I just spent a week in London after close to three years of not traveling internationally due to the impact of the pandemic. The primary purpose of my visit was to be a presenter at the Fintech Finance Awards hosted by Fintech Finance News. From hundreds of entries, 18 winners were selected, recognizing the best of the best in fintech offerings in sectors including consumer banking, business banking, embedded finance, open banking, payments, lending and many other financial solutions.

It is indisputable that fintech firms have become a valuable source of financial innovation and customer choice globally. However, in talking to bankers, fintech leaders and consultants at the event and during the rest of my visit to London I found challenges remain. My key takeaways:

- There are exceptional examples of fintech solutions that are helping to modernize the entire banking ecosystem.

- There is a wide divergence between the maturity and performance of the best and that of the rest (both by geographic region and fintech organization).

- There are few examples of fintech firms that have achieved scale or global relevance despite solution excellence.

One overarching observation: While the winners represented the best-in-class fintech solutions from across Europe, the names of most of these firms would be unfamiliar to people and organizations outside the region. In fact, some of the finalists were not even familiar to people at the event.

Is the challenge marketing, distribution, scalability, regulatory requirements … or something else?

Fractional Marketing for Financial Brands

Services that scale with you.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Some Fintech Firms Are Winning Despite Marketplace Challenges

The uncertain economic environment in Europe and globally is impacting the entire banking ecosystem, but has hit the fintech sector especially hard. Funding new and existing fintech firms has become an uphill battle as valuations have fallen. That said, many of the most differentiated and future-ready fintech firms have found ways to remain resilient, leveraging flexible business plans and positive cash flow to their advantage.

According to McKinsey, challenges for fintech firms include market maturity, access to capital, a challenging regulatory and legal framework, access to talent, the ability to scale across borders, and customer receptivity to new solutions. Issues of language and currencies can also play a role in determining whether fintechs can emerge and scale across regions.

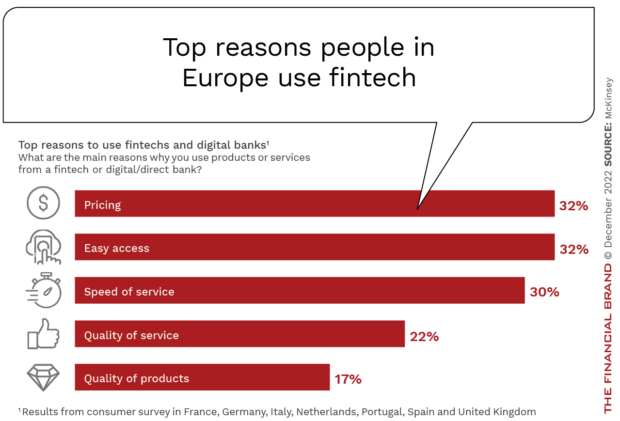

In Europe and the U.S., several fintech firms have moved from the fringes of the banking industry to become primary players. For instance, in each of the seven largest European economies, at least one fintech firm now ranks among the top five banking institutions as measured by market value, McKinsey found. In most cases, the growth of fintechs has been driven by strong customer satisfaction scores, very aggressive pricing, ease of use, speed of service and product differentiation. Some examples include Swedish fintech Klarna, London-based Revolut, China-based Ant Group and Tencent, and Brazil-based challenger bank, Nubank.

Fintechs have also contributed significantly to the speed of innovation across the entire banking ecosystem. This has been as a competitor as well as a digital transformation partner for legacy financial institutions. In some less-developed regions, fintech firms have become the de facto financial services leader by providing banking to underserved or unserved markets.

Read More:

- What Banks and Fintechs Must Do to Survive the Recession

- Why Neobanks and Fintechs Have Made ‘Underbanked’ an Obsolete Term

- The World’s Biggest List of Digital Banks

Wide Divergence Between the Best and the Rest

Research shows there is a wide gap between successful regions of the world and those less successful in the development of fintech organizations. For example, the United States, United Kingdom and Sweden significantly outperform other European countries. Developing countries also tend to do well with fintech performance. The U.S. benefits from a rather homogeneous market, with a single language and a relatively cohesive regulatory system.

