“Ephemeral” and “banking” are two words that haven’t gone together, historically. Banking has always been about longevity, solidity, and, above all, permanence. Anything touching on the temporary, fleeting nature of a word like “ephemeral” would never have passed muster in the executive suite.

Yet now “ephemeral marketing” is growing in popularity, even for financial brands, and for any bank or credit union marketer whose roots extend back to classic times has some mental hurdles to get over.

Broadly, ephemeral marketing “is content that’s only available for a temporary amount of time,” according to Laura Ziemer, Director of Insights, Digital Strategy, at Comperemedia, a Mintel company.

Why would a brand want marketing that goes “poof”? The equivalent of a Mission Impossible self-destructing message?

“Consumers are perceiving this as much more authentic and organic,” says Ziemer. “So even if it’s a message from a card issuer, a bank, or a credit union, you come across more as a person than as an institution. This is because you are engaging with someone in a way that’s very raw and authentic. And that’s resonating with consumers.”

Messaging with a Shelf Life and Limited Length

This appeal proves especially strong among younger consumers, who like the channels that are especially conducive to ephemeral marketing. The guerilla and casual nature of ephemeral marketing feels more genuine to these consumers than many typical financial marketing formats, according to Ziemer. She recently published a report, 2020 Omnichannel Marketing Trends, that included ephemeral marketing.

Instagram is a prime example of ephemeral marketing, with its Instagram Stories, postings which typically expire and go “off the air.” Ziemer says one notable effort was by American Express, which promoted the revamp of its Delta SkyMiles American Express Card with actress Elizabeth Olsen in a Stories sequence.

“They put the event on Instagram Stories so that people who weren’t in New York could attend the event virtually,” explains Ziemer. “Promotions like these, because they are brief and not posted permanently, aren’t necessarily perceived as advertisements. People perceive them as organic engagement instead.

Instagram Stories has over 500 million daily users, and users under 25 spend over half an hour daily looking at the stories.

Smaller banks and credit unions can make use of such short-term social promotions, Ziemer continues, for events like grand openings. They can also be used to bring consumers to longer-lasting content, such as a website series on financial health topics, she suggests.

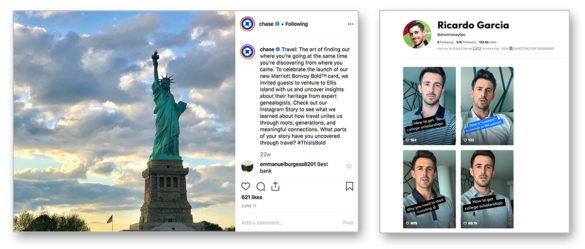

Chase announced the debut of its Marriott Bonvoy card with Instagram post and Instagram Stories, left. Ricardo Garcia’s TikTok effort is cited by Comperemedia as an example of how to reach younger consumers. Garcia boils financial advice into 60-second blocks.

Other platforms can also work with the ephemeral approach. In this case, while they may not disappear, they are quite brief — blink and they are done.

Ziemer says this technique is growing in popularity for marketers who use the TikTok app, which features ultra-short videos — 60 seconds and done.

Comperemedia’s research indicates that more than 9 million TikTok engagements were driven, by mid-November 2019, by short clips that consumers posted showing something about the Apple Card, for example. Some were as simple as five-second clips showing the social poster activating their Apple Card on their smartphones.

Another meme across multiple platforms is #CreditCardChallenge, in which parents give kids with credit cards one shot to use their cards without supervision. The test: Can they catch the card with their forehead as it drops along a wall after being released by a friend or parent?

Read More: Financial Marketers Staggered by Facebook’s Radical Ad Rule Changes

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Who and How and When You Want to Reach Them

To financial marketers steeped in the science of the sales funnel, it can be hard to get the mind around such, well, ephemeral things. But increasingly, Ziemer says, financial institution marketing is not going to be about any one channel nor any one audience.

First, she says, different parts of the audience institutions want to reach will prefer different media.

“We all have our preferences for where we engage with content, and how we engage with content,” says Ziemer. The emphemeral approaches she spoke of “are going to be very effective ways for financial institutions to connect with a younger audience and with consumers who are very active on social media.”

