“Win-win” is bland and overused, but sometimes it really fits. As the partnership between BankMobile and T-Mobile to offer T-Mobile Money kicked into its hard launch in mid-April after a soft start late in 2018, it has been tough to figure which company scored the bigger coup.

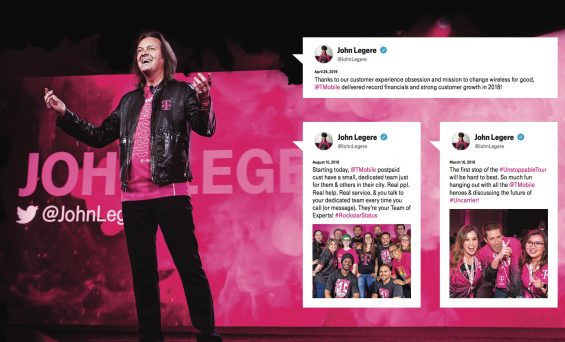

For T-Mobile, which proudly calls itself the “Un-carrier” to reflect its buck-the-crowd ways the banking deal represents a victory for John Legere, CEO, to break down yet another market barrier.

“As more and more Americans manage their money on their smartphones, we saw an opportunity, as the Un-carrier, to address another consumer pain point and create a new value proposition,” Legere said during an earnings call posted on YouTube.

“Un-carrier” John Legere of T-Mobile may not become a fixture at mainstream banking conferences, but his new T-Mobile Money is making a splash.

Legere, who carries himself like a rock star — complete with black leather clothing and pink accents— could easily call himself “The Un-Banker” while he’s at it. He has noted that T-Mobile saw an opportunity to climb aboard the mobile money management trend, because “traditional banks aren’t mobile-first, and they’re definitely not customer-first.”

The T-Mobile leader told CNBC in an interview several years ago that he ignores barriers, an attitude that his fellow industry CEOs don’t subscribe to. “And that’s a competitive advantage that’s worth billions,” he insisted. In 2013 T-Mobile became the first major carrier to drop contracts for mobile service.

In banking, Legere wanted to change things up, offering consumers an insured transaction account that offers 4% interest on balances of up to $3,000, and 1% on balances above that. The mobile-based accounts, which are available to anyone, not just T-Mobile users, includes a physical debit card, and are promoted as being fee-free. Marketing clearly targets overdraft fees as public enemy #1.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

T-Mobile aims its T-Mobile Money service at consumers tired of bank fees and inconvenience. The video spot this is taken from puts big banks squarely in its crosshairs.

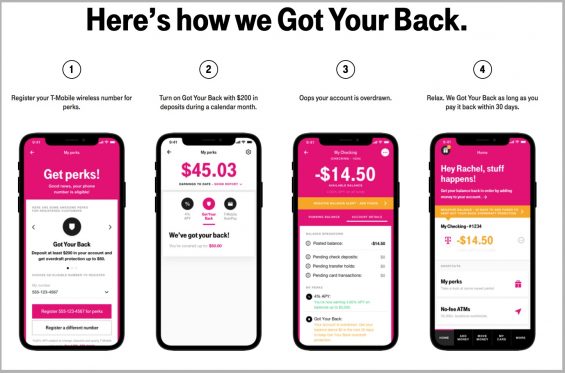

T-Mobile users get the full 4% interest-rate, provided they deposit at least $200 monthly. Depositors who do not have a T-Mobile account earn 1% on all balances. “Got Your Back” overdraft coverage can be opted into, with overdrafts of up to $50 permitted without charge, so long as the balance is restored within 30 days.

The account, built to be mobile-first, offers multiple mobile ways to pay for products, services and bills. Users can enroll in the Apple Store or the Google Play Store.

Read More:

- Becoming a ‘Digital Bank’ Requires More Than Technology

- Eight Challenger Banks Traditional Institutions Should Worry About

Deep New Pool for BankMobile to Fish in

While T-Mobile has avoided speaking of specific sales targets, the potential is vast. Consider that T-Mobile has north of 80 million mobile customers, and that on top of that built-in constituency, it is a marketing machine whose reach keeps on growing. It is in the midst of a merger with Sprint, a deal that would combine the third- and fourth-largest carriers if efforts to win over skeptical regulators succeed. But even before that, T-Mobile has maintained a growth streak of over 1 million total net customers each quarter for 24 consecutive quarters.

