of skins, weaponry, characters, in-game cosmetics and more, enabling the future of banking,” says Goykhman.

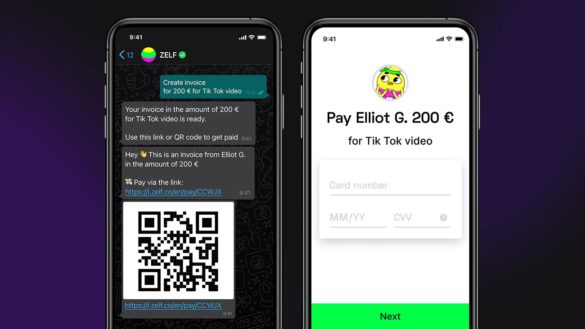

As eSports — competitive video gaming — grows in popularity, so does its segments of gamers playing for digital commodities or cash. To ensure that their customers can facilitate safe and reliable payments, Zelf also introduced an invoice software right into the messaging apps.

Invoices definitely could use some improvement, Goykhman explains. “If you ever created an invoice in PayPal, it probably takes five minutes of typing and then you need to send it to the person’s email. They need to receive it, but then they also sometimes prompt you with a pro account,” which he adds creators often can’t afford.

What Else Zelf Is Up To

Prior to launching Zelf, Goykhman and his team designed banking software and social messaging app integrations for banks in Europe. With the money they earned, they launched LikeBank, which eventually became Zelf. Goykhman — a serial entrepreneur — says that he’s frustrated banking is not as innovative as it could be.

“Some of the most inventive technologies in the world are iPhones and Teslas,” he says. “It just pains me to see how this technology is not utilized to its full potential.”

Zelf, although it exists right now only in apps like Facebook Messenger and Discord, is slowly rolling out more banking features. Right now, members of Zelf can open an account and then make purchases with the money they earn from gaming, using a digital credit card. The card can be loaded onto customers’ Google Pay or Apple Pay accounts. Goykhman explains that there has been no need yet for Zelf to offer physical cards.

Down the road, however, he says customers might be able to order it separately if they so choose. “There might be a cost associated with it, just for us to really offset the carbon footprint and the impact on the environment.”

In the first quarter of 2022, Goykhman says Zelf will roll out controls so parents can monitor their kids’ accounts. “A lot of our customer base is young, which means that oftentimes they are doing banking as a sort of dependent of their parent account.”

Goykhman also notes there is no need for Zelf to pursue a banking license in the United States right now, because in many ways, it is easier to expand geographically by “riding the coattails” of institutions that are already federally recognized.

( Dig Deeper: How Neobanks Are Catering to the Youngest Generation of Consumers )