Regarding the second group, TikTok has a reputation of being a Gen Z hangout. Comperemedia research has found that while Gen Z has driven growth of the platform internationally, in the U.S. 33% of Millennials have used TikTok. In fact, among adults over 45, usage can be credited to fathers who want to use apps that their kids like. 24% of fathers with children under 18 use the video app at least daily. Comperemedia also finds substantial crossover among platforms, with millions of mentions of what’s happening on TikTok appearing on Instagram and Twitter.

“People will engage on platforms that make sense for them,” says Ziemer. “So your brand has to be on a variety of channels so consumers can engage on their terms.” The analyst says she tends to use Instagram, and doesn’t spend as much time on Snapchat or Facebook.

Tag, You’re It. Tag Again. And Again

A major shift from the past is increasingly there is an “omnichannel” of marketing. This does not refer to the way services are delivered in this context, but instead to the way messages reach and are absorbed by consumers.

The trend, says Ziemer, is to look at “multi-touch” attribution. She explains that this is not just the last form of marketing outreach that a consumer experienced before making a buying decision, but every interaction with the brand.

“The idea is to look at everything that you were exposed to that influenced your decision to apply for this credit card or open this deposit account,” explains Ziemer. All forms of contact and content contribute to the eventual result — online ads, direct mail, interactions in branches, and, as described, ephemeral marketing efforts.

“You might have certain groups that receive social media and direct mail from your brand. You might have others groups that get social, direct mail, and streaming video,” says Ziemer. “When you get applications or open accounts, you can look back through and see what channel mix drove sales most effectively for you.”

Because consumers are influenced at multiple times, in multiple ways, marketers shouldn’t necessarily always be looking for a literal cause and effect relationship immediately. Some channels serve best as ways of gauging consumer sentiment toward a product or a brand, suggests Ziemer.

Pointing to the #CreditCardChallenge, Ziemer acknowledges that it’s not likely a consumer will apply for a card on the basis of an activity like that on social.

“But you can probably get a sense of how consumers feel about your brand and others’,” she adds.

Read More: How Financial Brands Can Master Multi-Channel Marketing

Video’s Becoming a Mandatory Marketing Tool

One standout trend on many platforms and channels, says Ziemer, is the role of video.

“Regardless of the channel, video-based content is increasing rapidly,” she says. “Whether you are talking about YouTube, an ad that runs before an online news clip, a streaming video post, or ephemeral marketing, things are going video instead of static.” In the report, Ziemer cites figures from Google and Cisco indicating that by 2021 85% of online viewing will be video-based. Increasingly brands must come up with ways to get around ad blockers, or at least to make their material worth consuming.

Anecdotal evidence indicates that more financial brands are hiring in-house video talent, something that would never have happened except in the largest institutions a decade ago.

“It makes sense to have experts like that in-house. They really know your brand and they can work with your product managers, and they can work with your regulatory and risk teams to make sure everything is as it should be,” says Ziemer.

Smaller banks and credit unions need to consider that the costs of reaching consumers with video is cheaper than it used to be. YouTube and other video platform buys can be narrowed substantially to reach only the people the institution truly wants to reach. This not only means that video is cheaper than it was, but can, because of that ability to target, be less expensive than the institution’s previous mix.

“Streaming platforms are actually pretty affordable and you can do some great test campaigns without having to go all-in with a six or seven figure budget,” says Ziemer. “Consumers are spending a ton of time on streaming video.”

Something that’s just beginning that excites Ziemer is the marriage of streaming video and technology that allows the consumer to pick their own path, with the content changing. A financial example might be a general opening about lending that branched to related video concerning a particular borrowing need that the consumer has. While this method might not produce an immediate sale, it can help guide future marketing simply by showing where the consumers choose to take their video journeys.

Don’t Forget the Branch. Yes, the Branch

Ziemer says re-thinking physical offices is also beginning to show promise. Her report looks at Chase Home Centers, which are specialized branches designed to bring together prospective borrowers, real estate agents, and mortgage specialists. The centers are designed to educate consumers and help them assess realistically what they can afford and to then look at properties in that range.

“So, rather than thinking about the branch as a transactional place, use it to support consumer research,” says Ziemer. “What’s great about the Chase home centers is that they’re a very soft sell. They make it clear that they are there to support the consumer, and that they aren’t going to ask for the sale immediately.”