“T-Mobile MONEY is about the future of banking, platforms and disruption,” opined TheStreet.com. “It’s a trend investors must understand.” While there are skeptics — BankRate’s Greg McBride, Chief Financial Analyst, thinks the $3,000 top-out for high interest will limit the appeal — T-Mobile Money represents a few more pieces of the banking-commerce wall falling down.

Here’s where the “win-win” begins to show. T-Mobile has accessed banking services not through any special charter or an obscure loophole, but from a relatively new twist on the classic “white labeling” strategy that long dominated retailer credit cards. The banking engine behind T-Mobile Money is BankMobile, the mobile-first division of Pennsylvania’s $9.8 billion Customers Bank. The deal with T-Mobile represents a major expansion of the BankMobile’s “Banking as a Service” strategy.

From its beginning, says Luvleen Sidhu, BankMobile’s Co-Founder, President and Chief Strategy Officer, the institution “saw a shift in consumer needs, but at the same time recognized that the old sort of customer acquisition model in terms of traditional banks is quite inefficient.” Bank branches open a comparative handful of accounts, she says, versus what can be done in serving consumers via the web with completely mobile services.

“Banking as a Service” is something of an evolution for BankMobile. Its roots go back to when veteran banker Jay Sidhu, Chairman and CEO of Customers Bank, and Luvleen’s father, gave an impassioned speech at a 2015 fintech conference eviscerating the industry’s branch model, its customer service practices, and its overdraft and nuisance fee policies and remarking on how inconceivable he found it that so many American consumers are unbanked. It was the passion of a convert.

“I used to be addicted to these fees,” said Sidhu of overdraft fees in particular. “I decided, never, ever again. I want to be part of the solution now.”

“It makes sense for us to be able to acquire customers and to partner with companies that share the same mission and vision, with us, that there is a better way to do banking.”

— Luvleen Sidhu, BankMobile

BankMobile had just launched its first foray at the time of the speech. It was a “skinny” mobile-based account designed for young people, the middle class, the unbanked and underbanked, and others anxious to save on banking costs while enjoying convenience.

“Banking as a Service” begins to approach banking futurist Brett King’s idea of banking becoming an embedded function within other products and services. (The provocative King was actually Jay Sidhu’s co-panelist at the aforementioned event.) It builds on a commonality of interests between the mobile carrier and the mobile bank.

“It makes sense for us to be able to acquire customers and to partner with companies that share the same mission and vision, with us, that there is a better way to do banking and that we can continue to improve on the experience,” says Luvleen Sidhu. “Our partnership with T-Mobile exemplifies this, because we both share that sort of mission and ambition.”

With other white-label partners, she adds, “we want to solve consumer pain points, get more engagement, and more loyalty, and acquire customers together. We’re not going to just roll out the same application with the same product as we’ve done for T-Mobile. We’ll look at how we can link with their current product offerings. We have a flexible, customizable platform where we can walk through what meets potential partners’ objectives.”

Sidhu indicates that BankMobile’s concept of who a partner could be is quite wide. “There are several sorts of verticals,” she says. “Employers are one — you’d have a direct deposit relationship with their employees. You have unions, and that sort of membership model as well. And there are large brands that have loyal followings with emotional connections. Adding financial services is another touchpoint for creating more attraction and affinity with the brand.”

Read More:

- Digital Banking Strategies Doomed If You Don’t Prioritize UX

- 6 Keys to Designing a Best-in-Class Financial Wellness App

Pursuing More Accounts on Multiple Fronts

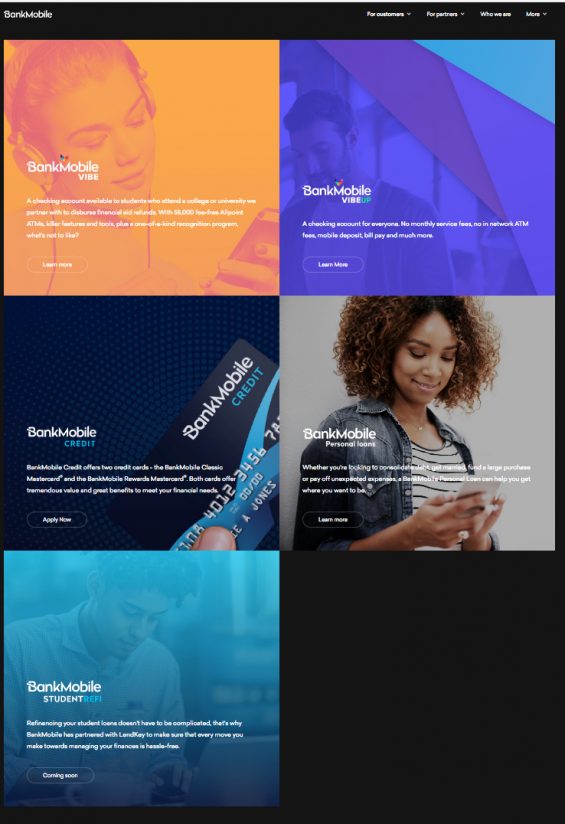

Between the initial BankMobile efforts and the T-Mobile deal came other efforts that the mobile bank has been building on. It started when the bank acquired a company that assisted colleges and universities in the disbursement of student aid benefits. Today BankMobile has relationships with approximately 800 schools nationwide and close to two million student or graduate customers.

While this aspect of Banking as a Service is limited to basic checking accounts, Sidhu explains that the game plan calls for retaining those relationships long past graduation. With a mobile-based relationship, and no reliance on branches whatsoever, and access to a network of ATMs, there is no reason that consumers who start out with BankMobile as students need to move their business elsewhere.

“It’s a customer for life strategy,” Sidhu explains. Once students graduate the bank offers them savings accounts, personal Loans, credit cards — now the mobile bank’s highest single source of income, according to its financials — and the opportunity to refinance student debt. This can help create a stickier relationship, she says, than simply offering a checking account.

This begs the question, is a primary checking account as important as it once was, as the core relationship with a consumer.

“I don’t know how things will play out five to ten years from now,” says Sidhu, “but in today’s era it’s still important to create that primary direct deposit relationship. Remember, most people stick to the same bank for 15-20 years.”

Broadening the relationship as quickly as possible ranks highly, because consumers seem to value wider options. “That’s why you see fintech companies that started in one vertical building out into others,” says Sidhu, “because you don’t want to pigeonhole yourself.”

Thinking Beyond Today’s BankMobile Lineup

About 40% of BankMobile’s staff of 250 is devoted to improving on its products, a huge percentage of its workforce that goes beyond having an innovation lab under a bank’s roof. This portion of the staff includes user experience experts, design teams, and engineering teams.

“They are all looking at how to create a better experience for our customers in ways that align with their needs,” says Sidhu. “This will help us continue to leverage and build out our technology to be able to remain at the forefront of white-label banking, where we can help roll out a bank with a partner at a fraction of the cost and time that it would take to start up from scratch.” Management estimates that it cost over $20 million for the research and development, technology, and product development to prepare the bank for its white label efforts.

Personal financial management is something Sidhu would really like to tackle. Most PFM packages have not taken off — some are moribund — and yet the need to find solutions for consumers is strong.

“People are scared of addressing the topic of money,” Sidhu explains. “We aren’t really educated in financial management, and yet we’re sort of thrown into the real world pretty fast. Even as a Harvard- and Wharton-educated daughter of a banker, Sidhu says there are things she wished she’d known. “There was never an educational period where I could explore my finances and my financial goals.”

In the area of account design, different institutions have tried to address one end or another of financial management, but most efforts take on a piece here, a piece there, or a function, such as rounding up charges to put aside a little bit of savings.

“No one has cracked the code yet, where we can proactively, rather than reactively, help people on a real-time basis, decision by decision, day by day,” Sidhu says. “In today’s age, a lot of that sort of guidance should be driven in a technological fashion,” and BankMobile lives on the devices that make that happen.

“Sitting down and reading articles, that’s boring,” says Sidhu. “But to be able to deliver understanding in the moment — education and advice at the same time —can be done with technology.”

Something that she would like to explore someday is a sort of cross-generational approach to mobile banking.

“I love the idea of thinking more about the family and its finances, and family accounts, and starting earlier in getting people onboard with financial accounts and financial education,” says Sidhu. “How can we connect the dots between parents and children with the products and services we’re offering? It’s not something we’re doing today. But it’s an interesting case for us to explore.”