Similar to the U.K, the U.S. has connections to other large economies and has a large pool of investors, making access to capital easier. Both countries can also attract talent from the world’s best universities.

Wake-Up Call:

In some markets, fintechs are already serving 30% of customers and generating 3% to 5% of banking revenues.

– McKinsey

A wide performance gap also exists between the strongest fintechs and those struggling to achieve relevance, funding, scale and revenues. This gap has grown much wider in the past year as the economy and funding sources have faltered.

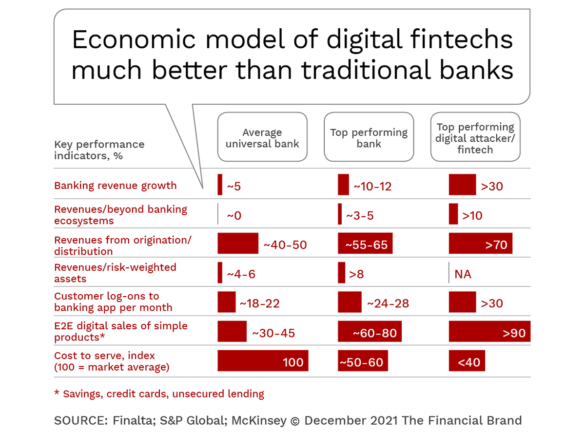

The same performance gap exists among traditional financial institutions. Those legacy banks and credit unions that have doubled down on digital transformation initiatives have became the darlings of Wall Street.

Larger financial institutions as well as leading non-traditional firms are stealing the lion’s share of market cap growth in the financial services industry and are breaking records for venture capital investment. According to McKinsey’s Global Banking Annual Review, this is causing a significant divergence between the industry’s top performers and performance laggards.

Provide Your Thoughts on LinkedIn: Can Fintech Firms Gain Global Relevance?

Challenges to Global Expansion

Building scale in the fintech marketplace is usually very slow. Even then, growth is often achieved within a single region. McKinsey indicates that most countries with more than one unicorn it takes between six and eight years from initial funding to become a unicorn. Often, the inability to scale beyond borders occurs because the fintech’s business model was built without an internationalized vision.

Scaling for Success:

To become future-ready, fintechs in every global region will need to be able to expand beyond their home market.

– Digital Banking Report

McKinsey found six factors inhibit global (or even regional) expansion. These:

- Market structure and maturity: A major factor affecting the ability (and desire) to expand is how many years a fintech firm has existed and the founders’ experience. Broader solutions tend to be from fintech firms that have benefited from the experiences of others.

- Access to capital: The availability of capital within and beyond the origin of a fintech has become a key determinant of success, especially during these challenging financial times. Without a lifeline of capital, global expansion is unlikely.

- Regulatory and legal framework: In some European countries regulators are seen as facilitators of innovation, while in other countries they are seen as an impediment to innovation and expansion. Most countries are trying to find the right balance between enabling fintech innovation and ensuring customer protection. Just as challenging are the differences in regulations from country to country. Without uniform regulations, expansion will remain difficult.

- Talent availability: Remote work has improved the ability to acquire talent internationally. However, there is still massive competition between traditional banks, fintechs and other tech firms for talent. In addition, building a team to serve international needs is beyond many fintech firms’ scope.

- Requirements for scaling: In some cases, the challenge can be as fundamental as lack of a widely spoken language or a universal currency, differences in culture, or a coordinated regulatory structure.

- Customer trust: Dealing with money bring responsibilities and challenges for fintech firms. Fintechs usually need to offer significantly superior products that provide clear benefits or convenience to customers to overcome a lack of brand recognition and trust. Incumbent financial institutions have this benefit built into their awareness.

Says McKinsey: “In the coming months and years, it will be critical for all stakeholders — including public institutions, established financial industry players, and fintechs — to combine their strengths by establishing the enabling structure and mechanisms the sector needs to reach its full global potential.”