Varo Bank, the first, and only, consumer fintech to obtain a de novo national bank charter, has downsized its staff, reconsidered the scope and goals of its marketing, and doubled down on product development. But what founder Colin Walsh isn’t having second thoughts about is the strategy Varo had when it first set out to become a bank.

“I have no regrets in our decision,” says Walsh, CEO. “It was informed by a number of factors that still hold true.”

The key one, according to veteran banker Walsh, in an interview with The Financial Brand, was that “we could create an institution that could help millions of consumers trying to achieve greater stability and control in their financial lives” and that doing so would require a full-service charter. The bank’s slogan is “A bank for all of us.”

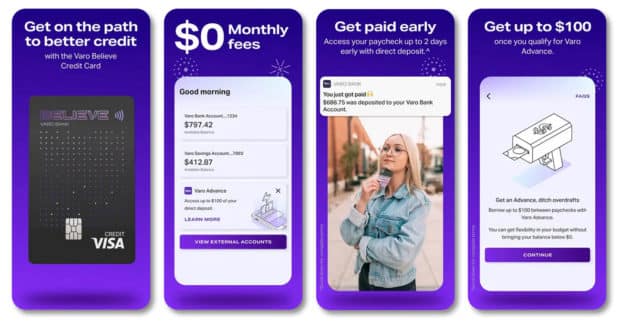

The original Varo Money, founded in 2015, was among the pioneers in the account features that drive many neobanks today, ranging from eliminating charges such as overdraft fees to helping consumers build credit with secured cards to offering early access to payroll direct deposits.

Critical to doing all that was the charter, which cost organizers roughly $100 million in legal and advisory fees to accomplish, according to estimates. Walsh says that the only practical way to help people succeed on both sides of the balance sheet is to have a bank charter. The national charter was awarded by the Comptroller of the Currency in mid-2020.

“No sponsor bank can allow you to run the whole gamut of financial products,” says Walsh in reference to banking as a service arrangements. That’s also why the now moribund OCC “fintech charter” wasn’t attractive to Varo, Walsh says — it favored specialized operations, not full-service players.

Being in total control also means speed to make changes, according to Walsh, essential to Varo and to every institution in a changing economic environment.

Walsh says this will make a big difference for profitability, which hasn’t happened yet. Quarterly losses have been in the millions.

“You’ll see, in our call report for quarter three [2022], that we’ll have our losses down by 40% from where they were in quarter two, because we were able to pull the levers very rapidly. That would be much harder to do if we had to go through a sponsor bank.”

— Colin Walsh, Varo Bank

Walsh thinks the charter has played out well in many ways, though Varo is in the midst of multiple course corrections, in the wake of a 10% staff layoff in July 2022.

“The charter was hard-earned,” says Walsh, “and it will start to show through as the more robust business model as we traverse the choppier waters ahead.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Answering the Critics: Varo Is Viable and Not for Sale

Varo has had to take steps to slow its capital burn, but Walsh has stressed, both in this and other interviews, that the institution remains strong in capital and that it is not going to run out. He admits that there were surprises along the way. Walsh adds that the costs of establishing a newly chartered bank at times rose higher than anticipated.

“I think we may have underestimated how much we were taking on directly ourselves,” says Walsh. The costs of bringing many back-shop functions in-house that had formerly been handled by Bancorp Bank was a challenge. These included deposit operations, anti-money-laundering compliance and anti-fraud functions.

“We quickly figured out what we needed to do,” says Walsh, “but that first year was not for the light of heart.”

Having a charter and its own deposit insurance has enabled Varo to control its own regulatory destiny, something he’s valued, though at times the process has been challenging. “When you’re operating with a sponsor bank, you’re not a bank and you’ve outsourced your regulatory responsibility to another institution,” says Walsh.

With a charter that’s just over two years old now, Walsh thinks those who focus on Varo’s losses “forget the fact that we’re like a brand-new bank, even though we’re operating at a level of scale,” he says.

Indeed, something that gets lost is that when Varo gained its charter, it had to acquire the deposit relationships it had had when it was Varo Money. The roughly two million relationships belonged to Bancorp Bank, which had provided banking as a service support before the charter.

Within the last couple of decades, regulators typically expected de novo community banks to hit profitability within seven years, later reduced to five. Many neobanks and fintechs today have yet to reach profitability. Yet there are pundits and observers who seem to take relish in predicting that Varo, which has also been burning through capital, is on thin ice.

“I guess it’s just all good sport because they are also rooting against everybody in crypto, investment apps, digital banks, you name it,” says Walsh. “I guess because we have to publish a call report we make an easy target.”

Optimism on Varo's Horizon:

Varo Bank's Colin Walsh says he doesn't want to give an exact date when Varo will become profitable, but he believes it will do so in the next couple of years. At some point afterward, if securities markets are in a receptive mood, he can see Varo going public.

Some might think that a profitable Varo could make an attractive acquisition, but Walsh insists this isn’t in his plans.

“It’s not something I’d be looking to do. I built this company because I want to create a culturally relevant brand that endures the test of time, that stands for something meaningful and purposeful in banking,” says Walsh. “I would never rule out being an acquirer at some point of other companies at the right point in time. But we’re not considering that at the moment.”

Read More:

- Dave’s CMO Breaks Down the Neobank’s Digital Marketing Strategy

- Understanding the Retail Bank that Apple Has Quietly Built

- Can Innovative ‘Save Now, Buy Later’ App Challenge BNPL?

- Neobank ‘Cheese’ Targets Unique Market Via Banking as a Service

Shifting from Marketing to Product Development

Varo’s first marketing consisted generally of “bottom funnel” efforts — promotion to push hard for signups and new accounts. Before long, the new bank’s marketing emphasis began to shift to much more of an “up funnel” approach to build much broader awareness of what Varo is and who it wants to serve.

A major nationwide campaign followed, including a commercial run during the 2021 Super Bowl, transit ads, hand-painted billboards in urban neighborhoods around the country and more. The huge campaign for Varo stressed the theme of “bank for all.” A common element in all media was use of images of common people of diverse groups on U.S. currency.

More marketing stressing the bank’s overall theme was put out to spread awareness after basketball star Russell Westbrook invested in the bank and was featured in commercials promoting his belief in what Varo was doing. Westbrook, of the Los Angeles Lakers, heads his own philanthropic group which has a strong interest in financial inclusion.

The cost of these and other marketing efforts added up. In the bank’s yearend 2021 call report the line item for advertising and marketing expense came to $123.3 million. The bank had assets of $593.2 million in mid-2022.

Walsh said as he and his management team began to discuss ideas to contain costs, marketing spend came under scrutiny.

“We thought, ‘Look, we’re probably getting a little ahead of ourselves in terms of investments in branding and paid acquisition. So let’s scale that back’,” says Walsh. This is one of multiple steps taken, according to a message from Walsh to employees, to decrease the bank’s burn rate “to ensure that Varo has sufficient capital to execute on our strategy and path to profitability.”

At the same time, management decided to focus on creating additional products to better serve its target market, predominantly lower-middle-income consumers.

To handle this, the bank created Varo Tech, which unites its technology, design, data and product functions into one business unit. The idea of merging the functions is to reduce friction by eliminating silos.

“We’re doubling down on our tech chops to create products consumers will love,” says Walsh. “You’re going to see some exciting things.”

Walsh adds that some have taken this move to be an effort to provide Varo’s own take on banking as a service, developing products not only for its own use but for licensing to other institutions.

“There’s been some speculation, but that’s not the case,” Walsh insists. “We’re not going into the third-party BaaS business.”

Read More: Cross River Bank’s Strategic Plan: BaaS, Crypto and Fintech Investments

Varo Customers’ Primary Banking Attitudes

Gossip on job boards and commentary elsewhere claims that many of the customer relationships Varo has are not primary banking relationships and that some accounts are quite small. How much truth is there in this chatter?

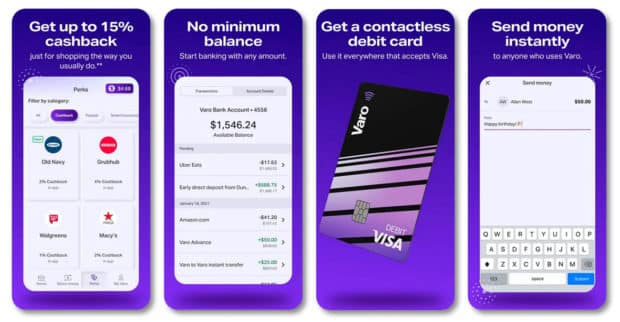

Walsh says it’s true that some consumers have narrow relationships with Varo, using the bank’s app chiefly to try to put some savings by or to access some of the perks the bank offers. An example of the latter are cashback offers from participating merchants that can be as high as 15%.

“So, yes,” he says, “it’s true in the sense that there are a number of use cases in which folks engage with us.”

“But then we have a core group of consumers that choose to make Varo their primary bank account,” continues Walsh. These people make recurring deposits. To increase Varo’s draw to consumers like these, it recently increased its base savings rate to 2%. Under some circumstances Varo depositors can earn a 5% rate.

“While that’s a subset of our base, those customers generate the majority of our revenues, and they’re the ones we’re able to unlock the most value for,” says Walsh. He says these relationships generate strong net promoter scores. He adds that the bank’s app has a 4.9 rating out of five on the App Store and a 4.7 rating on Google Play. (Just for comparison’s sake, both of those ratings are slightly ahead of those for Bank of America and Chime.)

Most of Varo’s assets currently consist of interest-bearing balances at other banking institutions, according to the June 2022 call report.

“We have the ability to raise deposits. So in a rising rate environment I am in some cases the only neobank celebrating every time the Fed raises rates 75 basis points, because we are sitting on a lot of cash,” says Walsh.

Read More: How Inflation & Recession Talk Is Changing Bank Marketing Strategies

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Key Goal: Profitability from Lending

Thus far, Varo’s lending activities have consisted chiefly of small-dollar programs for customers. These include Varo Advance, which provides short-term advances of up to $100, at no or low interest, depending on the amount.

Another credit option is Varo Believe. This is an app-driven secured credit card. Users can transfer a given amount of cash on deposit with Varo to back charges. The amount transferred represents the total credit line. Repayment can be handled directly or via automatic payment from the cash securing the card. Varo reports the repayment cycle to the credit bureaus to generate a positive credit record for the card holder.

Given this structure, loans represent a very small portion of assets at present — less than 5% — and the bank still relies on interchange income for a significant part of its revenue. Walsh says Varo is working on additional lending opportunities. One possibility is setting higher limits on the bank’s small dollar loans, which Walsh says it is experimenting with currently. Another potential product is a nonsecured version of the Varo Believe credit card.

This is just a beginning, says Walsh. “We absolutely have the ability to expand access to credit on our roadmap.”